Cryptocurrencies study part 1: Where are we in the market cycle?

This is the first part of an analysis i am working on. The goal is to get a clear view of the growth potential cryptocurrencies still have. I hope this is helpful for the community too. Feel free to leave me any feedback or questions in the comments.

Enormous market growth

The market and usage of cryptocurrencies has gone through a rapid growth since the official release of the bitcoin whitepaper by Satoshi Nakamoto in 2009. To illustrate the exponential growth rates , some graphs are shown below:

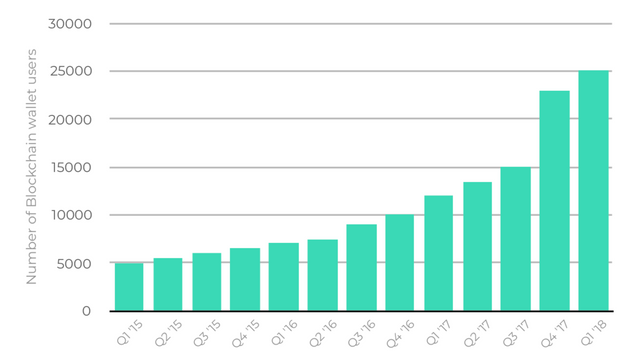

The number of registered bitcoin wallets has more than sevenfold over the last 3 years. Whereas in Q1 2015 around 3.180.000 wallets were registered on the blockchain, in Q1 2018 it were almost 24 million. That leads to an average compound growth rate of 96% and means, each year the number of bitcoin wallet users has almost doubled.

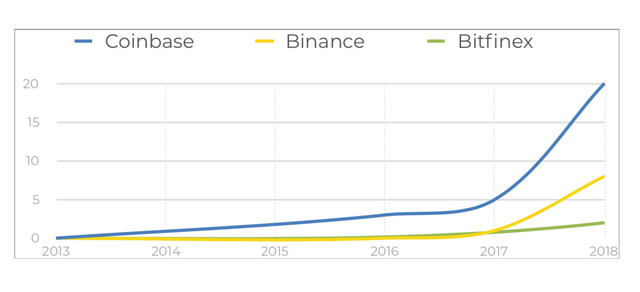

Another growth indicator is the number of users registered on exchanges. The largest exchanges today are Coinbase, Binance and Bitfinex measured by user numbers. The most dramatic growth faced Binance, the youngest exchange of the large ones in the market. Founded in June 2017 they are already managing a total of around 9 million users by today (Q2/2018). On January 10th they onboard 250.000 customers in just one hour according to their announcement one day later. Coinbase already surpassed 20 million users in Q2 2018.

Adoption: User Characteristics

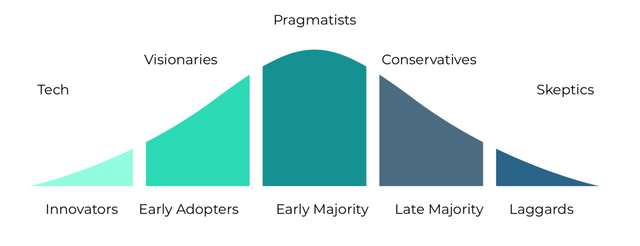

As much as the past market growth is appearing nicely it is only valuable in case the growth rates in the past can be continued in the future as well. An important indicator of where we are in regards to adoption in the market cycle is the characteristic of the average purchaser and user of cryptocurrencies and token.

Typical characteristics of current market participants are:

• Very tech-oriented

• Enthusiastic about blockchain and cryptocurrencies

• Consumes news and updates about the market on a daily basis

• Acts like a speculator and expects the market to rise massively

• Libertarian mindset and non-religious

• Is averagely at young age, between 18 - 30 years

Putting the described characteristics into the bigger picture of the adoption cycle, one can guess that we are still in the stage of early adoption. This conclusion aligns with the exponential growth rates we during the past years.

Penetration: Market lifecycle

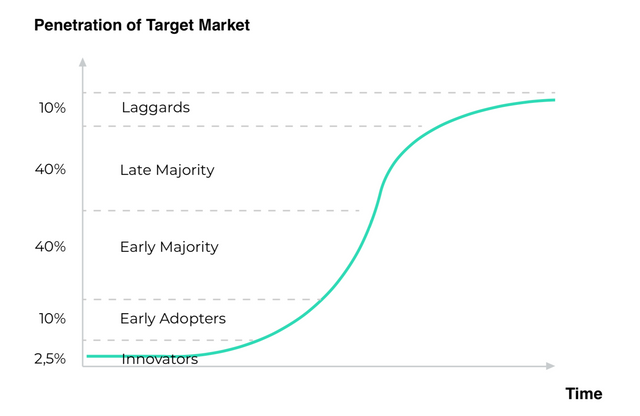

Another way to estimate the state of a market lifecycle in regards to a technology or product is to take a look at the market penetration. According to a survey made in Q1 2018, only 8% of Us- Americans have purchased cryptocurrencies. Though there are other countries such as South Korea, Japan or Singapore, where market penetration is at way further stage, America is taking the lead here in regards to adoption in the western world since another study showed, 53% of randomly interviewed cryptocurrency purchasers are from US.

Assuming that virtual currencies are a potential key technology in regards to the exchange of value or goods and due to its characteristic as a circulating product it is a likely scenario that they are being fully or partly used by the majority of the society in the future. A usage among 8% of a population then indicates an early adoption stage, too.

Website: https://mintfort.com/

Twitter: https://twitter.com/mintfort

LinkedIn: https://www.linkedin.com/company/mintfort/

Facebook: https://www.facebook.com/mintfortbank/

Follow me on Twitter: https://twitter.com/philipppetzka

LinkedIn: https://www.linkedin.com/in/philipp-petzka-817510105/