Potential Steem Use Case: Powering a University's Endowment

In this article, I perform a thought experiment to imagine a college endowment that could pay tuition for students by making use of Steem's blockchain rewards.

Introduction

pixabay license: source

Back in March, I wrote the article, A hypothetical method for creating Steem endowments that resist embezzlement to suggest a mechanism for creating an embezzlement-resistant endowment mechanism on the Steem blockchain.

As a reminder, an endowment is an investment fund where the original donations are invested and never withdrawn, and charitable giving is accomplished entirely through the proceeds from the investments.

The method that I suggested for an embezzlement-resistant endowment involved the use of two accounts and required no new smart contracts. In short, one account would be funded and powered up, then all of its Steem Power would be delegated to a second account, and finally, the keys to the first account would be destroyed. This act of destroying the keys would make the delegation irrevocable. The owner of the second account would then be able to grow their own account and fund their charity through curation, author, and beneficiary rewards, while the initial grant would be untouchable by a would-be embezzler. (Of course, it's possible that the blockchain has a simpler mechanism for irrevocable delegation, and I'm just not aware of it.)

Not only would this resist embezzlement, but it would also give the holder of the second account a powerful incentive to vote and create content in a way that protects and grows the value of the Steem blockchain.

Today, I'd like to extend that thought experiment by thinking through the use of Steem blockchain rewards to power a university endowment. I'm not going to focus on the implementation, however. It would be equally effective to use a traditional Steem account along with procedural or legal controls to prevent the base funds from being withdrawn (Barring embezzlement).

Purely as an example, I looked up the tuition at our local University (from which I received my first master's degree), West Chester University of Pennsylvania and then threw together a spread-sheet to see what it would take to set up an endowment that could pay one student's tuition completely out of blockchain rewards starting in 10 years, and continuing every year after that. Of course, it would be desirable to continue increasing the endowment to pay for even more students after that. As you're likely aware, endowment lifespans can last for hundreds of years.

I'll work through the details in the remainder of this article, but here is the bottom line. I believe that, even with very conservative assumptions, it would be possible to launch an endowment that would fund one student's tuition out of blockchain rewards starting in the tenth year after launch.

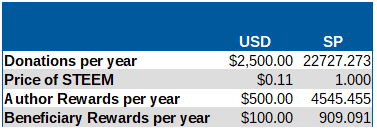

Here are the assumptions that I made:

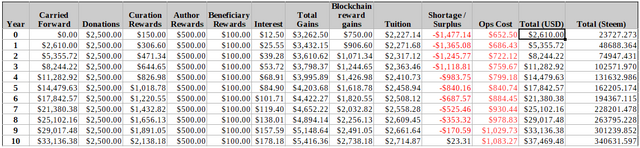

|

|

|

West Chester's tuition is listed on their web site as $1,113.57 per semester, giving an annual total of $2,227.14. After 10 years of inflation, that works out to $2,714.87.

Under those assumptions, I found that the endowment would - hypothetically - reach $2,738.18 in blockchain rewards after 10 years, which is a $23.31 surplus over the tuition price.

Note that this is not financial or legal advice. I'm doing a thought experiment about the technology. Anyone who wants to implement something like this should consult financial and legal professionals

The numbers

Here are the details behind that bottom line.

Now let's talk through the columns in the sheet. Note that all columns except for the last are shown here in dollars, but they'll actually be held as Steem Power (SP).

Year

This is probably self-explanatory. It's the number of years after launching the endowment.

Carried Forward

This is the amount carried forward from the previous year.

Donations

Donations are received through plain old-fashioned fundraising. Universities are already very good at this. I assumed a fundraising draw of $2,500 per year.

Curation Rewards

Here's where things get interesting. The Steem blockchain pays curation rewards to account holders for voting on posts in an effort to crowd-source content evaluation, appraisal, and ranking.

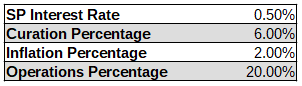

I assumed a 6% per year rate of curation rewards. My own personal curation bot has been achieving 8%-15% for a period of 3 years. Additionally, this bot is motivated by a desire to support quality content, not by a desire to maximize curation rewards. Therefore, I think 6% is probably an extremely conservative estimate. In looking over some of the data, I have seen other people's bots realizing up to 50% APR at times.

