Reward Curve Deep Dive

Hello Steemians, I’m @vandeberg, Senior Blockchain Developer at Steemit and today I want to do a more technical deep dive in to the rewards system of Steem and shed some light on the nuances of changing a reward curve. We recently proposed changing the reward curve to a "convergent linear rewards curve" as part of the effort to improve the economics of Steem. What does that mean?

To read more about how the Steemit team believes the economics of Steem can be improved, check out this post on @steemitblog.

ELI5

When Steem was first created, rewards were distributed based on a “superlinear” rewards curve. That meant that accounts with a lot of Steem Power had more innate influence on a per-Steem-basis than smaller accounts. That curve was very effective at encouraging people to consolidate their Steem into one account, which made it easy for other users to find and respond to bad actors. But a side effect of this curve was that the “rich got richer” at a rate which made the ecosystem feel extremely unfair.

Switching to a linear rewards curve meant that every account had the same degree of influence (on a per-Steem-basis) on the rewards pool regardless of the total amount of Steem they had in their accounts. At the time most felt that this dramatically improved the fairness of the ecosystem, and since that change was put into place, we have seen a reduction in the income inequality in Steem. One problem with this change was that it reduced the incentive to consolidate one’s stake in a single account, which made it easier for bad actors to divide up their stake and hide their activities.

Reward Mechanics

To gain a deeper understanding of how these different curves function, let’s look at a few hypothetical scenarios and see how they play out based on how much stake the users have, and the type of curve that is in place.

When a comment is 7 days old, it is rewarded based on the number of reward shares (or rshares) it has, modified by some function called a rewards curve. Steem currently has a linear rewards curve, which means the rshares are modified by the curve f(x) = mx + b. Specifically Steem uses the curve f(x) = x where the rshares are not changed at all. This is compared to a moving total of rshares recently paid out. Let's work through a simple example.

Let's say that Alice authored a post that received 10 rshares. The pool of recent rshares contains 1000 rshares, and the reward fund holds 100.000 STEEM. The reward curve is applied to Alice's 10 rshares, giving us 10 rshares and those are added to the total recent rshares, giving us 1010 rshares. Then Alice is rewarded with 10/1010 of the reward fund, or 9.900 STEEM. The actual values on the blockchain are much different than this, but the math is the same. In addition, the recent rshares are decayed slightly each block. Over time it reaches a pseudo-equilibrium which normalizes rewards over time.

With the same constraints, what if Bob had a comment rewarded at the same time, but he only had 5 rshares. Both of their rshares would be added to the total recent rshares for a value of 1015. Alice would be rewarded with 10/1015 of the reward fund for 9.985 STEEM and Bob would be rewarded with 5/1015 of the reward fund for 4.926 STEEM. As you can see, Alice's comment had twice as many rshares voting for it and she received twice as much STEEM as Bob. We might also call this a proportional rewards curve because the rewards are proportional to the number of rshares voting for a piece of content.

The Different Curves

When Steem was first launched we had an n^3 reward curve, which was changed to n^2 before the first payouts began on July 4th, 2016. Let's run the example again but with a rewards curve of n^2. To make the values somewhat close, we also need to increase the size of the recent rshares to 5000. We have to add an extra step in the calculation that was implicit before, the application of the rewards curve. Alice's comment has 10 rshares, but when we apply that to f(n) = n^2 we get an actual value of 100. Doing the same to Bob's comment gives us a value of 25, for a new total recent rshares of 5125.

Now, Alice is rewarded with 100/5125 of the reward pool, or 19.512 STEEM, whereas Bob is rewarded 25/5125 of the reward pool, or 4.878 STEEM, four times less than Alice! We call this a superlinear reward curve. Certainly this is not fair. Steemit and the witnesses agree, which is why we changed the rewards curve to linear on June 20, 2017 in Hardfork 19.

Superlinearity

However, there is a really nice property of a super linear reward curve. It encourages consolidating stake in order to maximize rewards. In the Steem Whitepaper we refer to this as "anti-sybil". The scenario that it seeks to combat is a single entity spreading their stake over many small accounts in order to hide their actions in noise. A single entity doing this can hide their intentions and siphon off small rewards over time and be difficult to detect. Superlinear rewards incentivizes consolidating stake or at least having the smaller accounts act together, which makes the behavior much more difficult to hide if the entity wants to act in an optimal manner.

Best of Both Worlds?

Is there a way for us to capture the fairness of linear rewards and keep the anti-sybil benefits of superlinearity? We believe so with what we have termed the convergent linear rewards curve. This curve is of the form n^2 / (n + 1).

Let's look at the example above again, but add in Charlie who has a comment with 20 rshares. We will go back to a recent rshare value of 1000. We will also be using the specific reward curve of n^2 / (n/5 + 1) for this example.

Alice has 10 rshares which are augmented by the rewards curve to be 33 rshares.

Bob has 5 rshares which are augmented by the rewards curve to be 12 rshares.

Charlie has 20 rshares which are augmented by the rewards curve to be 80 rshares.

The payouts then for Alice would be 29.333 STEEM. Bob would be 10.666 STEEM. Charlie would be 71.111 STEEM.

Looking at Alice and Bob, Alice only has twice as many rshares as Bob, but was rewarded with 2.75 times as much STEEM, an increase of 37.5% STEEM per rshare.

However, while Charle also has twice as many rshares as Alice, he was only rewarded with 2.42 times as much STEEM, an increase of 21% STEEM per rshare.

