Huobi Token (HT) Analysis – Similar Growth Potential To Binance Coin (BNB)?

Huobi, one of the leading cryptocurrency exchange by volume, has created its own native token, Huobi Token (HT), in the same fashion as other cryptocurrency exchanges, such as Binance and Kucoin. The value of the token is highly tied to the performance of the Huobi.Pro exchange and its affiliates, but more extensively to the coin’s supply and demand drivers within the Huobi ecosystem. With Binance Coin (BNB) being valued at more than $1.5 billion and KuCoin Shares at $300 million, can Huobi Token (currently valued at $132 million) see similar growth? We believe so. In this analysis, we present HT’s use cases, and conclude with a comparative analysis of Huobi Token against Binance Coin, KuCoin Shares, COSS Token and Bibox Token (if you’re already aware of the benefits Huobi Token provide, we highly recommend you to stay with us, and to jump to the comparative analysis section)

REGISTER: https://www.huobi.pro/topic/invited/?invite_code=tdzc3

Huobi Token Enables Voting For Coin Listing, As Well As Being Rewarded For Doing So

In our HADAX overview article, we already described the platform extensively. However, we did not elaborate deeply on the role of HT within Huobi’s hybrid exchange. As a reminder, Huobi Autonomous Digital Asset Exchange (HADAX), is a hybrid cryptocurrency exchange which enables users to vote for the projects they want to see listed, with Huobi performing a minimal audit, and investment firms, such as Draper and ZhenFund, conducting their due-diligence – ensuring that projects are compliant with regulations and have a minimum quality standard.

Not only do Huobi Tokens enable users to vote for their favorite projects to be listed on the platform, but also allow them to receive free tokens from these projects. In essence, in order to encourage users to vote, the exchange enables projects to set up their own reward mechanism for voters if the project gets listed. For instance, a project can decide to airdrop 10 of their token for every vote they receive, and tokens are given to voters if the project wins the competition – if not, HT tokens are refunded to the voters. In either scenario, voters cannot lose.

Reduced Fees

Unlike Binance, where everyone has access to reduced fees from the moment they own BNB tokens, Huobi proposes a subscription scheme. The scheme works with five tiers, as shown below. The current fee on Huobi, for all users, is 0.2%, in comparison with the 0.1% proposed by Binance. However, by subscribing to the VIP fifth tier, Huobi’s fees can be reduced to match Binance’s.

At first, Binance might seem the more beneficial option; however, the offer on Binance is temporary and the fee reduction will be halved every year, with 50% of a trading discount the first year, 25% the second, and zero from the fifth. This means that from next year, fees on Binance and Huobi will match – with Binance losing its cost advantage against Huobi. You can argue that 12,000 HT tokens per month in order to receive a 50% reduction in trading fees is high. however, this system is definitely not aimed at “small investors”. Huobi has been clear that it wants to attract institutional investors, for whom the benefit of saving 50% on trading fees outweighs the costs – saving these investors thousands of dollars per month.

Huobi Token (HT) Potential

Supply and Demand Drivers

The two use cases above are the main advantages of holding Huobi Token, and are the key drivers of its value. Another advantage of holding HT is that it is likely to see price appreciation. The price of any asset is ruled by supply and demand factors. Concerning the demand for HT tokens, the main driver will be 1. the number of institutional investors joining the platform, 2. the number of users speculating on a rise of the token’s value, and 3. interest from the public concerning the rewards provided by projects during voting rounds, as it can be seen as a guaranteed return with limited risk.

All demand drivers are highly tied to the cryptocurrency market as a whole. As the market grows, an increasing amount of institutional investors will want to trade, and may therefore subscribe to the VIP membership.

In regards to the project airdrop rewards when coins are listed, as the cryptocurrency market cap increases, the competition to be listed will become more fierce, and therefore, to win the round, projects will have to offer more attractive rewards to voters – incentivising more people to vote for their projects, and buying HT as a result.

One mechanism exists within the exchange in order to reduce token supply. The supply reduction exists in the form of the buyback program which Huobi undertakes every quarter, where 20% of the exchange’s profits are used to buy HT from the open market and lock them in an Investor Protection Fund – meaning that the circulating supply of HT tokens will decrease every quarter.

Comparative Analysis

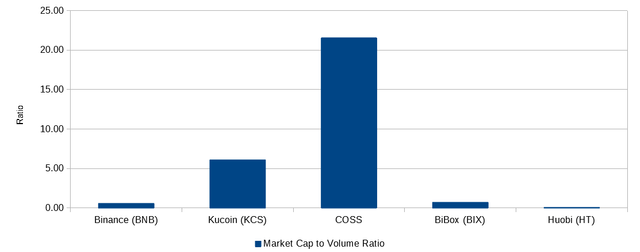

We looked at Huobi Token in comparison to four other tokens: BNB, KCS, BIX, and COSS, from Binance, Kucoin, Bibox, and Coss, respectively. The chart below shows market capitalisation compared to volume ratio. Surprisingly, with a daily trade volume of $1.7 million, COSS token has a valuation of $35.5 million – demonstrating that COSS is overvalued when compared to the competition and based on this ratio. Bibox, with 0.73, has a similar ratio to Binance, at 0.59, while Kucoin has a ratio of 6.10 – which might be explained by the fact that cryptocurrency investors believe that “dividends” add more value than buybacks, despite this belief not being true, as either scheme should have a similar impact on the asset’s price. On the other side of the spectrum, Huobi has a ratio of 0.08 with a volume of $1.6 billion and a market cap of $133 million – showing an undervaluation in comparison to other exchanges’ native tokens. When taken in the context of these ratios, HT seems highly undervalued, as its range should be situated closer to those of Binance and Bibox, in a range from 0.59 to 0.73.

Furthermore, when comparing BNB directly against HT, Binance has a trade volume that is 1.7 times bigger, but its market cap is 12 times bigger. The difference in token prices could be explained by the fact that Huobi has employed less extensive marketing efforts than Binance has in the West, with most people not even being aware that Huobi has its own native token.

Final Thoughts

We recommend taking a serious look at Huobi Token, as there are many use cases which can increase the demand for the token while also reducing its supply. When compared to the competition, Huobi Token seems undervalued; not only is its volume to market cap ratio the smallest among the exchanges mentioned above – despite Huobi being among the top five cryptocurrency exchanges by volume – but also when compared against Binance, the difference is quite large.

The lack of knowledge surrounding the token due to the lack of marketing performed by the team until now, at least in the West, leads us to believe that the token should see increasing interest, similarly to what happened with KCS and BNB, once marketing is increased and word gets out. We are long Binance Coin, as we believe the exchange has plenty of growth ahead, and for the same reasons have a positive outlook on Huobi Token – especially given its perceived undervaluation.

Disclaimer: We hold HT.

As always, this is not financial advice. This article is based on personal opinion, and we advise everyone to do their own research, and consult a financial advisor if needed, before investing.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://bitshouts.com/huobi-token-exchange-ht-analysis/

Hey @habtc, great info on Bitcoin! Thanks for sharing. The markets are fun right now and it's great to have the updates from good content here on Steemit. Cheers!

Coins mentioned in post: