Steemit Crypto Academy Season 2: Week2 | Cryptocurrency Contracts For Difference (CFDs) Trading

Hello Everyone,

I am grateful to take part of this lecture. I have gone through the lecture notes thoroughly and I’m confidence of the work I produced. Thank you prefer @kouba01 for this opportunity

Let’s get started...

Question 1

What is cryptocurrency CFD?

Cryptocurrency is a digital or virtual currency. They can be used to buy goods and services or invest in cryptocurrency. Most of these currencies are decentralized which means it is not regulated by any financial authority like the banks. CFD in full is Contract For Difference. Cryptocurrency CFD is a contract agreed between an investor and a broker based on a token such as BTC and DOGECOIN. This agreement require a lose or win situation. An investor make profit if the price moves to his predicted direction and he lose if the price moves to the opposite direction.

Question 2

How do i know if cryptocurrency CFD are suitable for my trading strategy.

it is obvious that the value of cryptocurrencies fluctuate with time. So there is the need to make some points into consideration before getting involved. Lets take into account the following points

An investor is suppose to be able to take and endure risk. Since we cant tell what the future holds, there are some reasonable risk we have to take time to time during our investment.

Investor needs to have some good knowledge about the market. The investor should know what kind of token to invest in and the trend of each token to make a good huge profit and make low or no lose.

CFD trading is suitable for a short term trade. The rise and fall of the value of tokens makes it hard to determine what will happen along the way.

Can i sell my token when i want to? This is a question an investor needs to ask himself. There is a period which you want to sell your token when the market seem to start falling. You may get to a total lose without the ability to sell your token.

An investor needs to be patients. The market is hard to be predictable. we dont know when it will rise or fall so when you make an investment, all you need is to be patient. Imagine selling your token and later it starts to rise , you start to regret not being patent for a while.

Question 3

Are CFDs risky financial product?

I think there is an amount of risk in every investment. you just have to know and weigh your risk and expect a positive results. The key thing here is to always know what your risk are. so i will be explaining some risk involved in CFD.

Laverages:This is another key feature that comes with risk in CFD. It increases the amount of your profit as well as your lose more than your initial capital.

Price Volatility:The high rate of change of price value in the cryptocurrency market is a risk factor. Some token has the capability to fall to about 40% a day.

Charges and Founding cost:This is a factor to be considered. The fees has a huge impact in an investor profit which vary significantly from firm to firm.

Holding cost:An investor may attract holding cost which depends on the positions he hold and how long he hold usually on a daily basis.

Lesser and easier steps to buy cryptocurrency with your fiat currency

High chance of of profit during rise of fall of crypto value

Easier and lesser steps to open an account

Has tools for better risk management

There is high fees for holding anposition for a longer time.

Marging trading can lead to huge loss of not controlled properly.

Question 4

Do all brokers offer cryptocurrency CFDs?

No not all brokers offer cryptocurrency. Intermediary is not needed all the time to facilitate a transaction. Transactions can be made without the payment of fees to an exchange.

