The Art Market: The only market not bothered about inflation.

.jpeg) Potato eaters : A painting by Vincent Van Gogh

Potato eaters : A painting by Vincent Van Gogh

With the whole markets crashing and bleeding starting from stocks to crypto coupled with the stagflation coming,there is a market that is unfazed by all these. This market is the Art Market. The Financial Times declares it as an overlooked investment that is "bulletproof".

The Art Market is up 25% in the first half of 2022-compared to 20% losses for the S&P - and the WSJ calls art "among the hottest markets on Earth".

What could be the magic behind this ? The reason this market is not affected by all these bad macroeconomics changes.

Here's why:

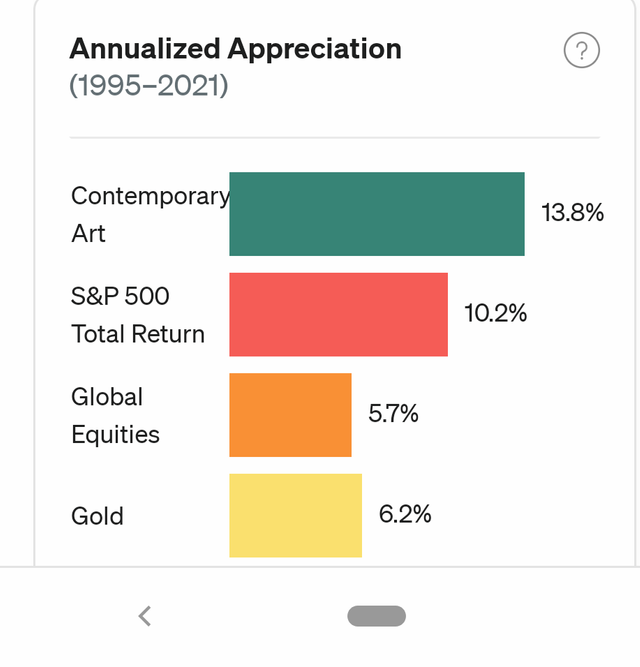

First, 14% annual appreciation (1995-2021): There has been sustained annual appreciation of art from 1995. Contemporary Arts has also demonstrated strong real appreciation in high inflation periods and appears well positioned for a medium to high inflation environment.

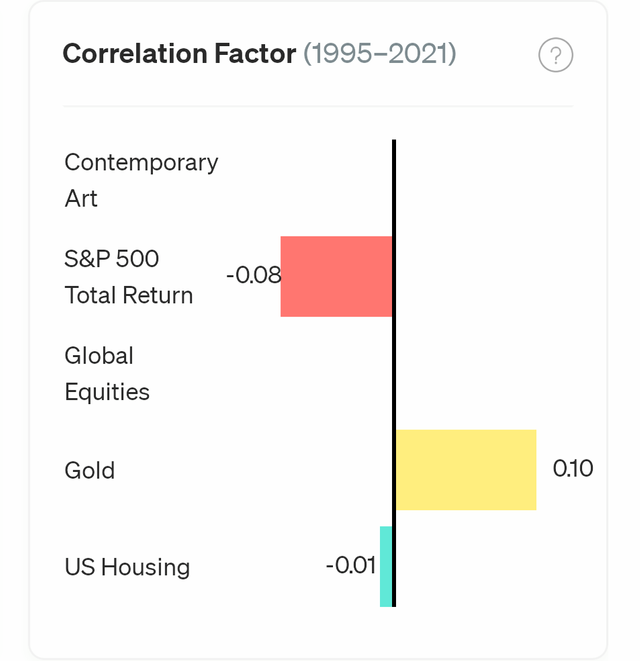

In addition,there is low correlation to equities of any asset class. Citi private bank calculated the long-term correlation coefficient of 0.12 between Art and the S&P 500 index which is a very low level of correlation. This is the reason why art is good in diversifying any portfolio

Furthermore, it doesn't dip whenever you know who tweets it. One good thing about art is that even if the owner is known it doesn't change the price of the art work so far it is a master piece. Unlike in crypto and stocks,once an individual is known or behind a certain crypto asset the asset tends to appreciate or depreciate.

To conclude this article,with the whole inflation looming and recession at the door,it is wise for one to diversify his or her portfolio not just only stocks and crypto. Try to add one or two arts in your portfolio. Try art and you will be happy you did.