Burned tokens, rewards, and inflation summary September 24, 2022 - Total burn estimates: 104,675K STEEM/SP and 60 SBD

Steemit launched the #burnsteem25 initiative on May 22, and the corresponding rewards started being delivered to @null on May 29. Subsequently, on August 9, Steemit announced that they'd be monitoring post promotions daily. Here is the next weekly update with PowerBI charts to visualize the burned token-related statistics since those dates.

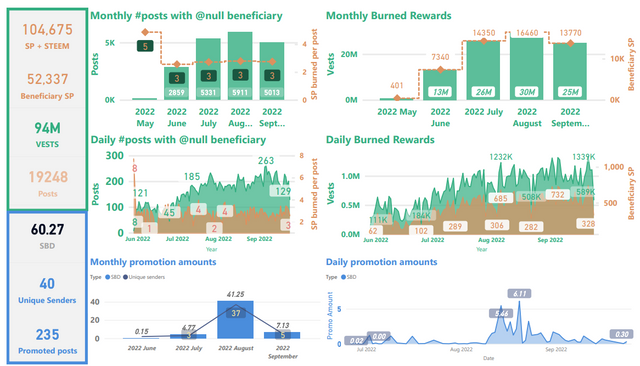

Slide 1: Burn amounts in beneficiary rewards and transfers to @null.

Weekly totals were about 7,747 STEEM/SP and 0.33 SBD. The top-4 burn amounts happened during the month of September, with the highest value, 745 SP, observed this week on Wednesday (September 21).

Top sidebar summary cards show total number of STEEM, SP, and VESTS burned, as well as the total number of posts with @null beneficiary settings. This is where the headline number comes from.

Top-left is a new graph showing the number of posts and average SP burned per post by month.

Top-right: This shows the VESTS and the estimated SP beneficiary rewards burned per month.

Middle-left: This is a new graph showing the number of posts and average SP burned per post, by day.

Middle-right: This shows the daily VESTS and the estimated SP beneficiary rewards that have been burned.

In all three of the above charts, VESTS are shown against the left axis, SP and STEEM are shown against the right.

Bottom-left sidebar summary cards show totals for SBD burned in post promotion.

Bottom: SBD transfers to @null. As readers are likely aware, SBD transfers to @null can get a post added to the /promoted page. The visualization on the left shows the breakdown by year. The visualization in the middle shows a monthly aggregation of SBDs transferred and a count of unique senders. The visualization on the right shows the daily record.

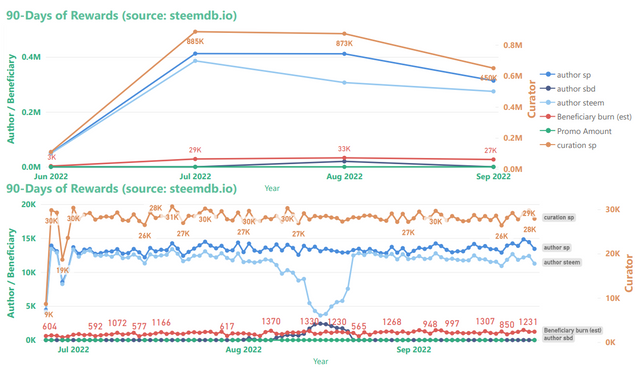

Slide 2: Rewards summary

Curator rewards use the scale on the right, author and beneficiary rewards use the scale on the left. Thus, curation rewards appear to be scaled down relative to author & beneficiary rewards. Beneficiary rewards for @null in this chart (red) have been adjusted in order to account for both SP and liquid rewards. The top graph shows the monthly aggregations, and the bottom graph shows daily totals.

Unchanged from last three weeks is that SBD printing has remained paused, due to the continuing sluggishness in the price of STEEM (and crypto markets at large). With the present SBD supply, it looks like the median on-chain price for STEEM needs to get back to about $0.252 for SBDs to start printing again.

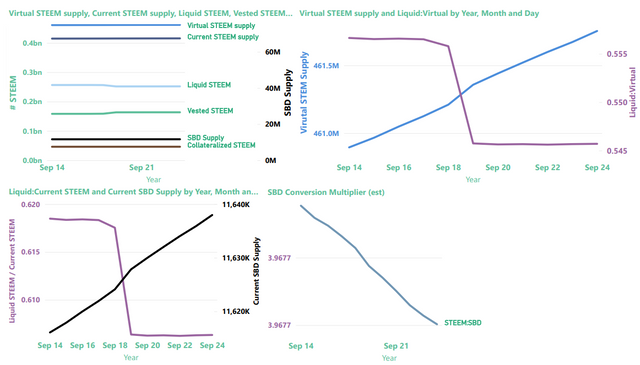

Slide 3: STEEM & SBD Supply as well as vested (i.e. staked or "powered up") STEEM

Noteworthy this week is a big drop in liquid STEEM as a percentage of current supply and of virtual supply, mostly as a result of the 5M powerup from @hungry-griffin (top-right and bottom-left charts). Both percentages dropped by about 1%. With virtual STEEM, the liquid portion dropped from roughly 56% to below 55%, and with the current STEEM supply, the liquid portion dropped from almost 62% to less than 61%.