Question 5

Explain how you can trade with cryptocurrency CFDs on one of th brokers

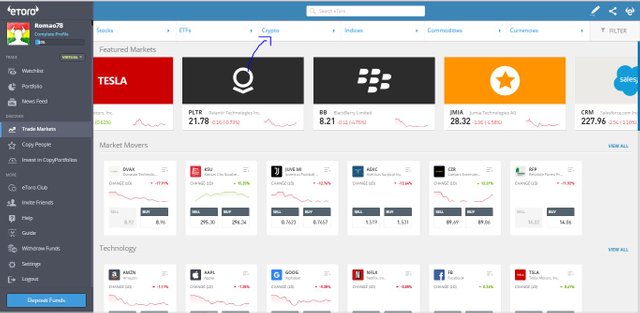

I Visit https://www.etoro.com/ which is the official website

i created the account and logged in

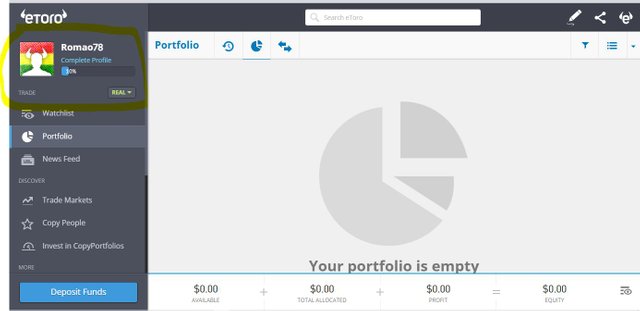

I visited my profile and input the necessary information needed

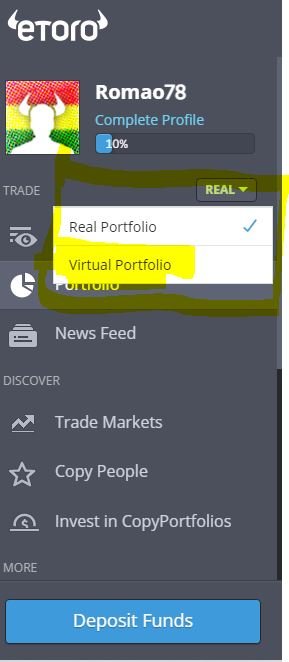

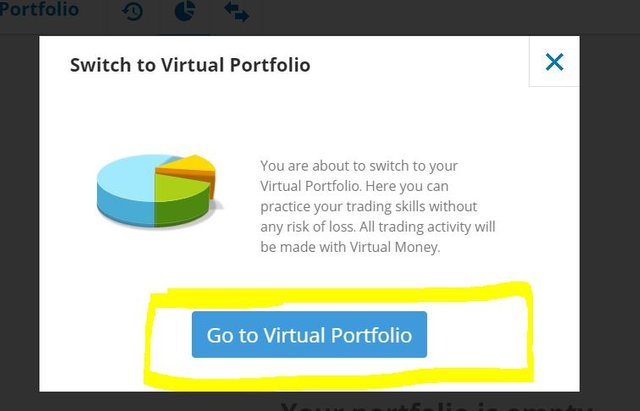

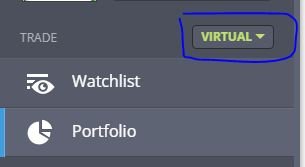

I switched from real portfolio to virtual portfolio

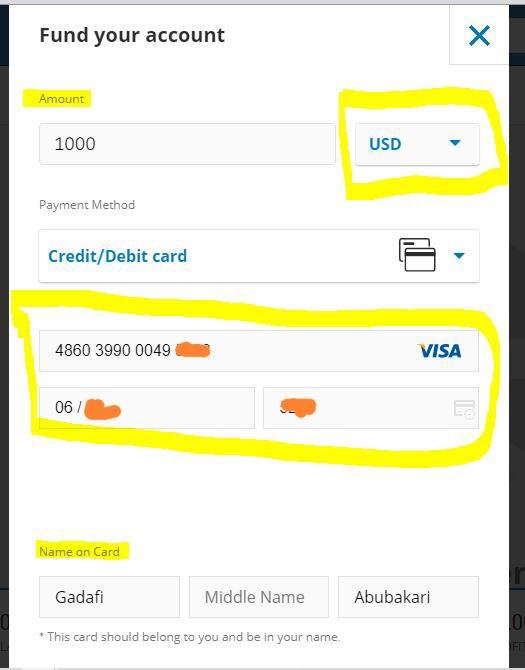

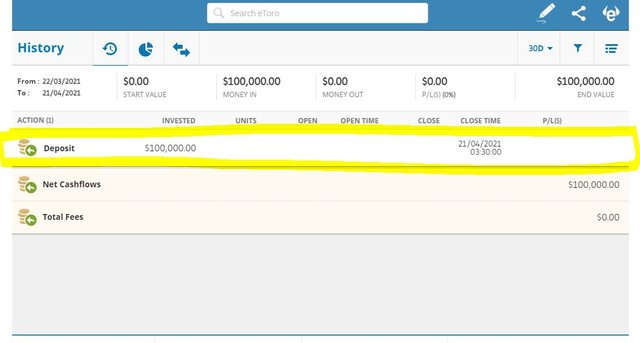

I deposited some funds into my account using my Debit Visa Card

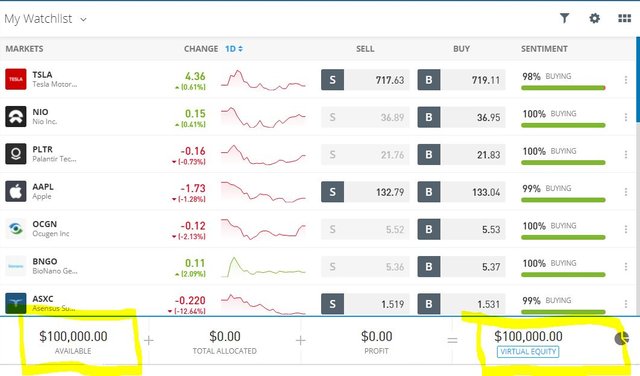

checked my virtual portfolio to confirm my transaction

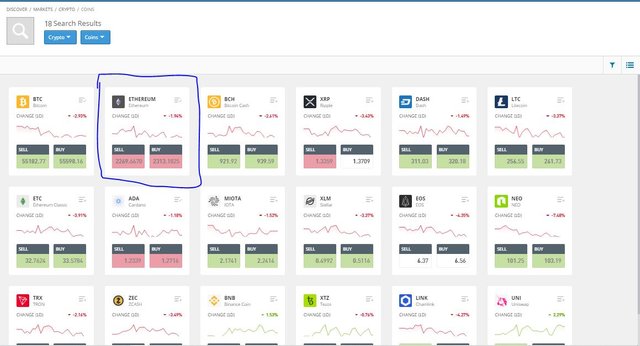

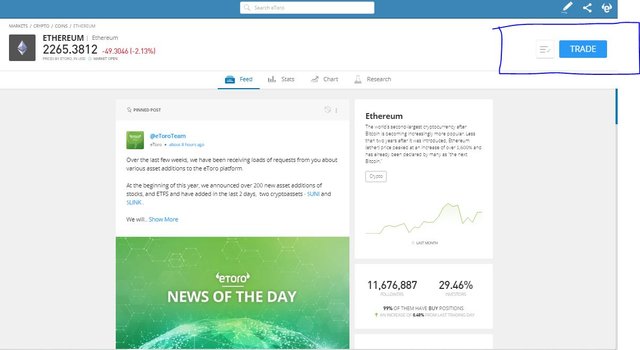

I navigate to the trade market

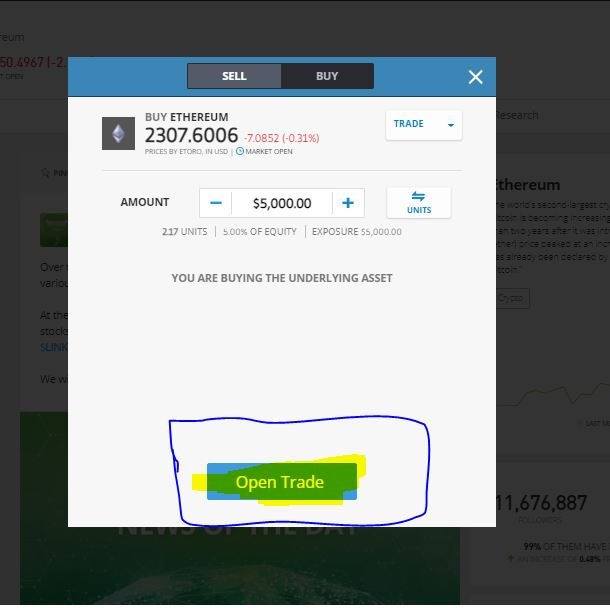

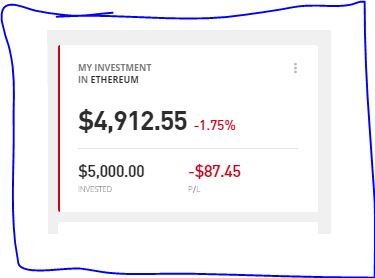

I opened trade of $5000 for Ethereum

All investment has an amount of risk involved. An investor is required to know the risk involved in an investment and also advantages and disadvantages. It is advisable to invest money you can afford to loose for a short term investment to make some little profits.

#kouba-s2week2 #cryptoacademy #steem #trading #cfd #steemit #ghana

Hello @roma078,

Thank you for participating in the 2nd Week Crypto Course in its second season and for your efforts to complete the suggested tasks, you deserve a 7/10 rating, according to the following scale:

My review :

Good content in which you were able to answer the questions raised to some extent. What I would like you to add is your personal opinion regarding the suitability of your strategy for trading with CFDs, as it was possible to try another broker.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01