The Ultimate Guide to HODL and Double your Crypto Portfolio Growth within One Year, Portfolio Balancing Automatically!

In this article I will share with you How to Start a Bitcoin & Crypto Portfolio, using easy strategies that can Double your Crypto Portfolio Growth within one Year!

FYI: HODL is a acronym used in the Bitcoin and Crypto community which means 'Hold On for Dear Life'.

Disclaimer: The following strategy I am about to share with you is based on a 1-year minimum period that may reward you with positive results. I am not a financial adviser and this is not financial advice, I am simply sharing with you my own Crypto portfolio strategy I use from research I concluded. Only use funds you can afford to lose as Crypto's are high risk!

My Crypto portfolio strategy is easy to implement and can be summarized into three steps:

- Identify Crypto coins/tokens to hold for long term, e.g. Bitcoin, Ethereum, Stellar Lumens, etc.

- Dollar Cost Average when purchasing coins/tokens.

- Portfolio Balance coins/tokens in portfolio.

Identify Crypto Coins/Tokens

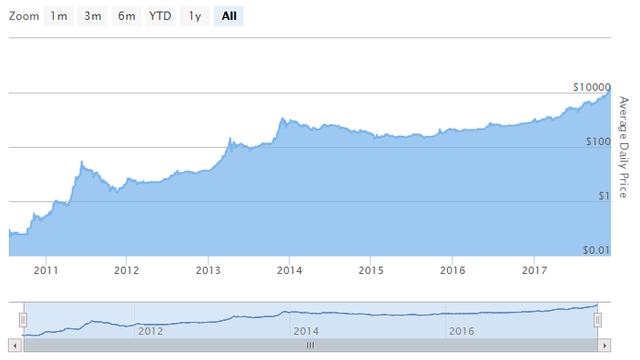

If you had bought Bitcoin on the 14/09/2017 ($4100.28 USD) and held it for one year until 14/09/2018 ($6487.91 USD), your Bitcoin would be worth 58.17% more! Despite the correction that took place during year 2018 you would still be in a profit, even more so if you had bought Bitcoin on 14/09/2016 it would be worth 932.68% more on the 14/09/2018! It for this sole reason that I decided to take on a buy and hold strategy with Bitcoin and other Crypto's in my portfolio as the potential upside is huge, with minimal effort other than buying and holding your Crypto's.

Besides Bitcoin, there are other Crypto's which also have a huge potential for future growth, and the right ones I believe will have growth projectiles much bigger than that of Bitcoin. However, please do your own research as there are more ‘zero coins’ (going to zero value) and ‘scam coins’ in the Crypto space then there are legit ones. It is estimated that more than 90% of all Crypto's will go to zero, and I tend to agree with these forecasts so do your research before purchasing Crypto's other than Bitcoin.

It is of my opinion that the Crypto market is in the same state/hype as that of the ‘Dot-Com Bubble’ which saw many dot-com companies close, resulting in investors losing their investments. However, after the dot-com bubble the companies who made it like Google, Microsoft, Apple, and Amazon, thrived afterwards and you could have made a killing even if you had invested during the dot-com bubble and held onto your shares until today. Similar to investing in the right companies during the dot-com bubble, I identify Crypto projects that have real world use cases which solve global problems, and able are to benefit or help communities around the world. I search for Crypto projects that have great business models (whitepaper) which I can understand, a competent team and advisers with proven track records, and ultimately a project I believe will be here 10+ years from now. I believe Bitcoin will be one of many Crypto's around 10 years from now, and that it's main function in future will be a 'Store of Value', a Digital Gold, but I do not think it will be as dominant by market cap as we see today. But this is just my two satoshi's and only time will tell...

10 Tips for Creating a Killer Cryptocurrency Portfolio

Chart showing the price of one Bitcoin in U.S. Dollars on a logarithmic scale. Chart was pulled from 99bitcoins.com on 12/13/2017, and is licensed under CC BY-ND 4.0. I have cropped a screenshot of the chart from the site.

