Bye 2022, Hello 2023 | Are You Ready, Traders?

Over the past 12 months, the industry has experienced a lot of ups and downs. The industry, as always, has adjusted itself accordingly. These ranged from war-related market volatility to the ban of MetaQuotes and the winter in cryptocurrencies.

In 2022, Apple's shocking removal of two MetaQuotes apps, MetaTrader 4 and MetaTrader 5, from the App Store may have had the most significant effect on the FX/CFDs market. The tech giant made this move without explaining, but reports indicated that it did so as millions were stolen by scammers who had obtained licences for the MT4 and MT5 apps.

In conjunction with this, the brokers who provided services merely with these two trading platforms, aside from MetaQuotes, faced numerous difficulties as MetaQuotes has always been the market leader in retail CFD trading. After Apple's ban, demand for MetaQuotes' rivals' products increased significantly. Additionally, brokers started developing their own in-house services by launching their own platforms. One thing is sure: brokers will continue to broaden and diversify their platform offerings, and traders will continue to trade – with or without MetaQuotes.

African, Asian, and Latin American emerging markets are all expanding. Additionally, brokers are aggressively growing their businesses in the multilingual Southeast Asian nations and the Middle East and North Africa (MENA) region. However, industry experts have differing opinions when it comes to making predictions about the next major market. Higgins, the CEO of Gold-i, believes that Latin America, with a large population and a reading mindset, is the next market where FX/CFDs brokers will grow in 2023. However, Chailis from Libertex Group places his bets on Africa as the next growth region. Capuano representing Capital.com, on the other hand, claims that Asia is a better place for new broker penetration.

Trends dominate every market, and FX/CFDs are no different. Now that 2022 is over, those participating in the trading market are forecasting 2023's trends and making adjustments as necessary. Brokers and other market participants always plan for some anticipated trends, even though there will always be unforeseen events that have the potential to disrupt the market.

In terms of regulations, there were no significant reforms in 2022, but things might change in 2023. To end the unethical and immoral activities carried out by some brokers, the European Securities and Markets Authority (ESMA) has already demonstrated its plans to close regulatory supervision gaps regarding the passporting of licences. Even the Cypriot regulator's enforcement procedures which supervise numerous FX/CFD brokers were criticised.

Read WikiFX's projection of 2023 on this matter here: https://www.wikifx.com/en/newsdetail/202212216314457110.html.

Major technological changes are also anticipated, particularly in applying artificial intelligence (AI) in the trading industry. Brokers will use such cutting-edge technology for analysis, risk management, and automated trading.

Incorporating environmental, social, and governance (ESG) factors in investing is another significant trend that could take off next year. The demand from investors for these products is skyrocketing, and numerous brokerages are allowing retail traders access to ESG data. ESG data for stocks and a few of their other investment products are now being offered by Swissquote and CMC Invest. Similarly, financial institutions may consider incorporating ESG criteria into their risk management policies to gain a better understanding and mitigate potential risks associated with their investments.

If you are someone who has “learn trading” on your resolution list, WikiFX has something invaluable to offer.

Head over to our Education site (https://www.wikifx.com/en/education/education.html) for free learning resources that are beneficial in helping you achieve your trading goals.

