Ethereum Drops 24%, Bitcoin Loses, Too, Amid Cryptocurrency Selloff

PHOTO: MICHAEL BUCHER/THE WALL STREET JOURNAL

By PAUL VIGNA

Jun 26, 2017 3:01 pm ET

10 COMMENTS

Cryptocurrencies led by bitcoin and ether were falling across the board on Monday as a massive run-up this spring has spurred some profit taking.

The most prominent drop came in ether, the digital currency used on the Ethereum network that is still reeling from trading problems last week. Ether fell 24% Monday to $231, and has now lost 41% of its value from its peak June 14, according to data from Coindesk. Meanwhile, bitcoin was down 7% at $2,424. They were not alone. Thirty-eight of the top 40 digital currencies listed on the site Crypto Market Cap were all down, including other prominent coins like ripple, down 8.6%, and litecoin, down 14%.

The selling comes after a sizable runup in the prices of these currencies. Bitcoin tripled from April 1, when it was at $1,079, through earlier this month, when it crested above $3,000. Ethereum rose more more than 4,000% earlier this year, jumping from $8 in January to $400 by June.

The gains have been so large, even the biggest crypto-bulls have been expecting a pullback. Indeed, the digital-currency market has been shaky for about two weeks now.

“My gut says we are headed for a selloff in the crypto sector,” venture capitalist Fred Wilson wrote in a blog post early on Monday. His Union Square Partners has been investing in the industry for several years.

Earlier this month, bitcoin prices fell about 27% from their high around $3,000 before recovering. Last week, ethereum experienced a sharp selloff, and a “flash crash” on one major exchange, GDAX. A number of smaller cryptocurrencies, which had seen exponential gains during the run-up, are down 25% or more on Monday amid the selloff.

“Market was a bit overbought,” said Joseph Lubin, a co-founder of Ethereum and CEO of startup Consensys. “Fear and greed cycle. Once it starts to move, sheep pile on.”

Much of the rally has been driven by two factors. One is a speculative fervor sparked by so-called initial coin offerings, or ICO, in which start-up offer their own token-like currencies in a process that is like a cross between crowd-funding and initial public offerings. The other is new money coming in from Japan, where government authorities implemented new rules around bitcoin that recognized the currency. Codifying the currency in that manner encouraged investors to start poking around the space.

This is worse than the Red Wedding on Game of Thrones.

Hehehe. Market will still get back to normal!

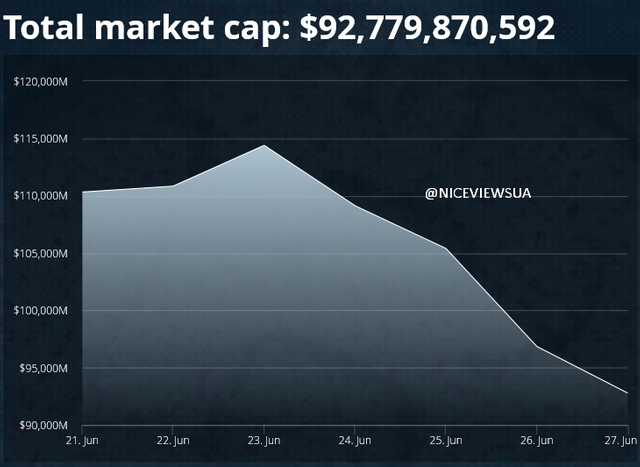

Market capitalization is going down :(((

https://steemit.com/cryptocurrency/@niceviewsua/bitcoin-and-altcoin-capitalization-is-down-this-week-did-you-now-why