BITBOND: THE FIRST GERMAN SECURITY TOKEN!

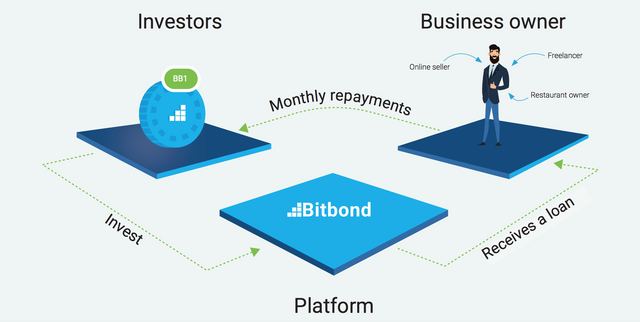

The structure of the platform

This is the first online Bank that is officially registered in Germany and will offer small loans to borrowers who live in Asia and in other countries of the world. It is expected that Bitbond STO will have a binding to such popular platforms as eBay and Amazon. Those who have a cryptocurrency BB1 have already received loans for these platforms in the amount of 15 or us dollars.

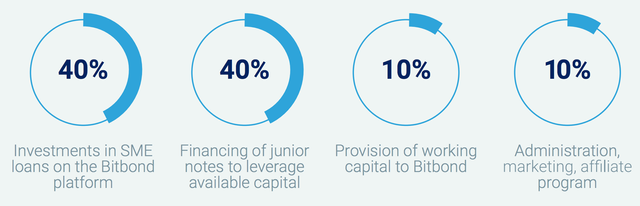

Bitbond has managed to release assets with the marking of quotations BB1. The cost of one asset is estimated at 1 Euro, the blockchain is tied to the Stellar standard. The platform plans to attract about 3.9 million us dollars to its project. It is expected that the raised funds will be directed to lending to the platform's customers.

It is expected that TO will work directly with small businesses, and under their requirements to provide loans online. Now bitcoin is integrated on the platform where you can make payments through SWIFT technology. This is the first time that bitcoin has official recognition for transactions via international swift communication channels.

How Does Borrowing on Bitbond Work

So as to utilize the platform to obtain a loan, the FICO assessment of the borrowers must be set up.

- The appraisals are positioned from A, the most elevated, to F, the least.

After this, the borrowers post the project in the marketplace where investors select which offer is the most appealing. - The postings must be completely funded in 14 days, yet the closeout will be shut if the postings get all the money it needs before that time lapses.

- The base aggregate which can be loaned by investors is 0.01 BTC and borrowers are not permitted to assume different credits at once.

- At the point when Bitcoin's cost goes up during the lifetime of the advance, the quantity of Bitcoins that must be paid back goes down. Likewise, when the cost of Bitcoin diminishes during the lifetime of the advance, the number of Bitcoins that must be paid increases.

Loan Interest Rates

The financing costs produced by advances are not fixed. The rates fluctuate contingently upon the borrower's appraisals and the terms of the advance on which the two parties have settled upon. Bitbond's loan costs can be somewhere in the range of 7.7% to 25%.

Deposits & Withdrawals

Deposits and withdrawals to Bitbond platform can be made by occupants from SEPA-upheld nations of Europe. Bitcoins can be kept straightforwardly into Bitbond wallets. There are no charges for fiat or bitcoin exchanges, however there might be a system expense connected.

Charges

A one-time beginning charge of 1% to 3% of the complete credit sum is connected. Contingent upon the length of the service, these charges may fluctuate. On the off chance that you need to reimburse the credit in a shorter measure of time, you are charged a lower start expense.

Points of interest and highlights

Obviously, the possibility of the Bitbond task did not show up by some coincidence, it was gone before by different issues that have met and still happen in all nations of our reality. Pretty much consistently little and medium-sized business visionary is looked with the absence of satisfactory financing for their business thoughts or an instant working model. When in doubt, they look for money related help from different banks or other monetary foundations. Which thus don't generally have the chance to help each business person.

The idea of Bitbond takes out this issue, growing little and medium-sized organizations in all edges of the planet by methods for innovative devices and advances. All they need to offer moms currently is to turn out to be a piece of this heading and help to create business loaning to little and medium-sized organizations turned out to be increasingly moderate.

Bitbond ICO Roadmap

07/2013 Launch of Bitbond

Launch of Bitbond is a peer-to-peer lending platform06/2014 Credit scoring with eBay

Kicked-off scoring with transactional seller data from eBay08/2014 Seed funding

First Seed funding round led by Point Nine Capital10/2016 Bitbond BaFin License

Bitbond obtains a license by German financial regulator BaFin04/2017 Equity & debt funding

Further equity and first institutional debt funding by Hevella Capital10/2017 Automated credited scoring

Rolled out enhanced cash flow modelling for automated scoring2017 & 2018 Partnerships

Start of cooperation with Jumia and Delivery Hero03/2018 1 Million in loan volume

Averaging 1 Million in loan volume month on month03/2019 Day 1 of STO Reached 1 million in investment

Launched STO at 12:00 pm and by 00:00 am we had reached 1 million EUR in investment

Details about the STO

Bitbond publicizes details. The crypto-credit corporation at the beginning merged with solarisBank. As can be considered from the release, all token holders will receive quarterly variable bonuses and fixed annual distributions. The bitbond token additionally has a validity of ten years. This skill that Bitbond is required to repurchase the BB1 tokens to its original fee of $ 1.