The top-left image provides a summary view of current and virtual STEEM supply, current SBD supply, liquid and vested STEEM, and the amount of STEEM reserved as collateral for paying off SBDs.

| Note |

|---|

Collateralized STEEM and current SBD supply actually represent the same value expressed in terms of STEEM or SBDs, respectively. They're aligned differently on the graph because they use different axes. |

The top-right graphic now contains a zoom-in on "virtual STEEM Supply" (left axis) and the ratio of liquid STEEM / virutal STEEM supply (right axis). As we learned, here, virtual STEEM supply is heavily influenced by price, so with STEEM prices down, it's not surprising to find the virtual STEEM supply increasing. The up-side of this is that it's now possible to burn more collateralized STEEM per SBD with post promotion.

The bottom-left visualization now contains the ratio of liquid STEEM / current STEEM supply (left axis) and a zoom-in on Current SBD supply (right axis)

The chart on the bottom right shows the value of SBDs in terms of STEEM, according to the blockchain conversion rate, not external markets. This is the inverse of the blockchain's: internal price (which is different from the actual feed median, for reasons that I don't currently understand).

Now, here are some more details about each of the values

| Parameter | Axis (left/right) | Meaning | Comments |

|---|---|---|---|

| SBD Supply | right | Number of SBDs in circulation | Equivalent in value to collateralized STEEM |

| Collateralized STEEM | left | Number of STEEM needed to pay off all SBD debt | Equivalent in value to SBD Supply |

| Vested STEEM | left | Number of STEEM staked as STEEMPOWER | |

| Liquid STEEM | left | Number of STEEM that's not staked or needed for SBD collateral | Calculated as (Current STEEM supply - Vested STEEM) |

| Current STEEM supply | left | Number of STEEM in circulation | |

| Virtual STEEM supply | left | Number of STEEM in existence |

Thanks for reading!

For previous updates, see:

- Burned tokens, rewards, and inflation summary September 17, 2022 - Total burn estimates: 96,709K STEEM/SP and 60 SBD

- Burned tokens, rewards, and inflation summary September 10, 2022 - Total burn estimates: 88,781K STEEM/SP and 55 SBD

- Burned tokens, rewards, and inflation summary September 3, 2022 - Total burn estimates: 80,692K STEEM/SP and 54 SBD

- Burned tokens, rewards, and inflation summary August 27, 2022 - Total burn estimates: 71,850K STEEM/SP and 49 SBD

- Burned tokens, rewards, and inflation summary August 20, 2022 - Total burn estimates: 64,876K STEEM/SP and 37 SBD

- Burned tokens, rewards, and inflation summary August 13, 2022 - Estimated beneficiary burn since May 29: 56,855 STEEM

- Burned tokens, rewards, and inflation summary August 6, 2022 - Estimated beneficiary burn since May 29: 49,365 STEEM

- Burned tokens, rewards, and inflation summary July 30, 2022 - Estimated beneficiary burn since May 29: 42,556 STEEM

- Burned tokens, rewards, and inflation summary July 23, 2022 - Estimated beneficiary burn since May 29: 35,497 STEEM

- Burned tokens, rewards, and inflation summary July 16, 2022 - Estimated beneficiary burn since May 29: 28,408 STEEM

- Burned tokens, rewards, and inflation summary July 9, 2022 - Estimated beneficiary burn since May 29: 22,185 STEEM

- Burned tokens, rewards, and inflation summary July 2, 2022 - Estimated beneficiary burn since May 29: 15,312 STEEM

- Burned tokens, rewards, and inflation summary June 25, 2022 - Estimated beneficiary burn since May 29: 12,412 STEEM

- Burned tokens, rewards, and inflation summary June 18, 2022 - Estimated beneficiary burn since May 29: 8,994 STEEM

- Burned tokens, rewards, and inflation summary June 11, 2022 - Estimated beneficiary burn since May 29: 6,492 STEEM

Pixabay license, source

Reminder

Visit the /promoted page and #burnsteem25 to support the inflation-fighters who are helping to enable decentralized regulation of Steem token supply growth.

I follow the hungry-griffin account, the guys are really great. They have increased their influence and also train steem authors to make quality posts. More steem has already been burned this week. This makes me happy!

Thanks for the report. This adds to my enthusiasm to keep setting 25% payout to @null. We are waiting for the next report. 🥳🥳🥳

My 104k burn is truly extraordinary. It will be great if we reach 1 million and then 10 million.

This post has been featured in the latest edition of Steem News...

On some occasions I think that it is a quality publication, I like to comment, I see several posts, a photo or two appears, however the number of votes is impressive, it is the so-called monopoly that makes quality publications, which are of quality, be ignored, it's my opinion and I think many here see the same thing as me, but they don't dare to say it, I do dare and assume the consequences, no problem