Fight of the Century Update: Crypto Freedom vs Govt/Bank Slavery

Governments and banks barely knew they were in for the fight of their lives when a scrawny $0.05 weakling named BTC birthed from obscurity. BTC had mighty hopes of maybe becoming legitimate enough to buy a pizza one day. That goal accomplished with 5000 BTC (yes, someone actually payed 5K BTC for a pizza creating the greatest pizza regret episode in history), the new semi-contender began an epic climb.

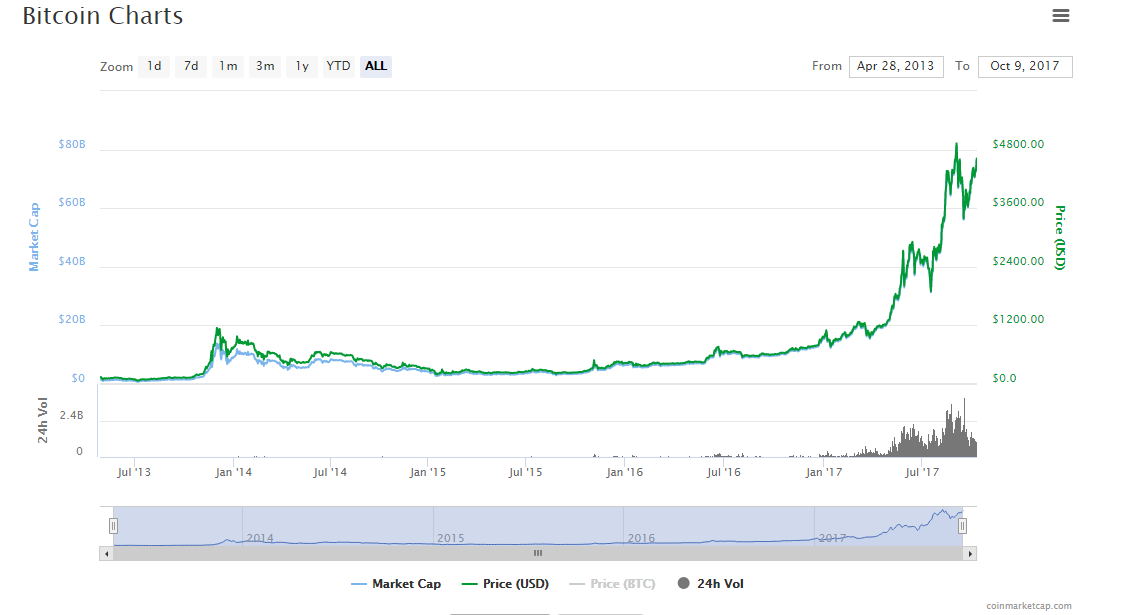

Coinmarketcap.com's chart of the BTC rise shows the divine past, and the unbridled future:

More importantly, the fight has morphed into a battle: BTC leading the charge flanked by emerging coins now combining for a higher evaluation than BTC - depending on the day.

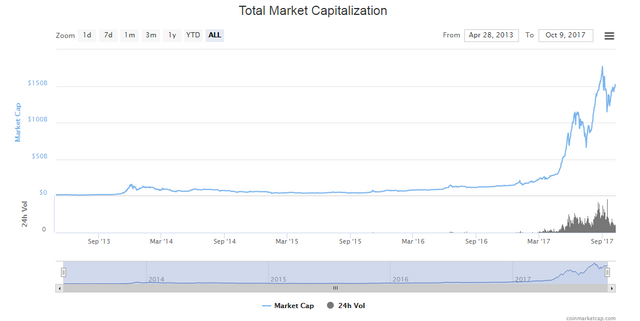

Coinmarketcap.com's total market chart shows the trend of crypto devouring government and bank fiat currencies:

At an average rate of roughly $30 Billion of fiat value per year converting to cryptos, with an upward trend this year of over $140 Billion added since September '16, governments and banks are in full panic mode.

First BTC, now DASH, ETH and other coins have devoured earnings from Western Union, bank wire business, and similar direct competitors. Though the legacy money movers still exist, their earnings and business volume are trending down.

We are now at the stage where cryptos have the financing, the motive, and the resources to begin displacing the credit card, debit card, and SWIFT systems. While these systems run smack into U.S. FINRA rules meant to corral us into the bank and government control grid, they will not hold up to the crypto world of technical creativity.

Once we as a community establish our own means of crypto to fiat transfer without government or banking interference, and eventually displace fiat entirely, then the world will be a far more creative, free, and equitable place.

Macro investment trend for cryptos: Positive with higher lows and higher highs.

Medium term investment trend for cryptos: Negative with a tradable top in the near term as shown by the majority of cryptos losing their uptrend

Short term investment trend for cryptos: Reaching the fall out stage, where the long term cryptos will emerge and the hope and prayer cryptos will begin disappearing.

Next article: An idea for creating an independent credit card / debit card / mass adoption system to transition cryptos into real world use.