One of the interesting things about imagining that a college would implement this is that colleges have computer science departments where students and professors could develop and improve Steem voting agents as part of their curriculum or research activities.

Author Rewards

I assumed $500 per year in author rewards. These are rewards that the blockchain pays to people for posting articles and links to videos or other media.

As with curation rewards, colleges are already well positioned to pursue author rewards. They could put their marketing and recruiting information on the blockchain, and they could post about school activities and events like athletic contests, musical performances, or theater.

And, in addition to the on-staff professionals that focus on communications, colleges also have literature, art, music, and communications departments who could contribute content for the endowment as part of their coursework (see @phillyhistory during the beginning of 2018 for an example of how this has worked in the past.)

Further, parents, students, alumni, faculty, and employees could all be encouraged to join the Steem blockchain and vote for the endowment's posts.

Beneficiary Rewards

On the Steem blockchain, a beneficiary award is a way that a post's author can assign a share of the author rewards to other account holders where the payment to the beneficiary automatically goes straight from the blockchain to the designated beneficiary.

Those same parents, students, alumni, faculty, and employees could also be encouraged to assign beneficiary settings for the school's endowment in their own posts. I estimated this at $100 per year..

Interest

The Steem blockchain pays new tokens to stakeholders who have "powered up" their liquid STEEM into Steem Power in a process that is basically equivalent to paying interest. At present, the rate is over 2%, but it fluctuates, and I assumed a very conservative 0.5% APR.

Blockchain reward gains

This is the sum of curation rewards, author rewards, and beneficiary rewards.

Tuition

This is the tuition, starting at $1,113.57 per semester, and increasing by 2% per year. The number came from here.

Shortage / Surplus

This is the difference between blockchain gains and tuition for the current year.

Ops Cost

This includes any cost of operations. This is probably the biggest question-mark in the analysis. I estimated it at 20% of annual gains, but I honestly have no idea. This would need to be fleshed out more.

I can imagine costs for legal filings to get established as a legal investment mechanism, costs for fundraising, hosting costs for any autonomous voting agents, paying staff and faculty for their time in support of the endowment, and I'm sure there are other things that aren't occurring to me at the moment.

Total (USD)

The total at the end of the year, in US Dollars, after accounting for gains and costs.

Total (Steem)

The total at the end of the year, after converting from USD to STEEM.

Conclusion

One objection that will occur to the skeptical reader is that these percentages aren't substantially better than a traditional investment vehicle, and blockchain is still a high-risk endeavor, so why would a college want to pursue this?

My response would begin by noting the educational opportunity that it provides for students in the school's computer science or creative departments. It's a unique opportunity to be able to give students a vehicle to contribute to the school's endowment without paying any money, and it gives them hands-on experience with blockchain technology that is going to play an ever-increasing role in their future.

Additionally, I would add that although it is a high risk venture, all of these assumptions assumed no change in the price of Steem. It is also possible that an increasing price of Steem could improve the results dramatically.

Another point worth noting is that schools could follow this up through the use of steem-engine tokens, and/or the upcoming SMTs and Steem Communities to create a customized blockchain and web 3.0 experience for their own academic communities. That customized experience would extend far beyond the simple endowment.

Thanks for reading, and I welcome your commentary on the concept.

Beneficiaries:

@anyx - 5% - support for anyx.io API

@null - 10% - burn tokens

@steemchiller - 5% - support for steemworld.org

@steempeak - 5% - support for steempeak.com

Thank you for your time and attention.

As a general rule, I up-vote comments that demonstrate "proof of reading".

Steve Palmer is an IT professional with three decades of professional experience in data communications and information systems. He holds a bachelor's degree in mathematics, a master's degree in computer science, and a master's degree in information systems and technology management. He has been awarded 3 US patents.

Steve is also a co-founder of the Steem's Best Classical Music Facebook page, and the @classical-music steemit curation account.

Follow in RSS: @remlaps, @remlaps-lite

_

Thanks. Sounds interesting. Upvoted and resteemed.

I have to think later about this.

Thanks for the response and the resteem!

This is an extremely interesting proposition.

In fact if steem founders had allotted a portion of their original allocation for this purpose, it would have served not only a very useful purpose but could have also promoted steem to the academic community, which will be a big thing.

Your last point on steem-engine is worth noting.

