SuperBots: Platform for Algorithmic Trading and Investment

In the thrilling yet tumultuous world of cryptocurrency, new traders face a daunting statistic: 90% lose 90% of their capital within the first 90 days. The volatile nature of crypto markets often leads to emotional decision-making, driven by FOMO (fear of missing out), greed, and panic. However, amidst this chaos, an innovative solution called SuperBots offers a potential lifeline.

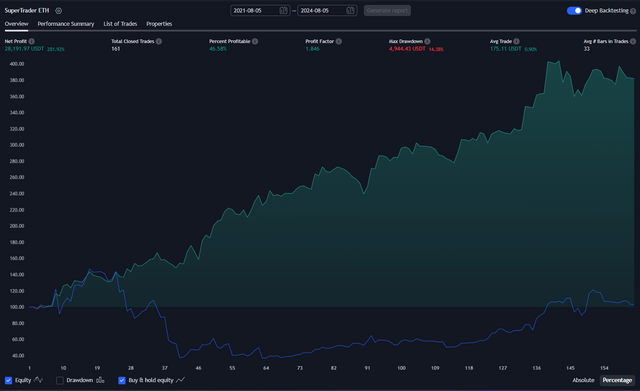

SuperBots, a player in the decentralized finance (DeFi) space, is providing tools typically reserved for institutional investors to everyday traders. At the heart of this offering is the SuperVault, a feature that simplifies crypto trading. The functionality of algo bots Algo bots, or algorithmic trading bots, are designed to execute trades based on specific criteria (usually hundreds of technical analysis signals and sometimes even market sentiment), eliminating the emotional pitfalls that often trip up human traders. These bots, when combined with machine learning and technical analysis, have consistently outperformed traditional buy-and-hold strategies.

The functionality of algo bots

Algo bots, or algorithmic trading bots, are designed to execute trades based on specific criteria (usually hundreds of technical analysis signals and sometimes even market sentiment), eliminating the emotional pitfalls that often trip up human traders. These bots, when combined with machine learning and technical analysis, have consistently outperformed traditional buy-and-hold strategies.

The SuperVault enables users to deposit USDC into a vault that is managed by algorithms trading on decentralized exchanges. This setup simplifies the investment process and aims to potentially increase the USDC value over time.

Security is a significant concern for any investor, and SuperBots ensures that funds in the vault can be securely withdrawn to users’ wallets at any time. This flexibility and transparency may be particularly important for novice investors.

By utilizing advanced technical analysis and machine learning, the trading algorithms are designed to adapt to market changes and identify opportunities that might not be immediately apparent to human traders. This automated approach aims to reduce the impact of emotional decision-making, potentially leading to more consistent strategy execution.

In a market characterized by volatility and uncertainty, SuperBots offers tools that were previously more accessible to institutional investors, making them available to everyday users who may not have deep technical knowledge. Algorithmic trading bots, such as those provided by SuperBots, could be useful in helping traders navigate the complexities and opportunities of the cryptocurrency market.

Copied from Utoday