Five phases of Steem inflation

In terms of percentages, Steem's inflation curve is simple. In terms of daily new STEEM produced, it turns out to be a bit more complicated.

Introduction

We all know the story about Steem's blockchain inflation. It goes like this:

It started at 9.5% in December of 2016 and gently declines by 0.01% every 250,000 blocks. This is better than Bitcoin because Bitcoin reduces its coin production by a harsh 50% all at once every four years.

But in my weekly reporting, I happened to notice for the first time that even though the inflation rate was decreasing, the number of new STEEM per day is increasing. Then, curiosity killed the cat, and I spent way too much time trying to understand what was going on.

In the last two weeks, I wrote two exploratory posts trying to understand the Steem inflation curve. They were: Is the STEEM supply growth rate approaching a turning point? and More about Steem's inflation models.

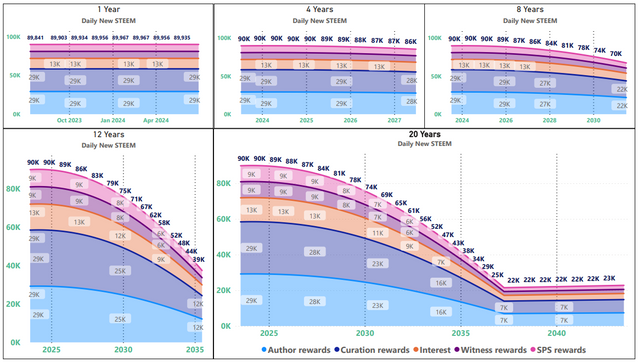

It started off as a simple question, and I had no intention of turning it into a 3-part series, but curiosity got the better of me. The question was, "Will the number of new STEEM per day keep growing indefinitely, or will it change direction?" The answer I arrived at is that (absent other factors), it will peak and start declining. As near as I can tell, the peak happens in early 2024. (note that the table here also calls a peak in 2023/2024, which I had never noticed before. Apparently, I could have saved a lot of time by just looking at that web site. ;-) )

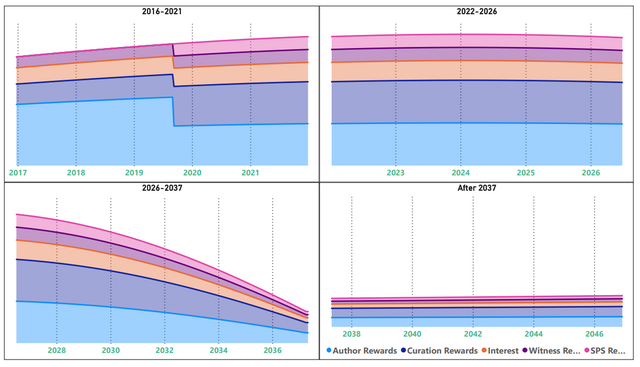

In exploring this question, I also happened to notice that when judging by new STEEM per day, we can loosely divide the inflation timeline into five phases:

- Before hardfork 16 (not visualized here)

- Hardfork 16 to 2021

- 2022 to 2026 (June)

- 2026 (July) to 2037

- 2037 and forward

I'm putting arbitrary dividing lines in a mostly smooth curve, so someone else could divide the timeline differently, but this is how I did it.

Obviously, in this framework, today is already well into segment 3 (top-right quadrant), but for the sake of completeness I'll write a few sentences about all of them here. The visualization above starts at HF16, so it doesn't include the first phase. I removed all numbers from the graph because the virtual_supply can also be changed by other factors, and it's just the shape of the curve that I'm interested in here.

Before hardfork 16

Please forgive any mistakes because I'm going from memory on this section, but I think it went like this. Before HF16, Steem had a 100% inflation rate. One artefact of the change is that people who were here and powered-up at the time got a nice percentage of new STEEM in comparison to people who started later. So, in a sense, they had a bit of a head start beyond just being early adopters.

