Trakx Bounty - One stop shop for Crypto Traded Indices ($500,000 TKX to Claim)

The cryptocurrency market has grown at a tremendous pace over the last few years, clocking in at over $750 billion in market capitalization and $50 billion in daily traded volume in late 2017 and early 2018. Yet, fewer than 4% of globally own cryptocurrencies. As the adoption of blockchain technology increases aggressively over the next years, so will the total market capitalization of the cryptocurrency market. In fact, according to some leading investors, it might not be unreasonable to assume that the total cryptocurrency market capitalization will reach $30 trillionn eventually. This will happen as more people come to own cryptocurrencies due to increased adoption, as well as existing investors increasing the percentage of their savings invested in crypto

As a result, Trakx.io which is passively managed basket of cryptocurrencies investment products such as ETFs have emerged as reliable and low-cost means for retail investors to obtain exposure to a diverse portfolio of cryptocurrencies. These are powerful products for investors who do not have sufficient time to analyze investments and/or want to diversify their portfolio without picking out every single stock in their basket.

As crypto markets mature and attract more investors, ETFs and ETF-like products will become a popular way of investing for most retail investors, or those lacking sufficient expertise and/or time to manage a portfolio actively. This will create a unique opportunity for people who have never invested before to be participants in one of the highest-potential asset classes in history. This participation should contribute to both individual wealth growth and to the macroeconomic development of societies and countries as a whole. The decentralized nature of cryptocurrencies and the ability to create smart contracts on blockchains create yet another unique opportunity, to not just bring ETFs to cryptocurrencies, but reinvent them altogether for the future.

Today, cryptocurrency exchanges are primarily designed for expert traders, and are often too complex for the average individual to build a balanced investment strategy. Trakx aims to solve the difficulty in obtaining exposure to diversified portfolio of crypto assets by becoming the easiest way for anyone to invest in cryptocurrencies using a decentralized ETF-like approach.

Trakx - One stop shop for Crypto Traded Indices

Trakx.io, bridging the innovation gap in cryptocurrency investing

- Not fully regulated: Existing crypto exchanges and products escape the regulatory framework

- Lack of safety : Very few companies offer safe and insured custody solutions

- Ease of access: Most exchanges have a very unappealing user experience

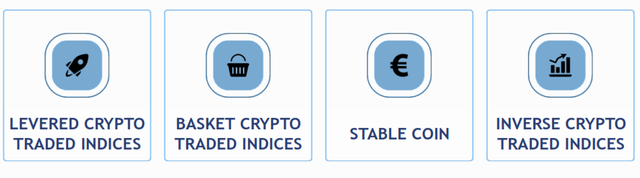

Trakx.io will extend the range of available cryptocurrency investing solutions through its strictly regulated CTIs. CTIs will allow investors, ranging from retail to institutional, to replicate a combination of advanced investment strategies, with the aim to buy or short sell cryptocurrencies at a lower cost than the currently available solutions. Through CTIs, Trakx.io will also be the first platform to offer inverse CTIs in the crypto investing realm. Trakx.io will make investing in CTIs a seamless and straightforward experience: if a trader is bullish or bearish on a particular cryptocurrency or basket of cryptocurrencies, she or he will simply buy the corresponding CTI. To unwind the position,

she/he simply needs to sell the same CTI. CTIs tradable onto the platform will include, non-exhaustively, inverse CTIs, levered CTIs, basket CTIs and stablecoins – those will be developed progressively.

Core elements of Trakx

Key Advantages of Trakx (TKX) and Crypto Traded Indices

- Instant diversification: Basket CTIs allow investors to quickly gain portfolio exposure to specific cryptocurrencies (e.g. top 10 largest cryptocurrencies by market capitalization, top 10 largest social media Dapps)

- Security: Trading cryptocurrencies might require accounts on multiple exchanges. Trading CTIs enable users to only have an account on Trakx.io to gain exposure to a diversified portfolio. The vast majority of each of the cryptocurrencies composing the index will be stored offline in cold wallets and through custody partners.

- Low cost: Investing in CTIs will be cheaper than open-end mutual funds or even individually buying multiple cryptocurrencies. Being passively managed, their fees will be cheaper than other cryptocurrencies mutual funds.

- Passive management: Designed to track an index, CTIs limit actively buying and selling securities. While there are advantages to active strategies, passive strategies tend to outperform active strategies on an historical basis and can provide better returns based on cost savings alone.

- Single access point: Trakx.io aims to become the one-stop shop for Crypto Traded Indices, providing CTIs for all kind of strategies (Long, Leveraged, Inverse, Basket). We simplify user experience and avoid them to register on several platforms with multiple KYCs.

- Trading flexibility: CTIs are traded 24/7 on our platform and hence can be bought or sold at anytime, with market makers ensuring liquidity and fair value pricing at their Net Asset Value. The pricing of CTIs is continuous during the day, and prices vary based on the underlying assets. CTIs investors know within moments how much they paid and how much they received after selling it.

- Transparency: CTIs will track a third-party index, thus limiting potential conflicts of interest. In addition, our underlying reserves will be constantly checked by a Big 4 Audit firm and our holdings will be published periodically. Users will be able to check what investment their CTI holds, their relative weighting in the structure and if the CTI has changed its position in any particular investment.

