Despite the Tether FUD, Bitcoin is still VERY STRONG!

Today we have a Daily Token Review and three really awesome cryptocurrency news segments to share with you from the market’s reaction to Bitfinex covering $850 million loss using Tether Funds, to Binance’s Report calling Ripple’s XRP the best Diversifier digital asset, to BMW presenting a blockchain-based odometer fraud prevention app called VerifyCar, developed in conjunction with VeChain.

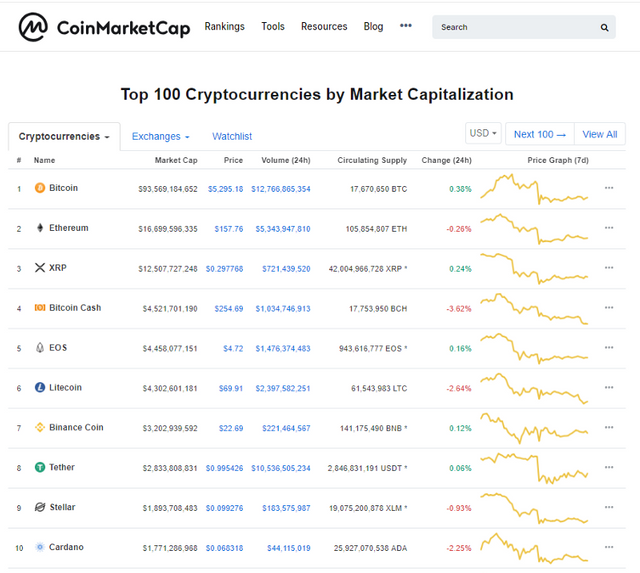

As seen on CoinMarketCap, we’ve got a mixture of greens and reds on the market. The world’s flagship cryptocurrency, bitcoin (BTC) has increased by 0.38 percent. Ether (ETH) still maintains its “second in command” status, and it’s currently losing by 0.26 percent. Ripple’s XRP maintains the number three position, and it has increased by 0.24 percent. Other considerable movements in the market include Bitcoin Cash and Litecoin, which are falling by 3.62 percent and 2.64 percent respectively.

Now, if I scroll down to the top 20, you can see here that once again the market is pretty mixed. It’s interesting to see that IOTA has however gained 13.24 percent, Maker has also gained well, increasing by 6.03 percent, while Ontology has fallen by 6.39 percent.

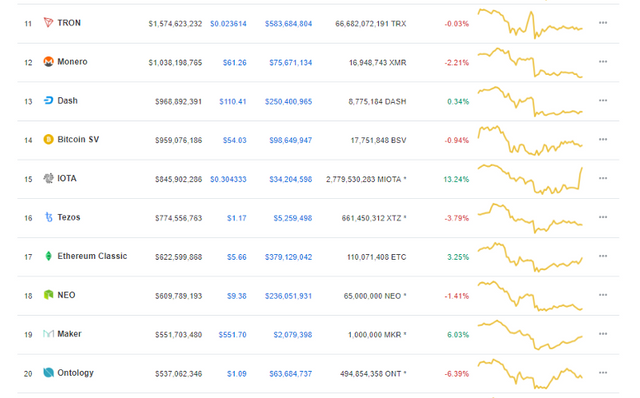

Now onto the news! I’m not sure if you guys have heard, but late last week, Bitfinex Covered $850 Million Loss Using Tether Funds. According to Coindesk, the New York Attorney General’s Office alleged that the major cryptocurrency exchange Bitfinex lost $850 million and used funds from Tether to cover the shortfall.

So how did this happen? Bitfinex apparently sent $850 million of customer and corporate funds to Crypto Capital Corporation, a payment processor that holds funds from other exchanges. Funds from the Tether Reserve were used to fill up for the shortfall, but the loss of Tether’s fund movements were not disclosed to customers. Tether’s cash reserves are technically supposed to be used to maintain USDT’s 1:1 USD Backing, but it appears perhaps not. iFinex, the parent company of both Bitfinex and Tether, have a court order from the New York Attorney General’s Office.

So how did the cryptocurrency community respond? It’s no surprise that the community was pretty shaken about the news when it broke out. Tether has always had its controversies, but as NewsBTC also reported, Bitcoin’s relatively small drop in the market ensured that after the Tether scandal, there is a lot of growing strength behind Bitcoin and the overall cryptocurrency community.

It shows that investors are not too afraid that the industry will fall as a result of the New York Attorney General’s Investigation as the market seems relatively stable. Chris Burniske, a partner at Placeholder VC even mentioned: “On one hand, I’m impressed with how $BTC has held given the #Tether news, on the other hand, the ~$200 spread between @BItfinex and other exchanges is making me feel queasy.”

It’ll be very interesting to see that with the Tether and Bitfinex situation, whether investors migrate away from USDT and move to other stable coins in the market to prepare for the worst.

Let’s now move onto the second news item for the day! According to the Bitcoinist, a new Binance report highlights that Ripple’s XRP is actually The ‘Best Diversifier’ when it comes to digital assets. Ripple’s XRP Token offers a diversifying position for investors.

So what does this mean? The Binance Research Report Details the Correlation between types of cryptocurrencies. The largest cryptocurrencies like Bitcoin and Ethereum shows the highest positive correlations or clusters, meaning that the prices of Bitcoin and Ethereum tend to follow the same market trends. Here when the prices move together, the investors are then exposed to similar increases so gains, risks, and losses in the market. Unlike Bitcoin and Ethereum, Ripple performs a bit differently. There is less of a correlation with Bitcoin and Ethereum’s trends, hence why it was coined ‘the best diversifier among digital assets with a market cap above $3 billion.’ In saying this though, diversifying cryptocurrencies might however not be the safest strategy given Bitcoin’s typical market behaviour.

And finally the last news item for today! BMW Presents Blockchain-based Odometer Fraud Prevent App VerifyCar Developed with VeChain.

It was announced at the VeChain Summit 2019 in April that VerifyCar aims to address odometer fraud, a widespread issue in Germany where 33% of second-hand cars have manipulated odometers, costing 3.000 EUR per car resulting in total damage of around 6 billion EUR per year.

So how does this work?

Here, “We build a digital ledger using the Vechain Blockchain. Every Interaction with a Car has a stored Has Key in the blockchain. That can be anything from changing a filter, changing the battery, having the annual service. Etc. Our cars all have a sim card which sends out datasets regularly. We store these datasets, verify them and of course make a call to the blockchain to prove that this call has already been made.” The great thing is the VerifyCar App has already been tested with internal vehicles, and BMW is currently determined to roll the product out!

So what are your thoughts on this situation guys?

Do you think the market is fairly stable despite the Tether fiasco! And are you going to switch stablecoin providers after hearing the news?

Are you confident in investing in Ripple’s XRP as an asset?

And what about VeChain’s work with BMW? Do you think the token prices will soar as VeChain partners and works with other major companies?

Let me know what you guys think below. If you like the content, please subscribe and watch our latest videos. It’s Cindy with CryptoPig, catch you guys around!

Please join us at our Telegram Group and follow us.

Disclaimer: Cryptopig content is written by a team of blockchain passionate people. We are not registered as investment advisors. Don’t take the information in this post as investment advice and make sure you do your own research before investing. Cryptocurrencies are a very risky investment, never invest more money than you can afford to lose.