History does not repeat, but it does rhyme!

I hope by now, if you've been reading my posts from before, you will have gathered that I am not a signal service, I am also not here to hold your hand through trades or investments. The purpose of the blog is to give you information and knowledge I have gathered from being a market participant since 2012.

As the saying goes : Clever people learn from their mistakes, but wise people learn from other people's mistakes.

I've made a whole lot of mistakes in the last 8 years, but I have learned very valuable (and expensive) lessons from them which I hope to pass along to my most dedicated readership.

A lot of people have been wondering if altcoins and most importantly here, Steem, will ever make a come back. Now, I'm going to ignore some of the on-chain fundamental analysis (more on that is coming later with an update to the Brain Energy Value Theorem) and take a look at the technicals as they tell a very compelling story.

Now, assumptions here are a many, but let's roll with them.

- Bitcoin will eventually make a new all time high (whether sometime near halving or not is another question)

- Steem sticks around for the above to happen.

As we can see from the chart above, I have plotted the Bitcoin Chart (BTCUSD) on top of the STEEMUSD chart. Personally, I believe that analysing Steem in terms of dollars makes more sense. This is because despite the issues with the SBD peg, the dollar value remains important on the platform, particularly as all the post values are quoted as dollars. And the inflation issuance is correlated to the market cap of STEEM measured in dollars.

As you can see, the first "hype" cycle for STEEM was very fast and coincided with the release of the platform in 2016. We had a very intense run up to 4 dollars or so, only for a complete collapse back down to around 5 cents. Now, fundamentally, STEEM has seen a lot of economic improvements to the protocol since then. For one, we have seen a reduction in the inflation from the ridiculous 100% or so a year, to now, around 9% a year. However, fundamentals aside and the initial launch hype cycle aside, STEEM actually behaves very much like any other alt coin in the sense that it has a strong correlation to the price of Bitcoin. It has a tendency to lag and therefore follow the BTC price, but it also tend to over-perform and under-perform with respect to BTC price as well.

So what does that mean for Steemians right now? Are we ever going to see Steem pick back up?

The best case to argue for the answer "yes" is right in the chart. As you can see, the Green dotted line, vertically and horizontally, mark the point at which Bitcoin re-tests it's all time high, 3 years or so after making it. At this point, it truly looks as though STEEM was pumped and dumped to the abyss and is never going to look to the upside every again - sort of what we see right now. However, just a few weeks after making a new all time high on bitcoin, and confirming a blue sky breakout, Steem begins it's historic rise. It would go on to make it's own new all time high shortly after Bitcoin topping out.

What we need to do is look for the signs of bottoming on Steem and also where Bitcoin price is relative to it's previous all time high. After-all, the signal for the alts in general is renewed interest in the crypto space, and an exuberant influx of fresh greedy speculators to buy up all our Steem coins right?

Now, since Steem wasn't around in the 2013 Bitcoin high, we can't really pull much data or make any inferences from the price regarding that period leading up to the breaking of the bitcoin all time high, but we do know that Bitcoin has been under it's previous ATH of ~20k for about 2 years now. According to our historic price action of BTC, we can see that it took a full 3 years after an ATH is made, for there to be a new ATH. Which leaves us with a new Bitcoin ATH around January of 2021.

Now that sounds quite scary because in our crude model, we're not expecting STEEM to make a new bull run until Bitcoin breaks it's previous all time high. During this time, we can even expect STEEM to trade in a sideways / slight downwards bias as it seeks to find a bottom. Not an entirely bad thing as the ebb and flows of the market will undoubtedly bring some relief rallies along the way, but I'm not expecting a wholesome bull market for STEEM until the end of this year, or early next year.

Just for fun, let's take a look at some other popular altcoins and see whether they have a similar pattern.

ETHUSD vs BTCUSD

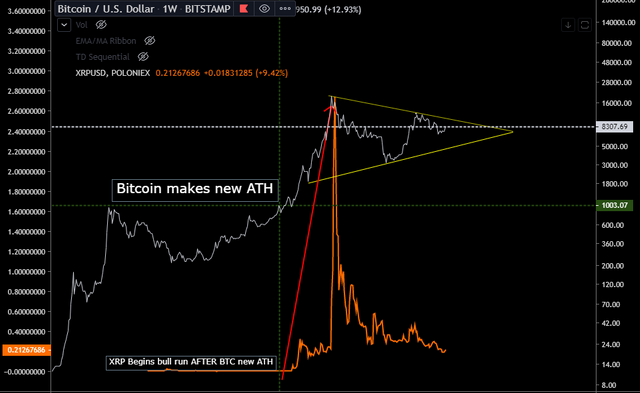

XRPUSD vs BTCUSD

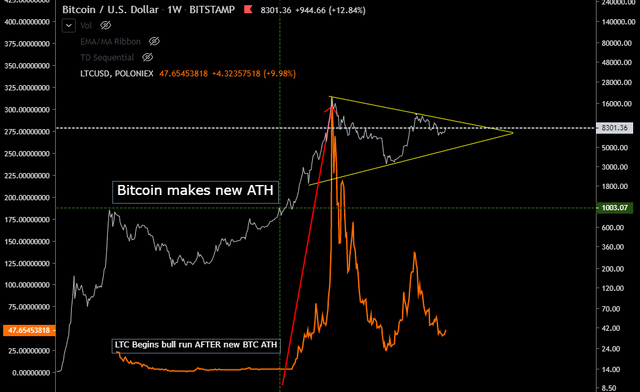

LTCUSD vs BTCUSD

XMRUSD vs BTCUSD

You get the point. The pattern is that all of the altcoins were in mostly sideways non-trending markets until Bitcoin made a move to test it's previous ATH. We don't have enough cycles to make a compelling case that this is going to be the case again moving forward, but this is why "History does not repeat, but it rhymes."

Whether or not the alts including STEEM will make a new ATH remains to be seen, in-fact, it remains to be seen if Bitcoin will even make a new ATH. But the pattern is clear, until Bitcoin tests the previous ATH, all the alts will have muted interest, and likely stuck in a base forming price structure. Deploying your money to alts a year out from now may not be the best use of funds for realising a gain, but at-least with STEEM, you can participate in the proof of brain consensus and earn yourselves some more coins whilst the market wrangles it's way back up!

Hello holdo!

Congratulations! This post has been randomly Resteemed! For a chance to get more of your content resteemed join the Steem Engine Team

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.