AppToken: Solution to the problem of apps funding

Since the first smartphones burst onto the scene, the market for mobile applications has grown rapidly. A majority of people in North America & Europe now have smartphones. Even in emerging markets like China, smartphone ownership has surpassed 50% of the population. This has turned mobile app development into a big business. In 2017, mobile users spent $58.6B on apps, 35% more than they spent in 2016. The demand for a more efficient means for app development exists, yet is not currently being met. Independent mobile developers are constantly coming up with various new ideas for applications, but they often are never created. The reason? Funding. In this article, we will analyze the existing financing methods for app development and highlight their difficulties, advantages, and opportunities.

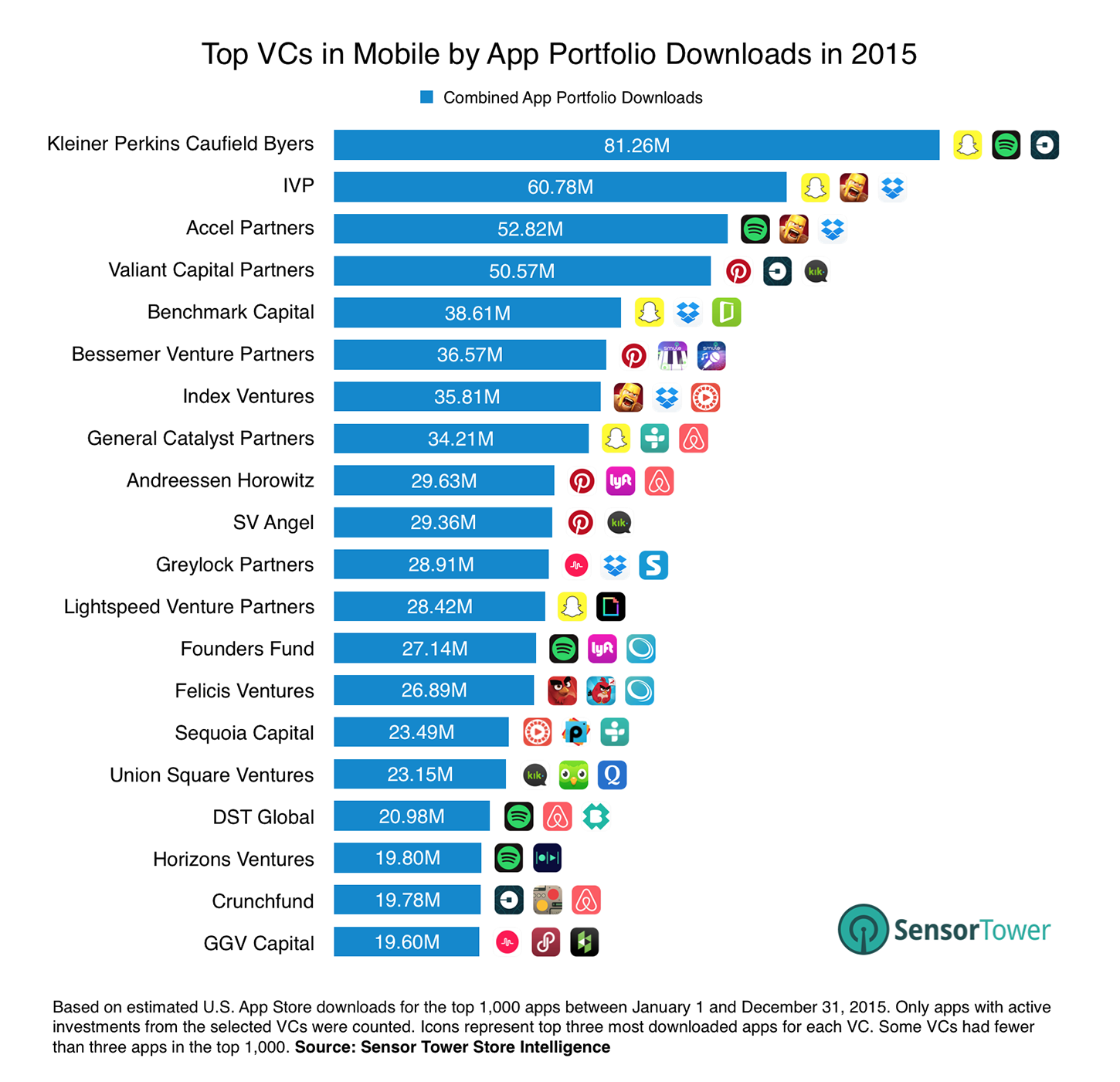

Up to now, app developers and application company founders have had few opportunities to get the proper financing. Banks rarely provide loans to the creators, and banking analysis struggles to estimate an app’s value. Until recently, the most common method of financing for apps have been to seek out funding from Venture Capital Funds.

What does this system end up looking like?

- Venture Capitalists partner with very few companies

- These funds prefer to develop a personal relationship with founders to understand their long-term vision, which means it takes a long time to receive capital

- Some VCs, like Sequoia Capital, are more interested in the projects which are at seed stage and don’t have current cash flows

- VCs prefer to work with exceptional, charismatic founders, who have a unique insight on the project’s purpose

- Startups must show high growth potential for VCs to be willing to invest → Startups without gross profit expectations are not likely to get financing

Some app developers do manage to get funded, but let’s look at the structure of such partnerships. In exchange for the high risk that venture capitalists assume by investing, they get significant control over the startup, as well a significant piece of ownership stake (sometimes about 20-30% of shares just in the first investing round).

To sum it up, app developers are destined to meet lots of obstacles along the way. That is why a great amount of them fail (according to Startup Genome Report, 92% of startups dead). All these things sound quite disappointing for future app founders...but a short time ago an alternative way of raising capital was developed.

A fintech company, BANKEX, developed a new product called AppToken.

What is it?

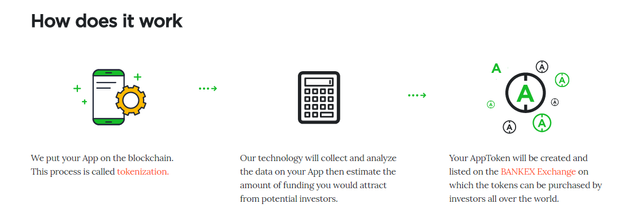

AppToken is an ERC-20 token issued on the BANKEX platform. It makes funding accessible for app developers all over the world.

How does AppToken solve the problems created by VCs?

- Mobile apps projects can use the tokenization protocol to get funding from real assets that they own

- BANKEX doesn’t require long-term relationship with clients → the process of analyzing the data on the App is quick and operative

- AppToken technology is designed for startups currently generating cash flow → the companies who have an existing product can get financing

- Tokenization is based on the evaluation of the asset by the AppToken technology, not the uniqueness of the project nor the charisma of the founder

- AppToken is available for startups that may not have high-profit expectations

The founder’s stock is not pilfered by outsiders

Moreover, AppToken has some unique benefits for app developers:

- No additional intermediaries: Blockchain and IoT substitute them

Through tokenization, app developers get access to $600B worth of cryptocurrency investors’ capital - The risks and the costs of funding are minimal because of the tokens’ packaging

- Machine Learning and Artificial Intelligence can be used to predict cash flow

- Through the integration with blockchain technology, publicity of the app will grow and new customers will arrive

The AppToken technology created by BANKEX undoubtedly breaks down the barriers of the mobile app market and gives life to a great deal of exciting, new applications.

The correct option is 2