Why The SEC and CFTC Hearing Was Awesome For Cryptos!!!!

www.cointelegraph.com

The Senate hearing that took place went incredibly well for cryptocurrencies.

While the news reports about it are mixed, to me, they are looking at things the wrong way.

We need to understand, the Senators nor the regulators were not going to come out and openly embrace Bitcoin nor any other cryptocurrency. They were not going to openly announce that these things are wonderful and that it is their job to do everything in their power to make sure they succeed.

Anyone who thought support was coming from the hacks in Washington is sadly mistaken.

The reason why this was an incredible win was simply because they did not oppose cryptocurrency. From what I can gather, never was the word "ban" mentioned which would have sent prices plummeting. As long as the U.S position is to NOT ban cryptocurrencies, all is well. Even though I do not even believe it remotely possible, the U.S. government could have hindered progress if that is the position it took.

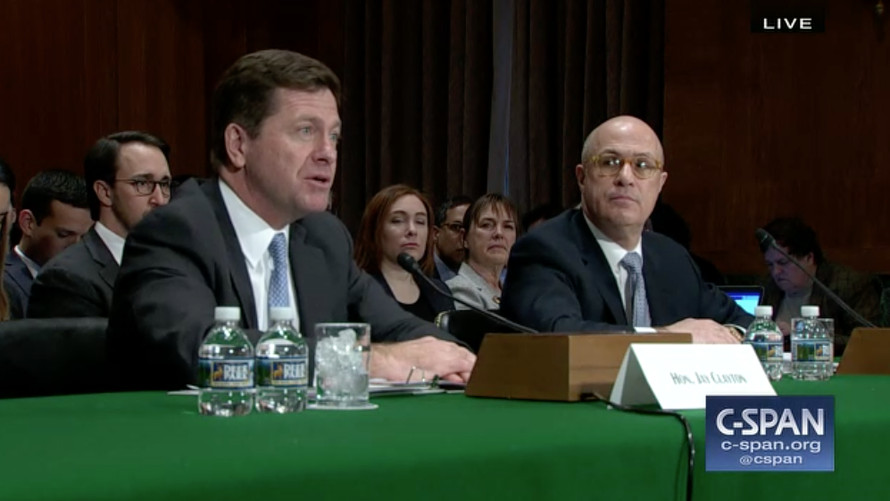

It is true the Chair for the SEC wasn't exactly glowing about cryptos. That is no surprise. It also makes sense that he would focus upon the ICO market and want to call everything a security. After many of the antics pulled in the ICO market, this is the one place we are going to have to live with a great deal of oversight. This made headlines, hence is on the radar of the regulators.

“I believe every ICO I’ve seen is a security… You can call it a coin but if it functions as a security, it is a security…,” Clayton said. “Those who engage in semantic gymnastics or elaborate re-structuring exercises in an effort to avoid having a coin be a security are squarely in the crosshairs of our enforcement provision.”

The Chair of the CFTC was more optimistic which also comes as no surprise. Many believe the futures market is the ultimate "truth" teller since people can both long and short. They feel no price action is true without people being able to short. Then you have a true market.

For Bitcoin, at least, that market exists. Hence I can see the CFTC taking the stance that they are establishing the "true value" for this asset. It also carries the belief that any gaming of the system will be shown here.

“The CFTC can now obtain trading data and analyze it for fraud and manipulation,” Giancarlo said.

“…With Bitcoin futures we’re now having visibility into underlying markets and spot markets that we would not otherwise have.”

What this all means is that, for now, nothing is going to happen. Senator Warner wants more coordination among the regulatory bodies. To me, this means we are going to see a pissing contest for a while which is a good thing. Let the Feds play their games while the industry forges ahead.

Ultimately, there will be more regulation coming. Hopefully, the snail's pace of Washington gives the industry time to grow to the point where it cannot be pushed around. As more money enters this arena, the players get bigger. This means there will be some big entities seeking to get in. Warner, showing who is padding his pockets, mentioned the fact that regulators didn't approve ETF (which would allow institutions to get into crypto) while allows futures to take place.

For full write up about the hearing:

https://techcrunch.com/2018/02/06/virtual-currencies-oversight-hearing-sec-cftc-bitcoin/

In general, I believe the blockchain/cryptocurrency horse is already out of the barn. There is no way for the governments of the world to stop it. However, while still in its infancy, these entities could really hinder progress. For that reason, the fact that the U.S Government, for the moment, decided to stand down, is great news. To me, this was as good as we were going to get.

One other point I want to make: Cryptocurrencies greatest ally is the banksters.

Huh?

Yes you read that properly.

At present, the institutional money (read bankster) is mostly prohibited from the crypto world. While we are in this downturn, the attractiveness of cryptos dwindled. However, when things start to move upward again, which they will, the banksters phones will start ringing off the hook. And do you know what they are missing out on? Trading commissions.

Therefore, I believe the greed of the banksters will be the greatest ally for cryptos. They are going to get into this arena at some point. Senator Warner, who I am sure is paid by the banksters, is already showing their hand. They want in. As the trading action heats up, outfits like Vanguard, T Rowe Price, and TDAmeritrade want their cut.

Blockchain and crypto will eventually destroy most of the banksters. However, that is down the road. Trading commission helps this quarter's numbers which is what Wall Street is most concerned about. Even though they are threatened by it, massive trading fees outweigh any long-term problems. They operate on 90 day cycles to the exclusion of almost everything else.

So relax, take a breath, and watch the crypto world explode once again. In spite of the price action, the blockchain are progressing along at a rapid pace.

https://steemit.com/cryptocurrency/@cryptovestor/why-u-s-restrictions-on-icos-and-exchanges-is-likely

Seems like this guy has a different opinion on it.

