Bitcoin’s True Supply, Betting on The Right Alt-Coins

What is causing the soar in the price of Bitcoin?

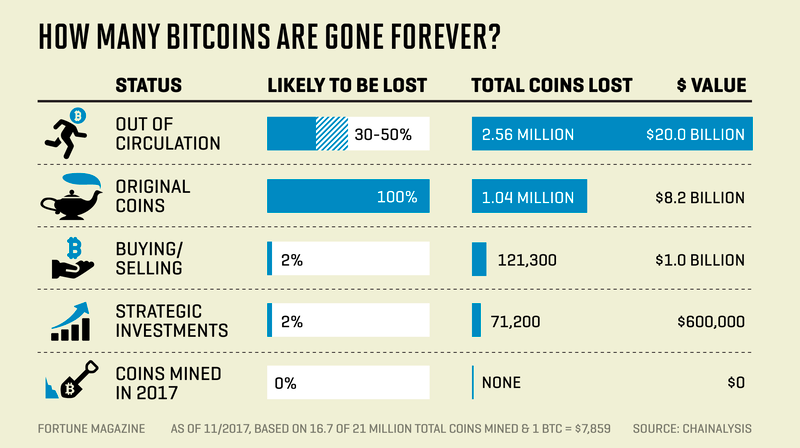

There will only ever be 21 million Bitcoin. Period. End of Story. However if you dig a little bit deeper you will realize that the number of Bitcoin that are being traded on exchanges (changing hands) is significantly smaller.

Estimates suggest that approximately 2.5 million Bitcoin have been lost forever. Not stolen or in hiding but the private keys lost.

Additionally there are 1 million or so Bitcoin that are held in Satoshi’s original wallet, which have remained untouched for nearly a decade. It's safe to say those coins will not be hitting exchanges any time soon, probably ever.

Another key facet to this discussion is the fact that many of the early Bitcoin investors simply bought and hold Bitcoin. For the most part, they have neither sold nor plan to sell a large portion of their BTC anytime in the near future.

So what does this all mean for the price of BTC?

Well my humble opinion is that when you factor in the number of Bitcoin that have been lost and the fact that most people are stashing their Bitcoin, you end up with a significantly smaller number of Bitcoin that become available on the open market.

Since demand for the asset has reached parabolic levels and there is a significantly strangled supply on the open market, you end up with an exponential price increase.

What exchanges are you using in the United States?

Coinbase is the easiest way to get in the game but their fees are high, the service has outages and it takes days to get fiat currency in your account.

Personally I’ve shifted all of my BTC & ETH trading to Gemini...25 bps fees, pre-credited deposits and the price of BTC has been as high as $2k lower than on Coinbase.

For alt-coins I recommend Bittrex or Binance, keep all of your coins on hardware wallets. My personal favorite wallet right now is the Ledger Nano S.

Should I buy ETH or LTC now that Bitcoin has gone parabolic?

I think BTC is still the best risk/reward at this given time and as such I believe it should make up ~50% of a diversified crypto portfolio, if not more.

I view Bitcoin as a digital form of Gold...Gold has a market cap of $8.2 trillion, Bitcoin’s market cap is approaching $300 billion, or ~3% of the gold market.

Which other coins do you like & what do you look for?

Personal favorites include Monero, Vertcoin & SALT.

I look for coins with a hard cap on the supply, this way there is no fear of dilution down the road. In altcoins I also look for a coin with a truly innovative use case with an enormous market opportunity.

Coins with greater levels of privacy, like Monero, will be poised for huge growth as the crypto market becomes more sophisticated.

Similarly a coin like SALT will provide users the ability to borrow against their crypto holdings, a transaction that is common in the real estate industry to avoid capital gains tax obligations from existing positions.

On another level, one strategy I have used successfully has been to identify and target coins that are likely to land on major exchanges.

Sources suggest that Ripple (XRP), Monero (XMR), Digital Cash (DASH), Bitcoin Cash (BCH) and Cardano (ADA) may be among the coins added to Coinbase in early 2018. While I have no concrete evidence one way or the other, after reviewing Coinbase’s Securities Law Framework, these tokens would seem to mesh with Coinbase’s long-term vision.

Tom is a Portfolio Manager of SportsCoin Ventures, a crypto fund based out of NYC.

Congratulations @tlm! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!