Ethereum Price Analysis

Ethereum (ETH) now has a US$29 billion market capitalization, second only to Bitcoin’s US$69 billion. ETH is also the second highest trading digital cryptocurrency or asset by volume, below Bitcoin and above Ripple.

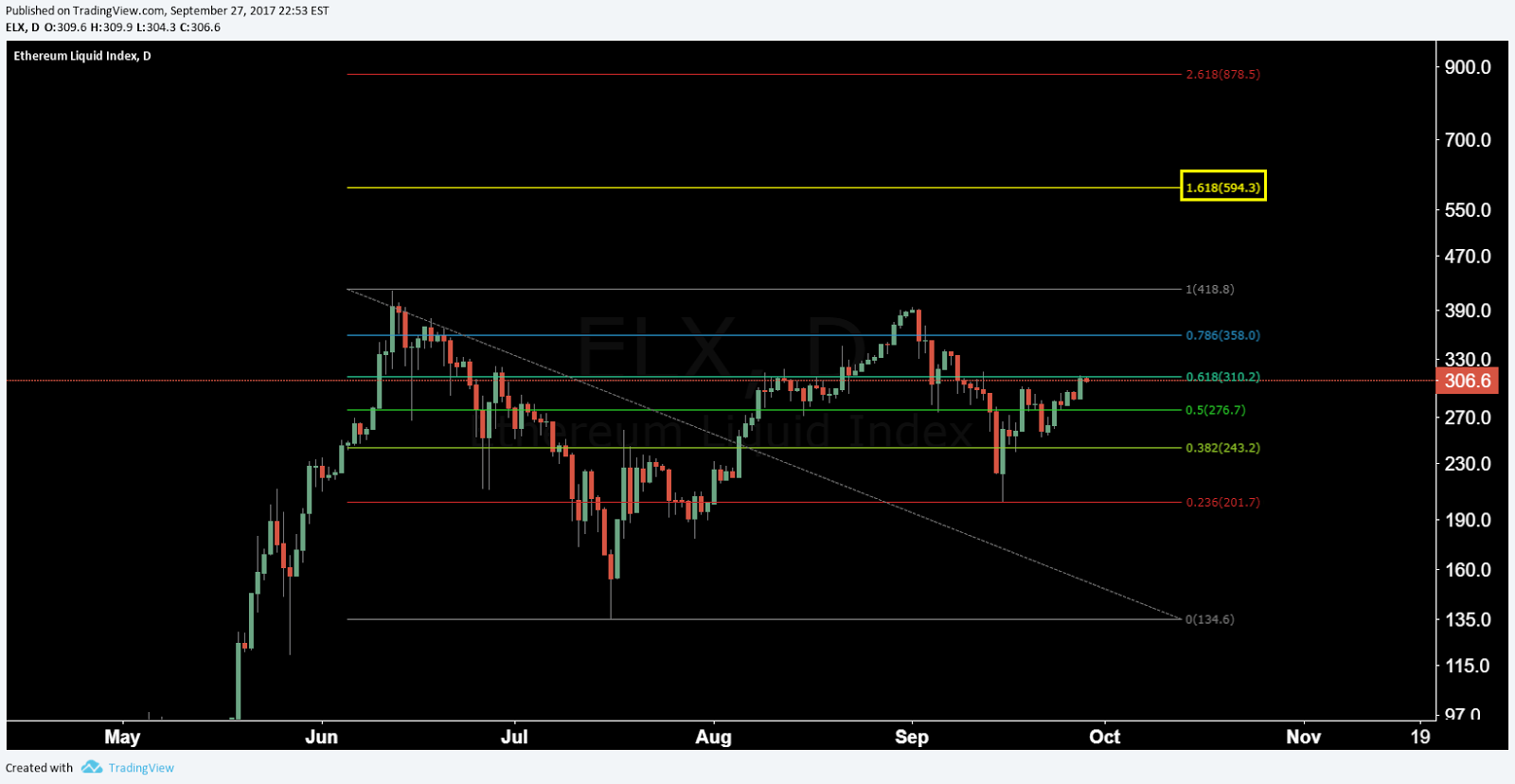

ETH has had a wild ride this month, dropping from all-time highs around US$400 to US$200. The cryptocurrency has since rallied and currently trades around US$300.

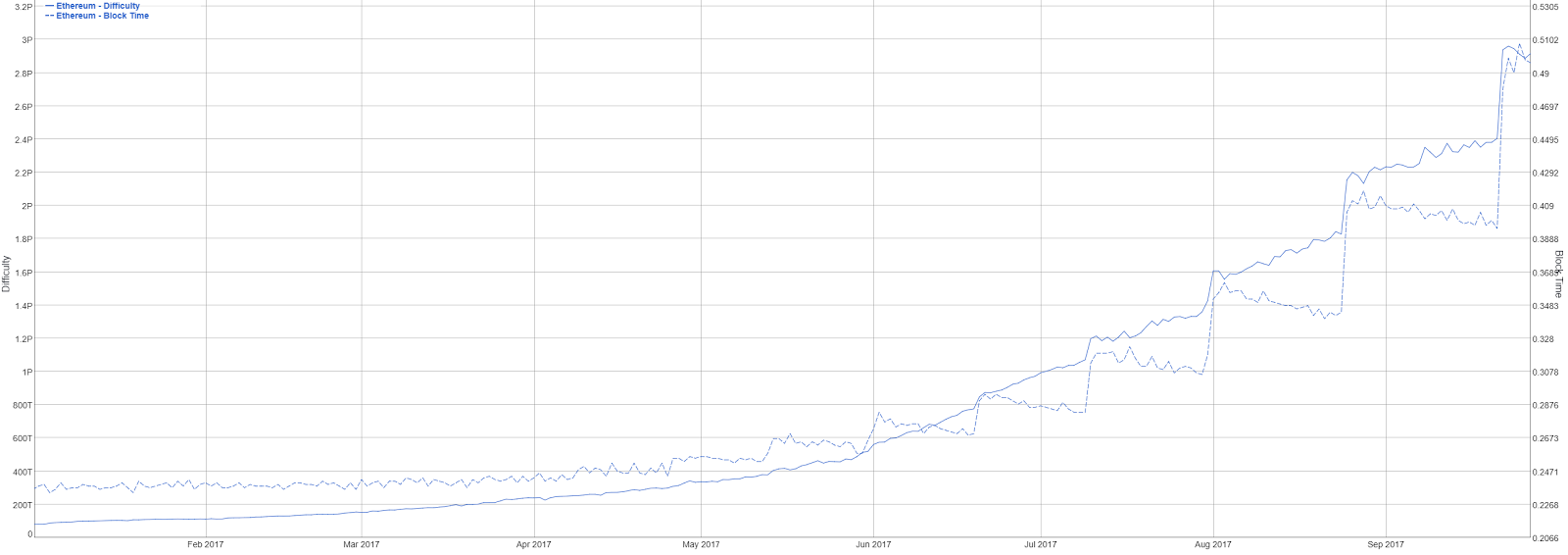

Unlike Bitcoin, Ethereum is not deflationary and currently has no maximum total. In order to slow inflationary pressures, the Ethereum developers have programmed specific changes in difficulty, while trying to avoid any major disruption in the network itself.

With the upcoming Metropolis hard fork, Ethereum will begin switching from a pure Proof of Work consensus protocol to a hybrid Proof of Work and Proof of Stake protocol, with Casper Stage 1. At the same time, there have been changes to the difficulty adjustment scheme so that each difficulty increase occurs exponentially.

As difficulty has increased, so have block times. Blocks are currently generated in just under 30 seconds. There have also been proposed changes to decrease the block reward, from 5 ETH to 3 ETH.

Mining will eventually become impossible, which is the desired result for the Ethereum development team, resulting in a pure PoS consensus protocol.

Vitalik has said that an implied minimum of 1000-4000 ETH will be required to earn stake rewards when PoS is fully implemented, which is comparable to the cost of a DASH Masternode. This is due to Gas transaction costs, which may change in the future. However, PoS rewards can also be acquired through a staking pool.

The difficulty and block time increases mean that less and less Ether are being mined over time.

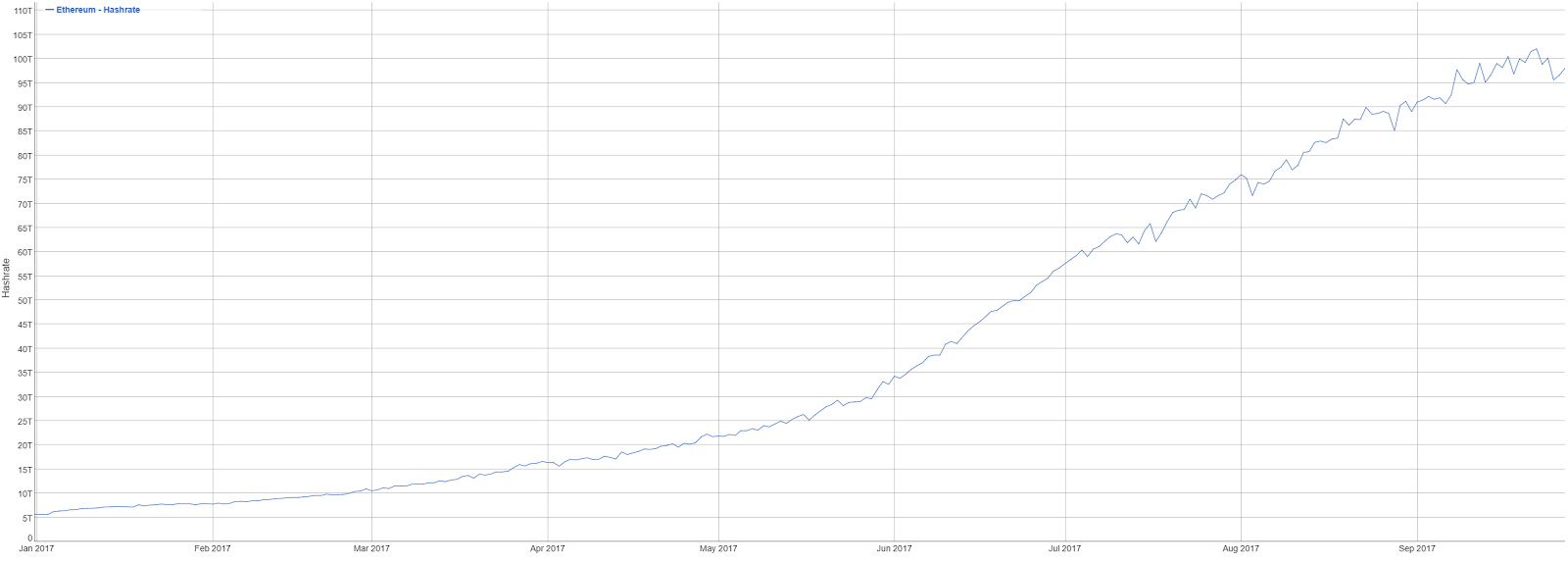

Hash rate has settled around 100TH/s, up from 5TH/s at the beginning of the year. Ether’s momentous price increase since January has heavily influenced an explosive growth in hash rate. The hash rate will most likely continue to grow in line with price increases, until such time as the difficulty adjustments make it unprofitable to mine.

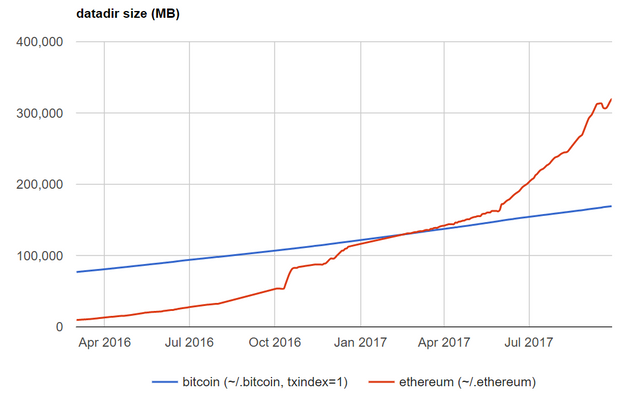

Network scalability continues to be a concern, especially if Ethereum continues to support decentralized applications with millions of users. The storage space required for a full ETH node is now beyond 3GB.

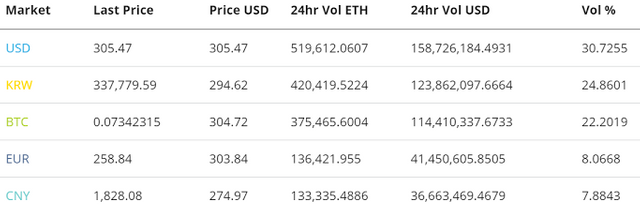

Ether exchange traded volume over the past 24 hours has been led by US Dollar markets.

The Korean Won (KRW) and Bitcoin (BTC) markets have about an equal share, following the USD. Yuan (CNY) trading remains very low as Chinese exchanges close.

There is no trading against the Yen (JPY) on any major exchange. Japanese traders use the BTC pair to gain exposure to Ether.

Technical Analysis

ETH continues to flirt with either a continuing bull trend or stalling, post-consolidation ranging. Considering the trend is your friend until the end, bullish continuation here is likely despite the current risk of an M double top.

The immediate upside target is the 1.618 fib extension from the previous high and low, US$595.

The Ichimoku Cloud on the daily chart, using singled settings (10/30/60/30) for quicker signals, shows neutral and bearish signals. Price has not yet cleanly broken Cloud, the TK cross is bearish, and Cloud itself is also bearish. A long entry signal does not trigger until all of these metrics flip bullish, which based on price and Cloud structure may occur within the next seven days.

Not indicating that the content you copy/paste is not your original work could be seen as plagiarism.

Some tips to share content and add value:

Repeated plagiarized posts are considered spam. Spam is discouraged by the community, and may result in action from the cheetah bot.

Creative Commons: If you are posting content under a Creative Commons license, please attribute and link according to the specific license. If you are posting content under CC0 or Public Domain please consider noting that at the end of your post.

If you are actually the original author, please do reply to let us know!

Thank You!

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://bravenewcoin.com/news/ethereum-price-analysis-upside-likely/