How To Alter The Global Economy With… Mud?

Mud. What do people do with mud? In our day-to-day routine, we sidestep mud in order not to get dirty. What do we know about seabed mud, for example? The female part of humanity appreciates it for some cosmetic properties.

What else? Nothing definitive to determine offhand in most cases…

What if I told you that potentially mud could become another economic driver of the 21st century? What if seabed mud processing can replace oil exploitation in terms of profitability?

Sounds like nonsense? Probably, unless the so-called REY-rich seabed mud is taken into consideration.

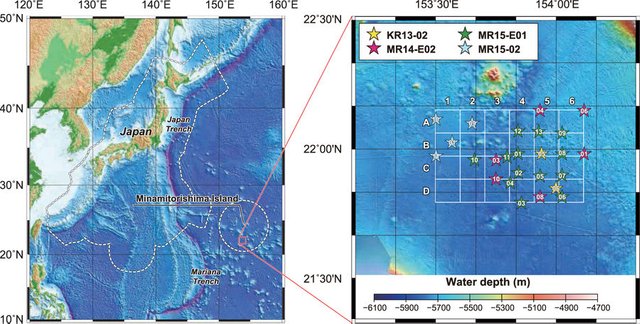

Do you know that a very small piece of seabed (small on a global scale) near Minamitorishima Island (Japan) contains about 1.2Mt of rare earth elements such as yttrium (Y), europium (Eu), terbium (Tb), and Dysprosium (Dy)?

image credit www.nature.com

This small seabed area can provide 62, 47, 32, and 56 years of annual global demand for Y, Eu, Tb, and Dy, respectively.

Got it? GLOBAL DEMAND!

How important are the rare earth elements for the contemporary economy?

Jack Lifton explained it in his interview of 2012, for example.

The emergency of exploration of the rare earth elements keeps growing with regard to the most burning trends of nowadays.

Thank God people have finally realized the deep meaning of eco-friendly technologies. This is not about just humane ethics anymore. This is about our survival as species.

The entrepreneurs who care about only their profits can be at ease since extra expenses for adding eco-friendly options to their business pay off significantly. Moreover, what we know as “green” industries constitute the only feasible business ideas in these days.

Hybrid vehicles, rechargeable batteries, wind turbines, light emitting diodes as well as many other advanced contemporary technologies become more and more lucrative due to their direct and indirect capabilities to save natural resources.

It seems the slogan of the modern business can be expressed as “be eco-friendly if you wanna be commercially successful”.

And in order to follow such a trend in the “green” industries, the newest technologies cannot do without rare earth elements, how odd it may sound.

Now we get back to the seabed mud issue again. A lot of military, medical, and computer technologies cannot keep their hardware up-to-date without both REY elements and such minerals as cobalt, zinc, copper, and manganese.

We have already given a very illustrative example of how a military sector depends on manganese supply. This mineral is so important for the arms industries that even the very national sovereignty can be at risk due to a manganese shortage.

image credit charismanews.com

We are living in the post-industrial economy, some may argue, only virtual assets matter today. The others can notice that any kind of mineral extraction should be left for the huge transnational corporations capable of exploring and processing minerals whatever value they can add to the business.

Both statements have questionable validity in fact even though they both seem self-evident. Let’s figure out what’s wrong with them from a purely economic perspective.

Myths # 1 to debunk:

The so-called virtual sector of the contemporary economy should not be underestimated, of course. Google, Facebook, Twitter as well as numerous fancy crypto projects own just virtual assets in the form of either publicly consumable content or ephemeral cryptocurrencies. And they really succeed.

Moreover, some politicians such as Venezuelan president bet on virtual cryptocoins. However, in the case of Mr. Maduro, his efforts to fix hyperinflation of the national currency with the help of crypto seem meaningless even though the “Petro” coin is backed by oil deposits.

As people say, it is too late to drink mineral water when your stomach needs urgent surgical treatment. The thing is that any currency (no matter fiat or crypto) is able to hold its value only when people trust the currency’s emitter. This is a feature of the “network effect” adding value to any virtual project.

What is the value of your coin along with your oil when nobody wants to deal with you?

Perhaps, Mr. Maduro missed a chance to reform the very socio-economic basis of the real-sector economy of Venezuela, and now he has to place hopes in virtual crypto miracles…

Without diminishing the profits many virtual business models can bring to their owners, the interdependence between real and virtual sectors is worth considering. In order to clearly realize who depends on whom, let’s compare hardware and software as the symbols of both real and virtual models.

The old chicken-and-egg dilemma, right?

Ask yourself then whether Facebook can do without those gadgets and desktop computers through which we all enter our FB profiles. Can Google run without its global network built upon huge data centers and numerous servers? What is any software without related hardware?

On the other hand, even the old-school button mobile phones and obsolete computers keep working once hundreds and thousands of the similar software are always available. Just visit App Store or Google Play to confirm this.

However popular and profitable virtual products can be, they cost nothing without a “real-world carrier” granting them the very existence.

Thus, the real-sector economy is prior to any virtual one. And what do we need to produce a smartphone, for example?

Right, we need minerals, metals and rare earth elements after all.

Myth #2:

Have you ever wondered why the electronics remain quite expensive despite the huge number of the currently available manufacturers?

image credit: Daily Mirror

Because the greedy digital giants have a tacit agreement to keep price high once they share the global market between several monopolists, some might explain. Although the concept of corporate complicity sounds convincing there should be some deeper rationale than just conspiracy.

What about the price of the basic materials the electronics manufacturers have to pay?

The thing is that Google and Apple do not extract Dysprosium, for example, which is necessary for the production of their gadgets. They both have subcontractors — the suppliers of the components where Dysprosium is contained in one or another form. In their turn, the components’ suppliers buy metals and minerals from some dedicated manufacturers who also purchase the raw materials from mining companies.

Thus, each link of such a long supply chain adds cost to the materials.

Let’s try to realize why the super-rich and powerful transnational corporations have to depend on the arbitrary prices of mining companies.

Such valuable minerals for electronic industries as zinc, cobalt, manganese, copper, and REY elements belong to quite limited onshore deposits. The countries owning those deposits along with some large private mining enterprises having licenses for extractive activities within the deposits keep control over extraction of those critical minerals.

The fact is that no onshore terrains have long been “terra incognita” geologically speaking.

Only two large areas remain insufficiently explored with regard to mineral resources — Antarctica and Eastern Siberia. And they both will remain in such a state in the near term most probably.

Hence, the current state of affairs makes even the most influential corporations depend on those limited supply of the valuable minerals whose price is fixed high.

Is there a chance to change the current situation in principle?

Leaving aside some speculative propositions about the industrial-scale commercial mining on other planets, the chance to find another rich source of minerals is available.

In contrast to all onshore mineral deposits occupied by the existing mining enterprises, much bigger unexplored deposits are still waiting to appear in the “aqua incognita”.

We mean the seabed mineral deposits containing billions of tons of minerals in the form of ferromanganese nodules and REY-rich mud. Even approximate estimations regarding their volume suggest providing the whole humanity with minerals for hundreds of years!

It explains why such small country as Japan can become the biggest global supplier of rare earth elements in the nearest perspective. The data given at the beginning of the present post hints at such a possibility. Of course, as long as Japan will be able to cope with the technological challenges related to deepsea mining. However, the fact that those REY-rich mud deposits are located in the 200-mile exclusive economic zone of Japan will most probably push Japanese Government (or Japanese corporations?) to apply their inherent pragmatic approach to the early resolution of the technical issues.

Our readers may complain that the given example describes a unique situation, that Japanese are lucky to find out such a treasure in their backyard.

Nevertheless, there is another example of the opposite attitude to the seabed treasures capable of making a certain economy flourishing.

The biggest currently known seabed deposit of ferromanganese nodules is located in the Clarion-Clipperton Zone where several big contractors conduct active explorations for many years.

The thing is that every state can participate in such an activity if a special license is issued by the International Seabed Authority. And the only state which needs no licenses is Mexico since the Clarion-Clipperton Zone covers the Mexican exclusive economic zone.

Have you ever heard anything about Mexico with regard to any valuable minerals supply?

Whether ignorance, whether negligence but the total indifference of the Mexican Government about such a gift from God is really puzzling…

Please don’t jump into conclusions, but all of the above can help us figure out how to make iPhones, for example, significantly cheaper and therefore more accessible for various strata of the global population.

If some new entities enter the global market of minerals with their abundant supply of critical elements for electronic industries, the new competition will affect the current fixed prices.

Thus, the successful seabed minerals’ mining can re-establish many sectors of the contemporary economy. The digital giants will have to double up…

How to literally dive deeply into the seabed mining? Do the issue have just some purely technological constraints? What should come first to a newcomer in seabed mining?

We will give the answers in our next post. Nevertheless, you are always welcome to join our social channels to learn more about the newest approaches to what we call Extractive Industry 2.0 (https://www.facebook.com/ExtractiveIndustry2/)