That is the beauty of this curve! As more rshares are awarded to comments, the marginal gain (percent STEEM per rshare) decreases. However, the actual STEEM reward per rshare still increases. If it did not, we would see Charlie rewarded with less than 2 times as much STEEM as Alice, resulting in a negative percent STEEM per rshare.

We have decided to call this a convergent linear rewards curve, because as the number of rshares increases, this curve converges on linearity and behaves more and more like a linear rewards curve. The specific curve it behaves like can be derived by calculating the limit at infinity. In the case of this curve, it behaves like the curve f(n) = 10n. We can tune how quickly the curve converges to the equivalent linear rewards curve by changing the coefficient of the denominator term.

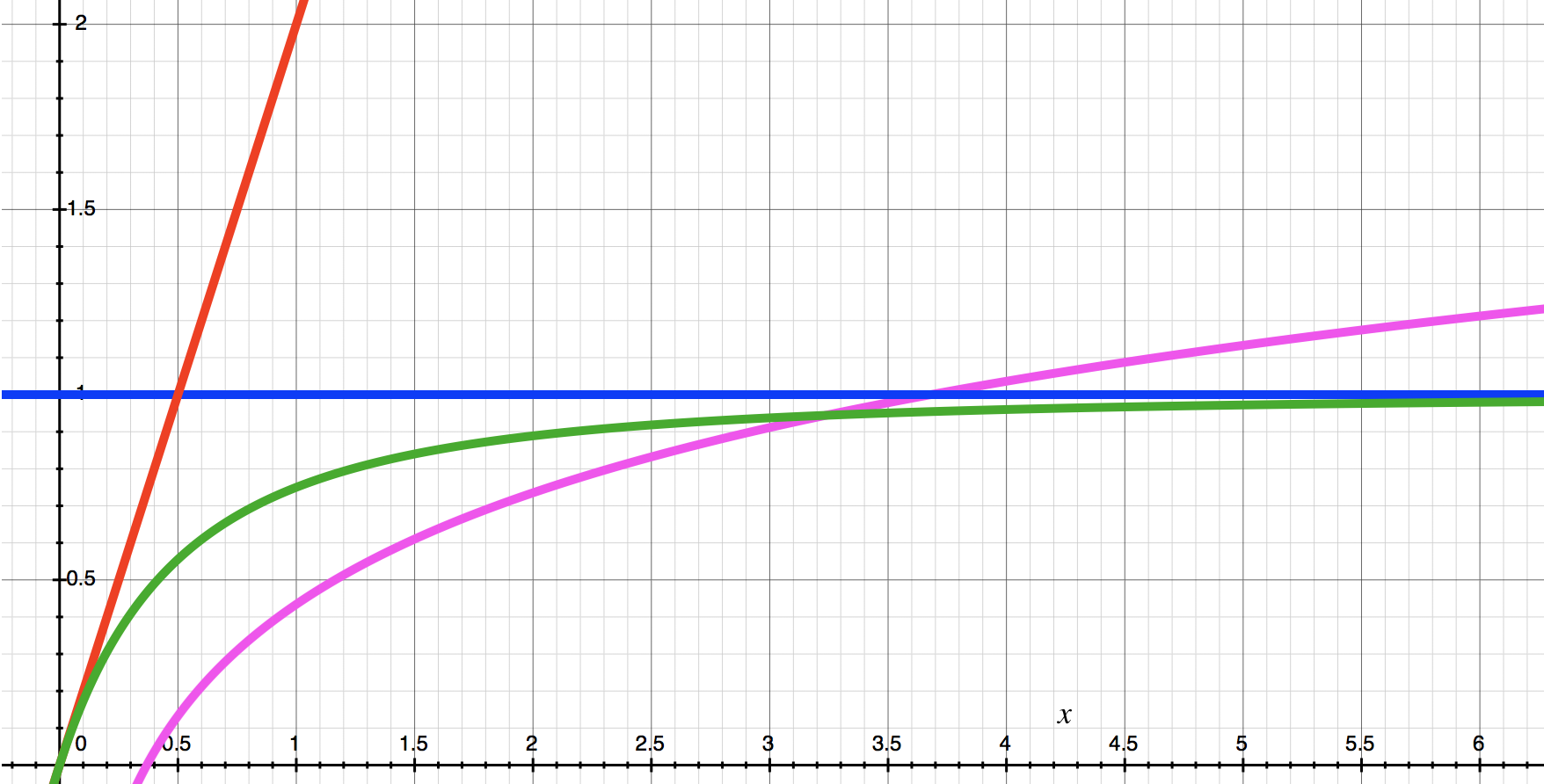

We can graph the derivatives of the reward curves to visualize their "fairness" over time. The red line is n^2, the blue line is n, green is n^2 / (n + 1), and pink is n log( n ). The pink line was added as another point of comparison because it is a common function that grows faster than n but slower than n^2 and is a reasonable candidate for a superlinear curve. This graph confirms what our intuition is regarding these curves from the previous examples. n^2 continues to get more and more unfair as rshares increase and n is fair regardless of rshares. The green curve for n^2/(n+1) is cool because you can see it start unfair with n^2 and end fair with n. n log(n) continues to grow forever. While it is not as unfair as n^2 it does continue to grow in unbounded unfairness, while n^2 / (n+1) does not.

The goal of this post was to deep dive into one of the critical pieces of the Economic Improvement Proposal. Let me know if you have any questions in the comments section below, or what part of the proposal I should “deep dive” into next.

