Tattooed Chef / Forum merger II analysis - A Plant Based Food Company

Forum merger II is a special purpose acquisition company (SPAC) sole purpose of which is to purchase assets of Tattooed Chef, a plant based food company and bring it to US stock exchanges via merger. The SPAC currently trades with symbol FMCI.

Key points:

• Relatively small company with aggressive growth

• Serves 13% / year growing market

• Lucrative price to risk ratio

• New management in transition from SPAC is a risk

About Tattooed Chef and target market

Tattooed Chef was founded in 2017 by Sarah Galletti and Sam Galletti, daughter and father. Sarah has from a young age, always being creative, but she didn’t know what she wanted to become until she traveled through Europe. Throughout the journey, she recognized she wanted to work within the culinary world, where she would focus on “better for the planet” foods. As a result, became Tattooed Chef!

Tattooed Chef is a plant-based food company offering plant-based food products that are sustainably sourced. Tattooed Chef’s signature products include ready-to-cook bowls, zucchini spirals, riced cauliflower, acal and smoothie bowls, and cauliflower pizza crusts, which are available in the frozen food sections of retail food stores across the United States. Examples of products are presented in figure 1

Figure 1. Examples of products and packaging [1]

Why is Tattooed Chef an interesting investment?

“Growing & making plant based foods for people who give a crop”

At Tattooed chef they want to save you time, by expertly designed and prepared healthy and sustainable food products to offer convenience for busy lifestyle, without sacrificing on quality, nutritional value or freshness.

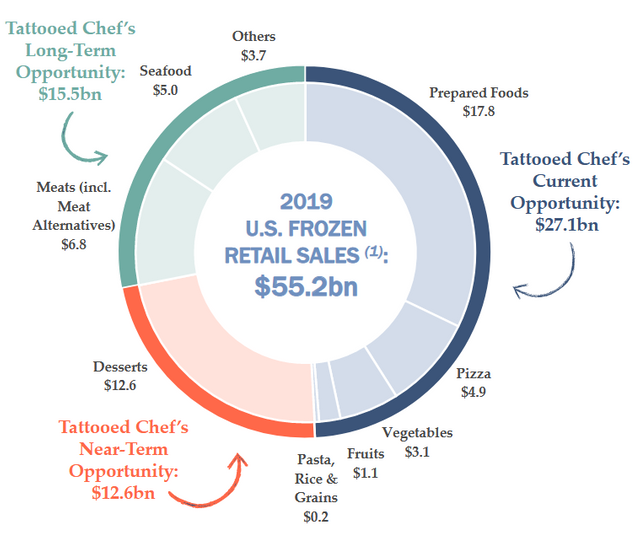

The frozen food market has a massive addressable market estimated to be around $55.2 bn. Where Tattooed Chef is targeting prepared foods market with total size of $27.1 bn, which is growing 13% annually since 2017.

Other possible markets presented in figure 2

Figure 2. Frozen food retail market [1]

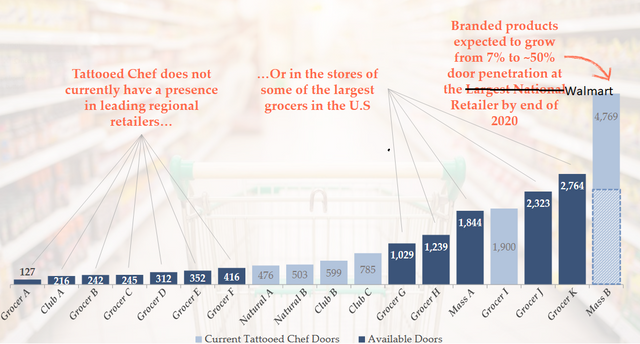

The projected net sales for Tattooed Chef is expected to grow 67% CAGR between 2018 to 2021p. With a $65.2 million net sales in H1 2020, a growth increase of 97% YoY. The company is just in their early stages. And we can already find these products in some stores, but there is still a lot of room to expand, without consider outside US. For example, these products is only in 7% of Walmart stores, at the moment, while it’s expected to grow to 50% of Walmart stores until the end of the year.

Store presence of Tattooed chef displayed in following figure 3 along with future foreseeable potential. Numbers indicate number of locations for each chain.

