BANQUE D'ORIENT *ΤΡΑΠΕΖΑ ΤΗΣ ΑΝΑΤΟΛΗΣ* Chapter No7 **The debate on the "monster"**

After the noise caused by zougla.gr's revelations about the Bank of the East, the "National Bank" issued, albeit late, a notice rejecting the objections of the Sorra family.

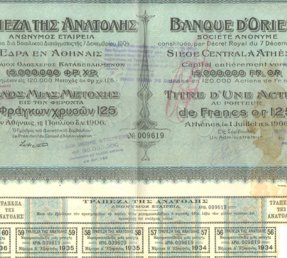

In particular, in this announcement, the National Bank claims that the liquidation of the "Bank of the East" merger was completed in December 1936, an extremely important detail which does not arise from documents, at least those that exist and are published. "Ethniki" then mentions the price of each of the shares.

In this respect, however, "Ethniki" argues that after the regulations resulting from Sloop Law 18/1944, which set the rate of the new drachma against the old inflationary drachmas of the Occupation, the value of the shares of the "Bank of the East" "Was nullified.

The official announcement of the bank on the merits of the latter reference to the value of the share epenerchetai in what temporal claimed the responsible of the "National" when someone holds shareholder sought to liquidate the least since 1940 until today.

** The announcement of the "National Bank" **

"On the occasion of the recent shake-up, once again, of" a non-existent issue of claims "of the Bank of the East" at the expense of Ethniki ", the National Bank of Greece clarifies the following:

In 1932, a merger contract was signed by the Bank of East Bank by the National Bank of Greece. This Convention was approved by Ministerial Decision 72186 / 5-11-1932.

According to the content of the merger agreement (which was approved by the General Meetings of the shareholders of the two banks), NBG undertook to pay the shareholders of the Bank of the East as a redemption price the amount of 200 drachmas (and not to any other currency) per share. Of this amount, GRD 50 was the purchase price of the goodwill clientele and the 150 GRD was an advance against the Bank of the East's special liquidation product. The special liquidation was completed in December 1936 and its result not only did not cover the pre-paid 150 drachmas per share but also left a high "opening" to the detriment of the National Bank. Thus, in addition to the initially paid 200 drachmas per share, no other payments were made or would be made in the future to the former Bank of the East (Articles VI and VIII of the merger contract)

.

Consequently, after the acquisition, all of the shares of the Bank of the East were canceled and any legitimate beneficiaries now only had a monetary claim from the EIF, to receive the above price of 200 drachmas per share. These requirements, like any other monetary claim, were subjected to the status of Law 18/1944 (Law of Svolos), which established an exchange ratio of 1 new drachma for each 50 billion pre-existing drachmas and thus substantially nullified. Moreover, in any case those requirements have been time-barred.

For all of the above (the cancellation of these titles from 1932 and the consequent lack of any claim against our Bank), the interested party Mr. Sorra and his attorney-at-law have been informed in writing several times by the Bank in writing. Also, a response has been given to a question from the Patras International Court of Justice. "

The Sora family responds in Ethniki's announcement

"By virtue of the 147611/1932 merger contract, legally published since then, merged through acquisition and absorption, the bank" EAST BANK SA "by" NATIONAL BANK OF GREECE ", a merger operation approved for of the ministerial decision 72186/1932, which was legally published in the Bulletin AE & 301 / 31-12-1932.

The merger agreement provided for a special liquidation to be carried out as a result of the transfer of assets and liabilities from "EASTERN BANK" to "NATIONAL BANK" (assuming universal succession) with the sole purpose of determining the redemption price and, in particular, the fair in lieu of which the other assets of the Bank of the East had to be liquidated, as was specifically provided for in the merger operation.

The above merger was carried out in accordance with the provisions of Law 5261/1931 and Law 2190/1920 (as at that time).