Vandeberg

Interesting!

My own idea, which I formulated about a year ago, is a reward curve which started as a*n^2 (thus flat at the very beginning and then getting steeper), and then later changed into linear which would work against self-voting as well as against the excessive rewards of pure n^2. I see your curve would end even flatter which I think is reasonable.

@clayop had a similar idea.

The curve in my mentioned post could be made more 'beautiful' (without a 'knee') by using spline interpolation, but it was about the idea (the mathematics would be your part then :-):

I also take the opportunity to present my other idea of implementing diminishing returns when upvoting the same accounts (including one's own) again and again to make it more attractive to upvote many different accounts instead of always the same 'best friends'.

Spline Interpolation is a technique that tries to approximate to a high degree of certainty more complex curves using simpler piecewise curves. Using it in this case would be a step backwards because the curve we would be approximating is not actually that complicated.

Diminishing returns on upvotes is an interesting idea but I don't think it would work. Even with superlinear rewards, I put all of my stake in to one account and then post comments with n+1 accounts, where n is the number of unique accounts I need to vote on to avoid such diminishing returns. The large account spreads out votes and avoids the diminishing returns.

You could also implement this is as an account to account time based diminishing return. Despite being expensive in the database to maintain, it would hurt content creators in the long term. Repeat customers are hugely important in media. YouTube, for example, puts new videos from channels you have watched in the past hoping that you will watch more of their videos. Punishing the author for creating a following will not help grow Steem.

I would like to add something:

Of course. However, I think it also increases social interaction on the platform if people benefit from trying so seek, read and upvote great posts also (not only!) from unknown authors as well. Then new users would have a better chance to get noticed and rewarded.

The current system can easily get exploited by people (like for example haejin) with at least two accounts, who write 10 posts per day just to upvote them all with their other account(s) without 'diminishing returns'.

Thanks for your reply!

I only mentioned spline interpolation because of my 'ugly' curve with that 'knee'. :)

However, anyway my curve only served as an example to show my idea: to start flat to make self-upvoting less attractive and to end also flatter than n^2 to avoid huge rewards for single posts.

There are much better curves (for example sigmoid function like curves could be interesting) to serve the same purpose ... but ... I was just too lazy to seek a suitable curve. :)

Yes, unfortunately, concerning 'diminishing returns' you are probably right: with enough accounts one can circumvent their effect ... but at least the 'traditional' circle voting would be somewhat more dificult.

I have nothing against building a following (I also like to upvote my friends and receive their upvotes), therefore I had suggested that the 'diminishing returns' only should have an effect for a certain time span (there could be a similar reloading mechanism like voting power anyway has).

Anyway, just consider my thoughts as 'food for (further) thoughts' - it's well possible that there are better ideas and solutions.

Don't think there is actually anything wrong with 'ugly and ugly could be of use if it aligns with the users mindframe (such as the redfish/minnow threshold). I would propose ugly in such a way is a desireable trade for user experience purposes.

Something like:

'My curve' is 'ugly' because I just mixed two curves together into one single graph to demonstrate my idea. I mean, if one used one single curve (maybe a sigmoid one?) instead, which also starts flat and ends not so steep, then it would have the same effect, but just looked much better. :)

You are right, in general there is no problem with looking 'ugly' of course.

Your example curve looks more or less linear ... :)

The example curve would give an 'ugly jump' 2.5% bonus at each of the fish-size thresholds used by Steemitboard because of the use of the floor function. Basically switching to a slightly steeper linear line at every power of ten thresholds for the vesting shares. Not sure if its the best function to use, but I do think that fish-size thresholds make a lot of sense for incentivizing the use of few large over many small accounts in a way everyone can understand. Give minnows a slightly better deal than redfish. Dolphins a slightly better deal than minnows, etc.

What may be ugly algebraically may well be quite simple as the interaction of two algorithms - just look at the curation rewards during the reverse auction to see what I mean.

Just an idea.

Now that type of reward function makes sense, tie it to something tangible that almost every Steemit user can grasp. I'm not sure that I agree with the chosen "bonus" (I think keeping it to something smaller like 1% is a bit fairer), but that's a whole other topic.

I imagine that type of function would add more of a gamification element into the Steem ecosystem, the real sense of "powering-up" each time that we move from one level to the next, which could drive more engagement within the community. It's also intuitive that the users who put up the most risk (power up the most Steem) get some extra perks for doing so.

It's certainly not as easy to power up 100K Steem as it is to do it for 100 (from the risk/reward perspective), having this type of bonus would certainly incentivize taking on a bit more risk and perhaps cause some who'd decide against it within the current linear function to reconsider their position.

Just did this post on the subject for those that are interested.

For clarity, here is an example of what the account size correction factor for both types of function could basically end up looking like.

The steps in the blue line show the different fish sizes. I hope these two together in one graph show the difference in impact on the handicap for new accounts.

