Long-Term Plans, Short-Term Guesses

Lately, the financial markets have managed to freak out a lot of people. Of course, there are a lot of things going on in the world.

However, despite our fascination with current events and the markets’ supposed reaction to those events, it’s all but impossible to predict what, if any, impact they’ll actually have in the short term. That’s a problem if you’re trying to build a financial plan by predicting what will happen next week or even next month.

By now, you know from personal experience that we just don’t know what the markets will do next. And while people may understand that fact logically, it’s very hard to remember because it involves OUR money.

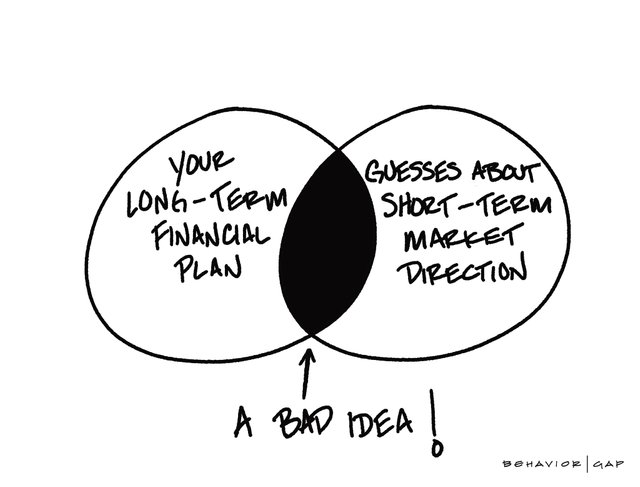

You may want to focus on long-term goals and plans, but the headlines are all about what’s happening in the short term. It’s a bad combination if you’re trying to behave. But you have a tool on your side that can help: a plan.

In theory, you’ve built a plan that takes into account the possibility the markets will do something crazy. It’s one of the reasons you built it in the first place so you didn’t need to panic when it happened (which you knew it would based on history.) Your job now is to remember that your plan is no less applicable this week than it was last week.

If for some reason you don’t have a plan, then hopefully it’s been a wake-up call that you need one if you want to lower your odds of making a mistake. The markets will do what they’ve always done: behave unpredictably whenever the mood strikes. Your only choice is to treat it like a younger sibling and just ignore it. But you’ll have a better chance of doing that if you’ve got a plan and it doesn’t rely on trying to predict what the market will do in the short term.