Dollar Cost Average

To further increase my portfolio growth rate, I only purchase Crypto's on exchanges using an easy strategy anyone can apply called Dollar Cost Averaging. And essentially what this means I determine beforehand how much USD (or any other fiat currency) worth of Crypto's I plan to purchase per month, and make smaller purchases throughout the month that is equivalent to the total USD amount I decided on.

Additionally, I would only make a purchase on the exchange once a coin has more than a -5% weekly drop in value, the greater the price drop the better, -10% to –20% I consider bargains! This strategy insures that my total USD capital purchased a Crypto/Crypto's at low price points throughout the month, and results entering the market at an average low price for the month, which significantly increases my portfolio future growth. Another reason for using this method is it has much better results than trying to time the market lows, which in my experience is impossible!

Hypothetically let's assume I decided to purchase $500 USD per month. I would only use $100 USD to purchase a coin/token once I notice a significant drop in value on the exchange of –5% or greater and continue to purchase $100 USD the for every –5% drop until the $500 is depleted. In this example that would equate to five purchases.

It may happen that you will not find an opportunity to purchase your desired Crypto within a particular month because they are all green (prices are going up) and are continuing to rise in value. In this case I wait until a correction takes place, even if that only happens in a month or two, I do not buy when the market is in the green!

How to Dollar-Cost Average Buy and Hodl Cryptocurrency Like A Boss

An example of ‘Dollar-Cost-Averaging.’

Portfolio Balance

To further increase my portfolio growth I use an easy strategy called ‘Portfolio Balancing’. By taking advantage of the Crypto market volatility, since the price of Crypto's is constantly going up and down in value (USD value), I trade Crypto's held in my portfolio that have gone up in value to purchase other Crypto's in my portfolio that have remained the same or that have gone down in value. I then repurchase back the sold Crypto once the bought Crypto goes up in value or the sold Crypto drops in value. When I re-purchase I make sure that I am re-purchasing at a price point that results in more Crypto bought back than sold. I repeat this process daily/weekly/monthly (called rebalancing period) and what results is an increase of underlying Crypto's (not the USD value but the Satoshi value, meaning 0.1 BTC, 0.13 BTC, etc.) held in my portfolio without injecting additional capital!

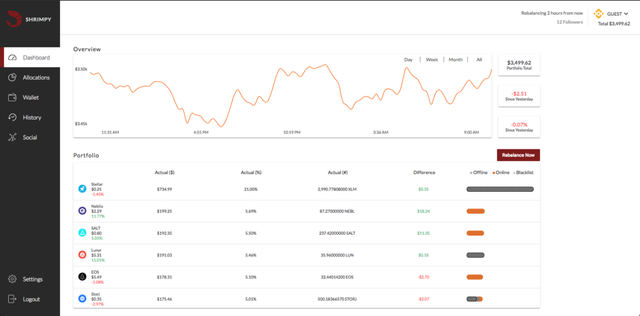

The great thing is I have identified a Bot (Algorithmic Program) that can do this for me automatically and it’s free to use! All you do is link it up to your exchange account via an API connection, set the time intervals the Bot should perform portfolio balancing (hourly, daily, weekly), indicate which coins you want to hold and what percentage (USD value percentage) of your portfolio should the coin carry. And Walla!

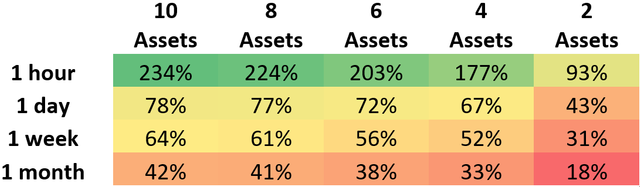

In an article (link below) it shows how portfolio balancing can increase portfolio growth for 1-year up to 234% more compared to that of just holding Crypto. This is truly incredible!

