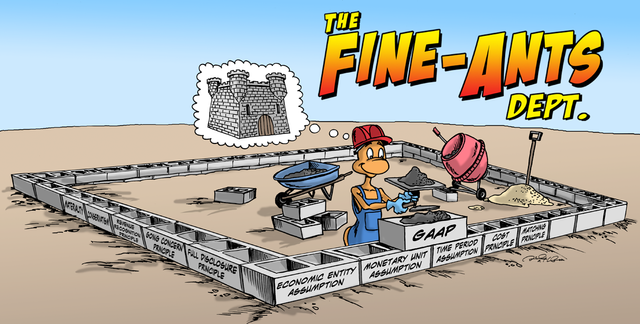

Accounting Principles & Guidelines

There are general rules and concepts that govern the field of accounting which form the groundwork on which more detailed, complicated, and legalistic accounting rules are based.

The phrase “generally accepted accounting principles” (GAAP) consists of three sets of rules: (1) the basic accounting principles and guidelines, (2) the detailed rules and standards issued by the Financial Accounting Standards Board (FASB) and its predecessor, the Accounting Principles Board (APB), and (3) the generally accepted industry practices. GAAP is very useful because it attempts to standardize and regulate accounting definitions, assumptions, and methods.

Since GAAP is founded on basic accounting principles and guidelines, it is easier to understand GAAP if we understand those basic accounting principles.

Economic Entity Assumption – For legal purposes, a sole proprietorship and its owner are considered to be one entity, but for accounting purposes they are considered to be two separate entities.

Monetary Unit Assumption – Economic activity is measured in US dollars, and only transactions that can be expressed in US dollars are recorded.

Time Period Assumption – This accounting principle assumes that it is possible to report the complex and ongoing activities of a business in relatively short, distinct time intervals.

Cost Principle – From an accountant’s point of view, the term “cost” refers to the amount spent when an item was originally obtained, whether that purchase happened last year or thirty years ago. For this reason, the amounts shown on financial statements are referred to as historical cost amounts.

Full Disclosure Principle – If certain information is important to an investor or lender using the financial statements, that information should be disclosed within the statement or in the notes to the statement. It is because of this basic accounting principle that numerous pages of “footnotes” are often attached to financial statements.

Going Concern Principle – This accounting principle assumes that a company will continue to exist long enough to carry out its objectives and commitments and will not liquidate in the foreseeable future. If the company’s financial situation is such that the accountant believes the company will not be able to continue on, the accountant is required to disclose this assessment.

Matching Principle – The matching principle requires that expenses be matched with revenues. For example, sales commissions expense should be reported in the period when the sales were made (and not reported in the period when the commissions were paid). Wages to employees are reported as an expense in the week when the employees worked and not in the week when the employees are paid

Revenue Recognition Principle – Under the accrual basis of accounting (as opposed to thecash basis of accounting), revenues are recognized as soon as a product has been sold or a service has been performed, regardless of when the money is actually received. Under this basic accounting principle, a company could earn and report $20,000 of revenue in its first month of operation but receive $0 in actual cash in that month

Materiality – Because of this basic accounting principle or guideline, an accountant might be allowed to violate another accounting principle if an amount is insignificant.

Conservatism – If a situation arises where there are two acceptable alternatives for reporting an item, conservatism directs the accountant to choose the alternative that will result in less net income and/or less asset amount. Conservatism helps the accountant to “break a tie.” It does not direct accountants to be conservative. Accountants are expected to be unbiased and objective.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.accountingcoach.com/accounting-principles/explanation

Congratulations @drcfo! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP