How Black Insurance brings insurance closer to the customer

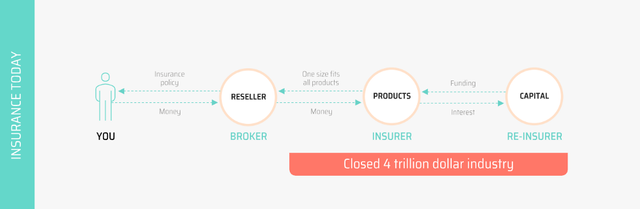

One of the biggest problems in insurance industry today is that the product design and customer are too far apart. This means that there are several parties between the customer and product. The system allows for a lot of bureaucracy, high costs and hinders innovation. Time to market normally takes years. Insurance business is currently a closed 4 trillion dollar industry, which needs to be disrupted.

There are (too) many different parties in the system: Re-insurers, Insurers, MGA’s, Agents, Brokers, Third Parties and Wholesale Brokers. As products are controlled by insurers, launching an insurance product takes a lot of time and the markets’ needs are not attended to fast enough. Whereas insurance brokers that are close to the customer and truly understand the market cannot get the desired product to market fast enough. There will be a lot of negotiations, time and costs involved. Often great ideas get neglected altogether.

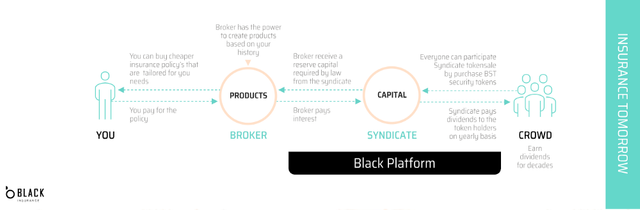

We at Black Insurance believe that insurance should function in fact the opposite way around that it is currently, it should be simple. Our business model is giving more power to brokers and removing uninnovative, slow and expensive insurers from the value chain. This helps great ideas get to the market faster, reduce costs and help innovation as well as to bring insurance closer to the customer.

Future insurance value chain will offer you or any other insurance customer the possibility to get cheaper insurance products that are custom-made for your needs as the brokers will have the power to innovate and create products that correspond to market needs, while doing it faster and more efficiency than today.

One example of bringing insurance closer to the customer are the emerging markets. Insurance industry has been lazy to cover risks in that area (mainly in Africa). Today only 5% of the population in emerging countries is covered with insurance. Black could potentially bring a lot of value to locals such as farmers, artisans and others who suffer great losses due to lack of insurance in the region. Similarly to micro-loans that kick-started and boomed there, micro-insurance has huge potential and added value for both — customers and local entrepreneurs, who know the local market and customer needs well.

Another angle of bringing insurance closer to the customer is the possibility to invest in the industry. We are opening up the historically closed insurance market for crowdfunding.

This means that the customer benefits will include both, better insurance products as well as the possibility to invest in the insurance business and earn dividends for decades.

The investments will provide capital for brokers for developing the well-tailored products that are missing from the market today.

Situs web: https://www.black.insure/

Lightpaper: http://www.black.insure/wp-content/uploads/2018/03/Black-insurance-lightpaper.pdf

Whitepaper: http://www.black .insure / whitepaper /

Twitter: https://twitter.com/BlackInsure

Facebook: https://www.facebook.com/blackinsure

Telegram: https://t.me/blackinsurebot

Bitcointalk: https://bitcointalk.org/ index.php? topic = 3372186.baru #

Linkedin baru : https://www.linkedin.com/company/black-insurance/

Nama : giangchuc1234567

Profile: https://bitcointalk.org/index.php?action=profile;u=1238167

ETH: 0x0Ef857D3BFf528Dd8176A9Df334f54646ecfbE83

Source

Plagiarism is the copying & pasting of others work without giving credit to the original author or artist. Plagiarized posts are considered spam.

Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/blackinsurance/how-black-insurance-brings-insurance-closer-to-the-customer-59baf013c454