Tesla Model 3, huge profits ahead !

Every year, Tesla makes investments that won’t start generating gross profit until the next year or multiple years down the line. This includes software and hardware R&D for its vehicles and energy products, opening new stores, service centers, delivery centers, and Superchargers, and employing thousands of engineers to design its future factories and production lines. All of these investments show up as operating expenses on Tesla’s income statements.

Critics mistakenly conclude that the investments Tesla makes in one year are necessary for it to obtain the gross profit it accrues in that same year. This is the source of so much ire about Tesla’s negative net margin. A negative net margin is bad if it is a result of a company operating at a steady state, with no growth in gross profit. A negative net margin can be good if it is the result of a company investing aggressively in order to grow fast. The latter is simply delayed gratification: taking losses now in order to create much larger profits later.

Growth

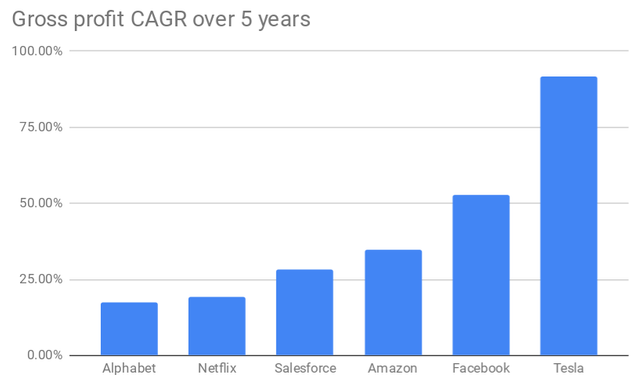

The compound annual growth rate (CAGR) of Tesla’s gross profit over the last 5 years is 91.8%. That’s faster than Facebook )and Amazon combined. It’s three times faster than Salesforce , almost five times faster than Netflix , and over five times faster than Alphabet !Tesla is one of the fasting growing companies in the world, and possibly the single fastest growing manufacturing company. Its gross profit has been growing at a rate over twice as fast as Moore’s law.

Tesla is unprofitable because it’s paying for this explosive growth rate by raising and spending more capital than it needs to sustain current sources of gross profit. Not because it is subsidizing its current sources of gross profit with capital. So much analysis written about Tesla overlooks this as a possibility.

Profit

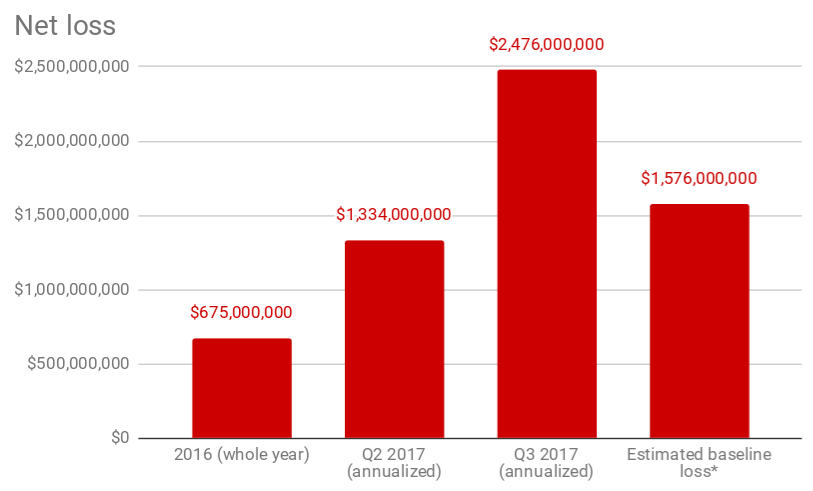

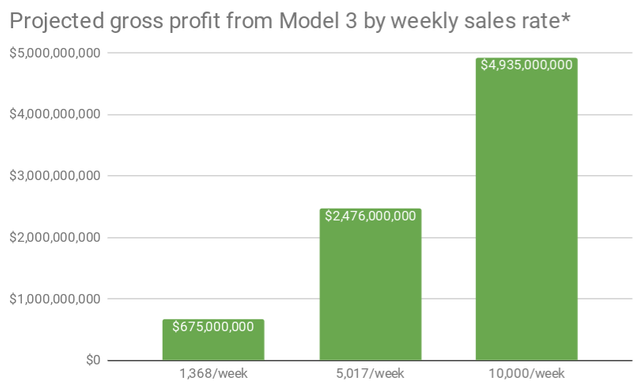

Take the Model 3. Tesla’s net loss in 2016 was $675 million. That’s equivalent to the gross profit from the sale of 64,286 Model 3s at the guided $42,000 average selling price and 25% gross margin. (These price and margin assumptions are based on management guidance.) Given 47 working weeks in a year, that comes to a rate of 1,368 Model 3s sold per week.

