TIB: Today I Bought (and Sold) - An Investors Journal #409 - Dutch Bank, Steel/Lithium, Marijuana, US Healthcare, Semiconductors, Euro, 56 Percent Club Update

Markets stutter with the Federal Reserve even though data and earnings are solid. Use the opportunity of a softer day to average down a few entry points in lithium, banks and healthcare. Profits in one 5G play go into another. Big shake up on options winners in 56 Percent Club.

Portfolio News

Market Rally

The rally stutters as Jay Powell speaks after Federal Reserve meeting.

The worst part is Powell was totally consistent with what he said last month. GDP and jobs data is in good shape and that justifies the Fed being patient. He reminded everyone that they do watch inflation and do want to see it a little higher - he felt subdued inflation was transitory. The market took umbrage and as one of the talking heads said this morning"just like a small boy or a small girl, they threw their toys out the cot"

Yields at the short end responded too ticking a little higher.

I look at the screens this morning and see the 10 year still at 2.50%. The bond market is not really rattled if that does not move.

https://www.marketwatch.com/story/treasury-yields-edge-lower-ahead-of-fed-policy-update-2019-05-01

Bought

ING Groep N.V. (INGA.AS): Dutch Bank. Averaged down entry price on December 2021 strike 14 call option vs closing price of €11.39 (April 30 trade)

Aphria Inc. (APHA.TO): Canadian Marijuana. Averaged down entry price in one portfolio and increasing diversification across the sector.

POSCO (PKX): Korean Steel. Rounded up holding on one portfolio so I can start to write covered calls. Investing thesis is on the work that Posco are doing in Electric Vehicles and lithium and not the steel business. Was discussing lithium with my builder who has been following the sector for a while and has holdings in Pilbara Minerals (PLS.AX) who are supplying Posco - got me thinking. Quick look at the charts - price did break the downtrend but failed to hold the momentum.

Now it looks like it is testing the bottom again. See TIB237 and TIB294 for the discussion on Posco and Lithium. Next chart compares Posco (black bars) to Van Eck Vectors Steel ETF (SLX - green line) and Sociedad Química y Minera de Chile S.A. (SQM - purple line), world's largest lithium producer over the length of the current steel cycle.

Posco is under-performing both and has been hard hit by steel tariffs. The lithium opportunity might address that.

CVS Health Corporation (CVS): US Healthcare. CVS announced results which surprised the markets upwards. Jim Cramer was discussing this saying the way the market has reacted to the "Medicare for All" proposals is not rational (and is unlikely to pass any time soon). I added to two of my portfolios to increase position size. Of note is the recent price moves could well result in some of the covered calls being assigned if this price move holds.

The investing thesis for CVS is it is transforming from pharmaceutical retail to being a healthcare provider after purchasing Aetna Health. The market is still working out the re-rating. A chart comparison with leading healthcare provider, UnitedHealth (UNH - red line) shows the gap - close half the gap and CVS gets back to late 2018 highs.

The technical features from the chart are not great - still in a downtrend and all one can really wish for is price to make it back to the trend line.

Xilinx, Inc. (XLNX): US Semiconductors. Deployed profits from sale of Qualcomm options into this 5G semiconductor play as a new entry in one portfolio. I am holding it in others.

Sold

QUALCOMM Incorporated (QCOM): US Semiconductors. I have had a pending order on a January 2021 57.5/62.5 bull call spread which has been too far above the market. I recalculated the likely exit price and was hit for 84% profit since December 2018. I retain a small parcel of stock as the handset play on 5G. Timing of the exit was fortuitous as Qualcomm announced earnings after the close, which disappointed the markets (on guidance)

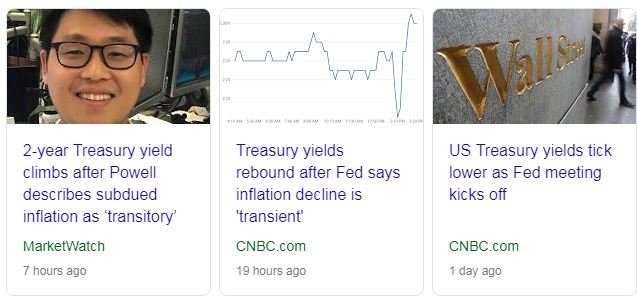

56 Percent Club

Each month, I review all my portfolios and tabulate the 56 percent movers from all time and highlighting the ones from the last 12 months. I review stocks and options separately. Why 56%? A friend was spruiking an investment scheme on Facebook and asked if anybody could point to a 56% investment - yup - I have a few.

First is the table of stocks. I have also marked up whether they have gone up or down since last time. New entrants marked in yellow

What stands out?

- Same size list with one newcomer, Afterpay Touch (APT.AX), replacing Zurich Insurance (ZURN.SW) which was 55.48% up only. (6 vs 6)

- Bank of America (BAC) retains its top slot with a big rise up 21%

- Biggest riser is Bank of America (BAC) riding the wave in US banking stocks

- Japan and European Mid Caps still feature

- New entrant, Afterpay (APT.AX), an Australian payments provider, was bought in the last 12 months. Thanks to my son for the idea.

