TIB: Today I Bought (and Sold) - An Investors Journal #275 - Copper, Building Products, Shale Oil, Rare Earths, Bitcoin, Ethereum, Europe Interest Rates, Japan Govt Bonds

A lot happens in a week away from the markets. Trade activity limited to cobalt, rare earths, corn and interest rates. Some big lessons come home in shale oil and company specific risk,. Cryptocurrency was the big roller coaster.

Portfolio News

Market Jitters - Tariff Tantrum A lot and not a lot happens in a week away from the markets.

Tech stocks surge. Facebook recovers a little. Treasury yields rise as supply grows. The tariff ding dong continues with China only able to respond on $60 billion vs the US threatened $200 billion at a higher rate. There is no doubt what is the biggest casualty of the trade war - the Chinese currency which touched over 6.90 last week. It did pull back a little when PBOC increase reserve requirements.

Talking heads are expecting price to move over 7.00 if the trade war continues as it is and to accelerate if it gets worse. My plan is to close the lower trade at 100% profit and let the other one run.

Bought

Castillo Copper Limited (CCZ.AX): Australian Copper/Cobalt. News flow from Castillo has been a mix of copper and cobalt news. They signed a joint venture to develop their Queensland nickel and cobalt assets. They confirmed a drilling program to explore the cobalt tenements in Broken Hill (this is my interest area). They then reported that copper assay results in Broken Hill were better than they expected. I took the opportunity on the first announcement to average down my entry price. The real challenge is going to be whether the management team can keep sufficiently focused to deliver all the projects. The joint venture does help as the JV partner is providing the manpower and management oversight.

Corn I have been watching the bounce in the Corn ETF (CORN.L) I bought a little while ago.

I had margin in my IG markets account and added new positions in a Corn CFD and also in September 2018 corn futures. Timing of the futures trade is not fully consistent with my trade thesis which is based on long term demand for corn from China (see TIB245). This trade is really a reversal trade based on the pullback in price after a good run up - the chart shows the reversal with the dot showing my trade entry.

The price action challenge is whether price will close the gap - markets often respect these gaps as resistance levels. Once broken, breaks through gaps do tend to be strong.

Big Star Energy (BNL.AX): US Shale Oil Producer formerly Antares Energy (AZZ.AX). Antares was my first introduction to horizontal oil drilling based oil production. The business started with tenements in Australia (as Amity Oil) and then bought into Turkey which is when I first bought stock. They sold the Turkey tenements and bought into the Permian Basin in Texas. My investing thesis was all about the advanced horizontal drilling technology they had developed in Turkey. The business made excellent progress in acquiring tenements in Texas and growing a strong revenue profile of operating wells. They were in the process of selling out and had identified a buyer when the oil price collapse of 2014/2015 arrived. They never did complete that sale transaction and were forced into administration. The administrators kept the business operating while they tried to close the transaction and/or find alternate bidders for the last 3 years. They did finally find investors who were prepared to take over the outstanding creditors and the shareholders took a massive 1 for 15 dilution.

In my portfolios, this has produced a very small holding which is essentially unmarketable. I added small parcels to bring my remaining stake back to a marketable parcel.

How has this investment stacked up? The bankruptcy and consolidation was ugly. Shares were consolidated 1 share for every 15 and price dropped from $0.50 on the bankruptcy to $0.01 making for 99.7% paper loss in my portfolios. I had been trading in and out of the stock since 2015 in my pension portfolio. Profits on closed trades were 38% and after accounting for the write down overall profits were 12% with a range of profits on closed trades between 21% and 94%. In my personal portfolio the story is not as good with trading profits of 56% reduced to a net loss overall of 3%. Returns on trades closed ranged between 39% loss and 513% profit with investments starting in June 2007. Combining the portfolios shows a net return to date of only 1% - a small return for a lot of work and a lot of risk.

Lessons: Shale oil does offer solid returns - one has to be wary of bankruptcy risk when oil prices collapse. This background story explains my current strategy for reducing company specific risk in my midstream shale oil investing. There is no doubt that the management team of Antares Energy understood how to buy oil properties and how to drill for oil cost effectively. They did not understand market dynamics and financial structuring well enough to survive and prosper.

Sold

Boral Ltd (BLD.AX): US/Australian Building Products. Signal came from research house to close some positions ahead of earnings season. I decided to close this one for 2.6% profit in 3 weeks.