Portfolio Rebalancing for Cryptocurrency

Rebalance vs. HODL: A Technical Analysis

The median performance demonstrates that the higher the rebalance period with the higher number of assets presents the highest gains for rebalancing. Each value represents a percent increase OVER buy and hold. That means a value of 18 means the median of that group performed 18 percent BETTER than buy and hold. This demonstrates, even the absolute worst case performs better than by and hold, even after considering taxes.

To Summarize my Crypto Portfolio Strategy

- Identify Coins/Tokens to hold long term (one year minimum).

- Dollar Cost Average when purchasing coins, and only purchase when identified coins are in a daily/weekly negative of 5-10%.

- Portfolio Balance coins to take advantage of price differences between the coins in your portfolio.

Please Support Blogger: By using my referral links when signing up with exchanges, and portfolio balancing bot, that way I can be compensated via affiliate programs for my many late nights researching and providing readers with valuable information, thank you :)

Shrimpy Portfolio Balancing Bot:

Shrimpy (Automated Portfolio Balancing Bot)

Shrimpy only works on the following exchanges at the time of writing; Binance, Kucoin, Bittrex, Poloniex, Kraken, and Coinbase Pro (they intend to add more exchanges in future). However, I only use Binance and Kucoin because these exchanges have the lowest trading fees (0.1% per trade for maker and taker), resulting in greater portfolio growth because less fees were paid over time compared to the other exchanges.

Crypto Portfolio Rebalancing: A Trading Fee Analysis

From the graph we can conclude that trading fees can have a large impact on portfolio bottom line performance. In the perfect world with no trading fees, hourly rebalancing proves to be the optimal strategy. However, we also observe that in a real-life scenario with trading fees, a daily rebalancing strategy shows the most consistent portfolio returns. Even for hourly rebalancing, the trading fees will have to be as low as .05% to match the return from a daily rebalancing strategy.

How to Connect Shrimpy to Binance

Note: Keeping your Crypto’s on Centralized Exchanges is risky, if the exchange gets hacked you could lose some/all of your Crypto’s because you do not hold the private keys to your coins/tokens. So in order to reduce the risk that comes with using centralized exchanges I make use of a feature on Shrimpy under the wallet tab called 'Active Wallet'. With the active wallet feature Shrimpy will be able to portfolio balance your Crypto portfolio while a portion of each Crypto asset is stored offline (cold storage or any other form of storage). It is recommended to store about 20% of each Crypto held in your portfolio on the exchange to allow Shrimpy to keep your portfolio balanced, to find out more how this strategy works click the link below.

Cold Storage Coupling for Portfolio Rebalancing in Crypto

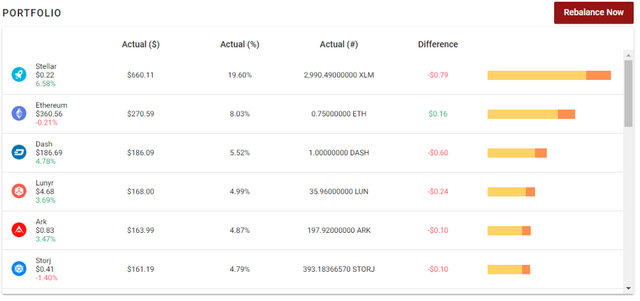

In Shrimpy, the horizontal bar graphs are yellow for offline assets and orange for online assets. As the orange section of the bar graph disappears, additional assets should be brought online to allow for proper liquidity. As the orange section of the bar gets larger, more assets can be brought offline. In the example above, we can see that approximately 80% of the assets are stored offline.

