Crypto Academy Season 3 Week 6 - Beginner's Course | Cryptocurrency Investment Tools. | @nachomolina2

This is my entry to Cryptoacademy: The Steemit Crypto Academy Weekly Update [ August 2nd, 2021 ] : New Courses. Homework Post for @reminiscence01: Crypto Academy Season 3 Week 6 - Beginner's Course | Cryptocurrency Investment Tools.. I invite all Steemit.com users to join. @juanmolina @betzaelcorvo @corinadiaz

Image created by the author, Steemit logo

1. a) Explain CoinGecko and why it is a good cryptocurrency investment tool.

According to my own opinion Coingecko is a cryptocurrency tool that provides information about cryptocurrency projects, showing statistical data, graphs, exchanges, markets, cryptocurrency and token classification, among other useful aspects to work in the crypto area.

What is Coingecko?

"Coingecko was founded in Malaysia in 2014 and is considered a cryptocurrency data aggregation platform that serves to understand the fundamental financial state of the crypto asset market. Conigecko's intention is to drive the market through fundamental analysis tools, price tracking with constant monitoring of the market and official blockchain sites in order to provide a complete service and adapt to the participant's needs while managing to grow as a community and actively develop the platform's open source code."

image source

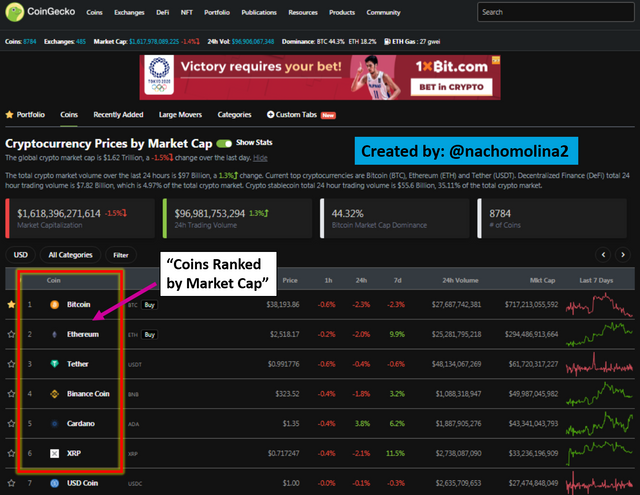

The interface shows the cryptocurrencies ranked according to market capitalization. Reason why the first place is occupied by Bitcoin (BTC 44.5%), followed by Ethereum (ETH 18.0%) and then the other mostly traded cryptos in the market.

image source

Exploring Coingecko

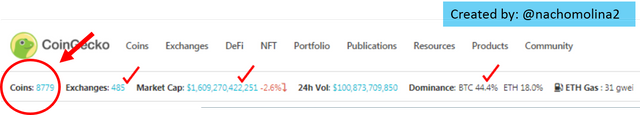

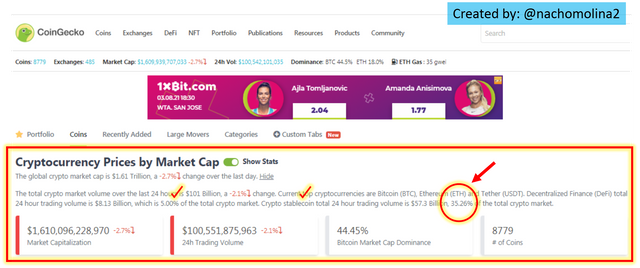

At the top of the page we observe an instant summary of the global cryptocurrency market corresponding to the last day, in which information about global capitalization, market volume, dominant coins, among others, is reported.

It is interesting to know that 8779 coins are traded in the market with a total of 485 exchanges; which represents a total market capitalization of $1,609,939,707,033. The transactional volume for the last day is $100,542,101,035.

image source

I would recommend every Coingecko user to first read the message offered by the platform about cryptocurrency prices by market cap. Through that information I could quickly consult that the DEFI market occupies 5% of the total cryptocurrency market, as well as, STABLE Coin have an operational volume of 35.26%.

According to the above we can see the practical way to consult the Coingecko tool in addition to the importance of the information offered for cryptocurrency investment.