Thank you for yoru work on steem and for coming into talk to everyone on the PAl discord today https://discord.gg/QBsa8fd

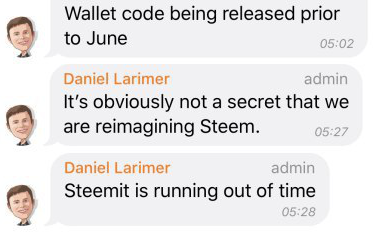

It was really cool to hear all the acknowledgement of steem-engine by steemit inc employees. Let's hope @aggroed and @yabapmatt help to push your team to work a little faster so we can have something before EOS and Block.one launches their MEOS wallet with Universal basic Income eclipsing Stem later this year, we really need to adress this comment by @dan Steem and Steemit FOunder, we need more people like you to actually tell us about the upgrades to steem we will need to compete with EOS since @ned has no plans on actuyally working together with block.one which is a shame after hearing this from @dan Steem/steemit founder

I still havent seen @nmed or anyone at STeemit inc actually answer this and tell us why steem shouldnt be reimagined by EOS and how steemit inc isnt running out of time? I mean thats the CREATOR of steem saying that.... Id really love to hear some actual answers from steemit inc about this like a roadmap to explain how they can even possibly think about competing with EOS

I like hearing from @aggroed today about plans to COOPERATE with EOS instead of trying to compete. also @stellabelle working at @pixeos has also made on chain comments here on steem expressing a wish to work together. Aggroed is adding EOS to Steem-engine so that will let peopel buya nd sell steem ro eos or eos for steem, and hes adding regular stocks from the stock market... see its THESE sorts of things that keeps steem relevanta nd I just havent seen anything come out of steemit inc anywhere near as big of a deal as the progress Aggroed and his team has made with Steem-Engine.com yabapmatt's keychain (Like our metamask) and SteemMonsters too, I wonder why isnt @ned funding Steem projects teh way EOS is with theiur 100 Million dollar EOS VC Venture Capital Fund? And forgive me for talking about this here, but there is literaly nowhere else to discuss this and @ned doesn't post so yeah, you're teh closest i can get.

Im glad people like you are working hard but seems like its not enough if @ned isnt going to do his mark and risk a little of his money on buying ads and marketing for steem like I myself have done, which is way more than i should have done considering my stake, if Ned had done a proportional amount of work to promote steem as I have done, theres no doubtr steem would be $10 by now with all the reddit bitcoin users and crypto twitter masses I would have won over with upvote contests and sponsoring of reddit and twitter Steem Tip Bots to promote steem and steem-engine tokens....

and Im glad to hear from @elipowel that she would like to ship SMTYs by Fall as she said today, we will try to hold her to that ;)

I would agree why not cooperate? I'm all for cooperation especially since Facebook is in the background waiting to compete.

Ned and Dan should work together and could. Why not simply port Steem and all accounts over to EOS? It's not impossible.

Steem-Engine will shortly need to accede to regulatory demands and require KYC and other mechanisms as necessary to comply with legal requirements. @blocktrades today posted that they were immediately implementing such operational changes for that reason.

I do not see this as beneficial to the community, for several reasons, despite that both need to comply in order to continue operations.

yeah theres no way steem engine will get way with out KYX for long, wether or not its legally necessary or not, its more about bullying and giving into men with guns nothing else.... this shit will all get taxes and regulated as soon as it makes any money of course....

we can hope that we stay under radar but of course @ned will give in to the first phoen call he gets from the feds and make everyone signing up to Steemit give up th3eir ID to steemit inc, who will then sell our data to advertisers and probly some criminals since ned is that bad at busines,s hahaha i can see it happening now... ned trying to act like hes facebook all teh sudden as soon as he realizes he wont eb able to pay the bills for steemit inc with advertising alone... especially when no one is using steemit.com like they used to..... BTW funny u got flagged lol proves your point

I flag trash. You have received a flag.

Thank you for breaking this down in understandable language!

Great explanation, thanks for taking the time to do it.

I think the only flaw is:

I'm not convinced any curve will dissuade an entity that doesn't want to act in an optimal manner. And I'm not convinced that the people we're talking about adhere to the description of "optimal."

Meaning, there are plenty of people who will act out no matter what the curve is. I was happy with whatever curve was in play. I'm happy with the current "curve." I'll be happy with whatever replaces it now. I do not see the curve as a magic bullet to get bad actors in line.

It doesn't have to change behavior to have benefit. If people still want to create a zillion little bot accounts and carry out hidden spam for the purpose of milking rewards, they can, but they will earn less and the rest of the community will earn more. That's still a win.

Well, limited benefit is a like a base hit when bases are loaded. What we'd all prefer would be a home run. It takes the same time to swing either way. Let's target more productive mechanisms and decrease the possibility of only getting a base hit.

I flag trash. You have received a flag.

Yes, that is the aim. The tricky question is how much less will they earn so that it does not significantly disrupt the system - or even lead it down towards an unwanted attractor.

The rest of the community earns a whopping 4¢ per day spread out to the whole community. It’s effectively a no-upside change. So why do it?

It's bad but where do you get that number? I think it's more like $1 a day or perhaps $2 a day, which is bad for people in developed countries but not as bad as you think for people in developing countries. You can make some posts on Steem and in theory do okay if you're in certain parts of the world.

That said, the problem is vote buying and selling, and the fact that quality content gets the same $1-2 as a low quality content. There is no incentive for content quality to improve over time.

Where does the number come from?

Also, I didn't say that I believed it won't change behavior (in fact I believe it will). My comment was explaining that there is still a benefit even if (however unlikely) behavior doesn't change.

Exactly this. A code change doesn't make people suddenly feel an incentive to curate up or down.

Chances are if you are interested in doing those things you are already doing them.

If you are interested in staking as many coins as you can you are probably doing that.

Both things are fine, but they don't change.