Another point is donors to educational endowments could possibly create a trust fund stipulating that the funds should be used in the manner you have stated.

Thanks for the feedback and the resteem! I'm glad the idea makes sense to you. I've been bouncing it around in my head for a while.

I agree, and of course larger donations could short-circuit part of that 10-year start-up period. And I think you're also right that engaging the academic community could be very valuable for the blockchain, too.

I said academic community is a big thing because it was the students and academic staff who gave the impetus to facebook to be where it is today. They have the numbers and hence the power to do so if the product appeals to them. Here is an interesting article on it: https://www.theatlantic.com/technology/archive/2019/02/and-then-there-was-thefacebookcom/582004/.

Yeah, my first facebook account was when I was a graduate student, probably in 2005, I guess. They were slick with their guerrilla marketing, too. When I signed up, I actually thought it was something that was sponsored by the school.

I've been thinking for a while that Steem needs to stop trying to onboard everyone everywhere and focus, instead, on bringing in groups of people who share common interests, one group at a time. It's a lonely experience to get here by yourself and find yourself surrounded, entirely, by strangers. As that article & facebook's history demonstrate, colleges and universities seem like a natural fit for the group-onboarding strategy. Local geographic communities are another possible niche, but that's a topic for a diferent day.

This is rather impressive.

I guess one assumption made is that the University in question are progressive thinkers and willing to take a gamble on steem blockchain. Computer science departments may know this but the first point of contact will most likely be admin staff who may not be aware or comfortable with it.

Personally, I like the idea and I think Steem's decentralized model means anyone can do it. You just need to find a group of likeminded people to synergise with

Thank you for the feedback. I agree about the need to find forward thinkers to prove the concept.

On your last point about finding like-minded people, that seems to be one of the biggest challenges to many aspects of Steem adoption. At the individual level, my efforts at recruiting have met with less than stellar success.

Feels the same for me and I believe that will change only when steem offers something more than a "blockchain solution". I thought about a concept where people can publish academic journals and papers through the blockchain, or maybe offer something like what researchgate offers.

I agree. I think it will take-off when an app emerges that people would want to use, even without rewards. Eventually, I think that will happen, but it's a lot slower than I had imagined when I got here.

I think @steemstem was initially working towards something along those lines. Not sure if they're still pursuing it or not.

This is a very interesting concept. Of course the possibilities are endless as to what the funds could be used for. This made me think of how a much smaller scale version of this could be used to help people or villages in developing countries.

I have seen a lot of corruption in the NGO world in Cambodia, and this post got me thinking how you could keep the funds safe and do good deeds bit by bit with the weekly power downs. Too many times a shady director has too easy access to the funds and flees with the treasure.

I knew one small NGO who was just trying to deliver a 50kg bag of rice and basic medicines to a remote village weekly. The owner skipped town with the funds, and this project fizzled out. Also, the volunteers were in a never-ending search for more donations because the director had been siphoning portions for years already. If all that lost money had been put into a safe account like you are describing, the project could live forever and be sustainably self-funded.

Thanks for the feedback!

I agree that an endowment like this could be applicable to just about any charitable cause. An advantage that universities have, though, is that they probably already have staff with the skills they'd need to start generating blockchain rewards without a very steep learning curve.

Right, using it in a developing country would definitely require a massive training effort.

Setting aside the intrinsic risk of blockchain to the endowment itself, which you address, what about the inverse (risk of the endowment to the blockchain)?

Do you think the existing investors in the platform as a whole would be inclined to support these accounts? If not, what would the result be if investors actively seek to negate rewards that the endowment delegates seek?

Thanks for the reply! These are good questions.

In real life, endowments and real-estate donations are often given with constraints on how the gift can be used by the recipient, so if large amounts of funds for the endowment were to be donated by someone on the Steem blockchain, it might be prudent to try to stipulate terms on the sorts of voting and content-creation behavior that are permitted or prohibited.

As to whether the blockchain community would be welcoming, I guess it depends on a variety of factors, but the endowment would need to navigate the same landscape as anyone else on the blockchain. As long as the votes and posts are geared towards promoting useful content, I'd hope that they'd be supported, but this is an important factor for consideration, because it clearly adds some uncertainty to the idea. (This is one of the concerns I have had with downvotes in general. It's not really limited to the endowment idea. For example, what if a major music label decided to launch a downvote campaign against all people who post competing music-videos...)

