Americans Are Broke! MASSIVE DEBT! Should You Save For Retirement or Buy Stocks?

These are the same mistakes being made yet again. On top of these mistakes, we are seeing new creations from the financial system, inevitably bringing it to its knees. But knowing the underlying truth is essential: central bankers created this system of debt, and they are using it against us.

LOOK THROUGH MY BOOKS!: http://books.themoneygps.com

SUPPORT MY WORK: https://www.patreon.com/themoneygps

PAYPAL: https://goo.gl/L6VQg9

BITCOIN: 1MbAUXsHa8XRFMHjGurd7L5nRDYJYMQQmq

ETHEREUM: 0xece0Dd6D0b4617A8D94cff634C64155bb1cD8C2C

LITECOIN: LWh6fji4WrJT7FAbFvFSZ9jVNCgVM3dHod

DASH: Xj9RXrvhXbaL3prMDvdzAxM8gDB2vDiZrh

MONERO:47q5qDPkDBLRadwcSXDsri3PNniYRYY1HYAhidXWAg8xXHFFZHFi7i9GwwmZN9J5CJd8exT4WARpg2asCzkuoTmd3dfcXr6

STEEMIT: https://steemit.com/@themoneygps

DTUBE:

T-SHIRTS: http://themoneygps.com/store

PROTECT YOUR CRYPTO WITH THE TREZOR: https://goo.gl/keoFei

Sources Used in This Video:

https://goo.gl/UpprQe

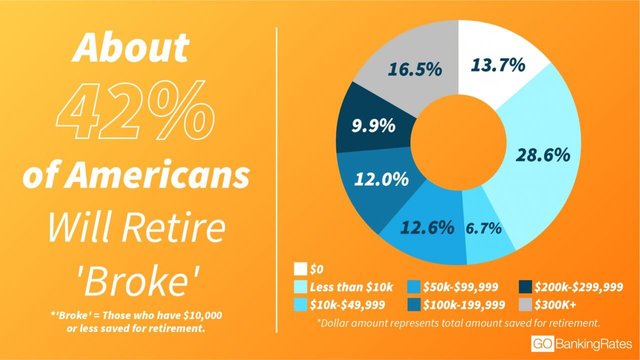

180227_gbr_retirebroke_1920x1080_overall-1280x720.jpg (1280×720)

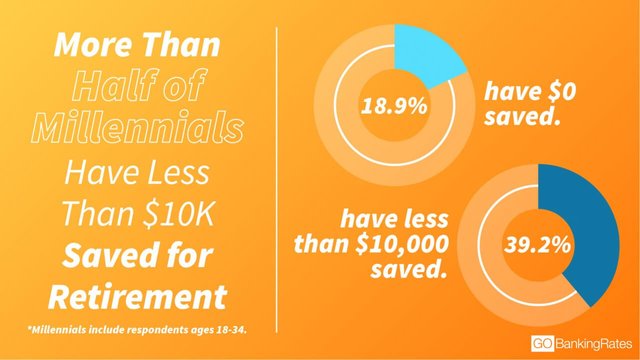

180227_gbr_retirebroke_1920x1080_age-1280x720.jpg (1280×720)

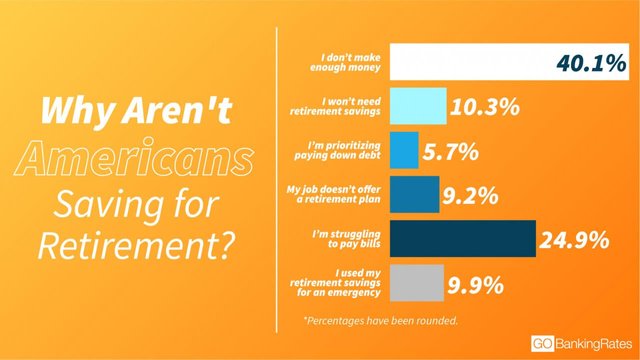

180227_gbr_retirebroke_1920x1080_reasons-1280x720.jpg (1280×720)

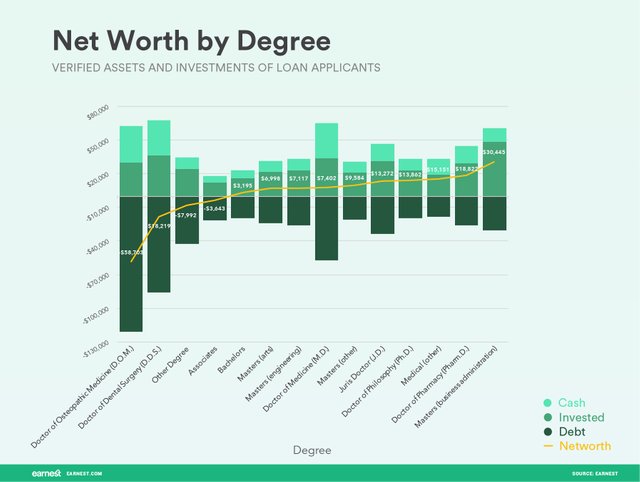

Net-Worth-Of-Loan-Applicants.jpg (1794×1350)

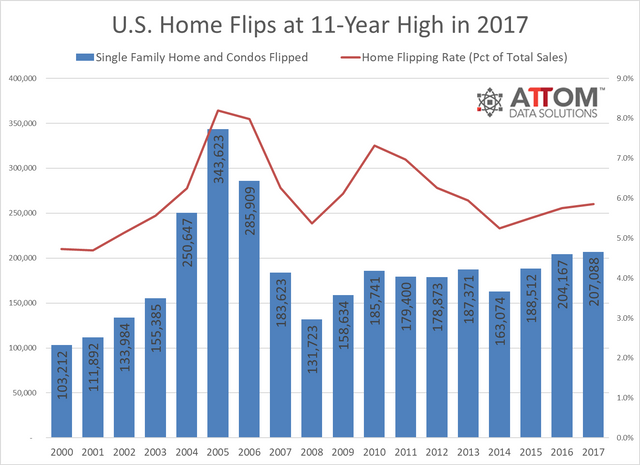

home_flips_historical_2017.png (1423×1034)

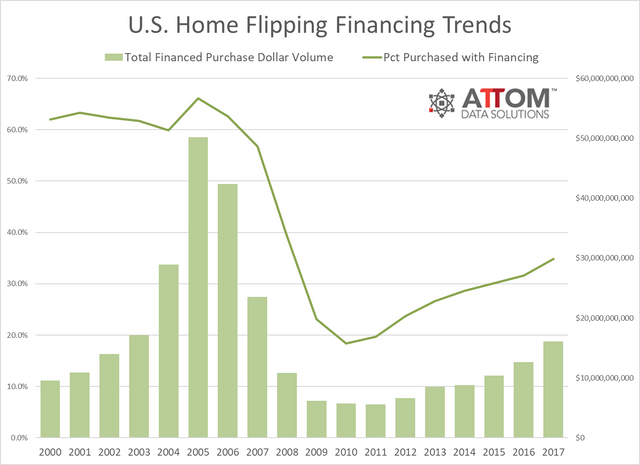

home_flips_financing_Trends_2017.png (1423×1034)

gdpnow-forecast-evolution.gif (628×456)

All that optimism for hot first-quarter economic growth is rapidly fading away

https://www.cnbc.com/2018/03/14/all-that-optimism-for-hot-first-quarter-economic-growth-is-rapidly-fading-away.html

▶️ DTube

▶️ IPFS

If you're in debt and actually want to get out, what do you do? Ask your corporation for help? Demand your government give you money? Or do you do what needs to be done? Never be afraid of hard work. But always recognize who we are fighting against: Central banking. It's an uphill battle, no doubt.

It seems that the global debt bubble is about ready to burst and the overly indebted western world will suffer most. I dread the consequences but I've been telling people for many years to avoid debt. When the going is good people love to buy new things on credit so a cautionary voice is the last thing they want to hear.

That's for sure. You can even see it on the comments of my YouTube channel. They say I'm crazy for recommending people get out of debt. What a crazy concept!

They are students of the banking industry & worshippers of things. One day they will figure out the definition of usury, but not before they get foooooooooked 😂

Virtually nobody understand the real theory of money. I only started to understand it 10 years when I started watching alternative media and got rid of my TV. It's hardly surprising really. I met someone today who was excited about purchasing a new house to rent out on an interest only non-fixed mortgage. It wasn't someone I knew well so I didn't want to 'burst their bubble' (excuse pun).

Good for you for educating yourself. When people tell me they bought a house, I can’t help but ask if they bought the house or bought the debt? Meanwhile rent inflation is Sky hi, I wonder why?

I only want to note, that I do not find this statistic very plausible, beacuse the category "I don't make enough money" is not exclusive. Because it is such a broad category, I would guess that especially answers 3 and 5 are also included in this answer when asking respondents.

The financial market led by the Fed does not incentivize traditional savings as real interest are near zero. They continue to push people towards risky asseta which have hurt savers in the past.

It's true. It's forcing people to invest in the stock market or other assets.

We are fooooked!!!!

Just a tad ;)

NO VIDEO⁉️