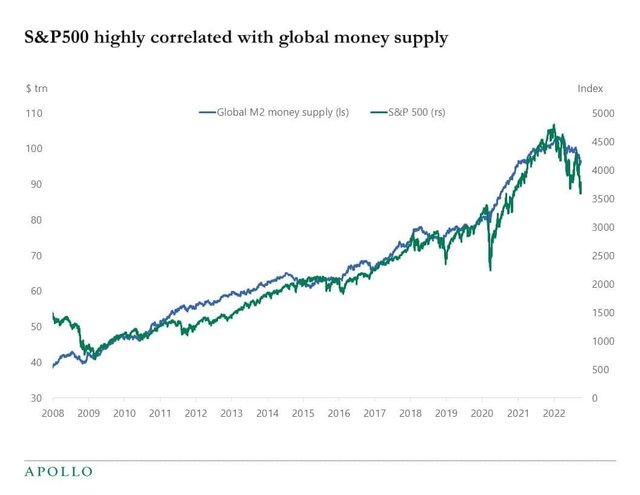

I hear people say this sort of thing. I am skeptical.

I am not sure in what sense it's "telling". There are complex reasons for this, and it "tells" the reasons if you have the theoretical context.

If you're implying that loose money drives up equity prices, and that's all that's going on, that is incorrect.

I don't mean to write a treatise, and anyway I only have a casual understanding, but I think the most intuitive, common-sense thing to get a handle on that is in the past 50 years or so, the economy has become very financialized. Equities represent a large proportion of stored wealth, and the S&P 500 in particular is globally dominant. As the value of stored wealth instruments goes up, we would expect the global money supply to pretty much track that. People need more money supply to reflect cash needs that track actual wealth holdings. Basically, more wealth means more cash transactions.

That said, it's also true that the velocity of money has gone way down. People are holding onto their wealth by storing it in equities. So we would expect that as the money supply grows, reflecting real growth in the economy, people are putting that away in the form of equity holdings, which drives up the value of the S&P 500. Here I refer not to inflated dollar-denominated value, but rather to actual value. The wealth is invested and drives growth. So there is a feedback loop and correlation between money supple reflecting GDP and wealth, and equity values.

Some people are attributing the rise in equities to ZIRP (zero interest rate policies -- central banks lending money for free, as they did 2008-2021), QE, PPP, and tax breaks.

My thought about that is while I don't mean to be mean, a one-word answer is about as sophisticated as you'd expect in terms of accuracy 🙂

ZIRP is actually the one thing he said that I think is more "true". It's not the main thing responsible for the graph, but it's a contributor. I do think that focusing on ZIRP and QE oversimplifies the relationship between money supply and equity prices, and doesn't address the structural issues that are the most relevant contributors.

I think the subsidies and tax breaks are a small side story, and PPP was temporary.

Keep in mind that global equities are about $110 trillion or something like that. Real estate is $330t or so. Debt is also $330t or so. Global money supply is $125t. So, while it's a lot, it's only about 15% of total global wealth. So it's more likely, intuitively, that it follows the trends driven by other factors, rather than it's the driver.

@tipu curate

Upvoted 👌 (Mana: 6/10) Get profit votes with @tipU :)