In Q3 2017, Tesla’s net loss was $619 million. Using the same assumptions, that is equivalent to the gross profit from sales of 5,017 Model 3s per week — close to Tesla’s 5,000/week target for the end of Q2 2018. At the targeted eventual rate of 10,000/week, that additional $619 million could theoretically drop to the bottom line, resulting in an annual net profit of $2.48 billion.

The current goal is to be at a production rate of 2,500 per week by the end of Q1 2018 and a rate of 5,000 per week by the end of Q2 2018. However, the most recent guidance from the company on gross margin is that it will probably take about 3-4 months after reaching a 5,000/week production rate to attain the 25% gross margin product.

*These projections for annual gross profit from Model 3 sales assume a $42,000 average selling price, a 25% gross margin, and 47 working weeks in a year.

Operating expenses are sure to increase as Tesla ramps up to a production rate of 10,000 Model 3s per week. To accommodate this growth, Tesla will need to open more delivery centres, service centres, and Superchargers. However, that doesn’t necessarily mean net margin will worsen.

The $619 million loss from Q3 2017 includes a sharp, temporary increase in cost of goods sold (COGS). That quarter, 222 Model 3s were produced using a production system intended to make 5,000 Model 3s per week. Tesla's head of sales, Jon McNeill, also said that Model S and X gross margins temporarily dipped due to the discontinuation of the 90 kWh battery pack. Inventory cars with a 90 kWh had their prices cut.

In Q2 2017, before Model 3 production started, Tesla’s automotive gross margin was 27.9%. In Q3 2017, the first quarter of Model 3 production, Tesla’s automotive gross margin dropped to 18.3%. If we attribute this drop to the start of Model 3 production and the discontinuation of the 90 kWh battery pack, that means Tesla lost $225 million of automotive gross profit in Q3 due to a temporarily increase in COGS and a temporary decrease in some inventory prices.

I'll add $225 million back to Q4's bottom line and use a net loss of $394 million per quarter ($1.58 billion annualized) as a baseline for the operating expenses required to support sales of 5,000 Model 3s/week. That puts Tesla’s annual net profit at $1.12 billion once it achieves that production rate. Again, I'm assuming a $42,000 average selling price and 25% gross margin, and reality may vary.

Valuation

Even if the Model 3 can make Tesla profitable, critics complain that the company is nonetheless overvalued. At the auto industry’s average price/earnings ratio of 15, $2.48 billion in net profit would yield $37.2 billion in market cap. That's a lot less than its current (at the time of writing) market cap of $58.3 billion.

However, at the S&P 500’s current price/earnings ratio of 26.7, $2.48 billion in profit would yield a market cap $66.2 billion. That’s a moderate step up (13.5%) from Tesla's current market cap, and a tiny step up (1%) from its all-time high of $65.5 billion. So, Tesla's current valuation would be roughly correct on that ratio, with a little room for upside. Since Tesla is not a typical car company, perhaps that is a more appropriate ratio.

What is an appropriate way to value Tesla? It comes back to the company's 91.8% gross profit CAGR. Suppose Tesla earns $2.48 billion following the production ramp to 10,000 Model 3s per week. If net profit also grows at a 91.8% CAGR, then over 5 years $2.48 billion in earnings would grow to $64.4 billion. At a price/earnings ratio of 15, that’s a $966 billion market cap. A huge step up (1,421%) from Tesla's all-time high.

I’m not saying this will necessarily happen. You can’t just extrapolate what happened in the past into the future. My point is that with such a high CAGR compared to auto industry peers or even fast-growing tech companies, it is rational for long-term investors to value Tesla at something much higher than even 26.7x the earnings anticipated from sales of 10,000 Model 3s per week.

Conclusion & Summary

-Tesla's gross profit has been growing at a 91.8% CAGR over the last 5 years. That's faster than Facebook and Amazon

combined.

-Tesla's operating expenses run ahead of its gross profit because it is aggressively investing in the sources of next year's

gross profit, and of gross profit years down the road.

-If Tesla stopped investing in growth after the Model 3 production ramp, the company would most likely be profitable.

I'll show you the math.

-Based on estimated earnings from the Model 3, Tesla's current valuation would be roughly correct (with a little room for

upside) on the average price/earnings ratio of the S&P 500.

However, I believe long-term investors should account for Tesla's 91.8% gross profit CAGR when valuing Tesla. There is a large potential long-term upside.

Even if Tesla has the opportunity to make a profit from the Model 3, it might decide not to. Rather than achieve profitability in 2018 or 2019, the best move might be to raise billions in capital that the company doesn’t strictly need in order to keep growing fast. That strategy optimizes for long-term earnings, rather than short-term earnings. As a long-term investor, that’s exactly what I want.

Thank you all for reading. Comment below what you think and if you have any suggestions for a post just let me know.

Disclaimer: This is not investment advice, I am not an investment professional. This is not an endorsement by me of the accuracy of the ratings agencies or currencies mentioned above. I am not your personal advisor and not recommending anything to you either way. This post does not create a client relationship between author and reader.