While rewards curve changes don't change those basic motivations, changes I propose below in reply to the OP do. It is the ability to extract rewards that drives financial manipulation, and there is no mechanism extant to encourage funding or delegation to development of Steem and the ecosystem. I propose mechanisms to all but eliminate voting for profit rather than curation, and also to encourage investment in development.

Code is like gravity, and changing gravity to discourage profiteering while encouraging productive investment in development is possible - and highly desirable IMHO.

Thanks!

I flag trash. You have received a flag.

It makes it less profitable to spam micro votes

In addition to other changes like curation increases, spamming votes below a certain point could very well be less profitable than curating, which is an economic incentive to adapt behavior

And finally and this part is important, but the reasoning to buy Steem? If buying Steem doesn't result in buying influence in some way (if the whales don't actually get more voting power) then how do you convince people to actually buy Steem?

Currently the price of Steem to BTC has been falling off a cliff for some time. I'm not saying it's the fault of the reward curve but if you're going to focus on economics shouldn't you also put some discussion into how you will increase demand for the actual customer (the Steem buyer/Steem investor)?

Fairness for the poster is nice and all but at the end of the day it's the sentiment of the Steem holder which is being neglected the most. Whales are whales because they either bought a lot of Steem or they earned it. I do think yes in 2016 you had a lot of whales who lucked out by being miners or whatever but there are whales who actually bought or earned their Steem only to watch it fall off a cliff.

What do these whales who bought or earned their Steem, and who held, get in return for their investment in the community, the ecosystem, etc? If the answer is nothing then this explains the price of Steem.

Agreed. We are having trouble keeping people with a 30% ROI on their Steem Power, how do we expect to keep them with much less than that going forward?

They get the benefit of a rising price with mass adoption if they can delay their greed long enough to let the math attract the masses?

Certainly, some of them won't do this, they will need downvotes to prevent their harming of the game.

bs

Go on,...

First, I'm excited to see how this will go because I've wanted to see how something other than pure linear would work in real-time (wasn't around back in the early days of superlinear.)

However, regarding the curve "converging" on linear at the top, won't this just encourage people to split their stakes into whatever quantity is optimal return (before it starts to flatten) or am I conceptualizing this incorrectly?

There is always some loss from splitting here (since it only converges to linear but never quite gets there) but the idea is that qualitatively the switch over happens at a point that the rewards are reasonably obvious and can't be hidden in thousands or millions of micro-rewarded comments. Since they are visible, if abusive they can be downvoted (part of the EIP is also to reduce the cost of downvotes).

Therefore splitting: a) still has at least some cost, and b) can't be done to the point where the rewards are hidden in many very small payouts, or the cost is large.

Great explanation, thank you @smooth.

In reply to the OP I propose mechanisms I think preferable to manipulations of rewards curves. Given your competence, I'd appreciate you proving my proposal would not work, and is stupid. If you can't, well, you know what to do.

Thanks in advance.

I flag trash. You have received a flag.

thanks, I was wondering the same thing.

Actually, if one looks at the rshares generated during voting, they are very large numbers, so I suspect the convergence happens very rapidly.

I also wonder if the code will use some approximating function for such large numbers, as happens with the square-root function in curation rewards calculations.

So we can have more comments that are relevant to the discussion greyed out by individuals like @ Iflagtrash? Rewarding bad behavior is not the way to go. I have seen many of @valued-customer's comments in this thread greyed out by iflagtrash, so those downvotes of his comments really add to the value of steemit and the steem blockchain? A downvote pool is a very very bad idea and will only aid the bad actors.

What is grayed out or not is a function of the UI and not the blockchain. Steemit.com chooses to gray out some content under certain conditions as is their prerogative; other UIs may do it differently or not at all.

That's a completely different matter from granting rewards, which needs a balancing mechanism against self-voting (where people can just reward themselves regardless of what anyone else thinks of it, which undermines the entire premise of the system).

If and when there are cheaper downvotes (and if there are not, social rewarding will continue to work poorly if at all), UIs might make different decisions about hiding. For example, they might require even more downvotes before hiding something, on the theory that downvotes being cheap and something getting only a small degree of downvoting means it isn't actually that bad.

Getting these systems to work well is always an exercise in balance and compromises, not absolutes. To understand how such a system operates, one must consider not only immediate effects but also resulting adjustments and counteradjustments. If this were all easy we'd have a splendidly working system by now. If it is impossible we should give up and turn off rewards (and stop paying the price of repelling investors with high inflation, resulting in a low and declining Steem price). It seems exploring the middle ground is more reasonable and closer to consensus at this point.

That's all well and good, and I have in previous comments mentioned that it is steemit, and I only use steemit. This is a post from steemit, not busy, not esteem, not partiko, but from steemit, and it is not a post about correcting a UI issue, but a steem blockchain issue.

>Hello Steemians, I’m @vandeberg, Senior Blockchain Developer at Steemit

Consensus, when it comes to anything from the company and relating to changes is 35 people being the mass majority on a poll that was only valid for a few hours before it was decided that there was overwhelming support for the previous change. There is no such thing as consensus on the steem blockchain, so I really do not understand why people pretend there is.

I know, and the vast majority of the people responding against the downvote pool all know it is a done deal so just get on with it, and let the serial flaggers have there way and have an ability to flag and still collect rewards and not only virtually rape users and rake them over the coals but also allow them to rape the reward pool they claim to be protecting.

There is consensus on the blockchain as demonstrated when a hard fork is enabled or (as has occasionally happened in the past), not enabled, the latter indicating lack of consensus.

