Why the United States needs Blockchain and Cryptocurrencies

Image from www.pexels.com

I recently reviewed a study done last year from the Economic Innovation Group (www.eig.org) called Dynamism in Retreat where they demonstrate the trends of lower levels of new business formation in the United States. They see this has translated to a “reduction in the vibrancy and vitality of the commercial community.” The implications set forward in the study are very negative for the potential economic environment for the United States and its population.

The following are the study’s key findings:

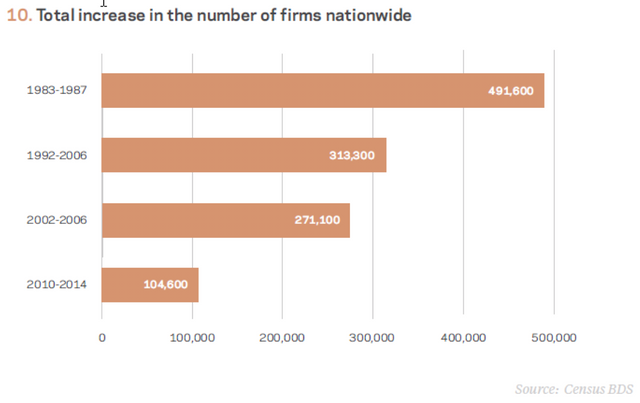

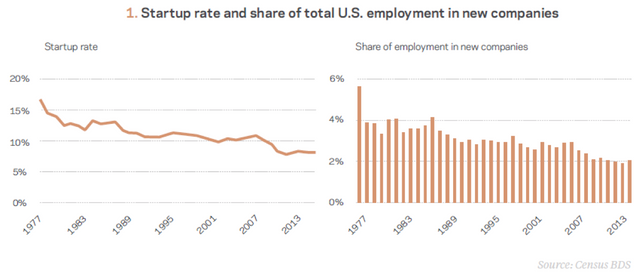

- Startup rates have been falling for decades but the recent financial crisis of 2007-2008 has impacted business startups more severely

- For the 30 years from 1997-2007, there was an average of 117,300 more business startups than closings

- Since 2008, businesses closing have outpaced startups on average

- It has been a nationwide phenomenon but some regions have been impacted less. However, this has narrowed the metro areas that have concentrated on business startups

- Companies at least 16 years old are dominating most industries as startups slowdown as they become larger

- Three out of every four workers now work for a company more than 16 years old

- 25% of nearly half of the United States industries are controlled by the four largest firms in that space

- In this time frame, evidence of less innovation is evident given the number of patents issued outside of health and IT per $1 billion in GDP

- The deficit in new business has reduced the number of jobs available in the labor market as new businesses are seen as job creators while longer aged companies tend to be net job destroyers

The study demonstrates the importance of entrepreneurship as new business drives important economic growth factors such as job markets, innovations that improve productivity, and competitive forces. The statistics presented on the report “suggests the US economy is far less flexible, less adaptive, and less resilient than it once was.”

This could potentially influence the future growth as the incentive structure for entrepreneurship decreases due to the concentration of larger and older firms controlling their industries. They could control the talent pool, real estate and pricing power. It would lead to a less competitive market which will ultimately hurt consumers and the financial wellbeing of the workforce. “Size and scale may boost efficiency, but they can also create an uneven playing field that suppresses dynamism.” The innovation will continue to fall as this occurs as the large companies do not use their profits on a commensurate amount to invest in their markets or human capital. “Persistently high profits combined with depressed investment levels are features consistent with declining dynamism and a malfunction of the competitive mechanism essential to a healthy market economy.”

While the study goes into detail on how the US has gotten to this difficult situation, one key factor opened my eyes as a continued warning sign. The study believes that regulation has had a material impact on the ability of many US industries to innovate and thus create interest in creating new businesses. Given the competitive advantages larger, established firms have gained through regulation, the drive to create new business is less than it was 20 years ago with the start of the internet/digital economy. The study says that there is potential to turn these trends around as the United States continues to have significant competitive advantages to other countries around the world.

Given the recent spur of growth and innovation led by Blockchain technology, entrepreneurial spirit is seen increasing given the amount of ICOs and Cryptocurrency projects seen since 2015. As the sector continues to gather interest from Venture Capital, educational organizations, governments, and financial services the ability to create new business also grows as the ecosystem can become more interconnected given the efficiencies gained with the new technology. We have seen approximately $10 billion come into the space since 2015 which is still a low figure relative to the size of the economy and many of its industries. However, the potential dynamism created by these projects could have a multiplier effect on the system as there are use cases for multiple US industries.

As Blockchain technology has been compared to the Internet boom of the 1990s, we could be seeing the start of a new phase of increased entrepreneurship and productivity. However, it will only be possible if the market remain open to supporting growth and innovation rather than controlling it via regulation. Therefore, the United States needs to be careful where the regulatory framework will apply as it could hinder the potential of this emerging technology which will not only improve current industries but also create new industries behind the technology. In addition, the borders of digital space are almost boundaryless so they can move swiftly and effortlessly to places where support is provided (as seen recently with certain Cryptocurrency exchanges). At the end of the day, it seems that the United States would have it in their best interest to foster this technology within its borders to ensure the improvement of the economic dynamism.

Could Blockchain technology save the US economy from further falling into a less attractive country for new business? How will regulators take these factors into consideration when setting up their legal frameworks, if they do so? Please let me know your thought so we can engaged is great discussions. I look forward to your thoughts below in the comments!

Follow me on Twitter: @NAICrypto

Don’t forget to vote, comment, follow, resteem and browse my channel for more information!

If you are like me and interested in continued personal growth, invest in yourself and lets help each other out by leveraging the resources they provide by using my referral link:

https://www.minnowbooster.com/referral/530636

DISCLAIMER: The information discussed here is intended to enable the community to know my opinions and discuss them. It is not intended as and does not constitute investment advice or legal or tax advice or an offer to sell any asset to any person or a solicitation of any person of any offer to purchase any asset. The information here should not be construed as any endorsement, recommendation or sponsorship of any company or asset by me. There are inherent risks in relying on, using or retrieving any information found here, and I urge you to make sure you understand these risks before relying on, using or retrieving any information here. You should evaluate the information made available here, and you should seek the advice of professionals, as appropriate, to evaluate any opinion, advice, product, service or other information; I do not guarantee the suitability or potential value of any particular investment or information source. I may invest or otherwise hold an interest in these assets that may be discussed here.

Blockchain, Cryptocurrencies, and ICOs are a great opportunity for this trend to reverse if regulation becomes clear and provides guidelines towards facilitating the sector.

Great post. It's tough to compete with the tech titans...google, facebook, apple, amazon. However, the blockchain offers "first to market" opportunities for new companies. But like the dot.com era, I expect a crash the weak won't survive, paving the way for the strongest, viable companies to flourish.

Upvoted ($0.12) and resteemed by @investorsclub

Join the Investors Club if you are interested in investing.

Excellent Post...and thank you for your support.