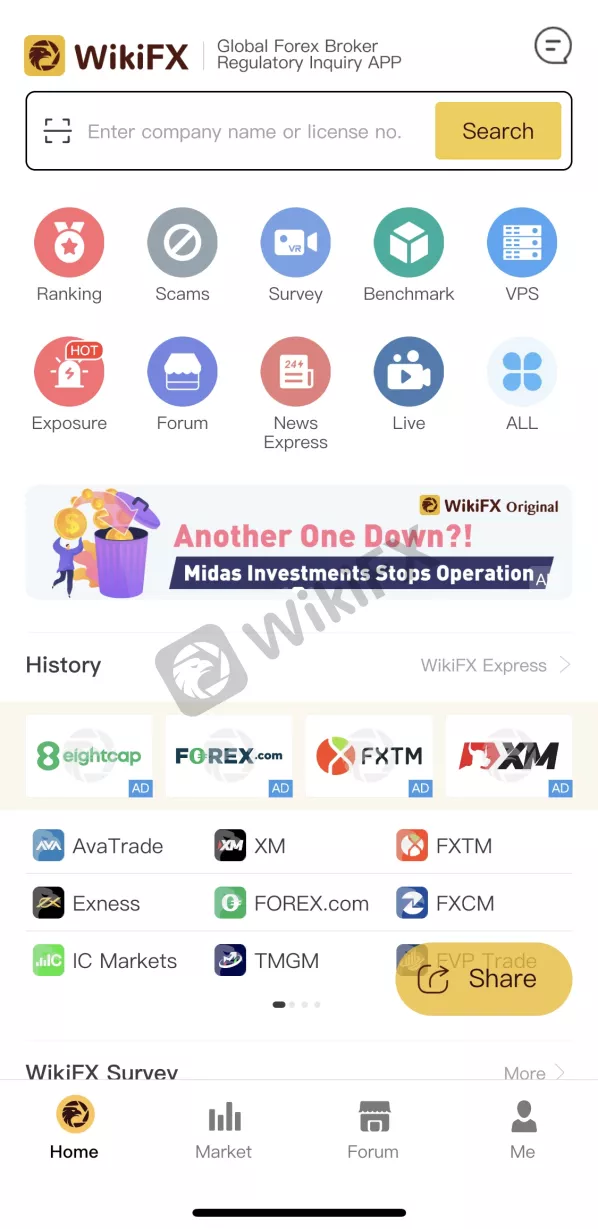

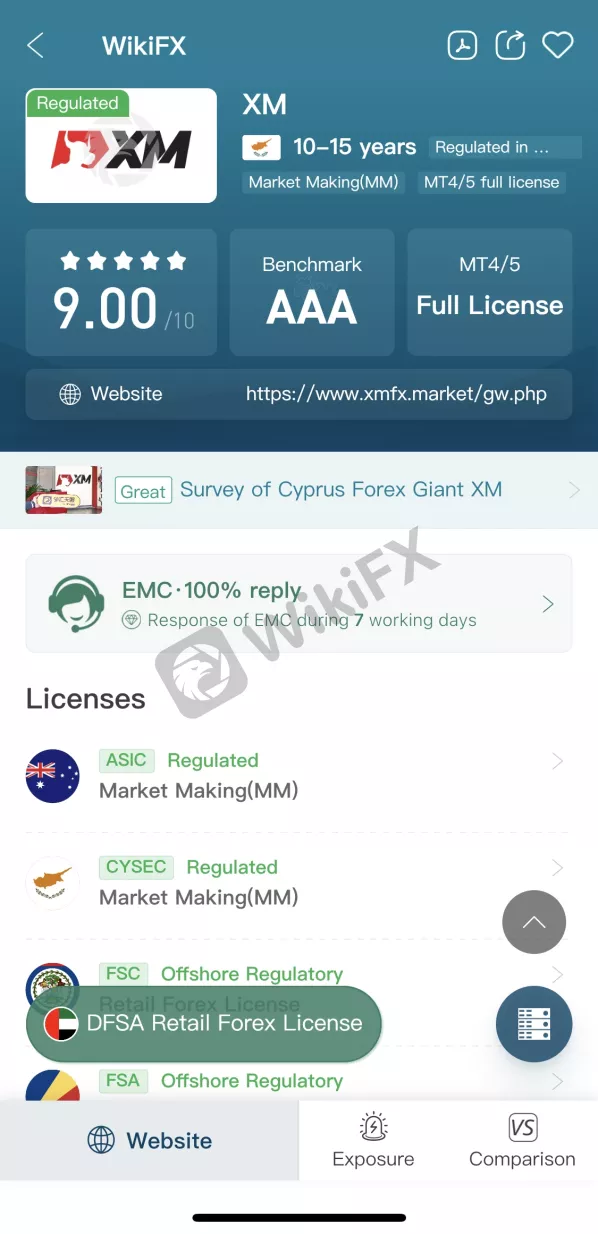

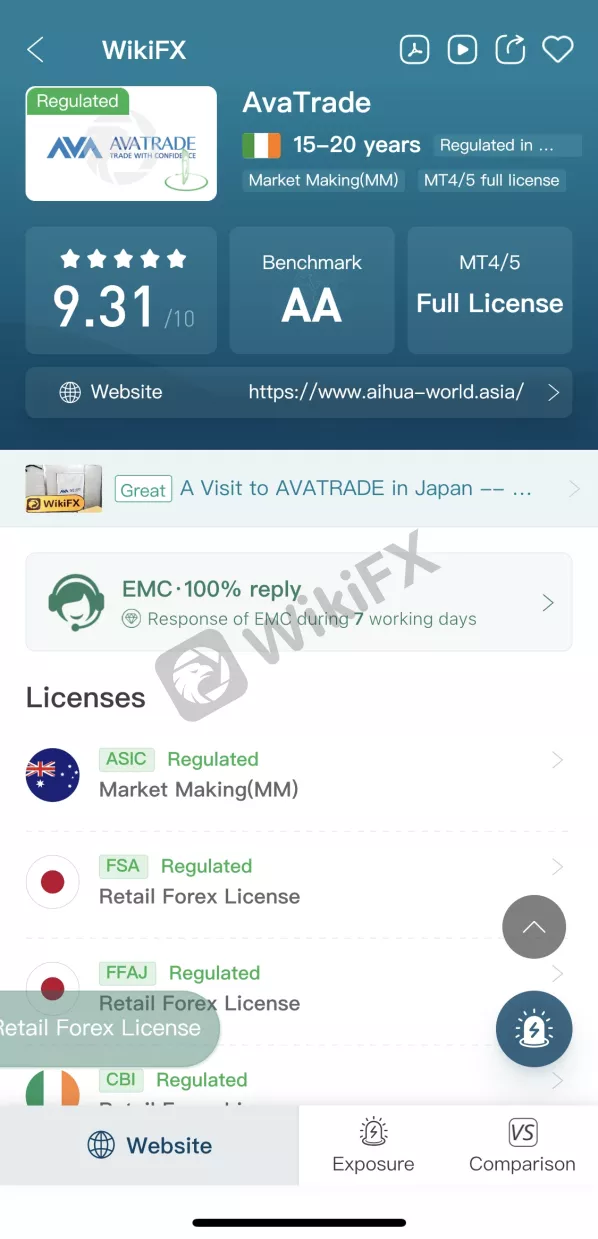

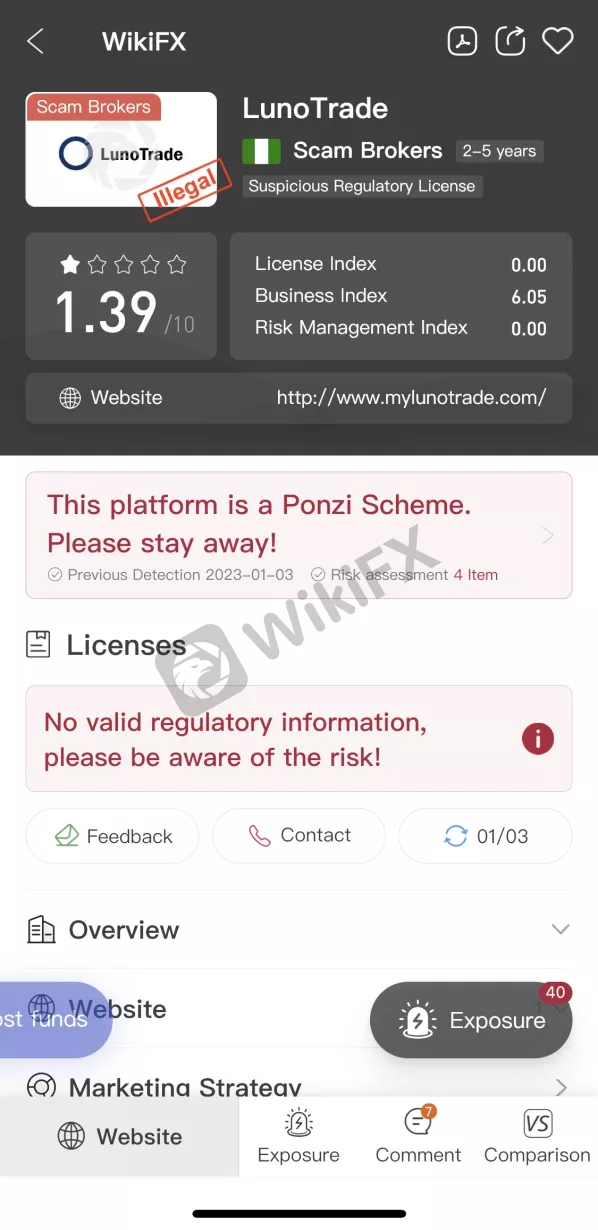

If you are a retail trader who is already on the move to bank profits from the financial markets, do remember to conduct a background check on your selected broker to ensure the safety of your funds. Simply download the free WikiFX mobile application from Google Play or App Store, and you will get all the relevant information about your broker in just a few taps.

We are a global forex broker regulatory query platform that houses verified information of over 41,000 brokers worldwide in collaboration with national regulators.

Good luck in 2023, traders!