Optimism vs Arbitrum: Who Will Prevail in the Red-Blue Race?

Both Optimism and Arbitrum are built with Optimism Rollup, but the two differ in many ways. First, Optimism and Arbitrum adopt different dispute resolution processes to verify transactions. While Optimism uses a single-round fraud proving scheme implemented on the first layer, Arbitrum relies on a multi-round proving scheme that’s executed off-chain. In addition, the two differ in terms of EVM compatibility. Arbitrum is compatible with all EVM languages, but Optimism only supports Solidity. Although the two Layer 2 projects are launched almost at the same time, the subtle differences in design have laid the groundwork for the development of their ecosystems.

Arbitrum vs Optimism

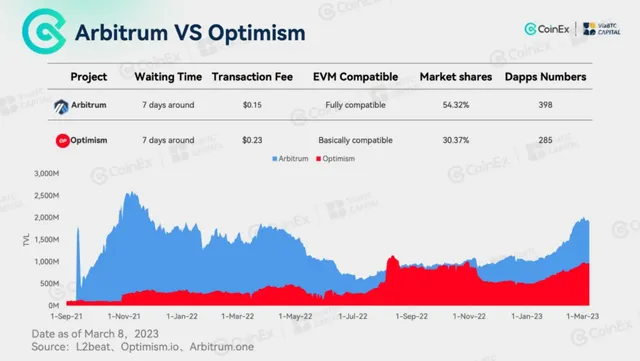

As shown in Figure 1, thanks to its full EVM compatibility, Arbitrum allows developers to easily deploy many DeFi projects on its platform. In contrast, in the early days, Optimism had a whitelist that specified the projects that could be deployed in the ecosystem. Consequently, Arbitrum was far superior to Optimism in terms of TVL and the number of DApps from the very beginning, with the former occupying over half of the market share. However, Optimism announced the removal of the whitelist in December 2021 and upgraded the platform to reduce transaction fees in March 2022. After raising $150 million during a Series B financing led by a16z and Paradigm, Optimism has started to flourish, with a growing TVL.

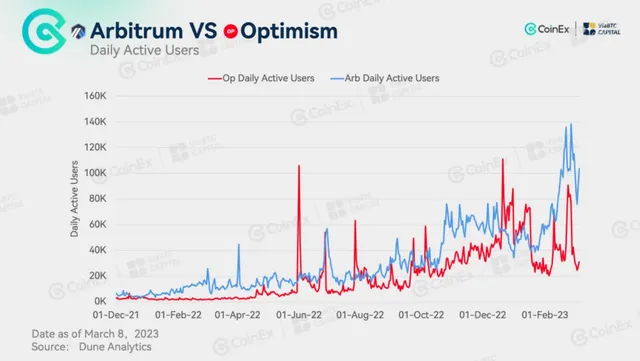

Recently, as the market rebounded, the demand for DeFi transactions on Arbitrum rose, leading to a 163% surge in its daily active users in the past six months. On the other hand, daily active users on Optimism significantly fluctuated because the platform launched a series of reward campaigns. Users could interact with the network to earn tokens or NFTs as rewards, but after the campaigns ended, the number of daily active users would plummet. For instance, following the end of the Quests program in January 2023, the number of daily active users on Optimism dropped to the original level. From this perspective, it’s clear that Arbitrum relies on native applications to retain users, while Optimism is more dependent on network incentives, which allow it to attract users in the short term.

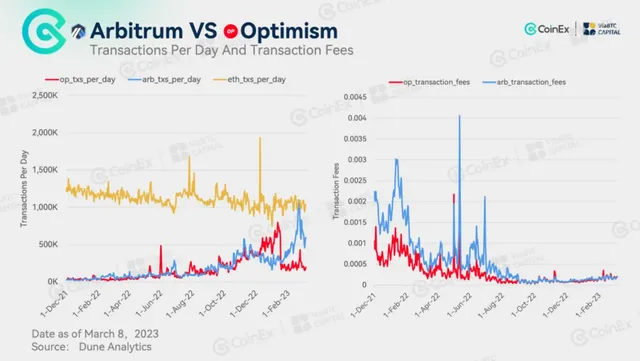

As mentioned earlier, both Arbitrum and Optimism have seen significant growth in transaction volume over the past six months, but Optimism’s growth figure slowed down after the incentives stopped in January. In terms of transaction fees, both Arbitrum and Optimism have cut down fees through network upgrades, and the increase in transactions has also reduced the transaction cost. Today, fees charged on the two networks are almost the same.

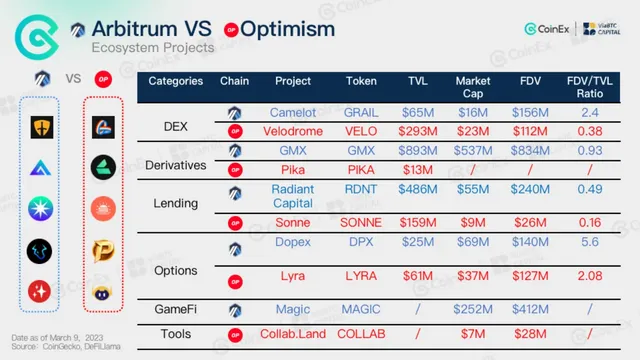

The number of projects on Arbitrum and Optimism has also grown by 145% and 235%, respectively, over the past year. As they have grown and evolved, many of the native Arbitrum projects, especially DeFi projects, have built a large user base, allowing Ethereum users to trade cryptos with minimal latency and reduced fees. In comparison, Optimism only offers a few native projects, and most projects in its ecosystem are migrated from other networks. Now, let’s check out the native projects of the two platforms to examine their pros and cons.

Projects in the Arbitrum Ecosystem

In 2023, the crypto market has picked up, and Arbitrum projects, particularly DeFi derivatives, have flourished, attracting growing user traffic.

|GMX

Launched in September 2021, GMX is a DEX that supports both spot and futures trading. Unlike the order book or AMM model used by dYdX or the Perpetual Protocol, GMX leverages a new GLP liquidity model, which enables users to provide liquidity for GMX by directly purchasing and staking their liquidity token, GLP. With this model, liquidity providers act as opponents and profit from the losses of traders in the pool. As such, the GLP price rises or falls according to the profits or losses of trading users. The advantage of the new model is that GLP pools are larger than conventional trading pair pools. In addition, as the trading price is fed by Chainlink or average prices on other DEXes, the impact of slippage is minimized.

l MAGIC

Focusing on metaverse resources, Treasure DAO (Magic) is a decentralized NFT ecosystem built on Arbitrum. The ecosystem’s development centers on economic mechanisms, with tasks linked to its economy through the governance token MAGIC. The project was initially launched in August 2021 as an NFT finance platform that supports NFT trading and lending. On Treasure DAO, users can earn MAGIC tokens by staking NFT assets such as Loot and Treasure, or AGLD (the derivative token of the Loot community). MAGIC, the governance token of Treasure DAO, runs through the whole ecosystem. MAGIC holders may participate in the project’s governance, voting, and decision-making process. The Beacon, a recently launched game developed with the support of Treasure DAO, achieved market success. In the future, as the project’s ecosystem continues to grow and expand, we expect MAGIC to record further success.

l JONES

Jones DAO is a yield, strategy, and liquidity protocol, with vaults that enable one-click access to institutional-grade options strategies while unlocking liquidity and capital efficiency for DeFi options with yield-bearing options-backed asset tokens. Jones DAO provides vaults for multiple assets and risk profiles. It generates yield through options strategies deployed on the assets deposited in Jones Vaults. With one click, users will be able to access the best yields, while unlocking liquidity and capital efficiency for DeFi options with yield-bearing options-backed asset tokens. The aim of Jones Vaults is to generate yield with sophisticated strategies. Moreover, the value of the vaults is denominated in the vault asset in order to accumulate more of the asset over time.

Jones DAO is built for three main user groups: 1) users who don’t want to actively manage their options strategies or would like to utilize its vault to deploy strategies; 2) users who would prefer not to lock their assets and would like to keep their deposits liquid; 3) protocols planning to earn additional yields on their treasury assets.

l RDNT

Radiant Capital is a cross-chain lending protocol launched on Arbitrum and built on Layer 0. It allows users to seamlessly borrow and lend in one network by depositing collateral in another. As the fastest-growing lending protocol on Arbitrum, Radiant Capital offers a unique feature called multi-chain lending. Simply put, the protocol enables users to deposit collateral on one chain and borrow on another. With a native cross-chain market, Radiant Capital uses existing currency market models and builds a cross-chain framework locally that’s operated entirely by its community. At the moment, the project’s TVL has reached $485 million. Radiant Capital started from scratch, without any VC or seed round financing. The protocol distributes all fees to stakers as rewards, mostly paid in USDC, offering them good returns. It aims to bring together the scattered funds (about 22 billion) on the top ten interaction layers.

l DPX

Dopex is a decentralized options platform that offers liquidity to options traders through option pools while maximizing gains for both buyers and sellers of options contracts through a rebate system, as well as arbitrage functions. At its core, Dopex provides Single Staking Option Vaults (SSOVs), which allow users to lock up tokens for a specified period of time and earn yields on their staked assets. Users will be able to deposit assets into a contract. The system then sells the deposits as call options to buyers at fixed strikes that they select for end-of-period expiries. To put it bluntly, users deposit assets to sell a call/put option. By the same token, there will also be buyers purchasing a call/put option for hedging.

Dopex adopts a dual-token economy where DPX serves as the governance token and protocol fee token. This means that fees charged for purchasing calls in an option pool, swaps, fines, and strategy vaults are all paid in DPX. At the same time, 15% of all fees charged will be distributed proportionally to DPX holders after each epoch. On Dopex, rDPX acts as the rebate token. To eliminate the risk of losses arising from extreme swings, option holders receive rDPX as compensation in each epoch. Dopex users can use rDPX to mint synthetic assets or have the tokens deposited as collateral to expand their exposure.

Projects in the Optimism Ecosystem

As a latecomer, the Optimism ecosystem features only a few native projects, with a small TVL. Still, with Grant (an incentive program provided by the ecosystem), Optimism has attracted a growing number of developers.

l VELO

Velodrome Finance is a liquidity solution for protocols on Optimism. Its TVL, which now stands at $309 million, surpasses that of many other leading projects. Plus, the project’s bribery funds set a historical record. Velodrome was adapted by the veDAO team from Solidly, which was launched by Andre Cronje’s team. The veDAO team also based Velodrome’s token design on Solidly’s (3,3) mechanism.

Liquidity providers receive VELO tokens as rewards, which can be locked up to obtain veVELO, the project’s NFT governance token. Holders of veVELO enjoy governance rights that allow them to determine the weight that VELO assigns to each liquidity pool. In addition, they get all transaction fees and bribes, and can relieve vote power dilution through rebase. As bribes and transaction fees in Velodrome grow, veVELO holders will earn higher returns, which will boost the VELO price. Moreover, the high returns earned by liquidity providers will attract more liquidity to the protocol, and strong liquidity drives up transaction fees, which then creates a flywheel.

l SONNE

Sonne Finance is a native lending project on Optimism. As of March 9, 2023, the project’s TVL stands at $39.72 million, second only to AAVE among all lending projects. Sonne aims to evolve into a top lending platform with the deepest liquidity and provide the most competitive incentives for money markets on Optimism. Also, Sonne combines its tokenomics with Velodrome, allowing users to bribe Velo holders with Sonne, and the VELO earned will also be distributed to Sonne holders, which improves the overall liquidity of Sonne Finance.

l LYRA

Lyra is an option AMM protocol that allows traders to buy and sell crypto options based on liquidity pools. In response to the high slippage and risks yet poor liquidity of the existing DeFi option protocols, Lyra proposes to actively manage those problems to reduce the risks threatening liquidity providers and improve the liquidity of the AMM. On Lyra, the AMM uses the Synthetix protocol to help liquidity providers reduce the Delta risk. It calculates the overall Delta risk of the protocol and then actively hedges the risk on Synthetix to remain delta neutral, which reduces the impact of price swings on option prices and minimizes risks for liquidity providers.

l PIKA

As a decentralized perpetual swap exchange native to Optimism, Pika Protocol offers up to 100x leverage, low slippage, and cheap fees. Recently, users can trade on Pika to earn rebates in OP tokens. Plus, its TVL has grown by 55% in the past three months. The project has not yet issued tokens, but an airdrop program is expected.

l COLLAB

Collab.Land, a tool widely used by blockchain projects on Discord and TG, allows any token holder to join Discord and use the Collab.Land bot to verify their membership. Used to confirm if a user actually owns a specific asset in his/her wallet, Collab.Land is now one of the most widely used DAO tools and SocialFi products. COLLAB, the project’s native token, is mainly used for governance and application within the Collab.Land ecosystem, where holders can vote on feature requests, provide bounties, and manage the Marketplace.

Conclusion

Arbitrum and Optimism are the two most popular Rollup solutions on Ethereum. Considered DeFi powerhouses, they are both promising Layer 2 protocols with unique advantages. Although the projects are still trying to catch up with Ethereum in terms of volume and transactions, Arbitrum and Optimism have attracted a large swath of users and projects with their faster transactions and lower fees. Moreover, the two are always able to improve the user experience through each upgrade. That said, to achieve long-term success, instead of being a sidekick of Ethereum, both must build a strong ecosystem of their own. From this perspective, the race between scaling solutions involves multiple tracks. There might be just one winner or multiple winners, but the ultimate goal is to deliver benefits to users and the whole DeFi ecosystem.

All crypto assets mentioned above are available on CoinEx, but the article offers no financial advice.