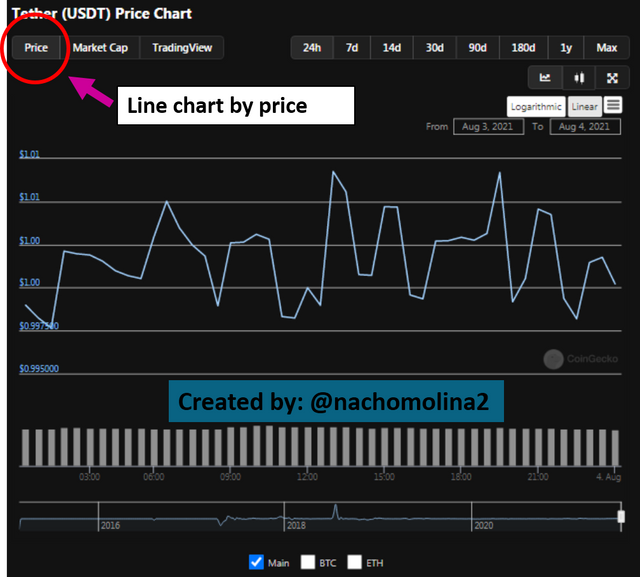

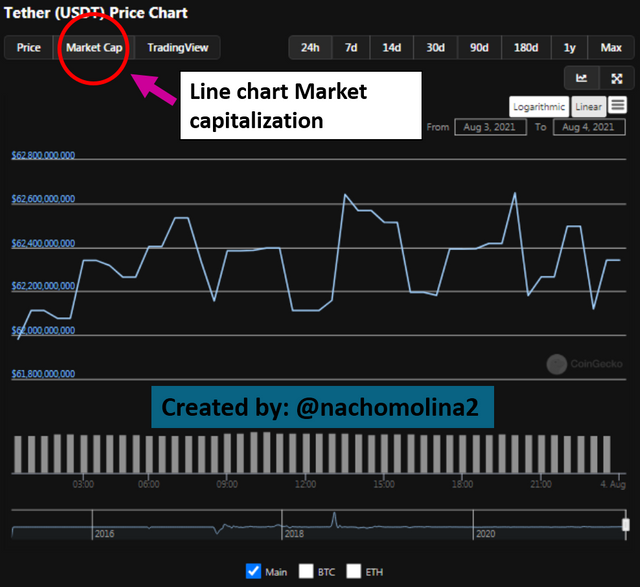

I will give an example of how to use the Coingecko cryptocurrency tool by exploring the stable coin Tether, but I should point out that this is the same process for exploring any other cryptocurrency in Coingecko.

Coingecko Use case:

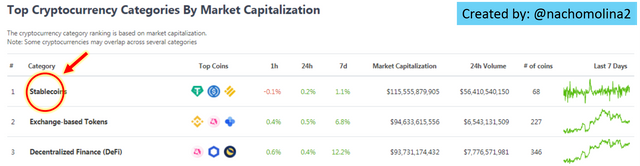

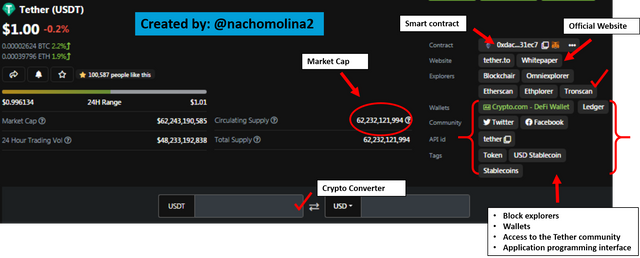

I personally hold my crypto earnings in Tether (USDT) and upon consulting Coingecko I was pleased to learn that this is the stable coin with the largest market cap. To explore this coin I had to select the "Categories " option, then "Stablecoins ".

image source

So I was able to validate that Tether (USDT) is ranked in first place of "Stablecoins" with a market capitalization of $62,665,132,995 over the next coin "USD Coin (USDC) " which has a market capitalization of $27,609,069,908. This makes me see that I made a good decision in choosing Tether as a stable and reliable currency. Let's remember that this data is extremely important for "Fundamental Analysis".

image source

It is also possible to view Japanese candlestick charts through Conigecko, which offers official and real-time data where you can also access Tradinview to extend the experience. Let's remember the importance of candlestick charts for "Technical Analysis".

|  |

|---|

image source

"The three graphs above show a summary of the Types of graphs offered by the Coingecko interface. Which represents a very useful tool for trading and Technical Analysis. "

Additionally I was able to consult relevant information related to the Tether blockchain: official Website, Smart Contract, Block explorers and crypto wallets available. Other aspects related to the API, which is a very sought after information for open source programmers and developers; Access to the community through the social networks Twitter and Facebook, in general, all the information needed to research about a cryptocurrency project and make a timely financial decision.

image source

This is just a sample of why Coingecko is a good cryptocurrency tool. My intention is to express through this "Use Case" example how to take advantage of the platform, what is its real potential and how to query the necessary information.

It should be noted, that it is possible to open a user account using only the email, which will allow the creation of a portfolio of cryptocurrencies to keep control and constant monitoring of the market.

These are the reasons why Coingecko is for me, the best cryptocurrency tool; besides offering useful and official information it is also a friendly interface that provides easy access to cryptocurrencies.

b) Explore CoinGecko and explain at least 5 unique features of the platform (Take a screenshot of the page).

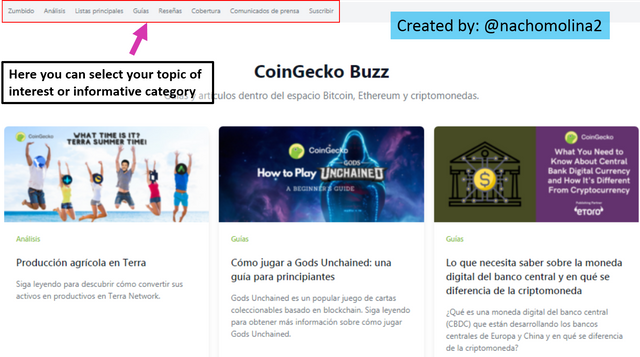

1. CoinGecko Buzz

CoinGecko Buzz consists of a library or information space containing documents about blockchain and cryptocurrencies. The information is very varied and well-argued made with broad professional sense.

As far as I could explore and validate by myself the documents can be analysis, guides or coverage and each one carries the copyright properly identified. Through unique features like CoinGecko Buzz I can notice that the intention of the platform emphasizes user education and training in the cryptocurrency area.

I was reading an article written by the author Shaun Paul Lee which was about the "Terra ecosystem "; it was a really informative and quite extensive article, with a lot of technical and development information. If you want to read the article here is the "Link". This is a performance agriculture network aimed at improving blockchain products by proposing low fees and easy to use applications.

At the end of my exploration of CoinGecko Buzz I noticed that it supports article subscription by the community in case someone wants to make a contribution of knowledge through an article that serves to swell the CoinGecko Buzz research library. I recommend.

