A Self Financed Universal Basic Income

Recently I described in response to a concern that most people will not be able to withdraw from the Canadian Pension Plan. While it will might be underfunded, I came up with some suggestions which would not only address future funding but also create a self funded Universal Basic Income program.

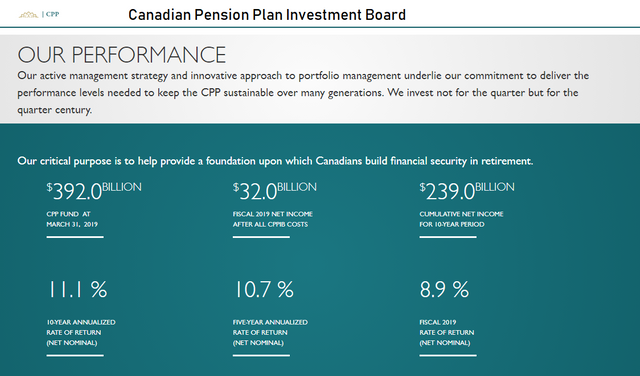

Certainly people invest on their own but realistically speaking many people do not have the ability or drive to do so successfully. In this sense the Canadian Pension Plan premiums are an equitable solution. Money is deducted at source and more or less done so equally for all people. Additionally the investment board has performed reasonably in obtaining a fair return. While professional investors individually can obtain a much higher return, the average person doesn't earn much for than 1% (if lucky) in comparison to the 8.9% the investment board has received this year.

Investment is hard for people as they cannot see the long term benefits. A brand new pair of shoes today is more tangible than a whole wardrobe of clothes 50 years down the line. The other thing that looms in the future for the next generation is that technology will replace lower skilled jobs. This is a pattern which has been seen for centuries. It used to be small farmers (crofters) would produce meat and wool in the Highlands of Scotland. There was an event called the Highland Clearances which showed the displacement of these crofters to be replaced with larger farms with fewer workers. A similar thing happened in our lifetime where dairy farmers used to employ many workers during the harvest, to have them replaced with technology so that the farmer was able to do it himself. Robotic farms today are now coming after the farmers. A large number of jobs in the automotive and transportation industries will be displaced with the advent of 3d printing of intelligent vehicles. While new jobs will be created to replace these old ones (we have seen it in the past), universal basic income has been seen as a way of smoothing the transition.

One solution that I thought that would address the concerns of both providing long term retirement funds as well as addressing the costs of a universal basic income would be to increase the CPP contributions. I used simple numbers for ease of calculations and to mitigate (ignore) the effect of inflation etc.

Imagine a person making minimum wage made $10,000

The CPP premium would be 10% - $1000

Currently the money is accumulated until retirement at which point it is paid back as a pension.

Instead I suggest that after the first year a person works that 6% of the investment is compounded while the residual is payed out in monthly payments. Using a Future Value Calculator it is possible to see that at the end of 45 years (assuming the person starts working at age 20) that the future value will be $212,743.51 giving a final 5% interest return of $11,985.48. This represents the equity that is built over time. However an important aspect is to motivate and protect workers in the present. For ease of calculation, I suggest that the investment board would be able to meet a 10% return on the investment.

After year one the minimum wage worker would receive a total of $60 in interest (1000 @ 6 percent). This isn't quite true as they don't pay the $1000 premium at the first of the year but a series of payments during the year. One half of the $60 dollars is reinvested and the remaining $30 is paid out on as a monthly payment of $2.50 per month. After the second year the monthly payments doubles $5.00; third year: $7.50 and so on. By the time the worker retires, the annual payout will be $11,985.48 - more than the $10,000 per year the worker was making through labour.

Unlike the current system, the $1000 deduction would continue after retirement. Once a person is no longer working, their total income (work + payout) will be less but as the person ages past a certain point their needs increase (healthcare, mobility issues etc). Continuing to invest in the pension plan will grow so by the time they are 80 years old, their annual payout will be $30,000. Instead of declining, peoples options will increase.

Inheritance. One of the unusual aspects of our society is that it appears governments don't want their citizens to become rich. I believe the idea behind the current CPP is that it is more of a Ponzi scheme than a true investment vehicle. Put money in to support the people currently retired and the people behind you will support you. There is nothing that indicates that the current pension is transferable after death to your children or grandchildren. My suggestion is that this plan would be transferable after death. It is entirely conceivable that after the first or second generation, the population could be on full universal basic income.