My opinion is the recent crypto draw down was created by bankers to get in on the game. When Goldman and JP Morgan openly discussing trading cryptocurrency to me it mean they are already in the game and trying to get a bigger strangle hold on the crypto market. Those bitcoin contracts were that far ago introduced either. Believers of crypto just have to stand strong and not sell at the lows but hold. Thanks.

I believe one of the best takeaways from this meeting was the fact that they were all mostly for non-shitcoins, and highly opposed to shitcoins such as BitConnectesque style lending platforms, which could only serve to clean up our beloved cryptocurrency space.

What happened should be an absolute signal to the world that in the United States, cryptocurriencies will find a legitimate, legal and regulated market to operate in. America is once again open for business. Besides cryptocurrencies will absolutely save America from hyper-inflation!!!!! All those dollars sloshing around in the world will be poured into cryptos, that will actually serve in growing the economy.

All you say it true @handofzara. The one group that is left out of that is the banksters...and they arent willingly going to allow that to happen.

They will fight at every turn to make sure it doesnt happen.

In the end, I think it is a fruitless fight...kind of like the newspapers trying to stop the Internet...it didnt happen and many went under.

It will be the same thing here...the banks that adapt have a chance of surviving...those that do not, will perish.

The banking institutions have little control over self contained communities utilizing crypto-currencies. Here on steemit real goods and services are being exchanged for STEEM. Not just resteem services etc. But actual sales of goods and services are being exchanged. If I want to buy an ounce of silver, I can do it right here on steemit with steem! If I want to hire a graphic designer for my website I can do that and pay in steem. At least at present we are beyond their grasp. One of the great quotes from the written testimony was that the technology genie was out of the bottle and could not be put back in. Also, the blockchain technology itself open source instant ledger is the Achilles heal of the banks and they are scared. Remember the mortgage crisis because of all the bundling of assets, no one really knew who owned what mortgages? Imagine if each note had been registered on an open source instant ledger (i.e. blockchain). No confusion, but then again how many banks in the fractional reserve system were counting the same mortgage note as an asset? No this is about to get real interesting, blockchain technology will expose everything especially who owns what. Consider yesterday's testimony as putting a choke collar on the banks.

i really hope DEX like BTS and other big players like Binance would do well and get established. We can't let the bankers have a big marketshare. Most of the young generation wouldn't be using banks to but cryptocurrency.

I agree with that. Not sure how long it will take so the more time that the crypto world is allocated, the better.

Over time, we are going to see blockchain penetrate every aspect of society. It will be not be noticeable at first until, suddenly, it appears the spigot is turned on. DEX will certainly be a part of it I believe.

It did seem rather promising, while the SEC thinks it needs to be regulated what they fail to realize is the really big question that came from one of the senators at time stamp 1:15 asking well who pays for the trials when the SEC shuts down a program.

Well the answer the tax payers the investors etc. not that so its just a big pit fall of money where they should have just left it alone instead of making everyone lose money and the SEC and their workers gaining it all through salary. I've seen this happen time and time again in the marketing world the SEC to me is just pure crap anymore and instead of building confidence for investors to me instead sparks fear and anger towards them. The exact opposite the brand was founded for!

What do you really think of them. LOL

lol, I get emotional some times :P

In this instance, I think it is well placed emotion....

Their track record speaks for itself......

They basically understand crypto is here to stay and they just need to make sure the average American knows exactly what they are getting into. But there are some negative, they are classifying ICOs as SECURITIES. Which means, the ICO game might not last very long. But all in all, very positive news for cryptocurrency. It's here to stay and make the world a better place via blockchains and smartcontracts.So much good healthy discussion out of this hearing. Some negatives that needed to be hit on and a lot of good points. I am so happy with the outcome, having a man like Gaincarlo on the front line is a positive.

Well the US regulations do not extend world wide so if they do indeed have ICOs as securities, they will move off shore removing the American buyer.

Of course, decentralized exchanges can work around that.

Yes, this meeting could have been so much worse for the crypto space, but the impression I got is that there are an awful lot of people, at the highest levels who don't have a clue what it actually is, how it works, and the disruptive power it's already showing.

There are obviously a few who do understand blockchain tech, it's current and potential applications. But wait until a blockchain business takes down an established player in a major industry - and they're not regulating it. Then they'll pay attention.

For the moment, the regulators are being kept at bay because they've not figured out what they're dealing with. And the ones who do know...are probably profiting from it.

If the market is starting to recover, I don't think it'll go straight back up. There'll be some wild swings, and with the greater awareness of cryptos now, some big money could arrive to take the profits of the next wave upwards.

That is true for most of these hearings. The politicians tend to not to have any idea about what is going on...I noticed this when they interview the Fed Chair...some of the question show they are totally ignorant.

Most just want to grandstand.

Missed the Senate hearing altogether. Are they still pushing through the Orwellian Senate Bill 1241, or is there hope for something that doesn’t equate crypto with terrorism?

I think that is still being pushed by some Senators.

I am not sure how it stands....yesterday's hearing had to do with the regulators...nothing about the bills the Senate might be taking up.

Indeed this is just the break that we need to rally for a second wind and come out swinging for a comeback.

The block chain is going to change the world and people are alrwady seeing a lot of use and integration into different systems.

The banksters can only hinder it for a few more years but indeed their greed will be the catalyst once it picks up again as they would see millions in dollars that they can amass wealth then they'll incognito support it while publicly denouncing it like what JP Morgan did last year.

I am not sure their greed can be tempered for a few more years. There are already rumblings from some of them that they cannot get into the crypto game. During the next bull run, when clients are calling on the phone, and these institutions are losing out on trading money, they will be climbing the wall.

Then their tune will change.