Northern Minerals Limited (NTU.AX): Australian Rare Earths. Northern Minerals is developing a dysprosium mining and production facility in Australia. The pilot plant was officially launched which drove a big spike in stock price. The original stock idea came from my investing coach at a time when all rare earths stocks rebounded from a long period of lows. I had added to my small holding when Northern Minerals ran a share purchase plan equity raising in February 2018. I bought the minimum parcel of shares allowed which was bigger than I wanted to hold with a plan to spin off enough to cover my trading losses to date. I had a pending order in place to do just that which was triggered on the news announcement about the pilot plant. I sold at $0.092 vs SPP price of $0.078 and achieved a 3% blended profit since October/November 2016. (See TIB187 for the SPP trade action)

Now to the important part of the story. Dysprosium is a key rare earth metal that is especially used for creating permanent magnets, the type used in wind turbines and electric vehicles and hard disc drives - all three growing demand categories.

As a pure metal it is little used, because it reacts readily with water and air. Dysprosium’s main use is in alloys for neodymium-based magnets. This is because it is resistant to demagnetisation at high temperatures. This property is important for magnets used in motors or generators. These magnets are used in wind turbines and electrical vehicles, so demand for dysprosium is growing rapidly. Dysprosium iodide is used in halide discharge lamps. The salt enables the lamps to give out a very intense white light.A dysprosium oxide-nickel cermet (a composite material of ceramic and metal) is used in nuclear reactor control rods. It readily absorbs neutrons, and does not swell or contract when bombarded with neutrons for long periods.

http://www.rsc.org/periodic-table/element/66/dysprosium

With a trade war looming, the Australian facility could become a key supplier outside of China. The stage of development is the pilot plant has been commissioned. They have still to finalise the development of the mine and a fullscale processing plant. I have since topped up my holdings buying back in at $0.088

Shorts

Japanese 10 Year Government Bond (JGB): JGB's had a few volatile days while I was travelling with yields spiking to 0.11% at one point. One of these spikes took out one of my take profit targets for 21 basis points profit (0.14%). Contracts are ¥1 million. I remain exposed to two contracts short. These are both currently profitable and one has a take profit target below the lows.

Euribor 3 Month Interest Rate Futures (IZ): Two contracts hit intermediate take profit targets at 9971 for 7.5 and 8 basis points profits (0.075% and 0.08%). Contracts are €250,000. I replaced one of the closed contracts with another short at 9973.

Cryptocurency

Bitcoin (BTCUSD): Price range for the period from July 28 was $1424 (17.2% of the high). This is basically an ongoing reaction to the SEC rejection of the Bitcoin ETF plus the fallout of the OKex futures action where one trader got caught on the wrong side of a trade and all traders had to take a haircut. The disappointing part of this event driven price action is that it pushed price below what was becoming an important level (the green line) and leaves price in "no mans land" again.

https://news.bitcoin.com/okex-socializes-loss-from-over-400-million-bet-among-btc-futures-traders/

I opened one new BTC contract (0.5 BTC) at $7055 on a 4 hour price reversal (August 5)

Ethereum (ETHUSD): Price range for the period from July 28 was $71 (15.1% of the high). ETH did not respond as badly to the OKex BTC problems and volatility for the period was less too.

As expected price did move down to the support level (the upper pink line) and appears to be consolidating. What is disappointing is price did make a lower low and really needs to push back to a higher high to be at all convincing. I did open trades on a few reversals on ETH at IG Markets at $467 (5 ETH - July 29) and $409 (2 ETH - August 5)

Each exchange problem like the OKex problem scares more investors away and just leaves behind the speculators.

CryptoBots

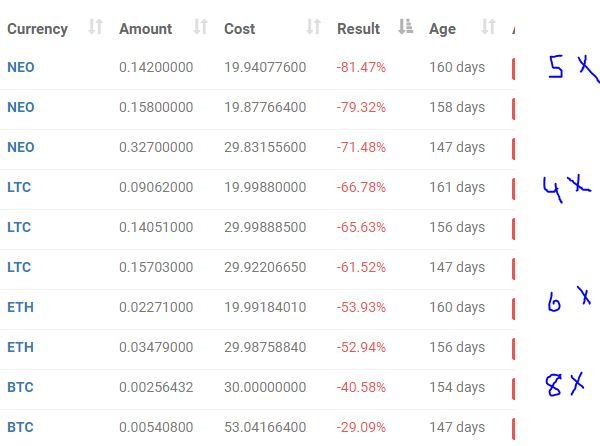

Outsourced Bot No closed trades. (213 closed trades). Problem children stayed at 18 coins. (>10% down) - ETH (-43%), ZEC (-50%), DASH (-61%), LTC, BTS, ICX (-74%), ADA (-53%), PPT (-74%), DGD (-66%), GAS (-77%), SNT (-44%), STRAT (-67%), NEO (-72%), ETC, QTUM (-63%), BTG (-67%), XMR (-40%), OMG (-53%).