Other than hard forks we haven't up until this point had an objective way to measure consensus, but the SPS will do so, since it will be voted in a verifiable public way by Steem stakeholders. Previous efforts at "polls" and such things have never been objective or particularly meaningful.

I don't actually know what point you are trying to make by bringing up Steemit vs busy or esteem, but there is only one Steem blockchain, and when you are looking at things like the reward pool being paid out, it is only the blockchain that matters, not the UI. When looking at things like what is hidden or grayed out, that is UI. The issues affecting one or the other are very different.

A downvote pool is not a UI issue. It is a blockchain issue, currently to downvote a post it cost the downvoter mana, it does not matter what UI they are using. If it was a UI issue then people using busy or esteem or another UI could downvote at will if their UI did not charge a mana fee so to speak for downvotes.

There is two sides to the downvote issue if not more. At what point does needless downvoting stop? Enabling a cheaper downvote is enabling bad actors. By lowering the cost of downvoting that does nothing to curb downvote abuse as is currently happening. The vast majority of downvotes appear to be going out to comments not plagiarism, not excessive reward, but to normal everyday comments.

People talk about wanting to stop the self vote and self vote from alt accounts, start with the first issue, the self vote. Do away with it. Then see if people continue to vote themselves with alt accounts. People will see a trend pretty quickly, then the downvote for reward abuse will work.

By eventually allowing people to get paid or to pay themselves because of their downvote actions is only going to exacerbate the issue. Because getting a downvote curation reward is where this is all heading, that is pretty obvious with the desire to have a separated downvote pool.

For the last 22 months on steemit, every time the self vote is bought up, it has never been simply stopped, removed from the system. Either it is good for the blockchain, or it is bad for the blockchain. Before creating new problems fix the problem everyone keeps saying is the reason for the downvote pool and that is to stop the abusive self voters. Just do away with the self vote and be done with it.

Self-vote is neither good nor bad. It depends on the content and context.

For example, if I post something really value-adding and want to jump start the voting with a self-vote, there is nothing wrong with that, and indeed could be argued as a very legitimate reason to buy Steem for (non-abusive) self-promotion. (And indeed further argued that if I'm not willing to spend my valuable vote power on my own content, maybe I shouldn't even post it.)

On the other hand, if I post a bunch of empty comments or other worthless 'content' and self-vote them, then I am abusing the system

The only mechanism that allows the blockchain to distinguish between those two cases is having other people either agree with me and add their vote (or at least do nothing and let my vote stand), or downvote it and both reduce/prevent the payout and discourage my behavior since my vote has now been wasted.

Self-voting isn't the problem, but even if it were, it is only a small part of the problem. Paid votes are just as easy to abuse, already exist in very large numbers, and would not be stopped or even slowed down by stopping literal self-votes. So, no, that is not a solution.

As you correctly stated, downvotes have a high cost and as a result there are only a tiny number of downvotes that happen (and yes, as you say, many if not most of that tiny number of downvotes are from annoying jerks), and so naturally we have people abusing the system though self votes and paid votes all day long.

I disagree with your suggestion that the most effective way to address the core problem is by focusing on literal self-votes. Not only is it easy to evade, but even without any obstacle in place to evade it is already only a narrow subset of the problem, effectively a distraction.

Probably never. Any system which allows people to interact will always have jerks who want to annoy others. But it also should not be the case that what one or two jerks do matters much at all (or, indeed, the system is much too fragile).

So, again, like I said earlier, probably UIs should demand a lot more downvoting before paying attention to it and performing hiding, negative reputations, etc. (effectively ignoring the few jerks who can still downvote, but will not be able to meet this threshold very often if at all). And for that to happen, we need a lot more downvoting from ordinary non-jerks, where well-deserved, which in turn requires that good non-jerks not have to burn their valuable vote power in order to perform a public service.

Should the steem account be used to fight abuse?

Wouldn't this reduce the burden on the rest of us, and make possible stopping the largest abusers?

No, and if you do that you are making Steem into an illegal security, even more than it already is (essential functions and therefore investment returns depend on the efforts of a central party).

The right way to address this is to improve the underlying economics so that it works as a decentralized system, or if we can't, recognize that it doesn't work and pivot.

How does a blockchain defending itself from attacks on it's value become prosecutable by the sec?

Steem is open source, not owned by any one entity.

What does it care about the rules of violent criminal gangs that force others to pay and obey?

Steem is a meme that cannot be put back in the bottle.

It is viral technology that cannot be stopped, except by the witnesses.

Not all of which are in the united snakes.

(I hear there may be a satellite that might let us rent space on it's servers.)

How do we open source the access to the keys?

Hard code a 85% witness, and 90% community, consensus mechanism that opens the keys to the code to allow changes?

By hard coding a mv influence cap, one that slowly rises over time, it takes the choice from any central parties.

There is no central party, only code.

They can try to punish coin holders, but c'mon, that isn't working for btc.

Maybe I misunderstood but when you said 'the steem account' I assumed you meant @steem which is owned by Steemit. If the critical functions of the blockchain are depending on one company (which also happens to be the company that developed it and launched it) going on four years in then it isn't a decentralized system.

I think probably anything is better than pure linear at this point because pure linear is proven not to work at all. But I also think that even if we make these changes, too little thought has gone into the question of "whale creation".

We shouldn't demonize whales. We should want people on the platform to want to become whales. We should think of "whale status" as the product which Steem sells to investors. And so far most of these economic changes attack the honest whales while rewarding the dishonest whales.

I declare the honest whales to be the whales who earned their status by the rules of the platform or who invested in the platform. I totally understand certain whales are grandfathered in and this has created most of the controversy but then what about the whales who earned or and invested their way to their status?

The problem? Being a whale doesn't actually improve the UX for those who are whales. As a result there isn't as much demand to want to become a whale. As a result the investment in Steem is lower. This is bad.

Yes some whales might have had too much power but as I see it if they invested into the community they purchased their power fair and square according to the original rules. If we are concerned with content discovery how does this fix the main issue most of us have which is the vote buying issue?

Yeah, I completely agree that I'd like to try ANYTHING other than pure linear. If I had to sum up what it feels like in one word it would be: STAGNANT. It doesn't feel like anything dynamic is going on. More like currency is just being mined irrespective of any "proof-of-brain" concept.

I also agree about whales. "Blame the rich" mentality is quick and easy, but rarely leads to productive discussions about optimal wealth distribution. You're spot on that there are few incentives to become a whale outside of altruism and perhaps a company combining many individuals' stakes to gain visibility on the platform.

Altruism, when it impoverishes oneself, tends to be draining and imbalanced. Of course some will always complain about "ninja-mined" stakes and who deserves what, but that is subjective and again, rarely leads to productive discussions.

I'm also very curious how these changes will affect vote-buying and bid-bots. At the very least, it should shake things up and force some adaptations which will hopefully make the platform feel less stagnant.

The thing about being rich, we want rich people to join our community to make our community much richer. I am definitely against the "blame the rich" ideology because we want the rich and the poor to both get richer. Everyone should feel like they have opportunities to get richer while having fun.

The issue I think with Steem is merely there was never enough opportunities. SMTs were promised, Oracles, communities, etc, which may have given people more ways to earn Steem and become whales (rich) in the correct way.

But to go pure linear and then also not have anything going on? To be honest playing DrugWars is more fun than posting on Steem at this time which is why I don't post as much. DrugWars might not be earning me anything at all but at least it's fun and feels like I'm earning something (gamification works!).

Vote buying made the whole thing pointless. Imagine if society were set up where you essentially have to buy your job. And the jobs are offered by a computer which takes digital currency and then hands out the jobs to all the people. In this we'd have the worst of communism and crony capitalism combined. In my opinion that is what we currently have on Steem.

The votes are essentially rigged by bots which sell rewards. How can it possibly get more broken than that?

nice! but imho, ad-revenue sharing with authors is much more important, and i'm not sure if steemit is even considering this. decentralized PoB is (almost) impossible (by the simple prisoner's dilemma). Nothing changes for people who use alts A and B to vote each other no matter which reward curve or author:curation ratio are used.

of course, i like the idea to try new things including this and reward ratio. but i sincerely hope that Steemit also admits that without ad-revenue sharing and centralized curation (e.g., utopian), PoB is impossible.

Google gets more than 100bn, facebook gets 50bn from ads, how Steemit can properly reward really good authors without ad-revenue sharing? impossible.

Thanks.

Ad-sharing is not a blockchain feature. The blockchain has no idea what ads are shown nor what the revenue from those ads are. These are entirely different efforts (@vendeberg is the head of blockchain development).

Hi @smooth, I didn't say ad-sharing is a blockchain feature. But it's so important to emphasize even in this post.

Actually it's so important to be considered as a part of blockchain feature. not ad itself but supporting ads, as many functions for steemit (post, voting, etc) is already part of steem blockchain.

Hope this clarifies my intention. (I also left a few comments on the current efforts, so my comment isn't irrelevant at all.)

ps. I contributed several across steem projects including the chain mentioned here, so I definitely know vendeberg is the head of blockchain dev (also know that you're an important person here). I also worked for ads team as an economist at Facebook. That's why I know and believe ad is very very very important. e.g., the main ad shouldn't be sold that way (by individual contract). ad-auction is needed. Of course, with the current resource of Steemit Inc, building own ad-auction is almost impossible. I understand that the current status is testing this and that. But eventually ad should be sold by auctions. (just using google's might be better than now eventually) Otherwise, it's very difficult to determine what's a good price to begin with. I believe that's one reason why the main ad's still almost vacant (I only saw some casino ad so far in the main ads).

Of course, I'm not saying that I'm right. Who knows? But I'm trying to help as a huge fan of Steem and Steemit.

They are very much related though. Reducing the initial growing potential of new users with what @vendeberg proposes could hinder growth of the platform with new users that could provide great content, that could increase the value of the platform. This hindrance of growth could be attenuated or even reversed by providing top content providers with insentive to move their blog/vlog to STEEM without having to miss out on their current ad revenues while they try to grow their platform revenues.

I'dd argue that rolling out the first without rolling out the second at the same time could hurt the platform, while rolling them out both at the same time could be highly beneficial to the platform in more than one way, given a well thought out formula (probably not a smooth curve if you ask me, but that is a different issue).

I agree that ad revenue sharing will be an important part of the next generation social networks.

thanks for agreeing :)

There is a lot which Steem can do. Steem can also learn from the BAT model as well. Attention economy can be built using certain mechanisms. Decentralized oracles can be used too. I just think first fix the economics so the active posters don't leave.

Agreeeeeeed ! ♥

that's why we should finally go to the UBI !

and increase more Curation Rewards !