It's also interesting to think of what might happen if someone did start voting to counter the rewards of a school with 10 or 20 thousand active students or more (and their families and alumni). Might that academic community respond by buying more Steem and launching a "bidding war"?

I have to say that I don't know, but those are interesting and important questions for anyone who might consider pursuing a strategy like this.

This is similar to what I speculate as well:

https://steemit.com/steem/@inertia/creating-demand-for-steem-power-vote-negation

I do think we have seen that happen in practice with some of the "flag wars" of the past. One time I remember in particular, I was assuming that Steem's value was going up because two parties were both powering up to downvote each other. It's ironic that when that happens, the competitors strengthen each other by bidding up the value of their stakes.

OTOH, sometimes the target doesn't fight back, but instead they pack up and leave. That's harder to do when they're tied to an on-chain endowment, though.

Dear @remlaps

My good friend @devann shared this publication with me.

I must admit that I've never used word "endowment" before and in the beginning I found it a bit confusing to understand meaning of it. Thx for solid explanation what endowment is about.

Why? Would it really be necessary? It sounds like a huge put-off and I cannot imagine many users willing to do it. It require absolute trust between both parties. Hard to achieve.

Interesting read (it may be a bit to long :)

Yours, Piotr

Thanks for the reply!

In general, I believe that people rely on legal or procedural controls to make sure that the principal portion of an endowment is never withdrawn. But there is always the risk of embezzlement by someone with access to the funds. By destroying the keys on the delegating account, a donor can guaranty that the funds are inaccessible for withdrawal.

But no, for this concept, that step would not be necessary. An institution could use legal and procedural controls, just as with a traditional endowment.

Dear @remlaps

Thank you for your kind comment and sorry for replying so late. I didn't see you posting since your comment. Hope you're okey.

May I ask you for little favour? I'm not sure if I did ask you about it already or not (hope I'm not repeating myself).

Could you please check out also my recent post if you have few min and share your thoughts on questions related to concept of "introducing steem blockchain to businesses":

https://steemit.com/steemleo/@crypto.piotr/my-very-first-trip-to-switzerland-one-of-the-most-crypto-and-blockchain-friendly-place-on-the-planet-earth

Your feedback is always appreciated ;) And I will upvote most valuable comment with 100-200k SP coming from project.hope account.

Yours, Piotr

Steem is not a charity. We can rule out any chairtable good will from the vast majority of people using Steem. This goes for any cause, nevermind people receiving the benefit of a free university education. They are already well looked after by traditional beneficiary programs. By virtue of acceptance already have a decent ticket to success and a second rate charity cause at best.

Unless it can clearly be demonstrated how this will help Steem, it isn't even in Steem's interest. It will just be another account trying to get more Steem, the same as the rest.

Most accounts benefit Steem in one way or another. Onboarding people who earn scholarships has limited value for the blockchain since they are onboarded as feeders. Would the receiver be required to promote Steem? These promotions likely have little value, especially when you look into what Steem is.

Steem is highly speculative. Most growth has been wiped out and it could get worse. Students need money based on a very specific schedule. They cannot just hodl and hope.

Further rewards can be negatively impacted by upset individuals. The last thing Steem needs is more stuff you cannot downvote for moral and ethical reasons or more accounts that have to be protected from attackers.

Perhaps putting money in something safer like companies graduates work in or commodities would be more responsible.

Blockchains can be used for education. Steem can be used for blogging or posting finished assignments. It can reliably earn students something like beer money, but even that makes me a little squeamish. Not only do I need my beer, but I wonder the value of only onboarding students. Facebook quickly mved away from them. The youth don't have money.

Thanks for the reply! There's a lot to reply to, there, so I apologize in advance if I don't address every point.

Steem is not a charity any more than the US Dollar is a charity, but both can be used for charity and investment - which is what an endowment is.

What I describe here doesn't onboard anyone as feeders. It onboards them as investors. They don't start "feeding" - as you put it - for 10 years, and even then they continue to invest and leave their base investment untouched in perpetuity.

There is a case to be made that people who are already on the blockchain would benefit from donating to a charitable cause like this because it will help the blockchain by potentially on-boarding people - both investors and users. Students may have no money, but they eventually become working professionals, so there is long-term value from on-boarding (and retaining) them.