The merger agreement agreed that the assets and liabilities of the EASTERN BANK are transferred (legally) legally and contractually (in which case an accounting merge) and in particular the liability directly to the various accounts of that liability, the assets, not immediately in aggregate, in the assets of the NATIONAL BANK but according to the progress of the liquidation, as provided for and defined in term IV of the merger contract. They explicitly disregarded the relevant transfer of the fixed capital and capital reserve reserve, as well as each other component of the liability, are not an obligation to be transferred to the capital of the EAST BANK, PARTICULARS of the LIABILITY, explicitly defined, ie capital, capital appreciation account in fixed francs; third party, "... ASINA must not appear in the above-mentioned condition IV special, as it will pay to the shareholders in the East bank the price of the shares under of the National Bank of Greece at the time specified in ... ".

The payment of the redemption price was foreseen to be made after the expiry of the special liquidation of the bearers of the shares of EAST BANK, although NATIONAL BANK made direct use of all assets and liabilities of EAST BANK. A simple comparative review and assessment of the assets and liabilities of the two banks in the year 1932 yields efficacious conclusions.

Pursuant to Law 2190/1920 and in particular Article 49 (until then in force and in general similarly applicable), it is provided:

- The appointed liquidators shall be obliged, upon taking up these duties, to carry out a census of the company's property and to publish a balance sheet of the Company's Limited Liability Company and of the Limited Liability Companies and of the Limited Liability Companies and submit them to the Ministry of Commerce.

- The liquidator shall be subject to the same obligation at the end of the liquidation.

- The general meeting of shareholders always retains its rights during the liquidation.

- Clearance accounts shall be approved by the general meeting.

From the date relevant research on the one hand has not found a published balance sheet and setting sheet of the Government Gazette (GG), as required by law on the termination of the liquidation, which would determine the purchase price, on the other hand has not found Decision of the shareholders' general meeting through which the (end) of the clearing accounts are approved.

Because the EIB, in its official announcement, claims that the special liquidation was completed in December 1936 (something that has not been stated in two out-of-court declarations - our invitations to date), all we have to do is to make public:

- the relevant report of the liquidators and the relevant financial statements, including the balance sheet ending with the liquidation,

- the relevant Gazette of the Government Gazette (GG) where the balance sheet of the end of the liquidation must be published and

the relevant decision of the general meeting of shareholders through which the (end) of the clearing accounts are approved.

-

-

Regarding the value of the shares of EAST BANK, we refer to the actual text of the merger contract and to the balance sheets of the two banks at the relevant time of 1932. Characteristics in Article II of the merger contract are: "The contracting parties acknowledge their impossibility on the current and forthcoming fair valuation of the property of the Eastern Bank, as a result of the general economic conditions, in addition to the specialties of this bank, it is unfeasible and unjust in this case the definition of the redemption price, but it is unprofitable for the shareholders of the East Bank ... ".

We consider that there is no need for a legal or sensible assessment of the invocation of Law 18/1944, which is completely irrelevant to the case (as any one can assess) and which the EIT can not justify in any way which refers to the "banknotes" and the currency of the drachma and of course does not refer to the rights of the shareholders of the bank EAST.

The shareholder's claim for payment of its proportion to the proceeds of the liquidation is an individual property right that stems from the equity relationship, as it essentially constitutes a lender's right derived from the partnership. This claim is generated by the shareholder relationship and acts as an abstract right of expectation until it has been materialized (which the EIB does not disclose), ie until all the foregoing clearing operations are legally correct.

Lastly, a limitation issue can not be proposed, precisely because, according to the law, the limitation period begins at the end of the year in which the annual financial statements that are ending the liquidation, as above, are approved and there is no such approval. Since the EIB has a contradictory position, it only has to disclose the above substantive legal documents.

The totally vague and generic position of the EIF is freely assessed and each may judge accordingly.

Athens 21-9-2011

Artemios Sourras ".

Source: zougla.gr (Wednesday, 21 September 2011)

what is finally going on with the liquidation of the share?

read the next article

Hi. I am @greetbot - a bot that uses AI to look for newbies who write good content!

Your post was approved by me. As reward it will be resteemed by a resteeming service.

Resteemed by @resteembot! Good Luck!

The resteem was paid by @greetbot

Curious?

The @resteembot's introduction post

Get more from @resteembot with the #resteembotsentme initiative

Check out the great posts I already resteemed.

You were lucky! Your post was selected for an upvote!

Read about that initiative