On the downside, though, the market really didn't like a cryptocurrency with a 100% inflation rate. Ultimately, it was very unpopular and the 100% inflation rate was forked off by December 6 of the blockchain's first calendar year.

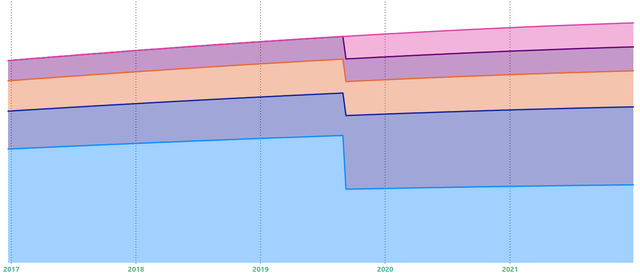

2016-2021

When HF16 kicked in for December of 2016, the inflation curve that we're all familiar with now began. During this time, the inflation rate declined from 9.5% to about 7.45%, but the number of new STEEM per day rose gently and steadily.

Under these circumstances, if the number of users stayed constant (or declined), then people would be increasing their daily rewards (on average). Alternatively, the blockchain could supply the same number of rewards per person to an increasing number of people.

Also during this time came hardforks 21/22, when 10% of rewards shifted from content to the SPS, and the author/curator split shifted from 25/75 to 50/50. It's interesting now to be able to visualize the huge haircut that authors took in August of 2019. I supported the change at the time, and I still do, but I have a better perspective now on why the authors were so alarmed at the time.

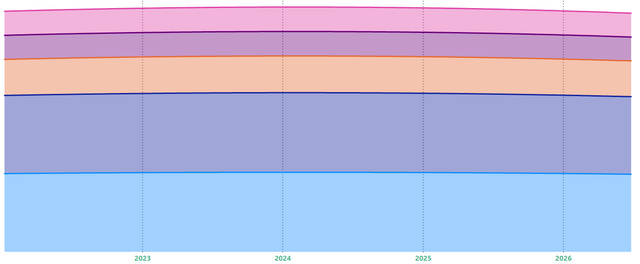

2022-2026 (June)

From the beginning of 2022 through June of 2026, the inflation rate drops from about 7.4% to about 5.5%, and the number of STEEM per day is basically flat. Yes, technically it peaks in February of 2024 - 7 months from now, but there's not a whole lot of change during these four and a half years.

Under this scenario, if the number of accounts doesn't change, we'd expect the rewards per account to be steady. If the number of active accounts goes up, we'd expect to see a decline in rewards, and if the number of accounts goes down, we'd expect to see an increase.

Anyone with a long term perspective on the Steem blockchain would probably want to be accumulating here because - as we'll see in the next section - it turns out that people using the blockchain now have the same sort of head start that the 2016 users had under the 100% inflation curve.

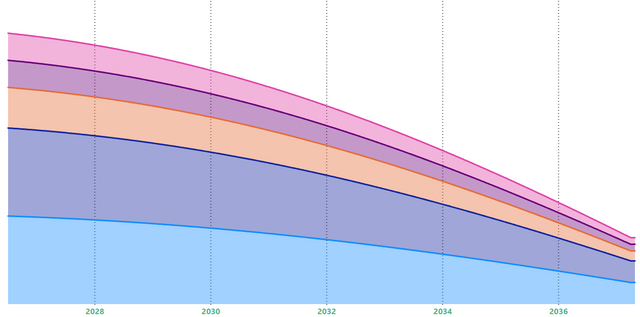

2026-2037

In my opinion, this is the most interesting part of the curve. The interest rate drops from 5.5% to its final value of 0.95%. But, remember the part about "This is better than Bitcoin because Bitcoin reduces its percentage by a harsh 50% all at once every four years."? Well, here we see new STEEM per day decline by 50% in seven years and then a second 50% decline in four years. It doesn't shock the system suddenly - in a single block - like Bitcoin does, but it is a pretty sharp decline.

During this period (all other factors being equal), the average rewards per account drops - by a lot.