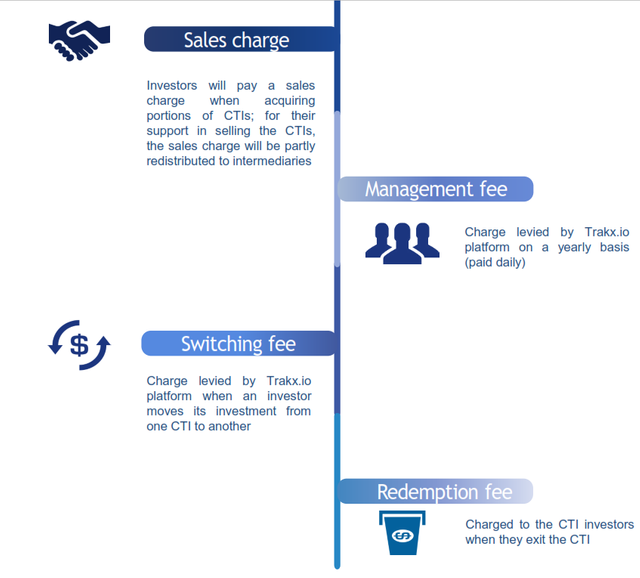

Revenue Model

Trakx platform and Crypto Traded Indices will generate revenue with the below fee-based structure. These fees will support the development of the platform in the long-run and allow to cover the general expenses associated with the project. Fees can be paid using TKX, the utility token of Trakx.io. We cannot finalize the pricing until we have reached agreements with partners and fees may be adapted and modified in the future.

Trakx Exchange Platform

An exchange platform will be created in order to allow for the CTIs to be traded, and will offer the following benefits for Trakx (TKX) token:

- Better control the flows: Most notably, the firm will partner up with market makers to substantially improve the liquidity of the Crypto Traded Indices.

- Be well insulated against legal risks, bearing in mind that both the exchange and the Crypto Traded Indices will be strictly regulated. First and foremost, it will enable Trakx.io to conduct strict KYC/AML processes. Then, it will help navigating through a regulatory shake up that will most likely negatively impact most traditional exchanges when the regulators will take a stricter stance, e.g. on the re-qualification of utility tokens into security tokens and on the KYC/AML processes.

- Offer a secure go-to platform for CTI customers, avoiding them to register and verify their KYC on multiple exchanges. Trakx.io aims to become the one-stop shop for Crypto Traded Indices, providing CTIs for all kind of strategies (Long, Leveraged, Inverse, Basket). We simplify user experience and avoid them the hassle of registering on several platforms with multiple KYCs.

- Offer creation/redemption service, where CTI investors can notably redeem their CTI tokens at their Net Asset Value, and Market Makers create new units when demand increases

- Offer a temporary centralised off chain settlement process aimed at reducing management and other general trading fees while key off chain settlements protocols such as Lightning and Raiden reach production maturity

One of the core feature of Trakx.io resides in its platform where participants can seamlessly trade Crypto Traded Indices, using Trakx.io utility token (TKX) and main cryptocurrencies (BTC, ETH, XRP). Users will be able invest even the smallest amounts, and get a clear picture of current and past performance of their portfolio and other CTIs. It will progressively feature numerous easy to use tools, such as:

- Fast speed of execution and powerful matching engine

- User-friendly design

- Referral program

- Portfolio management

- Advanced security features

- Market Analysis

- Performance History

- Multilingual support

- Extensive device coverage (smartphones, tablets)

- Internal and external APIs

- Instant conversion of crypto or fiat to TKX via third-parties

- Decentralized settlement

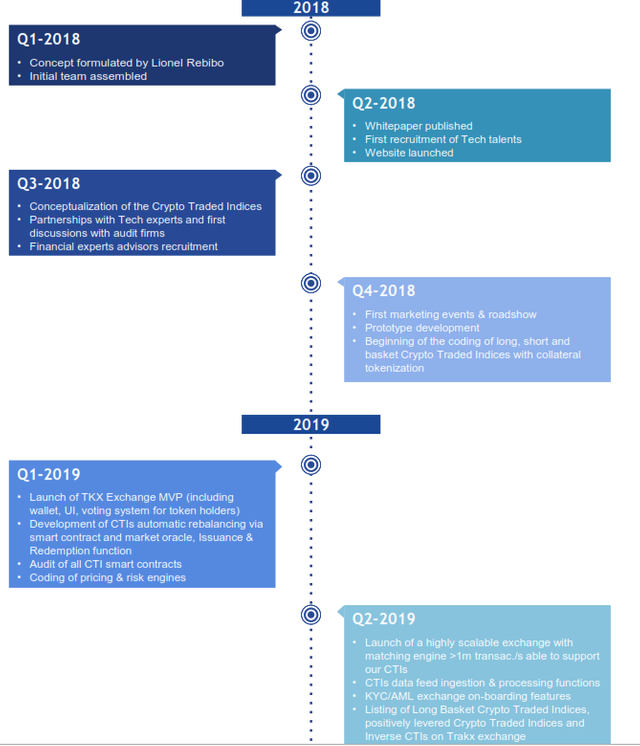

Roadmap

The Team

UP TO $500,000 IN TKX TOKENS TO CLAIM!

Registration procedures

- Join the bounty here

- Click on enter now

- Provide your name, email and ETH address and click on signup

- Verify your email and begin the bounty

- The more tasks completed, the more TKX tokens will be rewarded.

Social Media

Telegram Facebook Twitter LinkedIn Youtube MediumPosted from my blog with SteemPress : https://bountyairdroptoken.com/trakx-bounty-one-stop-shop-for-crypto-traded-indices-500000-tkx-to-claim/

Source

Plagiarism is the copying & pasting of others work without giving credit to the original author or artist. Plagiarized posts are considered spam.

Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://www.trakx.io/