William Gallagher's Ponzi Scheme: Millions of Dollars From US Bible Bills

Fraudster who collects millions of dollars from the elderly residents of America's 'Bible Belt'

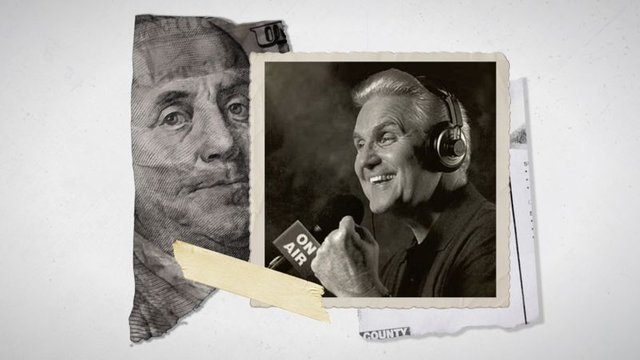

For his listeners, William Neil Gallagher, better known as 'Doc', is a good-natured financial guru who advertises his services on Christian radio stations, which are eagerly heard on the 'Bible Belt' or religious strip in the US state of Texas.

Their advertisements ended with a well-known tagline: "You will meet at church on Sunday."

An ad video posted on YouTube says of him, "Dr. Neil Gallagher is a true and excellent American who conducts his affairs very honestly."

"The purpose of his life is to help people retire safely, quickly and happily."

The three-minute video praised the elderly man's abilities and vision. The video explains that he guided more than a thousand people to become financially independent through his company, Gallagher Financial Group, and his book, Jesus Christ, Moneymaster.

But William Gallagher was, in fact, a swindler who raised 32 million through a fake ponzi scheme, in which he defrauded retirees between the ages of 62 and 91.

What are Ponzi Schemes?

Early investors in ponzi schemes make a profit by taking money from their successors.

The scheme assures investors that the income comes from legitimate business activities (e.g. product sales or successful investment) and they are unaware that other investors are the source of that money. Are

Huge profits are often promised to everyone with minimal risk.

To keep the business afloat, these schemes rely on a steady stream of new members giving money to those who have invested before them. When that doesn't happen, it's time to dump her and move on.

According to court documents, William Gallagher has been defrauding people through the Ponzi scheme since at least 2013.

In March 2019, the US Securities and Exchange Commission ordered the closure of two of his companies, Gallagher Financial Group and W. Neil Gallagher, Ph.D.

In November, a Trent County, Texas judge sentenced him three times to life in prison. He was also sentenced in March 2020 to 25 years in prison in Dallas.

Gallagher had promised five to eight percent annual return on his investment from his targets, but the investors did not get anything and William Gallagher paid most of the money to personal and business expenses as well as to former investors.

To cover up the fraud, he also provided fake account statements, which showed incorrect balances.

The BBC tried to contact Gallagher's lawyer but was unable to do so.

Although the case of William Gallagher has attracted the attention of the national media, it is not a new phenomenon.

Although ponzi schemes are named after Carlo Ponzi, a well-known traitor of the 1920s, such fraudulent schemes date back to at least the middle of the 19th century.

William Gallagher used radio to attract his listeners. Despite stiff competition from modern media, Christian radio has been extremely popular in the United States for decades.

But the nearly 200 victims of Gallagher show a different trend: Senior fraud is a crime that, according to the FBI, costs billions of dollars each year.

William Gallagher's victims included a woman with lymphoma in the 1970s who had invested more than لاکھ 500,000. He also targeted several serving and retired local police officers.

Many victims were forced to sell their homes, borrow from their children or return to work after retirement.

Lori Vernell, head of the Senior Financial Fraud Unit in Trent County, Texas Criminal District Attorney, told the BBC it was the worst case of major fraud in her career.

According to Lori, "these are the people who have spent their whole lives trying to save this money. It was his personal earnings. They are destroyed. It's not just about money, it's about fraud. "

To reach his goal, Gallagher promoted his company's services through churches and Christian radio.

There are thousands of Christian radio stations in the country that broadcast all kinds of programs, from sermons and talk shows to music and news.

According to the Radio Advertising Bureau, Christian Radio is very popular in the United States, where more than 20 million listeners listen to it every week.

According to Lori Warnell, it is not surprising that Dr. Gallagher used Christian radio to deceive his victims. According to him, "there is a lot of trust within the Christian community, especially here in the Bible belt."

According to Lori Warnell, once William Gallagher gained the confidence of his target, victims would be less likely to pay "more attention to detail."

According to David Lack, a former Los Angeles attorney, the tactic is a prime example of such a large-scale fraud involving emotions and special relationships.

Fraudsters in these schemes target members of a recognizable group, which may include people from religious or ethnic communities as well as those belonging to a particular profession.

In many cases they are used unintentionally by members of the group to provoke others and to convince people of its authenticity.

According to David Flack, "you see it in people from all cultural groups and from all walks of life."

Former federal prosecutor Jeffrey Kramer said older people are often a lucrative target for such scammers because they have large savings.

According to him, "most people of this age have more money because they have worked for a long time."

"There is no point in trying to deceive a 20-year-old. In the 60's or 70's, one could have multiple investments and a house worth at least five times more than their investment.

Lori Warnell says that in addition to her victims' beliefs, Gallagher has also taken advantage of the differences between the younger and older generations.

According to him, "If someone shakes your hand and looks you in the eye, these people think that person is fine."

Such religious people believe in people because lying to them is against religious belief.

Fraud experts believe that only a fraction of such cases are reported and that cases that go to court do not make victims likely to get their money back.

Fraudsters often spend funds as soon as they arrive or use them to try to keep payments or hide in foreign accounts.

Emotional value

In Gallagher's case, part of the money was spent, part of it was used to pay off debts, and the rest is still unaccounted for.

While the financial costs of fraud can be devastating for victims and their families, the real impact is often even deeper.

According to Jeffrey, "it comes at an emotional and psychological cost."

"It's a shame when you've worked for 20, 30, 40 years and you have nothing left."

Among them was Susan Pappi, a 74-year-old woman who, along with her husband, lost millions of dollars in the scandal.

"I no longer trust anyone except God and my family," he said in a statement issued by the Trent County Prosecutor's Office.

According to Lori, this type of fraud is not going to end.

He said a "joint operation" by fraudsters, many of whom are abroad, was stealing retirement funds from Americans at the rate of "millions" every day.

According to him, the elderly and their families should be aware.

"If anyone approaches you for religious reasons, you should be very skeptical," he said.

According to Jeffrey Kramer, young people on social media have grown up with more technology and now they are more likely to have this type of fraud.

A scammer can reach a very large audience, but then he hides behind an account and then disappears.