APIS: The Digital Token Providing Exposure to a Volatility-Focused Hedge Fund

Apis Capital Management is a groundbreaking asset manager specializing in unique strategies made to build your wealth in all market situations and conditions. With careful market analysis and their trading experience, they are able to profit in rising, flat, and declining markets, yielding consistent profits for our clients. Their flagship investment vehicle, the ACM Market Neutral Volatility Strategy Fund, has produced industry leading returns since inception.

Summary of Apis Token Ownership

Tokens serve as an indirect fractional ownership interest in the Fund. Fractional ownership of the Fund will be represented by the supply of Tokens registered on the Stellar blockchain. Representing the Fund with a Token allows Tokenholders to easily trade their Tokens, because Tokens are immediately resellable to non-U.S. persons following initial issuance. Other advantages of tokenizing the investment on a blockchain include cost savings from operational efficiencies, transparency of interests, and best-in-class security. Most significantly, after initial allocation of up to 20% of tokens to the Manager, Tokenholders will get all the performance of the Fund, without any deductions for management or incentive fees, which can take away up to 30% of the profits in a traditional hedge fund structure. Profits of the Fund will be sent out monthly to the capital account of the Issuer (Investment Balance), increasing the redemption value of each Token as a result. The Fund’s assets are set to be available for redemption in 12-month intervals from the initial issuance of an Apis Token. At the set time of redemption, Tokenholders who have submitted redemption requests can exchange their Tokens for their proportional value of the Fund’s assets, in either USD or other cryptocurrencies. After each Token is redeemed, it will be taken out of circulation.

Apis Technology and Security

Apis' primary goal is to use technology that keeps the Tokens secure, liquid and transparent. The Issuer will use Stellar, a blockchain that provides the best combination of a thoroughly tested platform, speed, efficiency, low transaction fees and liquidity. Powering Stellar is the third evolution of blockchain technology, which keeps the $400 billion USD crypto ecosystem secure. This “Blockchain 3.0” is greatly superior to the previous two.

Private keys controlling the Token and Distributor Accounts will be separated and kept in geographically distributed cold storage systems and recovered for use only when the management needs to do so which is on a monthly basis for profit distribution and at regularly scheduled redemption dates. The smart contract will have pausing and safe upgrade mechanisms in place to protect Tokenholders in the event that a vulnerability or a defect is discovered in the Stellar network or the smart contract itself. Notably, because the Fund’s assets will not be directly held by the Token’s smart contract, even in the event of a malfunction or vulnerability, Tokenholders’ funds will be safe and the Stellar blockchain’s immutable history will help enable the Token to identify and reverse any malfeasance.

Apis Token Blockchain Mechanics

Every time a Token is exchanged, the transaction is recorded on the Stellar blockchain. This enables the Issuer to track the location of all Tokens without major administrative overhead costs. In addition to recording transactions, the contents of the smart contract are public, which provides Tokenholders transparency around how many tokens are in circulation and how many addresses are in possession of these tokens. Issuer will provide a ninety (90) day notice ahead of the regularly scheduled redemption periods. The first redemption period will occur 12 months after the completion of the public sale to non U.S. persons. Upon receiving the redemption period notice, Tokenholders who wish to redeem their tokens must submit their redemption requests no later than sixty (60) days before the redemption date. On the redemption date, Tokenholders can exchange their Tokens for their proportional net asset value of Issuer’s interest in the Fund at the redemption date. After a Token is redeemed, it will be taken out of circulation and will no longer be outstanding.

Apis Token Advantages

- Re-sellable: There is no lock up period. The tokens are re-sellable instantly to non-U.S. individuals

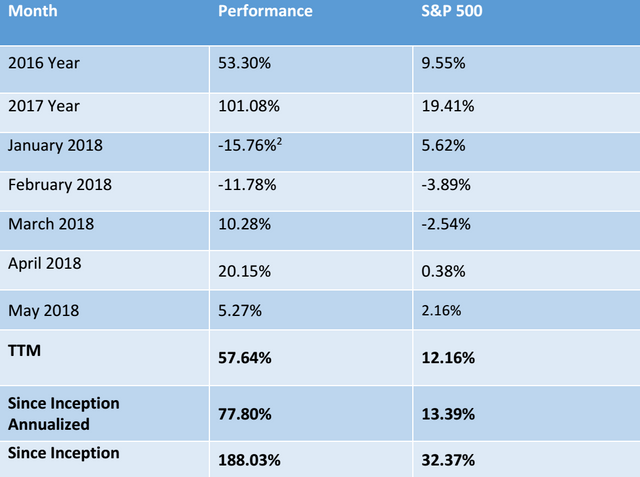

Distinct Strategy: The Token gives exposure to profits yielded by the Issuer’s investment in the Fund. The Fund’s investment strategy combines selling of “Volatility Risk Premium” (VRP) in VIX Futures or “Equity Risk Premium” (ERP) in S&P 500 Index Options strategies to effectively work in market conditions including bull and bear markets, with very little correlation of returns to the cryptocurrency market or the S&P 500. - Proven Track Record: The Fund has yielded gross annualized and audited returns of 70% over its existing 28-month track record. Simulated/backtested returns from 2009-2015 provide similar results.

No Minimum Investment: Unlike typical investments in hedge fund which require large capital contributions, a Token may be purchased with as little as possible capital. - No Fees: Returns from the token sale will be invested directly in the Fund by the Issuer and the Issuer will become a limited partner of the Fund. The General Partner of the Fund has executed and guaranteed a waiver of management and incentive fees to the Issuer.

Initial Token Allocations

There will be five investment phases for the Token:

- The private pre-sale: From May 1st to May 31st will be by invitation only. The Offering Price will be $0.80 per APIS Token and all funds collected will be invested in the Fund as of June 1st, and Tokens for investments made during this phase will be issued on that day.

- The public pre-sale: From June 1st to June 30th will be open to the public through registration. The Offering Price will be $0.90 per APIS token. All funds collected will be invested in the Fund as of July 1st and Tokens for investments made during this phase will be issued on that day.

- The pre-ICO phase: From July 1st to July 31st will be open to the public. The Offering Price will be the $0.95 per APIS token. All funds collected will be invested in the Fund as of August 1st and Tokens for investments made during this phase will be issued on that day.

- The ICO phase: From August 1st to August 31st will be open to the public. The Offering Price will be the $1.00 per APIS token. All funds collected will be invested in the Fund as of September 1st and Tokens for investments made during this phase will be issued on that day

- Ongoing subscription phase: From September 1st onwards, until the Hard Cap is reached, will be available to the public. The Token will be priced at an “Offering Price” determined by the Manager at the beginning of the month and adjusted +/- for the performance of the Fund during the month. The funds collected will be invested on the 1st day of the next month and Tokens issued to Tokenholders on that day.

The Token will have a hard cap of $50 million, to ensure that all the capital raised can be effectively deployed by the Fund to generate profits.

For more info, check out Apis website and Apis Whitepaper.

Bounty0x Username: ifeakinola