Is Steem a deflationary blockchain?

Short answer: "No, but..."

Let's look at numbers from coinmarketcap.com

| Date | Market Cap | Closing Price | Market Cap / Closing Price (estimated # tokens) |

|---|---|---|---|

| October 31, 2020 | $56,622,929 | 0.1444 | 392,397,290 |

| November 1, 2020 | $55,706,401 | 0.15 | 392,851,911 |

| October 31, 2021 | $244,921,205 | $0.6237 | 392,690,724 |

| November 1, 2021 | $238,794,601 | $0.6085 | 392,431,554 |

Update: The above table has now been updated with values from November 1, 2021. So, by coinmarketcap's estimation, the number of circulating STEEM tokens declined by 420,357 from November 1, 2020 through November 1, 2021. End Update

And coinmarketcap also shows 392,496,101 tokens in circulation at this moment. If coinmarketcap's numbers at closing time today yield a calculation that's below 392,851,911, then it seems that their measure for Steem's circulating supply will be deflationary (over a 1 year period).

It's off topic, but before moving on, let's just pause and recognize that these numbers show a 4x year-over-year increase in price. When you get caught up in the short term, it's easy to overlook things like that, but a one year increase from $0.15 to $0.60 is nothing to sneeze at. Anyway, back to "inflation" as measured by coinmarketcap...

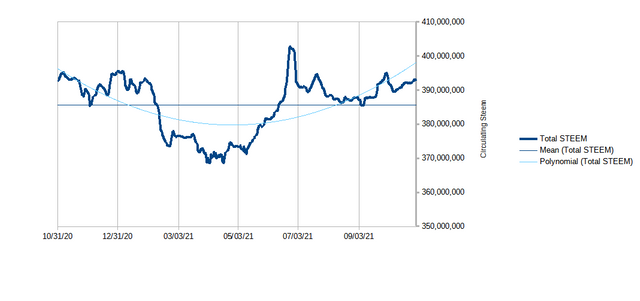

Here is a graph of the calculated tokens in circulation during the last year based on coinmarketcap's historical market cap and closing price records:

I'm the first to admit that this doesn't reconcile with what I think I know about Steem inflation, and I totally don't understand how coinmarketcap is calculating the number of tokens in circulation. They do provide this hint:

Circulating Supply is the best approximation of the number of assets that are circulating in the market and in the general public's hands. We have found that Circulating Supply is a much better metric than Total Supply for determining the market capitalization. The method of using the Circulating Supply is analogous to the method of using public float to determine the market capitalization of companies in traditional investing.

Assets that are locked (via smart contracts or legal contracts), allocated to the team or private investors, or not able to be sold on the public market, cannot affect the price and thus should not be allowed to affect the market capitalization as well.

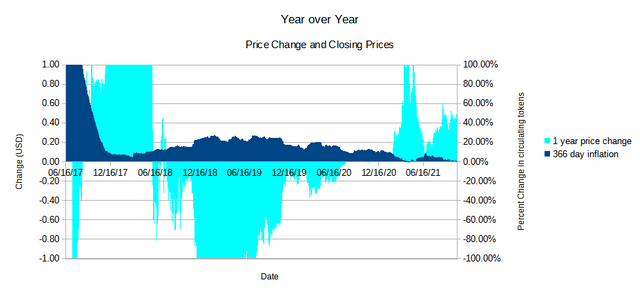

By the same calculation, we actually have seen the year over year inflation go negative earlier, most recently back in April of this year. This interests me because of what I see when I graph closing price against this "inflation" estimate.

I don't know which is cause and which is effect, but it's pretty clear that price growth is inversely correlated with inflation in the circulating supply, as reported by coinmarketcap. It may be interesting to see if this calculation turns negative again in coming days....

Let's face it... Most Crypto's are just "UN-STABLE" Fiat Currencies, backed by Nothing buy Limited Numbers... United States Electronic Coinage will be "STABLE" and "BACKED" by Corrected Silver and Gold Coins, if my Vision comes to Pass...

November 5, 2021... 24.8 Hollywood Time...

I agree with you when you admit that you do not know how coinmarketcap calculates the tokens in circulation but I understand that the creators of each project notify CMC how much token they have created and how much token is in circulation at that time and then the algorithm of CMC calculates how much token is circulating in each exchange house that the token is registered.

I do not know if this is true I have only heard it before.

Thanks for the reply! It's pretty close to the blockchain's "current_supply" property, which is published on the various blockchain explorers, but it's off by about a million or so. From my reading, I believe you're right that coinmarketcap takes the number from a Steem API using a method that was provided by the Steemit team.

I think there is a mistake on graph of coinmarketcap. They don’t show us 100% right information all the time. There are also many different of information in this kind of other website.

There are many error on graph for almost every coin. You really noticed very important thing. Thanks for the information.

My opinion is that steem is not deflationary. It has strong blockchain. If we called hive / blurt is son, then their mother is steem...

Dear friend, i have a question to you. What/who is penny4thoughts? Some days ago, he gave me SBD to my wallet...

While the boss comes, I'll give you a brief explanation: penny4 Thoughts is an experimental project, to encourage the participation of users in the blockchain through their comments or responses. Users are rewarded for their comments that receive positive votes (> = 25%) from the authors of the publications.

@alevin is right. If the author of the post sends beneficiary rewards to @penny4thoughts, then the account distributes the liquid beneficiary rewards from the post to authors of reply comments that receive >= 25% upvotes from the post's author.

It's really great. Thank you very much dear @penny4thoughts and also dear @remlaps-lite. I want to know who is the author of this project?

I would like this platform to last and improve over time, to be strong, stable, durable, that new people who arrive stay and do not leave, for this we all have to contribute, give our best every day. Inequality, as in all areas, threatens growth, and we have to attack and improve in this regard, since the larger the gap between those at the top and those at the bottom, the more danger the platform has. In conclusion, we must generate opportunities for integration, stability, growth and permanence of users on this platform.

Steem is very stable coin. I see that many altcoin change dramatically with bitcoin price change. But steem is not such. It js good for everyone.

Thank you for your guidance !