how to trade - simple analysis of the practical meeting the psychological

21/02/2019/

Trading is simply the act of buying and selling. In this context we are talking about digitised markets for commodified things (things that are basically the all same in each pair like stocks of apple, bitcoin or oil futures)

We are exchanging one standardised thing for another with the aim of profit.

The mantra buy low and sell high sounds so simple, but in fact it is devilishly hard to do. Why? Well in one word, it is psychology!

This post is going to aim to be a primer for those new to markets. A preparatory glimpse to the difficulties of trading.

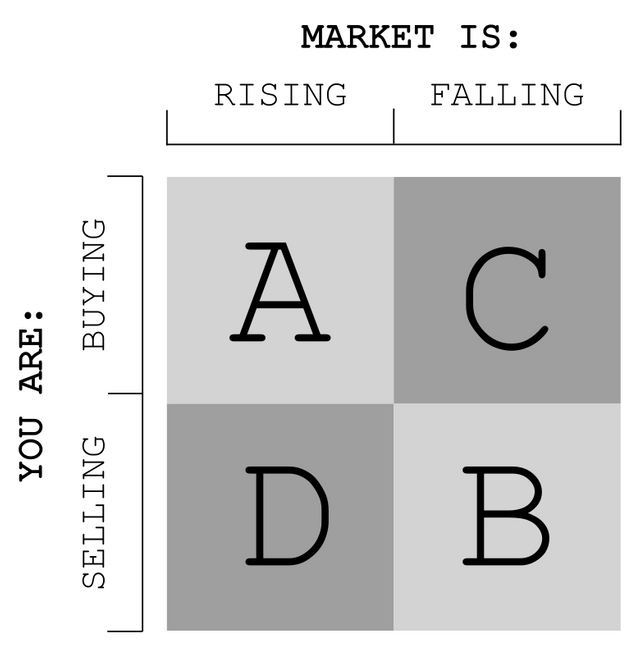

Trading is binary, you are either selling or buying (let's forget about hodling for now), and the market is basically in an uptrend or downtrend at any given time.

To keep this as simple and stupid as possible we are going to dissect the 4 trades!

Please note, I am assuming you guys know a little about trading and this is not intended to be an exhaustive how to trade post. There are plenty of posts out there that do a far better job than I can to explain how each kind of trade technically works.

Most human psychology herds us into either A or B behaviour. But if we are to think clearly it is the C and D behaviour we want to do. We know it instinctively that this is more likely going to bring us rewards or profit. Remember buy low sell high. So let's dissect how each trade works from psychology and practically how to perform such a trade

A

We want to buy. The thing we want to buy is going up in price. We want in as quickly as possible. The most simple order you can place here is a market order. Basically I want to buy 10 widgets now. What actually happens in the market is you are going to buy 10 widgets off the guy who is selling them at the cheapest price but has not yet sold. These are the sellers in the order book. You clean out a slab of the seller side of the order book. In the process you have pushed the price up which now sits at the highest price you paid for the last widget. In placing the market order, you have played your part in pushing that price up.

We have a term for this: FOMO or Fear Of Missing Out. I think this acronym is extremely apt for the emotion that drives this behaviour.

If you want to be a more sophisticated trader, you may want to buy the short term dips. Every rally has short retracements in price. They can last hours or minutes, but they happen. We have a stop trade, or better yet a trailing stop trade.

What we are trying to do is get the most out of our greed.

B

We want out! Now! This is the fear trade. The sky is falling and we want to dissolve our position in widgets as quickly as possible. With each passing moment your profits are vanishing. The most simple order to execute is the market order. Sell 10 widgets now! In the market your order will sell your widgets to the buyer willing to pay the most in the order book. Your sale will clean out a slab one the buyers side of the order book. The price at which you sold the last widget is now the current price of widgets on that market. In placing the market order, you have played your part in pushing that price down.

Stop and trailing stop orders can help you to mitigate the damage and sell in the mini rallys that are always present in each downtrend. This allows you to be a little more cool headed about this kind of market condition which presents much fear.

There is a term for this emotion as well: FUD or Fear, Uncertainty and Doubt. I think this sums it up well.

A and B

This is how almost all people with only casual experience in the markets trade. This is why most of them loose their money. This kind of trading is emotional trading. Sadly FOMO hits when markets are high and FUD hits when markets are low. The result is you buy high and sell low. The opposite of what you want to do.

From a psychological and emotional point of view, these 2 states are easy to understand and most people have experience with them, Now let's look at C and D. These are the more interesting emotional states to explore because some many unexpected changes happen to your emotional state.

C

When markets are rocketing upwards and you have already taken your position and watch your portfolio balloon in price, you are the king of the heap. Your smugness is hard to contain, you want to boast about your new found wealth. You start to eye those expensive toys that were out of your reach before, but are now possible in this new reality. Your day job seems to be far more tiresome than it normally is. Your greed is being fed.

This is a dangerous time for a trader, because in this state, one feel invincible. One cannot do any wrong. Ones bravery at entering the trade when you did, is being vindicated, rewarded. It is inevitable that you will feel that, from now on, you cannot make mistakes you are flawless. That you have literally become more intelligent.

Off course this is concentrated hubris so powerful, you yourself are blind to it. Your mind is playing a trick on you. It is dangerously extrapolating a bit of luck with providence. In this state of mind, decisions become clouded and prone to much more error that normal.

Ditching your day job to become a day trader, buying an expensive car, taking out a large loan to buy something frivolous. These are all manifestations of your mind extrapolating this new positive trend in the market you have entered into, out into the future for ever. Life will never be the same again. That is certainly true, but not exactly the way your think.

But markets do go into parabolic frenzies, but do not remain like this for long. What we are seeing is a short lived collective mania of FOMO.

If we were to analyse this properly, what we should be doing is selling into this. Taking our profits and fighting the greed monster to hold on to our rising positions just a little longer for just a little more buzz.

At this point what we can do is start to layer in limit trades at ever higher prices to start selling into rallys. The experienced traders will formulate a plan to sell his widgets in an ascending cascade pattern quite early in the trade, in fact at the time of buying them! Buy 10 widgets and then sell 5 when they have gone up 50% (break even) sell 30% at 75% and let the reaming 20% ride to the top using a trailing stop loss trade, for example.

In this way the trader grabs the meat of the uptrend and forgoes the bread at each end.

D

When markets are tanking and you have liquidated your position, this is the time to begin to get interested. I have noticed an interesting thing in markets. I have no data to back it up but I am pretty sure it is part of a psychological effect of the market. If widgets cost $1.00 and their price is going up, a $0.10 move is 10% gain. In one day this is a lot. Widgets are becoming a hot item and now they trade at $2.00. A $0.10 move is now a 5% gain. They are still hot and now at $5.00 so a $0.10 move is a boring 2% gain. A big gain is now $0.50 or 10%

As the market moves up, the steps of movement also increase. Everyone has their eye on percentages.

So on the way down the memory of price moves is more resilient, so lets say the price of widgets is down hard. They are trading back at the $1.50 level, but the part of the market that bought at $4.00 that want out, a $0.50 lower price is psychologically more acceptable than it is for those that bought in at $1.00.

Volatility at the bottom of downtrend markets can be quite choppy because of this phenomenon.

The saying ‘catching a falling knife’ describes the danger of trying to pick the bottom of markets early. If you are too early, you can get crushed quite easily. These are the most dangerous trades. The trades that more often than not result in losses.

When you feel greed is beginning to overpower fear, you have a strong desire to get into the market, but the risk of being too early and sustaining more losses is still high. In addition to this, rallys at the bottom of markets can be furious and extremely profitable if you time them right.

If widgets rise $0.50 from a price of $1.50, this represents a 33% gain, as opposed to 10% when they are at $5.00.

This is where a gentle dollar cost averaging strategy is the least stressful and easiest to execute. Say you will be buy 1 widget every week regardless of price. This means as price rises, your entry point is being averaged by the cheaper widgets you bought earlier on. To protect yourself during this buying in period, you can layer in stop loss trades to exit your position if there is another crash in the market.

C and D

These are the trades that win money in the long run. Experienced traders take out many positions concurrently with strategies similar to these. A lot of record keeping and calculations are required to pull them off with regularity. Traders are also willing to let trades fail and do not get hung up overly on losing trades. They get out to preserve their capital and hope to win in the next trades.

Do not be fooled. Doing this can quite easily be a full time job!

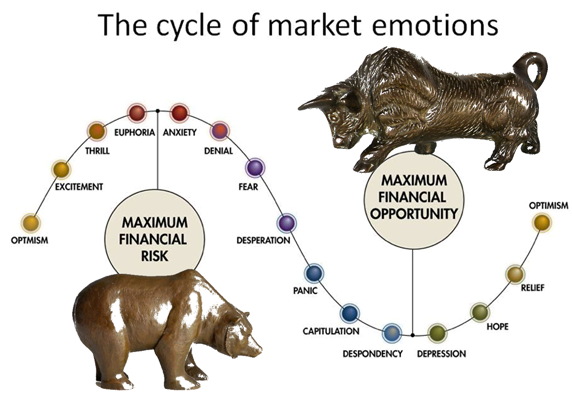

I will leave you with this perennial chart of market emotion. The more you trade, the more you will believe this chart to be true.

This is far from an exhaustive explanation of trading strategy and psychology. What I hope to do here is to introduce you to the various emotional and technical phenomenon that may assist you in trading markets with less stress and more certain profits.

As always guys, leave comments, have fun and trade safe.

Disclaimer: This post is not financial advice. Before investing any funds do your own research and make your own decisions. Cryptocurrencies are highly speculative.

And finally: Do not invest money you are not comfortable losing.

Help me to make more content like this.

Upvote me, comment and resteem.

Thanks