Something that we see after the BTC halvings is that a lot of miners leave the playing field. If Steem production encounters this level of decline, we might expect to see something similar. The time to start thinking about how to retain users during this phase of inflation is now, because 2026 is not that far away.

People do social media for free, so it doesn't necessarily have to be solved with rewards, but there's got to be a reason for people to stay when the rewards supply starts going down.

Some possibilities that come to mind include:

- Finishing the SMT rollout so that declining STEEM rewards can be replaced by other tokens.

- Connecting TRC20 tokens to communities for the same purpose.

- Website / dapp development

- Policy decisions by witnesses (see conclusion)

- What are your suggestions?

After 2037

In about March or April of 2037, the interest rate levels off at 0.95% and stays there until the end of time. At this point, the number of STEEM per day will change direction and start increasing again, but it's decades or centuries or millennia (I haven't calculated that far out) until it returns to the levels that we're seeing today.

Conclusion

Hopefully, this will be my last word on the topic for a while. I think I have finally satisfied my curiosity. As I showed here, it's possible to divide the Steem inflation curve into five distinct phases and reason about how accounts are impacted during each phase of the curve. Other people are certainly free to choose different dividing lines.

It's important to note that there are other things that can also influence the production of new STEEM per day, so this analysis is only part of the complete picture. Other factors that can influence the new supply are:

- When SBDs are being produced for author rewards, if STEEM's value goes up, the virtual supply is reduced, which also reduces the production of new STEEM.

- When SBDs are being produced for author rewards, if STEEM's value goes down, the virtual supply is increased, which would also increase the production of new STEEM.

- I'm not sure, but I suspect that paying SBD interest might increase the virtual supply beyond the amount of standard inflation, which would increase daily STEEM production. If so, witnesses might consider paying SBD interest in order to retain people between 2026 and 2037.

- Burning STEEM or SBDs can reduce the virtual supply, and therefore the production of new STEEM.

- The witnesses could change any or all of this by implementing a hard fork.

- Anything else?

Closing note: Since I'm writing on the topic anyway, here's the forward looking visualization with the numbers labeled starting tonight (July 7, 2023) and looking forward 20 years. As before, this is just one component of future inflation, so these numbers may or may not wind up matching reality.

Thank you for your time and attention.

As a general rule, I up-vote comments that demonstrate "proof of reading".

Steve Palmer is an IT professional with three decades of professional experience in data communications and information systems. He holds a bachelor's degree in mathematics, a master's degree in computer science, and a master's degree in information systems and technology management. He has been awarded 3 US patents.

Pixabay license, source

Reminder

Visit the /promoted page and #burnsteem25 to support the inflation-fighters who are helping to enable decentralized regulation of Steem token supply growth.

It is wonderful that inflation will gradually decrease. But can steem live up to that date? Because there are no updates for steem to develop, grow.

I'm actually more worried about what happens after the new supply decreases.

No one can afford to run a witness node at 1/4 of today's rewards-level unless the price of STEEM goes up by a factor of 3 or 4 and stays there. There's no guarantee that the price will move that way. Hopefully, it will, but we won't know until we get to that point.

Either way, I definitely agree that growth and development are highly desirable.

Congratulations, your comment has been successfully curated by @o1eh at 5%.

I think that the price of cryptocurrencies in general is dragged down by the price of BTC, normally when it goes up, the others go up too , what if I wanted is for this panel to work more, developers must innovate, no I see a lot of changes here, it's usually the communities that have the most innovations

Thank you for this clear explanation on our Steem inflation! Very much appreciated!!

steem is dieing saddly maybe desiflation will make it more valuable, same buy orders but less new supply and price should x3 or x4

I don't think Steem is dieing. The whole altcoin market is in a slump, but I think STEEM is moving in line with the rest of 'em.

You might be right that the price could go up if the new supply goes down. That's what we've seen from Bitcoin. Only time will tell. ;-)

Upvoted! Thank you for supporting witness @jswit.

@jswit reply-off