Figure 3. Store presence in US retailers [1]

Tattooed Chef is contracting the fields to plant their own corps, to make sure they are handling the whole chain the food from the fields to the consumer’s hands. They have two production facilities. One in US California and one in Prossedi Italy. This gives a good option to serve both US and European markets but officially US is the main market now. Handling the whole chain makes their business more transparent, but also give lots of possibility to develop their products and make their business more efficient. Products have been granted following certifications

Figure 4 Certifications [2]

Based on Facebook comments Cauliflower burger seems to be very popular as inventory is running out. Some comments of FB comment section.

“Please tell us where we can find cauliflower burgers. No longer at walmart.”

“your buffalo cauliflower burgers. Purchased them in Walmart. Can’t find them there any more”

This could be a possibility with hamburger chains later. Price is $13 for four patties as listed in webstore.

Valuation and peer comparison

In this section, we will dive deeper into numbers to get some kind of understanding what could be the value for the company. We are using three kind of valuation style to find out what kind of value and multiplies could be appropriated for Tattooed Chef.

Tattooed Chef

57.5 million total shares. Current share price is $14.7

Latest quarter net sales $32.0M

2019 net sales $84.9M

Market Cap $845.25M

Enterprise value $751.25M

EV/Sales =8.8

EV/Sales fwd = 5.1 (2020)

EV/Sales fwd = 3.4 (2021)

Growth = 50%

Conagra Brands

Latest quarter net sales = 3,094.6M

Market cap = $18.25B

EV/Sales fwd = 2.57

Growth = 16 %

Simply Good Foods Company

Latest quarter net sales =$215M

EV / Sales fwd´= 3.57

Market cap= $2.29B

Growth = 30%

Beyond meat

Latest quarter net sales = $113.3M

EV / Sales fwd´=18.68

Market cap=$8.8B

Growth = 100 %

(maybe questionable assumption from estimates due to three almost flat quarters )

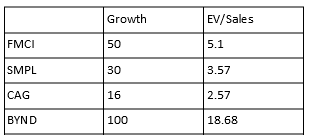

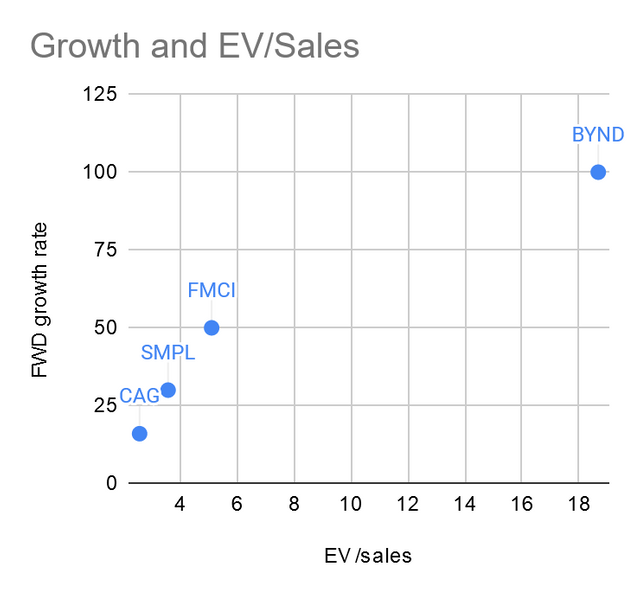

Table summary of growth and valuation as EV/s

Following figure 5 displays how growth rate and valuation map respect to each other.

Figure 5. Valuation map. Growth rate vs EV/s

All of them seem to fit to same line giving indication of fair value in peer group. Beyond meat on other hand seems to be overvalued compared to the rest.

