The altcoin world

Altcoins is an acronym for “alternative coins”. Any cryptocurrency other than bitcoin is called an altcoin. Bitcoin, the first and most known cryptocurrency is actually not suited for every economic aspect of our lives. However, the technology behind bitcoin is so groundbreaking that more than 1000 different altcoins have emerged and are now part of the cryptocurrency ecosystem. Each altcoin has its own design, development team, vision and characteristics. These differences makes altcoins suitable for certain niches. There are many different niches in the cryptocurrency space, think about privacy coins (XMR, PIVX, ZCASH,NAV), payment cards ( CENTRA, PAY, MONACO), smart contracts ( ETH, STRATIS, LISK), social media ( STEEM, ALIS), lending platforms ( BCC, REGAL, HEXTRA) and so on.

All these altcoins have in theory their own blockchain, miners and official wallet. So each altcoin has its own set of rules. Let’s take Litecoin (LTC) as an example. Litecoin has a bocktime of 2,5 minutes. This is 4 times faster than the bitcoin network. Transactions using LTC can be confirmed more quickly by the LTC miners. It is also much cheaper to use LTC. Another difference is the needed mining equipment to be able to mine LTC. Bitcoin now uses ASIC minors. This is very expensive equipment and not everyone can participate in the mining process. Litecoin on the other hand does not need that fancy equipment. Anyone with a CPU computer can join the mining network.

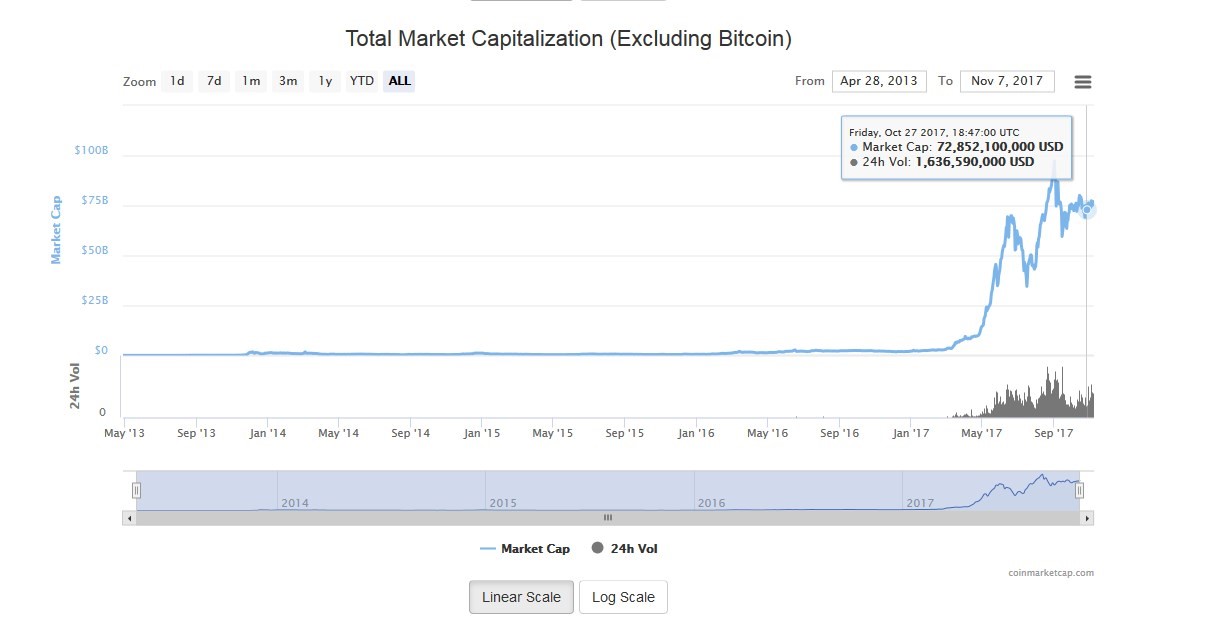

Altcoins have evolved immensely during 2017. The graph below shows the increase in total market capitalization of all the altcoins ( excluding bitcoin) from their inception until now. The big blast-off has clearly started during 2017.

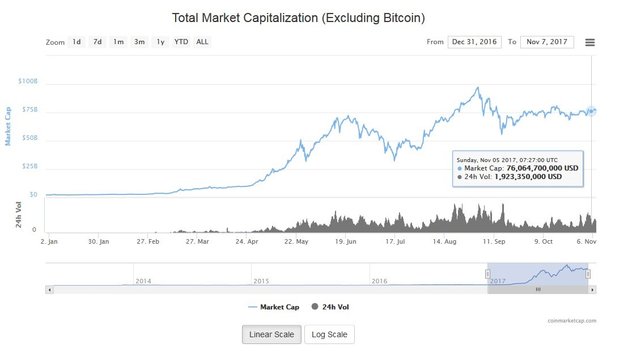

The graph below shows the increase in market capitalization for the year 2017.

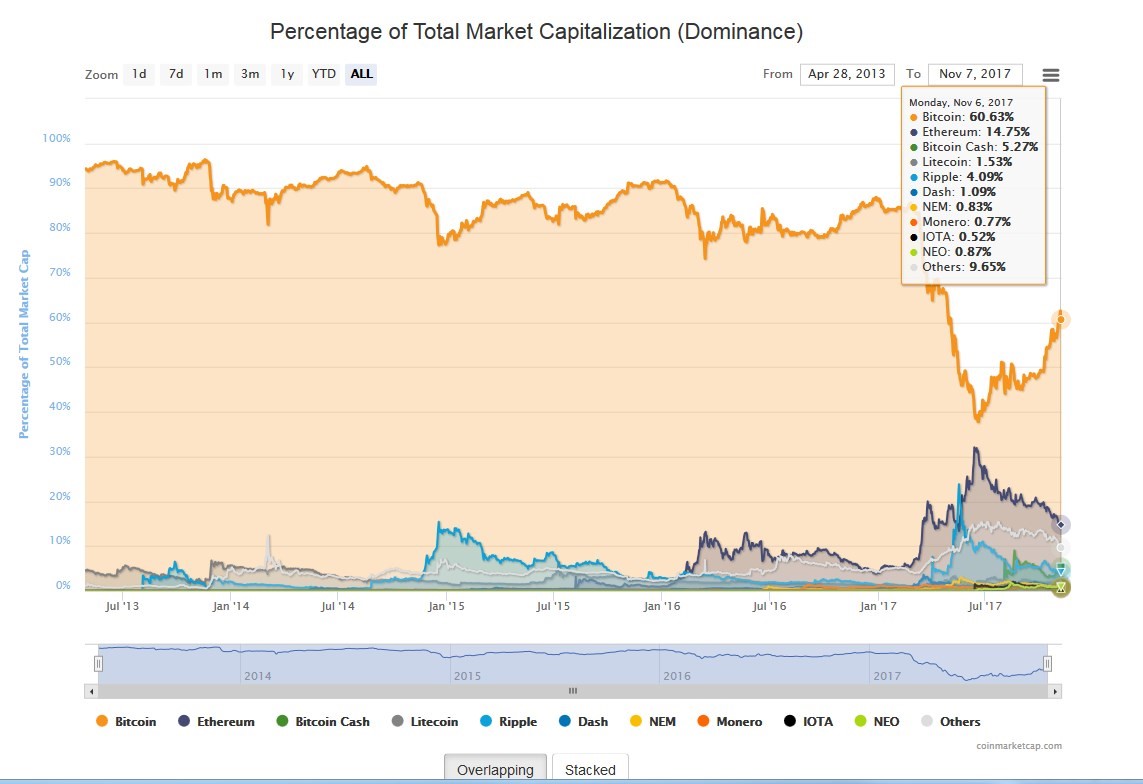

Next graph shows the Bitcoin dominance in comparison to its biggest altcoin rivals. During the years before 2017 Bitcoin kept it’s dominance over the altcoin market. This year it’s share in total market capitalization has decreased substantially from almost 90% to in between 45 and 60%). This means that the cryptocurrency market is finally opening up for newer technologies.

Not all these altcoins are as great as they sound. A lot of these altcoins are actually “scamcoins”. These are coins designed to fill the pockets of their creators. Creators often have the big bulk of all the mined coins. Once these coins get on exchanges and gain some traction it is time for “pump and dumpers” to join the party. “pump and dumpers” are groups of people that deliberately choose a specific coin ( the lower the market cap the better) to pump the price up and then sell when the price is at the top. These pump and dumpers are well organized. They choose a certain coin to pump it up. Once the coin has +-40% increase in value it will be visible to everybody. This is where bad informed people get in, thinking it will even go higher. This will pump the coin further up to sometimes astronomical increases in value.

At this point everybody is waiting for the price to drop. In general it’s the people with the biggest amount of coins that quit the pump and dump game first. This sell-off causes the price to drop significally. This is often followed by a panic sell. Recent buyers seeing the price drop panic and sell their coins at a loss, causing the price to drop even further. These pump and dumpers are giving cryptocurrency a bad name and at the same time, they attract people thanks to these astronomical increases in value.

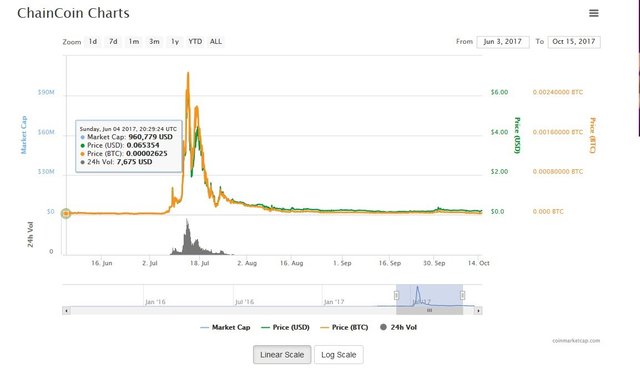

The biggest pump and dump I am aware of was the Chaincoin pump and dump. This was a coin left for dead. Developers had abandoned the project. This pump and dump took place mid-July right around the time masternode coins were the hype of the moment. Chaincoin has no attractive features except that it has a masternode. It is then that a youtuber decided to form a Hodling movement. Hodling is the art of holding your coins for a long time without being tempted to cash out. The vision behind the idea was really interesting. All people had to do to join the movement was buy the coins and put them into masternodes or just hold them. This way demand would always be higher than supply. Sadly, the movement was badly organized and in turned into a massive pump and dump. The graph below shows clearly the magnitude of this pump and dump. It started at a little under 0.1$ on July, 7th and went to as high as 6,80$ on July,14.

ICO’s have really became popular this year. Initial Coin Offering are used to collect funds to start a cryptocurrency project. It has become a new way of funding projects. A little like IPO’s on stock exchanges but the ICO process is much faster and much more efficient. These ICO’s have become so popular thanks to some great successes. For example: ethereum at its ICO was worth around 0.25$. If you go check the current price of ethereum you’ll understand why ICO’s have become so popular.

So how do you recognize a serious altcoin?

A good altcoin always has a solid development team. A lot of coins have dev teams that consist of 2 or 3 developpers. Million dollar projects should have several developpers. This way the continuity is way securer. What happens if 1 developper gets sick or decides to leave the project? The development team is usually presented on the official website of the coin.

Community support is extremely important. Some coins do not have real world use cases but they keep their value thanks to the community supporting it. A great example is dogecoin. This coin started out as a joke but it could manage to grow immensely and keep it’s value during long periods of time. Dogecoin came into light when the funny doge meme was hip. It has clearly no use in the cryptocurrency world but none the less it has a market capitalization of 130.000.000$ at the time of writing (07/11/2017). This example shows that a lot of the value of a coin is given by it’s users.

Most serious coin projects have a clear roadmap and they upgrade the whole system on regular basis. They are often very active on social media ( twitter, reddit, facebook,…). If you are invested in a certain altcoin it is very advisable to join the community through their different channels.

I didn’t want to make this article too long. I wanted to highlight some of the big aspects of altcoins. My next articles will go deeper into the different kind of altcoins, the succesfactors and maybe i'll even take a better look at ICO's

Hope you enjoyed reading this!

Any comments are always welcome

https://www.thebalance.com/altcoins-a-basic-guide-391206

https://coinmarketcap.com/

https://tokenmarket.net/ico-calendar

https://ico-list.com/