Unlocking the Power of Axioma: A Comprehensive Guide to Real Estate Investment

In the ever-evolving landscape of real estate investing, the emergence of innovative platforms like Axioma has revolutionized the way investors approach the market. Axioma, a groundbreaking real estate investment solution, offers a streamlined and efficient path to generating revenue from property assets. This comprehensive guide delves into the intricacies of Axioma, exploring its unique features and the opportunities it presents for savvy investors.

At the core of Axioma's approach is its emphasis on simplicity. The platform requires only a handful of straightforward procedures to enable investors to capitalize on real estate opportunities. This user-friendly model empowers even novice investors to navigate the complexities of the market and secure lucrative returns.

One of the key advantages of Axioma is the accessibility of its investment opportunities. The platform frequently auctions off properties, providing investors with a chance to acquire prime real estate at competitive prices. This democratization of the real estate market ensures that a broader range of individuals can participate and benefit from the potential appreciation of these assets.

The Objectives of AXIOMA

AXIOMA is now working to improve the liquidity characteristics of illiquid assets, especially real estate. Tokenization will enable the investor to have direct ownership and listing capabilities.

Investors with illiquid assets are encouraged to take their readily available stock and offer it to secondary trading platforms or list it in a way that complies with regulations. Furthermore, tokenization increases the attractiveness of the fractional ownership notion by enabling investors to sell any portion of their own inventory in addition to directly displaying their stock.

Investors together with the Project

AXIOMA develops platform technology and also serves as a transfer agent. AXIOMA's ability to: is one of its key characteristics.

Keep an eye on the money's issuance and transfer to ensure compliance.

Reports ought to be published, and a current list of the company's stakeholders ought to be kept.

Act as a mediator when it comes to the payment or dividend distribution.

Encouraging proxy voting and other investor participation methods is crucial.

Investment banks, fund managers, and individual issuers are granted licenses to use AXIOMA's technology platform in order to enable the following:

A platform for managing the shareholders' registry that each individual issuer can access

This platform can be used by multi-fund managers and broker dealers to raise funds.

Investment banks and high-volume issuers can both gain from asset lifecycle management.

Axioma's unique value proposition extends beyond just the acquisition of properties. The platform also facilitates the leasing of these assets, enabling investors to generate consistent rental income. In one such case, Axioma acquired a property and seamlessly leased it to the previous owner, who was able to continue residing in the residence while fulfilling the rental obligations. This win-win scenario highlights Axioma's ability to create mutually beneficial arrangements for all parties involved.

The Axioma project has garnered significant attention from investors, who are drawn to its compelling proposition. By collecting rent and distributing quotas to investors, Axioma empowers its participants to earn passive income without the need for speculative investing. This approach provides a stable and reliable source of revenue, making it an attractive option for those seeking to diversify their investment portfolios.

One of the most intriguing aspects of Axioma is its provision for the previous owners of the properties it acquires. The platform allows these previous owners the opportunity to repurchase their properties, enabling them to rectify their circumstances and regain control of their assets. This unique feature sets Axioma apart, as it demonstrates a commitment to fairness and the recognition of the previous owners' attachment to their properties.

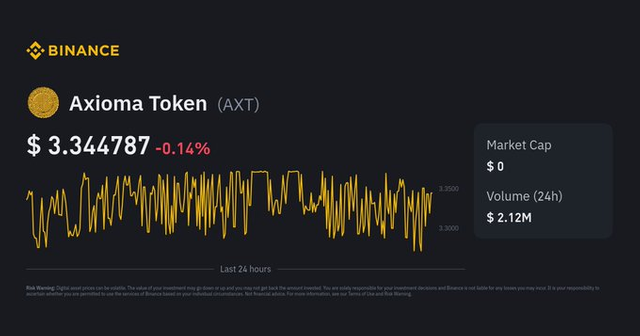

Axioma Token (AXT)

Symbol : AXT

Blockchain : Binance Smart Chain

Total Supply : 1,000,000,000AXT

In conclusion

Axioma represents a revolutionary approach to real estate investment. By simplifying the process, democratizing access to opportunities, and creating mutually beneficial arrangements, Axioma has positioned itself as a game-changer in the industry. As more investors discover the power of this platform, the Axioma project is poised to continue attracting attention and driving the evolution of real estate investment strategies

For more information

Website : https://axiomaeaglecity.com/

Bitcointalk Thread: https://bitcointalk.org/index.php?topic=5501402.0

Twitter : https://x.com/axiomaholding

Telegram : https://t.me/axiomapay

CMC: https://coinmarketcap.com/currencies/axioma-token/

Author by

Bitcointalk username: MR.SIR

Forum Profil Link: https://bitcointalk.org/index.php?action=profile;u=3413167

Telegram Username: @mistersirbit

BSC wallet address : 0x23911C68BDB9D03d98324333D1d1c4885E5fa341