Why I've Invested In TenX

Disclaimer: This is not financial advice, I own a position in TenX.

What I like about TenX:

- Lowest Fees: I’ve been looking for a card that allows me to spend my bitcoin/ethereum while traveling around the world, I’ve come across many cards (Bitpay, Cryptopay, etc. ) but a lot of the times there are fees associated with these cards (maintenance fees, bitcoin conversion fees).

TenX has no bitcoin conversion fees and no maintenance fee if you spend $1000/year, otherwise it’s $10 a year. If you take the time to compare the card that TenX offers vs other cards you’ll quickly realize that this is one of the best products out there.

- Developer updates: Julian the co-founder of TenX is extremely active with the community, he has bi-weekly Q&A updates on their YouTube channel. He answers community questions and updates people with information you wouldn’t find anywhere else and let’s the community know where TenX currently stands, where it’s going and how it’s going to get there. This is extremely valuable to me because it shows that they care about their investors, and I get to understand a little more of their decision making process, not to mention I also get valuable information directly from the co-founder himself (timeline info, thought process, etc).

It’s very clear if you watch the live streams they are planning for the future. They’re also growing extremely fast, Julian recently announced that they hit the 100,000 users milestone. I suggest you check out the live streams for information about what’s to come in the future if you want to know more.

- Working Product: TenX currently has a debit card available for use, although they’re currently back ordered because of high demand. They’re currently not capable of handling large transactions volumes which is why they are back-ordered. This is a positive for me because it shows that demand is there and they’re trying to maintain the quality of their service rather than just sending out thousands of cards on a system that can’t handle the volume.

- PAY token rewards: Rewards are currently not implemented, but TenX is looking to add a rewards program, .1% PAY token reward for every transaction the cardholder makes and a .5% Ether token reward for the TOTAL volume of transactions within the PAY platform. To get a better picture of what a .5% payout looks like let’s compare TenX to visa.

- In the year of 2016 visa had a total payment volume of $6.3 TRILLION dollars. Assuming TenX achieves that level of success, 0.5% of that would be $3.15 BILLION PAY tokens distributed to all PAY token holders. (Demonstration below)

They are able to do this through the use of the open source COMIT network, if you would like to know more I’ve linked the technical whitepaper in the description down below. One thing to keep in mind is that this will only be possible if the team is able to deliver on the COMIT network.

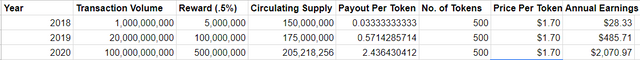

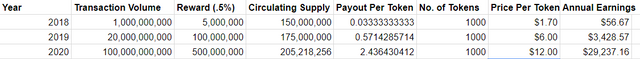

Here’s a little excel spreadsheet I made to demonstrate future earnings:

- I guesstimated the circulating supply for the next 3 years and assumed we would reach max supply by 2020 (No new tokens will be created).

- I used the current market price value of $1.70 per PAY token for the next 3 years.

- The transactions volume numbers from years 2018-2020 were pulled out from the TenX white paper.

- I tried to stay on the conservative side of things

- Also included a less conservative side of things

This is huge for early investors in PAY if TenX is able to make it past the startup hurdle, they are looking to pay these rewards out on a monthly basis initially with the hope of eventually having hourly payouts. To receive these rewards in the future, you need to have your tokens deposited in MyEtherWallet, they will not credit you with rewards if your tokens are on an exchange.

- Existing Users: Julian recently announced that TenX has 100k users up from the 10k-ish they had in August, that’s a 10x (pun intended) increase in just a couple of months. They have grown immensely fast, and from the looks of it aren’t looking to slow down anytime soon. With the launch of the COMIT network (No cost, high speed, high security routing) coming in Q2 2018 and U.S customers having access to cards in Q4 I’m expecting the value of TenX to increase if everything goes as planned.

How Does TenX Make Money?

Here is a paragraph from the white paper:

“For every card transaction a merchant accepts, the merchant pays 0.5-3% in the form of a merchant discount fee. This fee is then split among his bank, also called the acquiring bank, the card scheme and the issuing bank. The fee that is paid to the issuing bank is called the interchange fee. Traditionally this fee is plain profit for the issuer, but often is also used to give rewards to the user in form of air miles or similar benefits.”

In this example there are 3 parties, let’s assume $100 was spent and of that $100 the merchant pays a 3% fee ($3):

The merchant bank receives $0.6, the issuing bank receives $0.6 & the card scheme (TenX) receives $1.8 From that $1.8, TenX receives $0.9 and distributes the rest of the $0.9 to it’s users.

Here is another paragraph from the whitepaper:

“At TenX, we reward our users with PAY tokens on every purchase to allow them to become a token holder. Subsequently, PAY token holders will receive an incentive of 0.5% of the entire payment volume on the TenX payment platform initially on a monthly basis. TenX aims to distribute the reward in shorter periods of time in the future, with a target of hourly reward distribution.”

Remember that this is just an example to demonstrate how the business model will work, numbers are not factual.

My Thoughts:

If you’ve kept up to date with the TenX updates it’s clear to see that TenX team is a hard working team and passionate about what they are doing. One thing worth mentioning is that TenX is always planning for the future (example: looking for alternative payment solutions for debit/credit cards) and sometimes that can hurt short term investors, so if you’re looking to get into TenX consider this a long term investment.

My main concerns are whether they are able to execute to the deadlines they have set to stay ahead of the competition, they have been constantly expanding the team and are currently at 40 or so people from the 8 they originally had. We’ll see what the future holds for TenX. As for now I believe in the team and can’t wait to get my hands on one of those cards.

As far as I’m aware Monacoin is TenX’s main competition and they aren’t as far along and developed as TenX.

DO YOUR OWN RESEARCH BEFORE INVESTING.

If there are any mistakes in the article above, please send me a message and I will happily look into it and fix them.

COMIT white paper: http://www.comit.network/

I believe only the 0.1% cashback is paid out in PAY, the 0.5% is paid out in ETH.

You are correct, thank you for the correction!

i believe in tenx but i dont know what happen with the price.

Could be a number of reasons, card issuing has slowed down and people are waiting to see proof of the COMIT network but like I said I think this is a long term hold.

Interesting article

Thank you

If you would like to recieve upvotes from me on all your posts, simply FOLLOW @NirGF