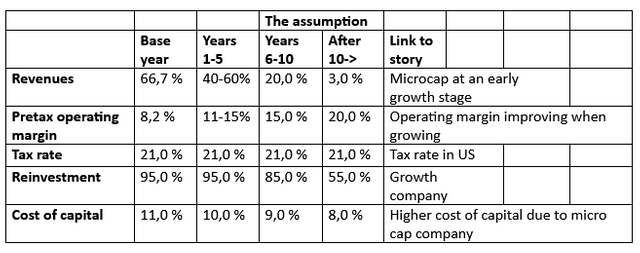

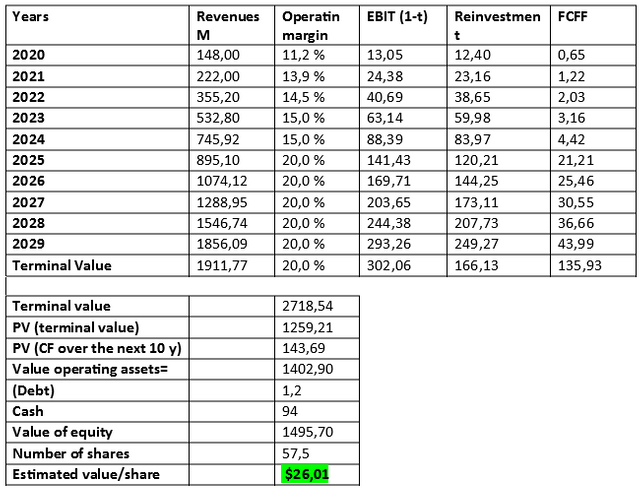

DCF Analysis

In our DCF model, we are using the assumption that Taattooed is growing the first 5 years 40%-60% and years 5-10 with a growth rate of 20%. This is much in line with the expected 67% CAGR between 2018 and 2021, while long term growth rate is expected to be around 20%. Operating margin is expected to improve with time, so we are using in our model 15-20% operating margin. As cost of capital, we are using a higher number due to the riskiness (early stage) of the company. We are using high reinvestment percent, because company is in a such an early growth stage.

Based on our assumptions and model, we are getting an estimated value/share around $26, which would mean a potential 85% upside. The DCF model used is directly taken from the book Narrative and Numbers by Aswath Damodaran. We also made a bear and bull case for this company, and got a range between $12-$50, so based on today’s price $14, we do see a lot of upside potential with a low downside.

Things we are watching

The story of Tattooed Chef is just at the beginning of their journey, and therefore, there is a lot of uncertainty. To be sure, the story will continue, we will follow these three things more closely going forward.

Growth

One of the most important metrics we are following is the revenue growth. The expected 67% CAGR net sales 2018-2021 looks really interesting. While the H1 report for 2020, showed great revenue growth with an increase of 97%. It shows that they are on right track and we can expect the growth to continue. Moreover, the sales in Walmart is expected to grow, because Tattooed Chef products will approximately be found in 50% of Walmart stores by the end of the year, while it has been found in only 7% of the Walmart stores. We expect Tattooed Chef to enter European market later as a new path for growth. Wealth in Asia is growing also fast and that market should not be ignored when time and resources are up for it.

Management

The company has a great family story. However, the company is relative young (founded in 2017), and we haven’t seen them yet, as a public traded company. We will be following closely on CEO Sam Galletti and how he execute. Interesting to see what kind of strategically moves he will do and how he will manage the possible growth.

Innovation and competition

There is no doubt a plant based food is a mega trend, however, it’s a really competitive landscape and quite easy for companies to enter. Therefore, we will follow closely on how Sarah and company are building their brand and story. We also expecting to see product innovation to continue. A lot relies on Sarah as face and innovator for the company. In time when the company grows she needs a team to help her in development of new items. We see the ecommerce site as a positive extra that was announced and will help sales channels if lockdowns due to Covid19 continue. As a whole we see Covid19 as neutral for the company. More people are eating home but again less retail activity balances to the other way for sales.The business of producing frozen food is not a difficult market to enter so more competition will likely emerge because the plant based market is growing fast.

Summary

We believe that FCMI / Tattooed Chef is a good buy at current ranges of 14 to 15 dollars. The base case price target was calculated to be $26 but higher is possible as early Q2 numbers already indicate high growth rate. Also Europe is a natural market to expand as the other factory is in Italy. The ecommerce site is good addition but meaning of it to numbers will likely be marginal for long but serve as path for additional growth later. Small companies like these carry risk especially related to recruitment of skilled management. We would like to see better social media presence from the company as things move forward. Obvious risk is of course that FMCI owners vote no to merger but given the share price, this seems unlikely.

Vinh Tram, DCF analysis and case development

Riku Pasonen, Initial company discovery and market research

References

[1] Investor presentation from FMCI. Available at: https://forummerger.com/tcip.pdf

[2] Tattooed Chef´s website. Available at: https://tattooedchef.com/

[3] Narrative and Numbers - Aswath Damodaran