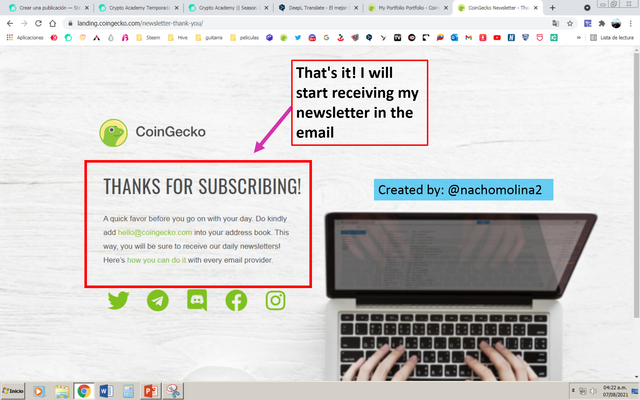

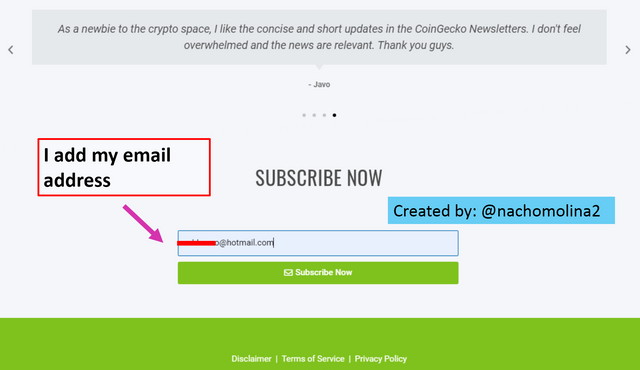

2. CoinGecko Newsletter.

It is a unique feature of publications in which you have the option to subscribe to receive a newsletter in your email.

Newsletters include:

- Top Coin Trends of the Week

- Currency Price Summary Update

- Monetary News

- Market news

I personally think that this unique feature of Coingecko is important because it is aimed at informing the user in a permanent way with the intention of not missing any news from the crypto environment, I also consider that it has to be first hand information from a team of highly qualified professionals. A good option to provide some assistance to the user while it can also act as a form of additional motivation to make life on the platform and get involved in all the happenings of the cryptocurrency and Coingecko's innovations.

On this occasion I'll move on to do my subscription on CoinGecko Newsletter.

- Step 1:

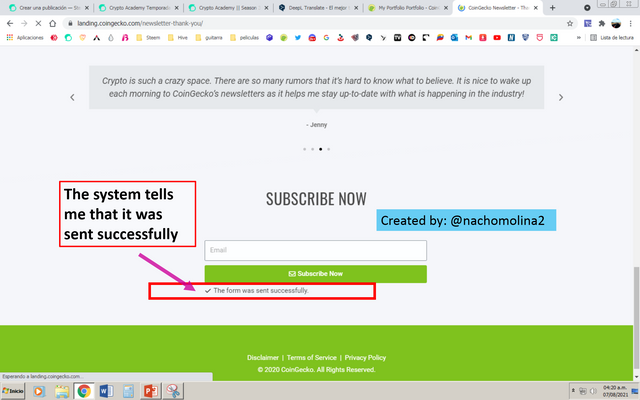

- Step 2:

- Step 3:

Now you just need to check your email to find the newsletters. Note that once you have subscribed you will be able to log in with your email address and enjoy all that CoinGecko Newsletter has to offer.

3. CoinGecko Podcast

According to my own opinion in the cryptocurrency environment we should be well documented and handle professional information. We must find a good source of research as well as recent news from the crypto world.

While exploring the Coingecko platform I have been surprised to find a unique and really useful feature for any participant which I would like to recommend. I am referring to CoinGecko Podcast a sharing of the platform that offers outstanding information about Bitcoin and Cryptocurrencies.

"This space consists of opinion interviews with prominent personalities in the crypto environment addressing issues of blockchain technology at different levels. It currently has a stock of documented interviews from January 2020 to July 29, 2021 with a total of 36 episodes."

In this episode which I was able to check out Yenwen Feng, co-founder of Perpetual Protocol talked about the background, innovations and future projection of the protocol. Touching on other technology topics such as leverage, speed and buffering.

The interviews consist of an audio file of the live interview and also a written summary of the most relevant quotes from the episode. Turning this unique space into a kind of university or crypto academy with classes and lectures coming from the most influential people in the Blockchain.

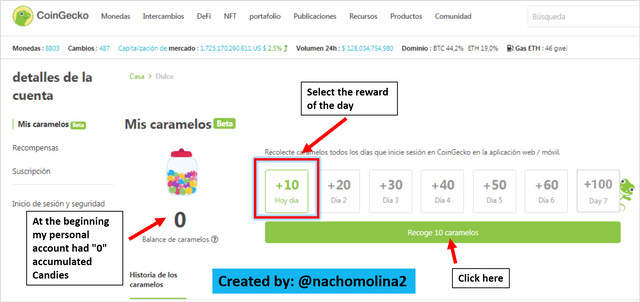

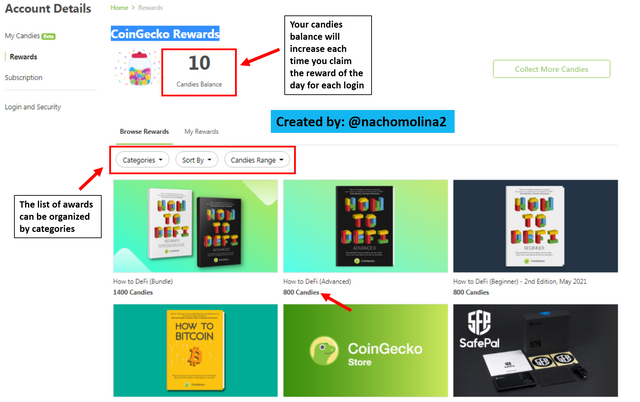

4. CoinGecko Rewards

They are used to accumulate points which then allow you to redeem for products on the platform. By simply opening an account you can enter the rewards section (Candy) by clicking on the icon and get the daily reward.