This was not a pretty week with only ETC making a big move upwards on the Coinbase listing possibility(-41% to -22%).

SNT (-44%), XMR (-40%) both joined the 40% down group. DASH (-61%) moved to 60% down group and ICX (-74%), NEO (-72%) both went into 70% down group which now has 4 members. GAS (-77%) is still the worst.

Profit Trailer Bot Thirty two closed trades while I was travelling (0.03% loss) bringing the position on the account to 0.86% profit (was 0.95%) (not accounting for open trades). There were 4 stop loss trades (NANO and POWR (twice each)). POWR trade was disappointing as the bot opened a new trade directly after the stop loss. I had coded the DCA configuration to prevent a buy within 8 hours of a stop loss - it seems that the Pairs configuration does not take this into account for new buys.

I will now be able to analyse the trade results to identify the best stop loss level (currently 10%) based on the average number of wins compared to the scale up size of losses. I am thinking it can be lower. I took both NANO and POWR off the whitelist.

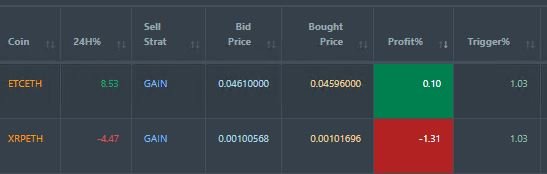

Dollar Cost Average (DCA) list has two coins (ETC and XRP).

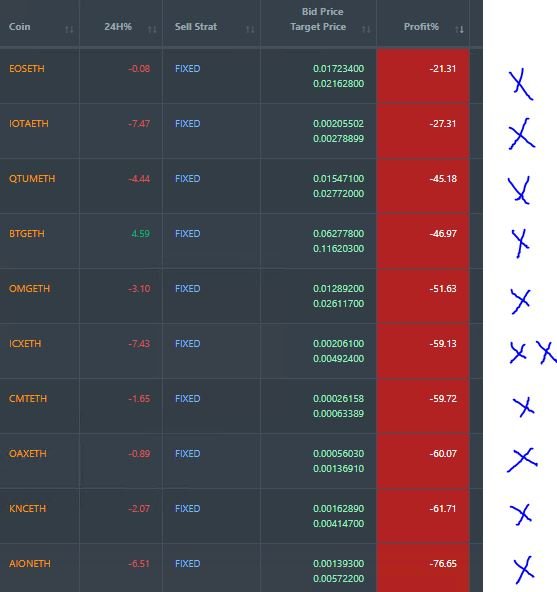

Pending list remains at 10 coins with all coins trading lower and ICX very much the worst faller.

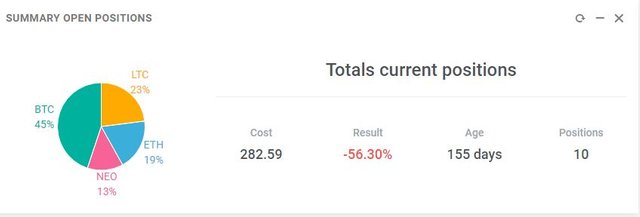

New Trading Bot Positions dropped 7 points to -56.3% (was -49.5%)

All coins dropped with BTC the largest at 8 points (also in relative terms). This is not the normal flow. Normally other coins fall harder than BTC when BTC falls.

Currency Trades

Forex Robot closed 12 trades (0.47% profit) and is trading at a negative equity level of 6.7% (higher than prior 5.2%).

Outsourced MAM account Actions to Wealth closed out 2 trades for 0.02% profits for the period.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

July 27-August 3, 2018

Congratulations @carrinm! You have received a personal award!

Click on the badge to view your Board of Honor.

Interesting story on Big Star (Antares) investment. I think this can happen to many blockchain projects that aggressively launched their ICO and are falling behind in their roadmap of execution. They believe they could ride the way of the crypto hype but will be challenged when delivering on their project. The added uncertainty now with regulation will make it difficult to go back into the market for more capital so many will fail to produce a viable, working project. Great learning!

I could not make sense of bitcoin’s price action the past 7-10 days. We broke that resistance around $7700 with volume and came back through a few days later. Thank you for citing that article about OkEX exchange - it makes a bit more sense now.

I am very happy to see your post again, after you go on vacation

Re-steemed

It looks like you are very busy with various work activities, and now you can update your posts again, happy to see you again and have a nice day @carrinm