But that's not what I was describing here. I was imagining here that a university endowment would use traditional fundraising mechanisms to buy into the blockchain at a rate of $2,500 per year for 10 years. And the endowment's account(s) would be owned by the university, not by a student.

From the blockchain perspective, you're absolutely right that it would be just another account trying to get more Steem. Which is why I described it as a "use case" in the title. But, as I point out in the article, universities have communications professionals and computer science departments and creative departments for fields like music, literature, and art, so they are very well positioned with the skills needed to go after rewards. I stayed away from implementation details, but the university would have to have some sort of mechanism in place for managing posting and voting authority for the endowment account(s).

On one hand, you're right that there is a lot of risk - as I acknowledged in the conclusion. On the other hand, though, much of that risk would be naturally mitigated through dollar-cost averaging. I think it's a matter of fiduciary responsibility for university endowments to have investments in their portfolio that run the gamut from high-risk/high-reward to highly-conservative. So, this would presumably be just a small part of their overall endowment funding, which is another form of risk mitigation.

I think your idea is better as a token of its own. There are already several charity tokens in existence and once SMTs come online you can leverage ICOs and its own inflation design for your purpose. However, Steem is like a universal social media platform that is co-owned by all users, as such it is a business. There are two parties, curators and authors, and curators invest in STEEM and share it with authors only when authors prove that they have contributed value to the network.

Authors are worthy of a share of STEEM only when they make the network and thus STEEM itself more valuable. Steem is very much a for-profit design and charities can actually cause downward pressure on its price. How so? If STEEM rewards were going to a college student fund, those students would be having to sell off the STEEM to compensate the schoool in the currency of their choice, resulting in downward pressure to the STEEM price.

The price of STEEM is the most important thing here, because Steem is first and foremost an investment as a commodity money and a business for those owning enough of the network to be concerned with its price and liquidity. So, Steemians would want to know how value was returning to Steem, not just, potentially, a decade later but immediately.

Charities benefit from tax deduction rules, and businesses would rather donate, deduct and receive social recognition for being charitable than just give it all to the government. I think the flaw in this idea is that I see no incentive model for the Steem network itself, certainly not an immediate benefit.

There are charity designs that work because they drive adoption, immediately. For example, let's say you made an SMT and motivated caring people to contribute value into your SMT and the inflation went toward students. Some Steemians might contribute STEEM toward your mission if via the SMT inflation it onboarded many college students regularly.

Let me provide an example... Let's say you created "Essay Token" as an SMT and people could spend their STEEM to obtain "ET" that they could stake and curate posts from students presenting their essays to the community. In turn, some campus adjacent shops agreed to accept those tokens for reduced price on their products. This benefits students living on a tight budget and benefits the businesses by likely adding traffic to their shops and some STEEM can even be earned from the ICO and general exposure to the whole of the Steem community.

I think something like this ultimately needs to become its own token, not a project taking a considerable chunk out of the reward system, which is competition-based for the sake of building network value. Charities doing things like spamming the blockchain with "Support The Whales Request #194,813" with the same copy pasta on all the same posts just isn't helping Steem grow, its parasitic in nature. I'm not saying that charities are not good things, they can be, but I think they would do more harm than good to Steem by trying to siphon out value from the universal reward pool unless they are providing immediate value to Steem in some way.

Thanks for the feedback!

I considered the idea of using a token, and it is certainly an option. It would be up to the institution that was doing the implementation to decide on that. I don't have a preference one way or another, but an institution might-well prefer to use a branded token, or a token that's tailored for the specific purpose.

However, I think there are some relevant points that mitigate the risks that you describe:

(i) The concept is not just a charity. It's also an investment. As an investor, the institution would have the same incentive as every other stakeholder to protect the value of the blockchain. They would be just as trustworthy as any other blockchain user. If we want to say that we can't trust a university to post worthwhile content, we may as well say that no one should use STEEM because everyone might spam it.

(ii) Under this concept, the institution would not be withdrawing any funds at all for 10 years, and when they start withdrawing, it would be on the order of 8% of their stake per year (and that percentage would continue shrinking). This small portion should not represent any kind of threat to the blockchain, especially since the concept is to continue fundraising and investing, and (coincidentally) the cost of tuition is on the same order as the new funds that would be invested. Thus, the university's stake in the platform would grow continuously.

