The ECB calls bitcoin "the biggest bubble of all", although it does not pose a risk

It is not a risk because its weight in the market is still small

Picture of Dreamstime

The European Central Bank (ECB) says that bitcoin has been the biggest bubble in history. In spite of everything, this digital currency does not pose a risk to the markets or to the economy because the money that moves the cryptocurrencies "is still small if compared to other asset markets."

In the semi-annual report on Financial Stability, the ECB notes that "the growth of bitcoin has surpassed that of other historical bubbles before it exploded in 2018, losing 65% of its value". Today Thursday it has been known that the US has opened a criminal investigation into the manipulation of bitcoin.

The crash of bitcoin

Bitcoin was about to reach 20,000 dollars per unit in December 2017, boosting the capitalization of the cryptocurrency market that reached 680,000 million euros. But 2018 has not been a good year for this digital currency, which has plummeted to the point of falling below $ 7,000 per unit. In the present session, the bitcoin moves in the 7,300 dollars.

The ECB maintains in its report that the extreme movements of bitcoin (and other crypto currencies) suggest "that the adaptability of these assets as a deposit of value, a means of useful exchange and an efficient account unit is quite poor".

However, the popularity of cryptocurrency is still remarkable. Since July 2017, "the market for these assets has quintupled in size, but it is still small compared to other asset markets".

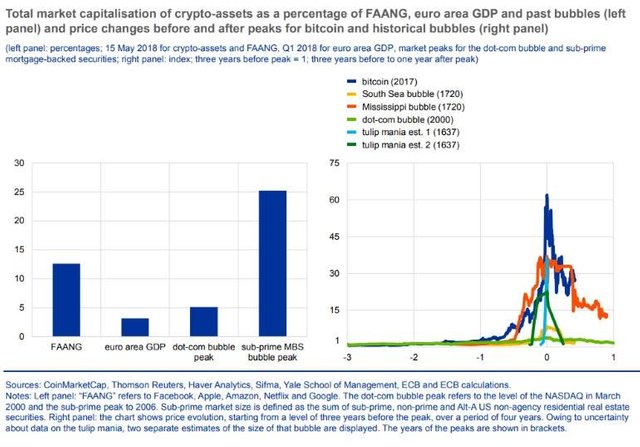

"Despite the recent correction, the aggregate valuation of this market is 330,000 million euros, although it has reached 680,000 million, a modest capitalization when compared to the market for large technology, the GDP of the Eurozone or the size of the great bubbles of history ", highlights the report of the ECB.

Weight of the capitalization of the cryptocurrency with respect to other sectors (left) and comparison with other bubbles (right). // Source: #BCE

Another fact that is revealing is the proliferation of this type of assets. In April 2013 there were seven digital currencies, while today the number could exceed 1,600. However, bitcoin remains the most relevant of all in terms of capitalization, although its relevance has decreased, now accounting for 40% of the total capitalization of cryptocurrency, while the past came to represent almost 100%.

This is the bitcoin

For those who are not familiar with bitcoin: this is a virtual and intangible currency (criptodivisa) conceived in 2009. The term also applies to the protocol and the P2P network that supports it. Bitcoin is characterized by being decentralized, that is, it is not backed by any government nor does it depend on trust in a central issuer. On the contrary, it uses a work test system to prevent double spending and reach consensus among all the nodes that make up the network. Similarly, transactions do not need intermediaries and the protocol is open source.

Like other assets, bitcoin can be 'mined' which is what the primary market would be, but you can also buy and sell bitcoins already mined, which would be the secondary market.

To achieve a bitcoin you need a computer and a special program. What the mining programs do is use the cores of the CPU or the graphics card to calculate codes. If one of those codes complies with the bitcoin protocol, it will have been mined and a bitcoin achieved.

However, it is very complicated to get a bitcoin with a normal computer and acting individually, so the so-called mining pools are used. These are mining groups (many people and computers), which joining forces make bitcoin mining more efficient. Even so it is important to have a great technological team to achieve results, the better and the more graphic cards are used, the greater the options of finding a bitcoin. Hence, the large warehouses in China full of microprocessors mining bitcoins at par.