Posted using Partiko Android

ads revenue is not really a lot. I dont think much can be gain from there.

I guess you're talking about the current ad revenue. I'm talking about different thing, as I provided examples of Google and Facebook. If you still say it's small, then it's just like chicken or the egg. Because there is no ad-revenue sharing, there are not many fantastic authors.

Surely you could estimate per user ad revenue that would provide useful comparisons to Youtube and Facebook. We're not very comparable to either platform in user numbers.

I flag trash. You have received a flag.

The current advertising models are non-sustainable in many aspects of their deployment. Large data tracking, data sales, and the future consumer privacy expectations have to be taken into account. I'm saying i agree with @d-pend here. The ad revenue sharing will be important. I believe it can be done inside the blockchain, bringing investment into steem, with our beautiful "smart contracts" (aka just custom json) features.

After reading this I will never ever dare to comment on this issue.

Keep doing a good job, I'll crawl back to my little cave and put some wood to keep my fire alive.

Complicated stuff to be sure! People that have built businesses based on existing parameters could have issues with changes.

Changing the reward curve is very risky. Some businesses on the chain may suddenly become less profitable or even not profitable.

All moves need to be made with caution. What benefits Steemit.com may not benefit the other front ends.

Some businesses are not beneficial to the ecosystem or the community. I note that all business enterprises on Steem presently are highly agile, and would be likely to be able to respond to nominal changes. Frankly, most of the community I interact with would prefer all bidbots die.

I would.

I flag trash. You have received a flag.

It's really not difficult to understand at a conceptual level

It's basically a superlinear head (to get rid of the profitable micro vote spam) with a linear tail (to retain fairness between large and small stakeholders). That's pretty much all there is to it :)

I would like to see, that the Coin "Steem" and its "Reward Pool" will be designed more towards an infrastructure Coin instead of using it primary for POB content discovery. The reason for that is, that with the introduction of communities and SMT the Steem Ecosystem is not only more about "Content creation" and discovery.

No, we have a bunch of financial dapps, gaming dapps, services etc... which don't have anything to do with content discovery. All those Dapps should have more or less "equal" chances to receive Support from the underlying Steem Reward Pool mechanism to earn and empower their communities.

I think Steem is good with Steempower for Voting on Witnesses and Proposals (plus a new feature in the future Voting for Communities and Dapps) and as a source of Ressource Credits. For me that should be enough, on the level what Steem is doing to support its Ecosystem and for the use of the POB mechanism...only vote for Witnesses, Proposals and SMT or Communities.

No, more voting and abusing the reward pool by creating and discovering or gaming the content creation part.

All this POB content creation and discovery mechanism should be happening on the level of SMTs, and its communities, because these groups will have Admins who are able to set in rules how each community handles its users and the way they value content creation.

If Steem gets understood as a infrastructure Token and SMTs are understood as a empowering Community Token, than we have a clear Vision for all participants Investors, Users and Creators alike.

I don't like the idea that we are aiming for a SMT Ecosystem where all these project fight for attention but the real mining of Steem only happens on the content side of things...somehow that doesn't make sense.

Why should other Dapps or Communities suffer from miss management of the Steem Reward Pool which is only used for content creation and discovery?

Posted using Partiko Android

This was my point in the last article I wrote on this topic - link is in this latest post. I used different words but an "infrastructure coin" is the same as a "central banking coin" - the point being that the social apps sit on top of this and may employ a mixture of native steem protocols and their own. Unless the core economic code is changed so that it truly aligns with its original social aims, our vision is the future - the near future.

Hi @rycharde thanks for your thoughts. I just checked {your post}( https://steemit.com/steem/@rycharde/we-are-all-bankers-here) you showed some interesting points about the "coin flow" and economics of the current Steem system. Your view is very focused on the financial incentive side of Steem.

I don't agree, that my view of an "infrastructure Steem coin" and your view of "central banking coin" are the same. But I think my suggestion would bring more clarity about the purpose of Steem as a Coin, that enables you to perform transaction on the Blockchain, and Vote for Witnesses and Communities, that keeps this place thriving. Without having the confusing discussion about POB mechanism to discover and create content.

Rather than having Steem as a "Bank Account" where you earn "interest" and earn "rewards for low quality content". The incentive would be more like, to hold Steempower because your Community is thriving with new users, and therefore you need more Ressource Credits for your Dapp to perform transactions on the Blockchain. Another aspect is that if Dapps hold large amounts of Steempower they will still get some portion of the Reward Pool and generate an income stream to empower their SMT Token and Users.

Hi, once you describe it, it looks even more like my idea! Maybe we may disagree on the methods, in that I can see a Dapp making rewards to back up their tokens but those reward-creating algorithms may not have anything to do with the Dapp itself. This is something for any finance officer of the Dapp to figure out.

That's forward thinking, and while I haven't deeply considered it yet, I think I completely agree.

That being said, I'd appreciate your thoughts on my reply to the OP below where I propose mechanisms I think relevant.

Thanks!

I flag trash. You have received a flag.

And this was the key mistake I think. I think yes we had the problem of whales before, and no system is going to be perfectly fair, but now we have a much worse problem of "buy your votes" replacing "earn your votes".

In other words now only the rich can earn at all because you essentially have to buy your votes.

Exactly, a curve makes it impossible and if not extremely hard to correctly divide the proceeds from bidbots since the order the delegations come in plays a large part in the calculation of how many vests/steem.

Posted using Partiko Android