How to View and Track my Portfolio

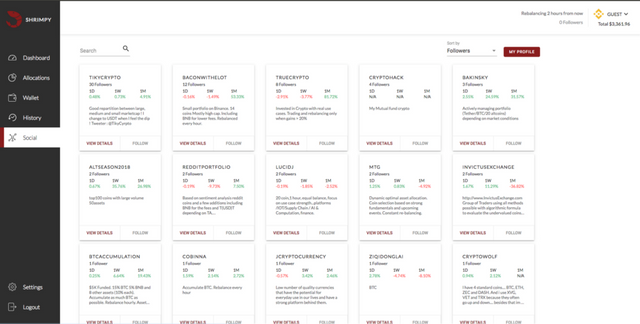

If you would like to view and/or track my portfolio automatically on Shrimpy you can do so through the Social feature, you will however have to subscribe to get access to this feature at 8.99 USD/month. The convenience of this feature is you can view my portfolio coins/tokens I am invested in which saves you the time identifying unique Crypto projects with great potential. Another upside is you can track my portfolio automatically, meaning any changes I apply to my portfolio will automatically be applied to yours.

Subscribing to Shrimpy will also allow you to view other peoples portfolio's which are shared on Shrimpy, and also track their portfolio's if you like. I would caution to do your own research on all Crypto's of a particular portfolio you decide to track, including my portfolio, since you are in full control and thus responsible for your own gains and losses.

To follow/track my portfolio, under the social tab in Shrimpy dashboard search for 'AFFINVESTMENTS' for Binance exchange portfolio and 'AFFINVESTMENTS2' for Kucoin exchange portfolio. Then click on follow, once you can see my portfolio allocation, adjust rebalance to automatic and then click follow.

Shrimpy Adds Social Portfolios For Crypto

Crypto Exchanges (Links) to Run Shrimpy on:

Binance Exchange (Biggest exchange by volume in the world)

Or input referral ID when signing up: 35293660

Kucoin Exchange (One of the fastest growing exchanges by volume in the world)

Or input referral code when signing up: Mr3e1H

Note: These exchanges above are crypto-to-crypto only exchanges which means you cannot purchase crypto’s with fiat currencies using credit/debit cards or wire transfers. I suggest you use the following exchanges below to purchase your crypto’s and then send crypto’s to one or both of exchanges listed above where you intend on balancing your portfolio on.

CEX.IO (Purchase crypto’s with Visa, MasterCard, or wire transfers)

Changelly (Purchase crypto’s with Visa or MasterCard)

Tracking your Portfolio:

You can track your portfolio on Shrimpy's dashboard, however with Shrimpy you will only be able to track Crypto assets on exchanges the bot is connected to and Crypto assets you manually entered as cold storage. Therefore, I recommend using Delta app, a Crypto portfolio tracker which can track on both exchanges and Crypto wallets via an API connection and wallet address. This App only allows you to track two exchanges and two Crypto wallets, if you want to connect more exchanges and wallets then you will have to pay a monthly subscription. However, I think for the most of us the free version will do, which has no adds, and is available on iOS, Android, and Windows. You can also install this App on two devices and sync your portfolio, if you you would like to sync to more than two devices then you would have to pay a monthly subscription.

Delta (Rated best Bitcoin, ICO & cryptocurrency portfolio tracker)

Congratulations @affinvestments! You received a personal award!

Click here to view your Board of Honor

Do not miss the last post from @steemitboard:

Thank you so much for sharing this amazing post with us!

Have you heard about Partiko? It’s a really convenient mobile app for Steem! With Partiko, you can easily see what’s going on in the Steem community, make posts and comments (no beneficiary cut forever!), and always stayed connected with your followers via push notification!

Partiko also rewards you with Partiko Points (3000 Partiko Point bonus when you first use it!), and Partiko Points can be converted into Steem tokens. You can earn Partiko Points easily by making posts and comments using Partiko.

We also noticed that your Steem Power is low. We will be very happy to delegate 15 Steem Power to you once you have made a post using Partiko! With more Steem Power, you can make more posts and comments, and earn more rewards!

If that all sounds interesting, you can:

Thank you so much for reading this message!

Congratulations @affinvestments! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!