You alright BABB? [Bank Account Based Blockchain]

We've been told that we can be our own bank with blockchain technology, and slowly we are getting there. BABB is "A decentralised banking platform that leverages blockchain, AI, and biometrics technologies to offer anyone in the world access to a UK bank account for peer-to-peer financial services." Ever since Circle disabled Bitcoin to GBP conversions, it's been difficult to convert back and forth without incurring large fees. Hopefully with BABB there will be a lot less friction again and it even has it's own payment card.

The company are aiming high, to "leverage blockchain technology to offer anyone in the world a UK bank account", shoot for the stars and you will hit the moon. This will be done via the BABB App, you will take a selfie and speak a passphrase. Once you are on the ecosystem you are technically your own bank and can interact with any others via your smartphone. I recommend not taking a selfie on the toilet, the accoustics might be good in your bathroom, but there may be mirrors or angles which could be unflattering in the image. Although there are no rules to say you can't do a toilet selfie from what I've seen :) Via the app you will be able to send money anywhere in the world instantaneously with minimal charges. According to https://bitcoinfees.earn.com/ the median average fee for a BTC transaction is 65,540 satoshis, which on 22/11/2017 is $8256.41 * 0.00065540 = $5.41 per transaction lol. BABB and most crypto transfers are much cheaper!

Gif courtesy of @opheliafu

You can even exchange money in person via the app similar to how you would exchange on localbitcoins.com

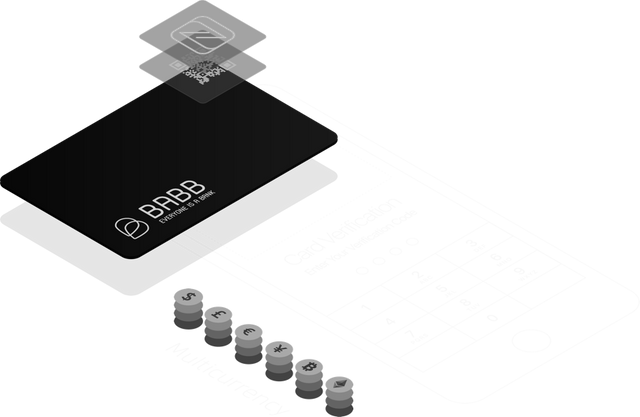

Black Card

Not to be confused with http://www.luxurycard.com/blackcard this card will be a bridge between the digital world and physical. My wife @opheliafu is often telling me to build a bridge and get over it, now one has been built for me. The secure payment card links to your BABB bank account via QR code or NFC (contactless). Retailers will be able to accept payment from the card by simply downloading the BABB App. If you have ever ran or been a manager of a retail/restaurant establishment you will know how hard it is to get a simple payment device and explanation of the fees involved. First you need a bank, then a payment gateway, then a payment provider, then the payment device(PED), then the fees for card processing, then the insurance for the device, then the admin fee for setup, then the merchant fees for usage etc. With BABB it will be much simpler to take payments! If you lose the card, you can simply unlink the card and pick up another one cheaply, if you find the lost card you can link it back up. No personal information is stored on the card.

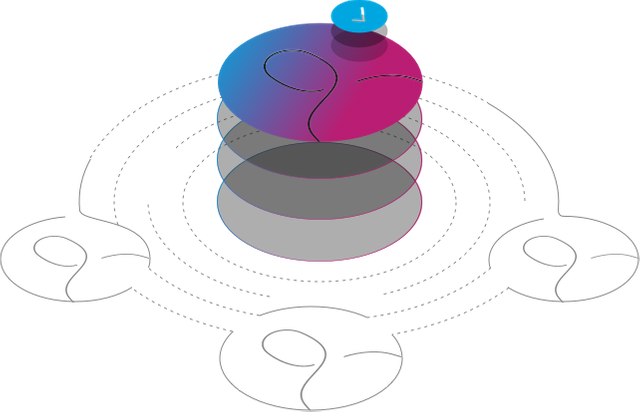

Central Bank-Issued Digital Currencies (CBDC)

BABB are collaborating with central banks, so that the localised currencies will not fluctuate and stay pegged with the national currency you are transacting with. This structure allows the plaform to be secure and compliant with regulation, as we all know for this space whether we like it or not, regulation is coming. Not only will you be able to transact locally on the central banks local system, but you can also transact internationally on BABB's global platform. For more information see Here

Social KYC

Anyone who is fully KYC compliant with validated documentation can vouch for other users to onboard them using social KYC. This will allow many users to come onto the platform without the requirement of ID documentation. This could create exponential growth on the platform and increase adoption.

The BAX token will ICO here https://getbabb.com/token-sale and have a hard limit of $50 million, they will be using an ERC20 token on the ethereum blockchain.

Check out https://getbabb.com and https://www.t.me/getbabb for more info

super interesting, checking out the links. this card stuff is gonna get locked down quick. i really like cryptopay.me too and the credit cards and virtual cards they have too.

What fee do they charge or rate do they include within the conversions? Do you withdraw as cash from ATM or send to UK or EU bank? Before I had zero fees with Circle, now I'm getting fees at the exchange (tiny) then fees for transfer of BTC ($5) then fees to convert to Euro then fees for GBP conversion and SEPA transfer at my bank acc, lol.

not sure what the fees are but yes they have fees, don't withdraw from atm as have no credit card only a virtual credit card with them that i load, that costs £1.50 to make each -- US, EU, UK -- i've got one of each, i can't add them to apple pay but i'm hoping they activate that at some point because then i can just use it with a phone at a till as RFID -- yeah the bitcoin prices are crazy right now for fees -- i've kinda switched to dash for now for things i'm buying for speed and low costs for services but don't have a cheap solution for bitcoin into cryptopay cheaper -- that being said they do say that litecoin is on the roadmap for support into their system so that's probably the route i'll go between -- steem > blocktrades > litecoin > cryptopay

Wirex will be accepting Dash and Bitcoin Cash soon, they have minimal fees but include a fee within the exchange rate last time I checked. https://wirexapp.com/card/

also need to check if a lot of these cards work with apple pay because that can be a stumbling block -- ideally i want the card to exist in the wallet so i can pay at RFID tills without having to use the card/swipe pin etc all of that so i always check before ordering a plastic card these days. cryptopay currently does not work with apple pay.

Tenx has a long waiting list but they do NFC cards, as well as wirex in the future https://wirexapp.com/guides/mobile-wallets/mobile-payments/ cryptopay will probably do the same too I would say

Looks like something substantial..

Firstly, I keep telling you that toilet selfies are not 'bang on trend' and to stop doing them.

secondly, you are confusing bridges with a cliff.

Thirdly, this looks very interesting, and i will have to look into this further.

Please resteem my post

https://steemit.com/introduceyourself/@lalitha143/iam-new-join