This feature works as a preference system for the user every time they log in to the Web or mobile application.

Coingecko Use case:

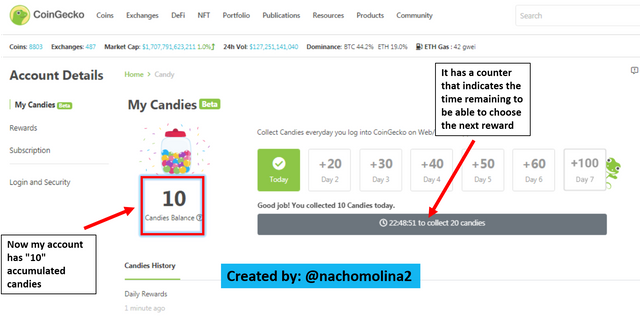

I wanted to test with my personal account and as shown in the image I just accumulated my first 10 Candies.

As we see in the image now the candies appear in my rewards compartment.

We can then go into the "rewards" section and see how many candies are required to access the products offered.

5. NFT

This feature of Coingecko has caught my attention as it provides access to the non fungible token (NFT) market, which is an innovative system in the world of cryptocurrencies.

"Recall that an NFT is a uniquely designed token which is created in limited quantities with a single creditor who becomes the owner for life. NFT can be associated with any type of real world property such as: artwork, designs, property, etc. They are considered collectible tokens issued in certain controlled quantities so that they cannot lose their value and utility when traded on the Exchanges."

After this brief review I will move on to explore the NFTs offered by Coingecko.

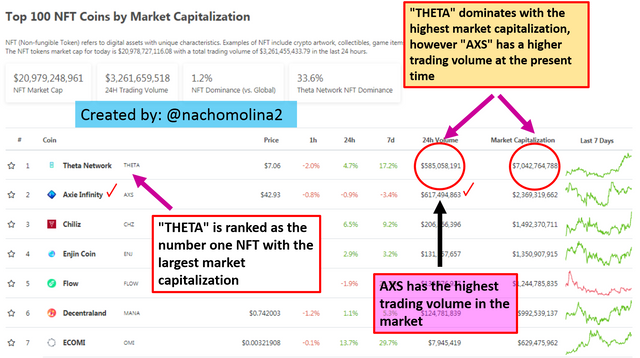

The graph shows the dominance of the NFT "THETA" occupying the number 1 position. The NFTs are organized by Trading Volume and Market Capitalization, in short Coingecko offers NFT information by Fundamental data in a similar way to the rest of the other cryptocurrencies which makes it interesting to explore this market, gain knowledge and see what its advantages are. Especially to establish comparisons with the other types of Cryptos existing in the global market.

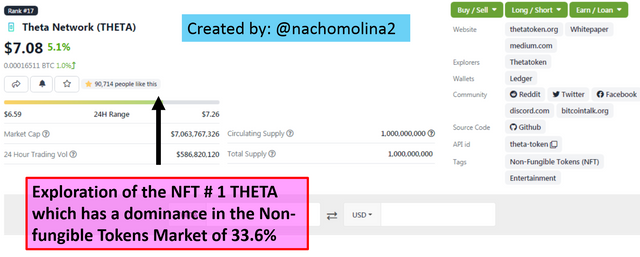

Exploring the "THETA" NFT in detail, I can notice that the fundamental information of the NFT is organized in a similar way to the rest of the cryptocurrencies we have seen previously. Letting see among other things that "THETA" is ranked #1 in the NFT ranking and #17 in the global cryptocurrency market. With a value of $7.09 USD, Market Cap $7,082,529,771 and 24 Hour Trading Vol $587,356,594.

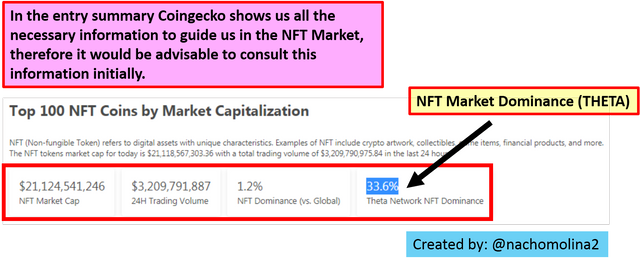

It is important to refer to the NFT summary offered by Coingecko before exploring the rest of the tokens in depth.

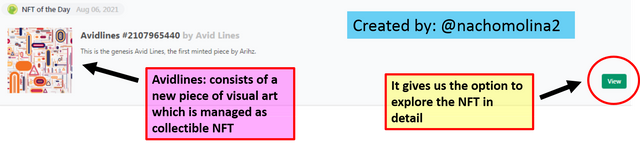

NFT Spotlight

After doing a fairly thorough exploration of the NFT I want to refer to Coigecko's special feature which displays the NFT of the day. For this case it shows the promoted NFT for the date 06/08/2021 at the time of writing this post.

If we look at the top we'll see:

When we enter the "Visit" option, we get a close-up of the image that allows us to appreciate the work in all its splendor. We can also skip to the previous NFTs and visit them one by one in a more in-depth exploration of this unique Coingecko feature for NFTs.

We will also find the "new" option NFT Spotlight where we will have access to the featured NFTs and we will be able to read interviews with the creators, know their purposes, trajectory, future vision, usefulness, as well as, appreciate the diversity of collectible artworks that they offer. This is a feature with a high human character that connects us not only with the NFTs but with the people behind each project. NFT Aidrops are offered.

|  |

|---|

2. a) Give a brief explanation of the Tradingview platform.

What is TradingView?

Trading view is a platform for crypto space analysis that offers tools to traders and investors for monitoring and studying assets. It consists of a community where you can establish financial relationships, share information and support stock market projects in order to be guided in the virtual market and grow in knowledge.

It is possible to access the different markets: Spot, DEX, futures, derivatives, Stocks, Bonds, FOREX, among other options. It has charts, drawing tools, indicators, extremely useful when performing a technical or fundamental analysis. It provides access to the official sites of the blockchain and has a wide range of cryptocurrencies mostly traded in the market.

To belong to the community you can open a free account using your email address or subscribe to a paid account to have access to even more advanced benefits. Currently the community has 30 million subscribers who use the platform for unlimited trading and corporate investments.

b) Explain the steps necessary to add indicators to the Tradingview chart. You can add any indicator of your choice except the moving average . (Screenshots are required).

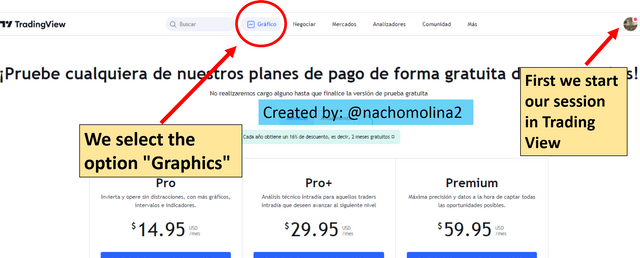

I will first log into my personal Trading View account and then select the "Charts" option.

Previously we must have selected the currency we are going to study. In this case I will use the "DOGE/USDT " pair to give the example. I have set the chart to a one-day timeframe "D".

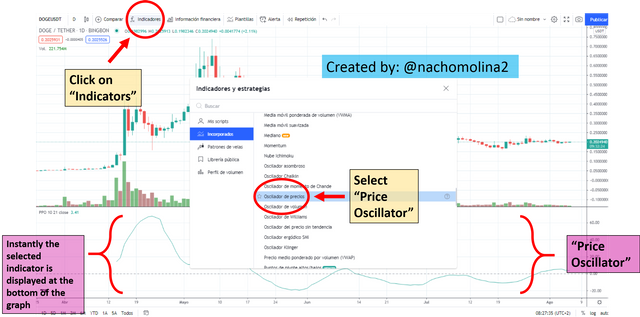

Now we go to the "Indicators" option and select "Price Oscillator". The "Price Oscillator" will be displayed at the bottom of the chart.

Note: The price oscillator (PPO) is an indicator that expresses in percentage terms the cryptocurrency price trend based on an average of moving averages. It is used for technical analysis and consists of a line that oscillates above and below the graph.

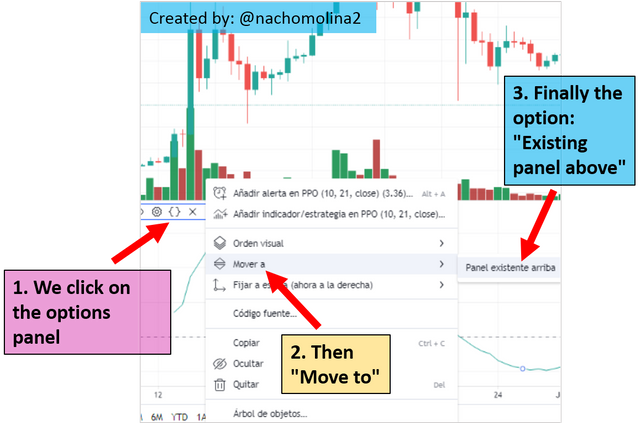

According to the steps shown in the following image we will be able to add the indicator in the Trading View chart we are studying. The process is explained below in detail:

image source

Finally the graphic will be displayed as follows with the indicator added on the same screen:

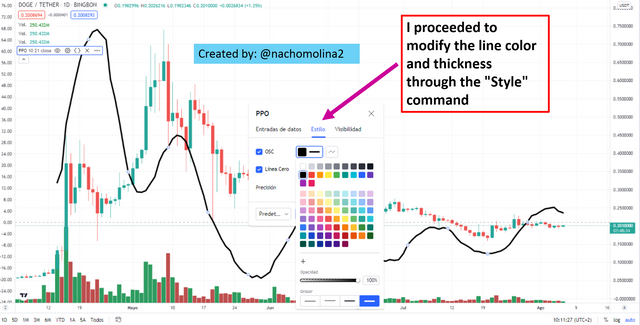

c) With relevant screenshots, illustrate how to modify the indicator you have added to your chart.

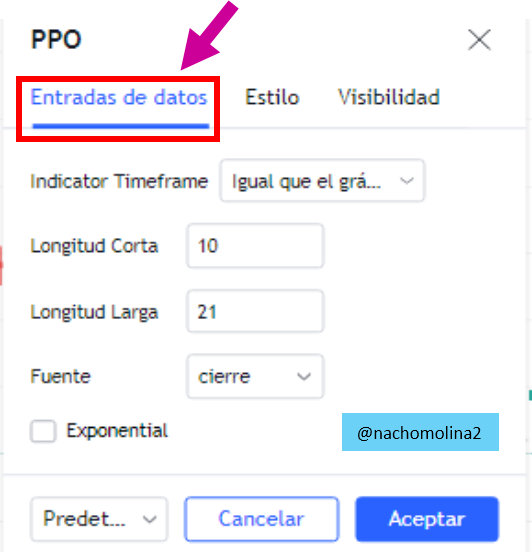

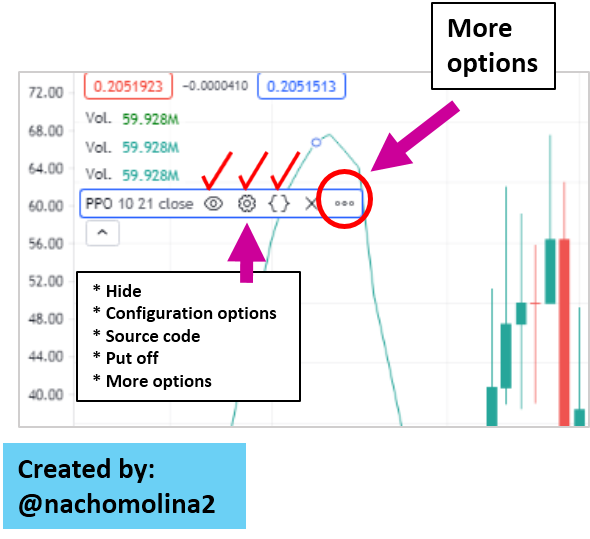

I will now go on to illustrate how to modify the Indicator once it has been selected and added to the on-screen chart.

You should pay special attention to the "Command bar" located at the top left of the chart. Here you can find the configuration functions for the indicator, which includes:

- Hide

- Configuration options

- Source code

- Remove

- More options

|  |

|---|

image source

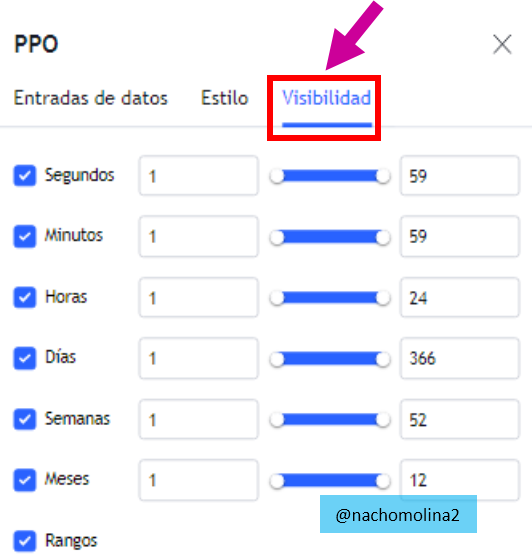

These are the options displayed in the configuration menu, through these commands you will be able to modify the indicator and customize its functions according to your interests. The "Data Entry " is used to program the technical data of the oscillator in reference to the candlestick chart, the "Visibility " is used to modify the time ranges and the "Style " for the graphic characteristics of the oscillator lines, such as: Color, line width, etc.

The chart shows how the oscillator looks after modifying the color and thickness of the line which has served to enhance a bit the stroke of the indicator above the candlestick chart and the default characteristics.

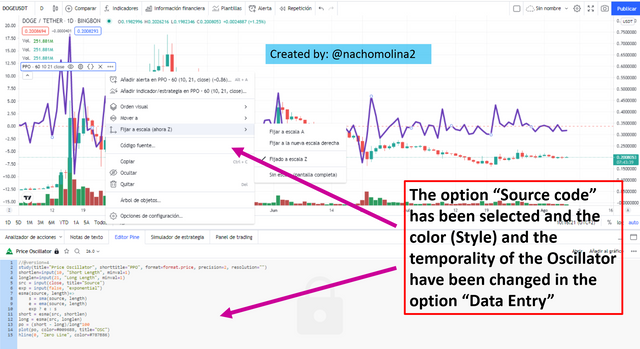

The chart shows how the oscillator can be modified via source code which is ideal for advanced users or developers who can integrate new functionality into the oscillator from a technical point of view. Demonstrating that Trading View adapts to all types of participants and different levels of knowledge.

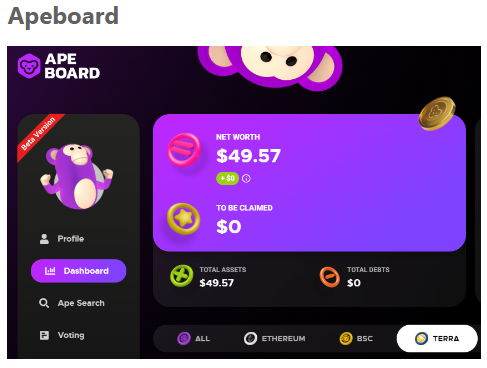

3. a) In your own words, explain cryptocurrency Portfolio and Watchlist.

To answer this question I will take as an example my cryptocurrency portfolio Coingecko since it is my favorite one.

A portfolio is a site where you can store your cryptocurrencies to manage them and track them based on market activity. Through this tool you can monitor cryptocurrency from your PC or mobile app in order to know when to invest.

The information provided is very extensive and is related to the fundamental analysis of a blockchain, despite providing access to sites that allow you to perform technical analysis through graphs and stock market indicators as is the case of the en lace with the TradingView platform.

Thanks to a cryptocurrency portfolio you can track your crypto in real time from anywhere in the world and be able to make timely decisions. It is worth noting, that a portfolio like Coingecko also serves to visit official project websites, check news information, redirect to trusted Exchanges, receive preference rewards (Like Candies rewards), join communities, share information or generate proposals for improvements through open source (In case you are a developer).

On the other hand, the watchlist refers to the compartment of your portfolio where the cryptocurrencies you are tracking and have previously decided to add to your favorites are stored. This option allows you to customize your account by displaying only the coins you want to see, plus you can add transactions and track them through the unique features provided by Coingecko.

The Coingecko portfolio will show you a summary log in which you can view your activity and keep track of your trades, gains or losses, as the case may be. You can add as many coins as you wish and study them from a single site "Coingecko Portfolio "; you can create several portfolios, share them, rename them or reset your account if you wish.

You can also schedule a "Price Alert" through the options panel of your account in this way your watch list will be more complete and practical without missing the changes that can give the trade.

b) Explain the need for Portfolio management.

According to my own criteria the need for portfolio management arises because the crypto space is a very volatile environment where fleeting financial decisions must be made and you must have as many tools that contribute to the financial management process as possible.

You can't just have one exchange wallet to store our cryptocurrencies which could lead to having different addresses on different Exchanges and not being able to keep a dedicated eye on each of our cryptos.

In such sense, I think that the Coingecko portfolio intervenes in improving the level of asset management in that it makes it possible to concentrate in a single space all our crypto and link to each of the official sites we need to study the market and take advantage of the best investment opportunities.

Additionally, it is worth noting that as participants in crypto trading, investors or traders that we are, we must all evolve and integrate ourselves into the world of cryptocurrency by making use of the most appropriate tools, as is the case of a Coingecko portfolio, which will lead us to improve the management of our cryptocurrencies and have greater success in our investment.

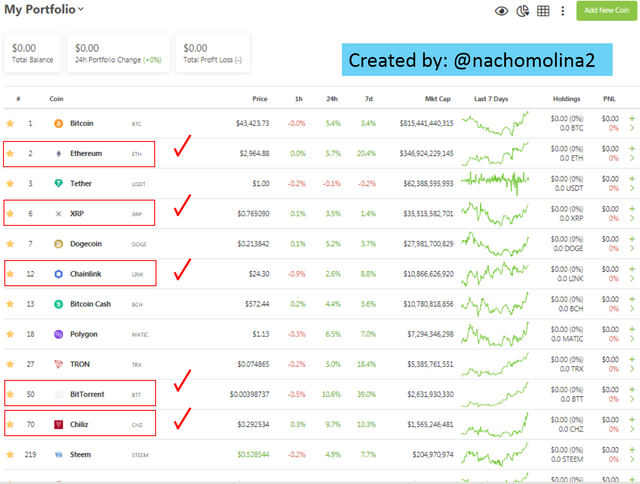

c) Select 5 cryptocurrency assets you wish to add to your Watchlist and explain your reason for selecting each of them. (Show screenshot of your Watchlist. It can be any platform).

Chainlink (LINK)

This is the first coin I will select to include in my portfolio. I like the price of this token which is currently $24.52 USD with a Market Cap: $10,806,485,250 which is ranked #12 with the highest global market cap.

According to the information I was able to check on the Website provided by Coingecko I researched that it is built on Ethereum Blockchain and is compatible with ERC-20 despite being an ERC-677 token which retains the same features.

Based on the fundamental data provided by Coingecko it has a Current Supply: 444,509,553 out of a total: 1,000,000,000,000 and 24 Hour Trading Vol $1,137,023,627. This shows me that its market acceptance is good as well as its liquidity, ideal for taking the risk of investing.

The utility of the token is mainly oriented to maintain security within the chain and avoid manipulations from external sources. After all it seems to me that it is a reliable project that I will follow up through my Coingecko list for possible future investment.

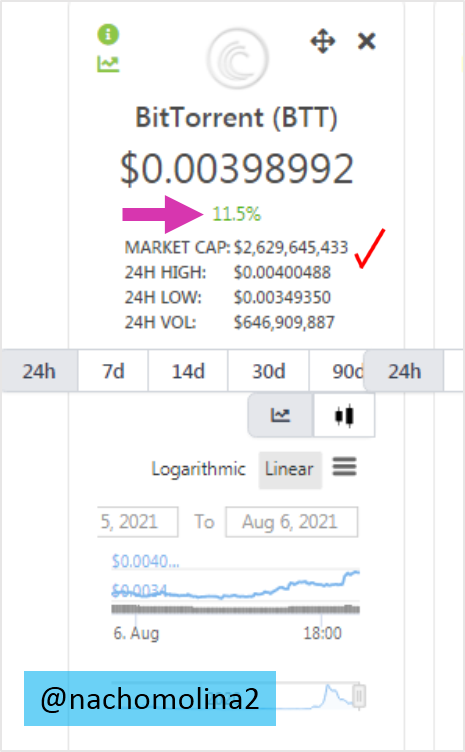

BitTorrent (BTT).

I decided to select this coin because it corresponds to a project promoted by Justin Sun under the TRON foundation, which is a confidence-building factor since it is a decentralized network built under a protocol that seeks to improve transactional speed, low energy consumption and economic rates.

As for the fundamental data I could see that BTT has a Market Cap: $2,627,565,632 USD which corresponds to a low capitalization, however, being a new project it caught my attention powerfully that it has had a trading volume for the last 24 hours of 11.5 % and given its average value of $0.00399156 USD it seems to me that it could leave some significant profit margin for a short term investment.

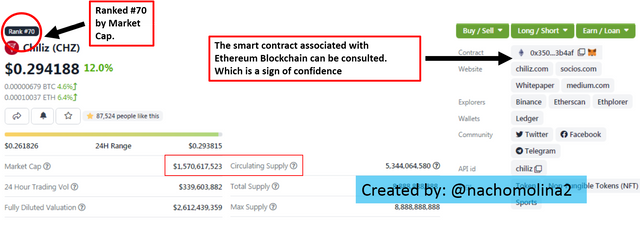

Chiliz (CHZ).

Visiting Coingecko and sorting the coins by trading volume over the last 24 hours I was able to detect that Chiliz (CHZ) ranked 10th with a percentage of 37.0%. Again I wanted to select this cryptocurrency to try my luck with short term trading.

With an investment volume in the last 24 H of $313,167,392 USD and a market cap $1,522,596,790 USD this project seemed solid enough to me to include it among the cryptocurrencies I wish to monitor through my Coincecko portfolio.

Thanks to the access to the official sites of the blockchain which Coingecko offers I was able to consult the white paper where I discovered that the utility of the currency is oriented to sports and entertainment leads in order to boost the use of the cryptocurrency among sports fans.

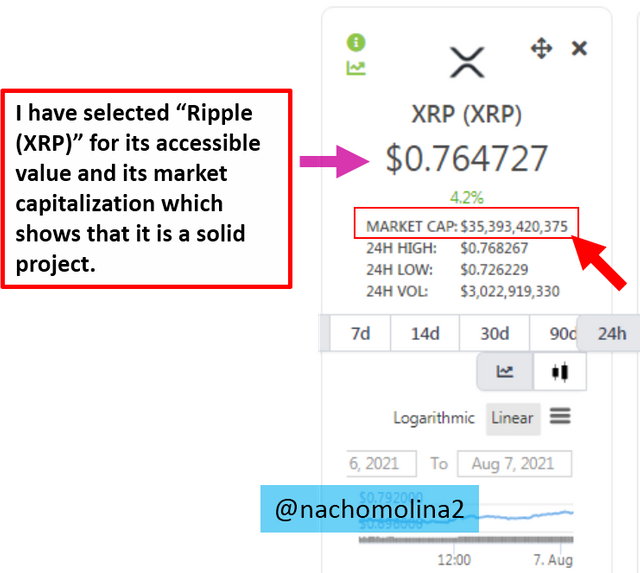

XRP (XRP)

I have selected XRP because it is a large-cap cryptocurrency with extensive history and strength in the market. It is characterized by having a lot of adoption and guarantees fast and inexpensive transactions.

XRP is ranked #6 with Market Cap: $35,410,849,661 USD and an investment volume in the last 24 Hours of $3,008,558,005 USD. It currently has 4.1% invested volume.

I have always wanted to follow this Cryptocurrency because of its similarity to Bitcoin although with much more accessibility, now by including it in my portfolio I hope to be able to invest in the future with some XRP.

Specifically that is the reason why I have selected it, apart from the fact that it is also listed on my trusted Exchange and has always been recommended to me because its margin of fluctuation in the market is good.

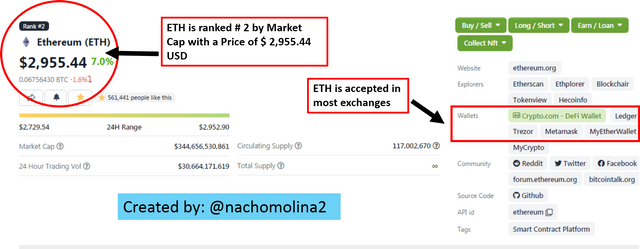

Ethereum (ETH)

I chose Ethereum for my portfolio because it is the second largest market cap cryptocurrency after Bitcoin. It holds the #2 ranking for market cap: $344,856,291,806 USD.

Currently the value of ETH is $2,955.44 USD with a Trading Volume in the last 24 hours of 7.0 %.

Generally speaking these are the reasons why I selected ETH to be added to my Portfolio. According to my own criteria it is important to follow the movements of ETH as it is the second most influential currency in the market with an extensive range of ERC-20 tokens built on this Blockchain which are to be affected by the fluctuation of ETH.

"To give an example of the importance of tracking ETH for me, I happened to recently start trading with a Crypto built on Ethereum blockchain which is called Poligon (MATIC) and I could notice that the fluctuation of the currency was proportional to that of ETH with almost identical accuracy therefore I decided to track ETH in the Coingecko portfolio to keep a more in depth monitoring of my ERC-20"

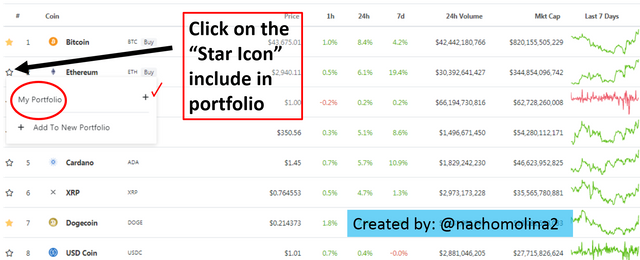

I'll take this opportunity to show you how to include a cryptocurrency in the portfolio.

- First, click on the star icon.

- Select the option add to portfolio

- Finally, it will be displayed among your cryptocurrencies.

Now to fulfill the final part of today's homework question I show you what my portfolio looks like after I have included the new cryptocurrencies I plan to track.

"Thank you for your kind attention has been all for now. This is my Steemit Cryptoacademy homework assigned by professor @reminiscence01"

Cc: -

@steemitblog

@steemcurator01

@steemcurator02

@reminiscence01

Original content

2021

Hello @nachomolina2 , I’m glad you participated in the 6th Week of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

This is an excellent piece fom you. Thank you for participating in this homework task.

Thanks professor @reminiscence01