Economic Interpretation of Market Fluctuations [ENG]

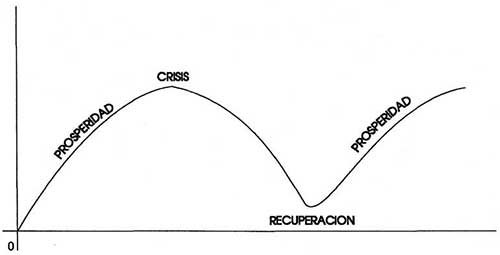

Although the economy presents irregular economic fluctuations that at first sight seem erratic, they can be decomposed in oscillating movements susceptible of economic interpretation. To comment on the cycle from an economic point of view, it can be considered as a succession of ascending and descending phases.

In a simplified description, the common elements found in every cycle are the following: depression or fund, recovery or expansion, boom or peak and recession.

The bottom is the lowest point of the cycle. During the depression there is a low level of demand in relation to the productive capacity available. The presence of this productive capacity not used will cause unemployment of productive resources and large quantities of stocks will be available, since they are not demanding for the finished products. In this phase some prices will fall and others will remain unchanged and few will experience increases. Companies will see their profits reduced, which will cause a loss of confidence in the future, so that employers will be reluctant to risk new investments.

Expansion is the ascending phase of the cycle. The passage from depression to recovery is explained because the aging of the capital that usually occurs during the depression will cause it to have to start replacing at some point. This renewal of capital has multiplier effects on economic activity, so that the income and spending of consumers will begin to grow. This pull of demand will encourage production, as well as sales and profits, so expectations will be more favorable. the investment will be encouraged, since the risk has been reduced and the possibilities of saving will have increased with the rent. As a result, the installed productive capacity will increase and employment will rise. In the recovery, since there is a level of demand lower than the available capacity, the prices will remain relatively stable or increase slowly and continuously.

The top is the maximum point of the cycle. This maximum is reached because in the last moments of the previous phase they will seem rigid; first, in certain specific factors, such as qualified labor and certain key raw materials, and subsequently, generalization will be made to most factors, since the installed capacity will be in full use. In addition to approaching the level of potential production will be increasingly difficult to increase production through the use of idle resources. In fact, once full employment is reached, production can only grow at the same rate as productive capacity increases through new investments that raise the productivity of the labor already used.

Finally the recession is the descending part of the cycle. It can occur smoothly or abruptly, considering in this case that it is a crisis. To explain the beginning of a recession, think that if you are facing a boom scenario, investments will no longer be profitable because expectations about the continuous growth of sales and prices will not be confirmed due to a certain saturation of demand.

On the other hand, by decreasing sales, financial costs will become a heavy burden. Companies will accumulate excessive amounts of stocks, so the investment will be reduced and some will start to fail. Production and employment will fall and as a result, incomes and spending will decrease, as new companies begin to have difficulties.

Prices and profits will fall and investment will be reduced appreciably, as unused productive capacity will increase. It can, in addition, that in these circumstances the level of capital stock previously desired is now too high, so that the investment will suffer further reductions. This dynamic of recession will lead to a period of generalized depression, which was the phase with which we began this analysis.

The domino effect of bankruptcies.

</

There is, however, an element that can complicate the turn when the depression deepens and can worsen the situation: the financial instability of companies. In normal times there is a small and uniform rate of bankruptcies; The problem is that during a severe depression the bankruptcies are very numerous and among the companies eliminated there are usually both competent and inefficient companies, because the latter can drag the former.

When businesses are wrong, both prudent and non-prudent companies can go against the wall and when a company goes bankrupt it can take its suppliers with it. This domino effect of bankruptcies is a factor that complicates the process, which can worsen a recession and generate what is normally called a crisis.

It should be noted that there are different types of fluctuations, the long, medium and short duration cycles.

The long-term cycles, whose extension is estimated at some sixty years, were measured by Kondratieff, thanks to an exhaustive analysis of the series and the use of sophisticated statistical techniques. This type of cycles is associated to the variations of the investment linked to the fundamental technological processes.

The cycles of average duration, between six and nine years, that usually are denominated cycles of the businesses or commercial cycles. They met thanks to the investigations of Juglar.

The small wave cycles, with an average length of about 40 months, which is the typical duration of the stock cycle. These cycles were typified thanks to the works of Kitchin. This type of fluctuation arises because, when stocks decline, production increases, driven by the need for storage, in order to place stocks at the level considered normal. On the contrary, when stocks increase, because sales have fallen compared to forecasts, production will decrease.

Publicado en el blog de Cryptofera