The Psychology Behind Bailouts. Why Obama is at the Mercy of Game Theory

I wrote this article awhile ago. My writing is not great, but part of the reason I joined steemit is to improve upon my writing.

The original article was written on July 22, 2012.

*I'm also going to try and add an image or two, but no promises on quality. I made some mistakes (writing and factual) but I'm trying to convey an idea and I'm less worried about specifics.

Beginning of Article

Politicians are at the mercy of game theory and they don’t even know it. Have you ever wondered why presidents implement bad monetary policy? Want to understand the psychology of bailouts? Then read on my friend.

Depending on your economic school of thought you either think the economic stimulus by the government is a good thing or a bad thing. In my opinion, quantitative easing (QE) is a bad thing. There have been rumors that QE3 is around the corner and may come before the next presidential election.

Let’s say for arguments sake that QE3 occurs sometime around the beginning of 2013. That’s 3 stimulus packages since Sept, 2008. Even Greece would be proud of that. The first bailout was never coined Quantitative Easing, but was implemented (thanks for opening the can of worms) by George Bush in 2008 and roughly totaled $985 billion dollars in bailout money.

QE 1 followed and concluded on March 31st, 2010 and roughly totaled 1.6 trillion dollars. This was also implemented by George Bush but ran into Obama’s first term (he will probably get another one). QE 2 was implemented by Barack Obama on Nov 3, 2010 and resulted in 600 Billion dollars.

That’s a total of roughly 3.2 trillion dollars in quantitative easing. Quantitative easing can be thought of as: bailout money, printing money by the FED, and the creation of digital money for banks to lend. All of it however is created by the government and not backed by anything. (google fiat money for an understanding of the current monetary policy of the USA).

If you believe what I believe, that the Federal Exchange Department is a corrupt agency, then you understand why it is so appealing for a president to be enticed by quantitative easing. In my opinion, quantitative easing is a short term solution that creates a bubble that will eventually burst. Most people still believe and apply Keynesian economics but Austrian economics has recently made a comeback thanks to Ron Paul. I always thought the economics applied by the government (keynesian) was a bad idea but I never knew there was another economic school of thought until Ron Paul was advocating the Austrian (not actually from Austria) school of thought.

It can be debated, but quantitative easing creates money out of nothing and usually results in some type of bubble. When this bubble occurs everyone is happy that the economy is good and nothing needs to be done. The bubble eventually bursts or at least the trend line reverses itself (free market correction). When this happens (our current recession/depression) people demand that politicians put policies in place that correct the error. However what most people don’t understand is that the error is the bubble and the solution is the hopefully temporary free market correction.

As promised I will explain why psychology and game theory are the reasons that quantitative easing will most likely be implemented by whomever the next president is.

I only have one rule for this scenario and the rule is -no president wants to be in office when there is a recession or depression in the economy- Since they do not want to have a recession they implement policies that will make the economy look like it is doing well. So, they formulate an economic stimulus that creates a temporary bubble (think government housing). When this crashes they must react swiftly so the economy does not self correct itself and result in a mini recession. This happened when George Bush bailed out the banks and wall street during his presidency, then followed it up with QE1.

When Obama took office he inherited a recession. Instead of letting the market correct itself he introduced QE2 and advocated more government spending and regulations. This is the time frame we are in now. There are conflicting reports of what the state of our economy is in now, but if you ask the average person they would report some type of negativity. As you can see it’s advantageous to the current president and the president before him to push quantitative easing, because it creates a temporary bubble that makes the economy look like it is doing well. The only problem with this is, well, take a look at Greece and tell me if they have problems.

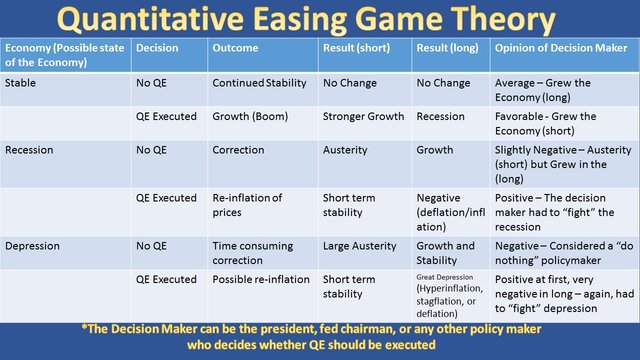

Let me try and make a table to better understand why psychology and game theory (dominant positions) can explain why politicians use quantitative easing even though in the long run it may be extremely harmful to the economy. (I’m trying not to be too biased with my agreement with the Austrian economic school of thought, so if you want to argue with those ideas go right ahead).

Hopefully you are able to read the table. Let me explain as it can get pretty complex. There are thee conditions of the economy (stable, recession, depression) in my hypothetical. Each decision to implement QE is met with a short term benefit followed by a long term negative outcome. The policy makers would choose the short term benefit because of the opinion of the decision maker is favorable. It's favorable by the general public and the national consensus. But as you can see, it is the wrong decision in the long run. Short term and and long term could be as short as a couple of months or so, but I had now way to quantify it. Also, the amount of QE will have a direct effect of the duration of the short term and long term. I'm sure there are points of no return with QE, but I don't have that type of knowledge yet.

Overall, you can see why policymakers decide on short term gains and why they are at the mercy of psychology and game theory. This isn't to say they don't know what they are doing, but its merely an explanation of the driving factors behind implementing bad policies. This also reminds me of the psychology idea of immediate gratification. One does not want gratification later they want it now. The reason game theory is involved is because the policymakers want to keep their job. Deciding to implement QE makes them look favorably instead of weak. Deciding to do "nothing" (the correct approach according to the Austrians) looks weak and will not reflect favorably on the decision maker/s.

Now you understand a little bit more about why an economy is at the mercy of politicians and the politicians are at the mercy of psychology and game theory.

End of Article

Great post and it applies just as much today. Politician are driven by the short term interests of the election cycle in many areas of life and this is just one. In order to maximise their chances of staying in a job they are happy to pass the buck on to someone else further down the line. It will keep continuing and we will keep having these booms followed by the bust of recession and more borrowing, QE and the like to restart the cycle.

That's one of the many reasons that a lot of us get into crypto like Bitcoin. The amount of Bitcoins is fixed (once they are all mined) and no government can decide to print more.

I think one day when people realise the folly of fiat money and how governments manipulate it - the only true reserve currency will be Bitcoin (or something like it).

This is because it will be the only currency that everyone can trust and politicians can't play these kind of shenanigans with.

I like Bitcoin. I just like gold more. But you're right, politicians can't manipulate bitcoin, which is a huge upside. If bitcoin or cryptocurrencies could be backed by gold, I'd be more convinced. Perhaps there are people working on this application as we speak. One company that I know that is trying to combine the block-chain technology and gold is goldmoney.com formerly bitgold.com. I'm very impressed with their product. You should check them out.

I do know of them. I think I might one day get some gold too. Right now I think there is more potential in crypto though - if I make a decent amount I will probably put some into gold.

haha, boy was I wrong so far. Crypto is exploding. bitcoin and litecoin to the moon.