(iii) As noted in another comment, the fund would be owned by the university, not by students. Further, withdrawals would be performed on an orderly schedule, not whenever a student happened to experience a cash crunch.

Thanks for your detailed reply. To be clear, I wasn't solely criticizing your opinion, but just the general idea that Steem is some sort of magic economy that can solve all problems.

Using Steem for an endowment fund actually hasn't been discussed much and it is an interesting idea. I understand that endowment funds are non-profit. Rich people donate to them to get tax write-offs, instead of the money simply being given away, the profits are used as investments.

There are just too many issues to get past despite the risk for crypto in general. Will the government let endowments invest in crypto? Probably not in America. Is Steem even a good first one to consider? Not only is it ranked 90 and not rising, but there is too much voting to be done to perform well. I could see an endless debate over what to post, what to curate etc. Perhaps delegating all of it with clear guidelines and at a specific rate would get over this. Maybe people will pay more to borrow from a university, that's their choice.

As for things to do with Steem, that is a definite advantage. But does it need to be attached to an endowment? Educators and computer programming students can easily post or develop for Steem and even make some pocket money while they are at it. It's a great testing environment and they may even make enough money to buy snacks. However, with the price of Steem being low, this isn't the best time to advertise how much you can earn with Steem. Even the developers are second-guessing things and everyone is trying to get funded with a proposal.

Then we have the issue of corruption. Would students and alumni be compelled to use Steem? Is it right to tell students to do their assignment on Steem when the university or professors make money from this?

There are so many avenues for abuse and corruption here. It makes a professor forcing students to buy his book seem simple.

Okay, students follow all accounts on the class list. Every week you must upvote and resteem the course-tutorial post, lab-post and the lecture post and leave an insightful comment on each. Additionally, you must create your own post setting the class account and university account each as 10% beneficiaries. This is 10% of your grade with a bonus of 10%/7%/5% for the 1st/2nd/3rd best influencers. FInally, if we catch any of you downvoting or saying anything bad, you are suspended and your grades will suffer. Time to fundraise...um I mean learn.

Thanks for the reply!

Many of the points you raise could be issues with or without an endowment, and with or without Steem. I agree that there's potential for abuse there, but I'm not sure if the existence of an hypothetical endowment exacerbates most it. If Steem ever sees mass adoption, most of those risks will exist, regardless of any school endowments (in fact, they do already.).

As to Steem as a first cryptocurrency, a reason a school might want to make that choice is that the concept does not rely on an increase in Steem's price. I'm not aware of many others where the school wouldn't have to depend on the value of the token to rise. Of course, you're right pointing out that the corresponding drawback is that it's not a completely passive investment.

I want to highlight two important points from your reply that are specific to the endowment concept:

(i) Is there an inherent conflict in interest in asking unpaid students to perform support activities for a school endowment? On one hand, students are asked to perform unpaid fundraising and volunteer work for school-specific things like music, sports, and equipment all the time, but on the other hand, it's not lost on me that the @phillyhistory project wound up donating their account to a non-profit institute outside of the school when their project wrapped up in 2018. I don't know the full reasoning for that. It might help if the endowment is structured as an independent external financial entity, separated from the school by a so-called Chinese wall.

Of course, if appropriate, the school would have the option to limit support activities to paid faculty and staff.

(ii) Would regulators permit it? This is why I had the prominent disclaimer to consult legal and financial professionals. I couldn't begin to guess. I would hope so, but that could be wishful thinking.

Not sure I understand all of this completely after one read, but I like the idea. It's especially interesting to think about the difference in motivation between an educational institution, an individual, and any other institution.

Thank you for breaking down the various rewards' and interest, and for noting the fact that your chart reflects the dollar value of Steem Power rather than actual dollar amounts. It'd be interesting to play with the assumptions you've built in to build an understanding of the range of possibility from conservative to overestimated.

Now that I think about it, I wouldn't be able to repeat this to somebody without mistakes if I didn't have it on hand to reference, so I am going to read through again to make sure I get it as much as possible. Cool thought exercise, though! I'll reference it if I ever post something similar with a tweak or two.

Thanks for the feedback! I can send you a copy of the spread-sheet if you are interested. It was done in LibreOffice.

Very interesting.