- One faller off the list in European insurance, Zurich Insurance (ZURN.SW) by a whisker

- Partial holding in one (was 2) marijuana holding is above 56%, Aphria (APHA.TO)

- All 6 stocks are risers in a strong stocks month.

On the options side same deal.

What stands out?

- Technology stocks dominate

- Quite a lot of change with holdings in Novartis (NOVN.SW), Technology Select SPDR ETF (XLK) and Consumer Staples SPDR ETF (XLP) sold for good profits.

- Falling off the list is European/US supermarketer, Ahold Delhaize, (AD.AS)

- New leader is faster riser and a new entrant, Qualcomm (QCOM) riding the wave of the patent settlement with Apple (AAPL).

- Other new entrants are both technology companies in Symantec (SYMC) and Advanced Micro Devices (AMD)

- Back on the list is French insurer, Axa SA (CS.PA) missing since September 2018. The market is recovering from its dislike of the merger with XL Group.

- Two fallers (one right off) and 6 risers

- 3 positions bought in the last 12 months.

Income Trades

3 new covered calls written all in one stock - two on new positions and one on existing position.

CVS Health Corporation (CVS): US Healthcare. Sold May 2019 strike 59.5 calls for 0.59% premium (0.51% to purchase price). Closing price $54.38 (before results) (lower than last month). Price needs to move another 9.4% to reach the sold strike (easier than last month). Should price pass the sold strike I book a 2% capital gain. Income to date amounts to 2.25% of purchase cost. On new positions data is 0.60% premium and and 4.4% and 4.7% capital gain.

Cryptocurency

Bitcoin (BTCUSD): Price range for the two days was $230 (4.5% of the low). Price confirms a higher low and stretches up a bit to the top half of "no mans land"

Ethereum (ETHUSD): Price range for the two days was $11 (7.2% of the low). I wrote this in TIB408.

Hard to say if this will hold as price did hold above the previous lower low and it could well push higher quite hard.

Price did choose to have a go at testing that short term resistance level at $159 closing just below it and thus confirming the higher low. Holds here it looks like a chance to test the next level up is on the cards.

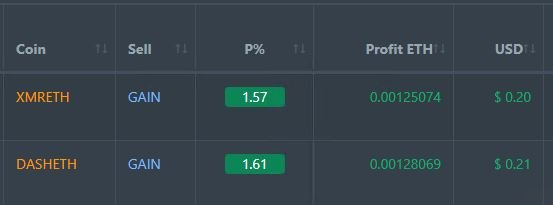

CryptoBots

Profit Trailer Bot Two closed trades (1.59% profit) bringing the position on the account to 7.09% profit (was 7.04%) (not accounting for open trades).

New Trading Bot Trading out using Crypto Prophecy. No closed trades.

Currency Trades

Euros (EURUSD): In one portfolio, I was getting uncomfortable with the level of Euro holdings especially given a shortage of Euro trading ideas. So I sold a parcel for US Dollars. Nice timing as US Dollar spiked after the Federal Reserve announcement.

Outsourced MAM account Actions to Wealth closed out 7 trades on USDCHF, GBPJPY, EURCHF and AUDNZD for 0.14% % profits for the two days. Good to see open trade closed on JPY for only a small loss during the Golden Week holiday. Trades open on USDCHF, EURCHF and AUDNZD (0.06% positive). Just got the monthly statement - a lot of churn in the account for only $44 profit (0.3%). Biggest winner is the spread broker.

Cautions: This is not financial advice. You need to consider your own financial position and take your own advice before you follow any of my ideas

Images: I own the rights to use and edit the Buy Sell image. News headlines come from Google Search. All other images are created using my various trading and charting platforms. They are all my own work

Tickers: I monitor my portfolios using Yahoo Finance. The ticker symbols used are Yahoo Finance tickers

Charts: http://mymark.mx/TradingView - this is a free charting package. I have a Pro subscription to get access to real time forex prices

Trading: Binance offers a wide range of coins to trade, tight spreads and low fees if you use BNB to pay https://mymark.mx/Binance

Tracking: Keeping track of your crypto trades is a whole lot easier with CoinTracking.info. Get 10% off all your account upgrades https://mymark.mx/CoinTracking

April 30/May 1, 2019

I’m not liking the banks I opened some puts on BAC yesterday. I also opened an iron condor trade on TLT.

Posted using Partiko iOS

Magic Dice has rewarded your post with a 95% upvote. Thanks for playing Magic Dice.

You have receive an upvote. Thanks for playing moonSTEEM

The US banks are proving an enigma right now. In historical terms they are under valued and strongly structured. Against any slowing economic story, they are looking a bit light on lending growth. My trades reflect that with a mix of short term puts (C and WFC) and some new stock adds (C and HBAN).

Maybe your iron condor on TLT is telling me the same thing.

I actually felt ok about his wording considering the comments from the President asking for not only a 100 bps rate decrease but even quantitative easing! When the ship does start to turn, it will be interesting the pressure to move and in what cadence.

Posted using Partiko iOS

I agree. I thought his words were exactly bang on what needed saying. Markets seem to be in "dream on" mode.

I do know that Donald Trump and Jerome Powell both like the use the market as their metric. I think Jerome Powell understands the markets a whole lot better AND will make more rational and reasoned choices. He just showed that this week and in January.

Congratulations @carrinm! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!