You can purchase the tokens now with Fiat currency, Stellar Lumens, Bitcoin and Ether. As the company similarly promises, all investors acquire their very own accounts, to which the business enterprise normally can pay the extra dividends.

- 1st round of financing: 11.3. to 1.4. (or up to 1 million euros): 0.70 euros (30 percent discount)

- 2nd round of financing: 2.4. until 8.4. (or up to 3 million euros): 0.90 euros (10 percent discount)

- 3rd round of financing: 9.4. until 15.4. (or up to 5 million euros): 0.95 euros (5 percent discount)

- 4th round of financing: 16.4. until 22.4. (or up to 9 million euros): 0.97 euros (3 percent discount)

- Regular financing: 23.4. until 10.5. (or up to 100 million euros): 1.00 euros (regular price)

About Bitbond Token

The BB1 security tokens are created on the basis of the Stellar Lumens blockchain and will be distributed by means of STO, as well as work with all online wallets that support this blockchain.

General

- STO Time: 11 Mar 2019 - 10 May 2019

- Whitelist/KYC: KYC

- Country: Germany

- Token info

- Ticker: BB1

- Platform: Stellar

- Token Type: SecuritySTO

- Available for sale: 100,000,000 BB1

Financial

- Pre-sale Price : 1 BB1 = 0.7 EUR

- STO Price: 1 BB1 = 1 EUR

- Accepting: ETH, BTC, XLM, Fiat

- Hard cap: 100,000,000 EUR

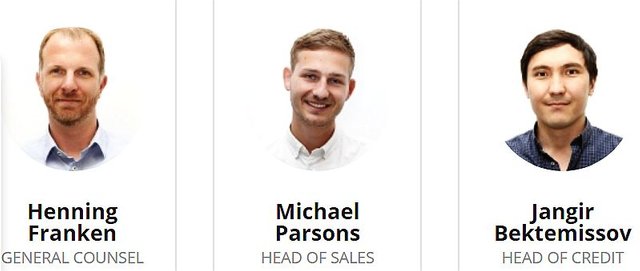

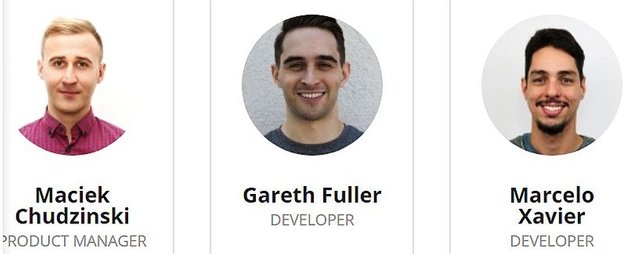

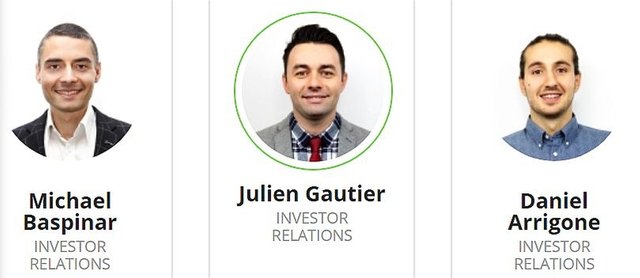

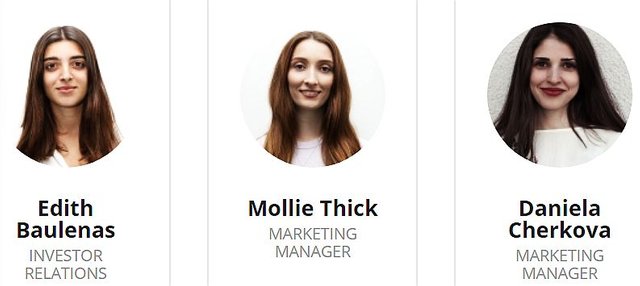

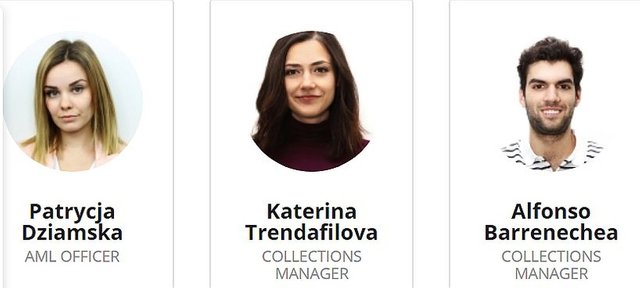

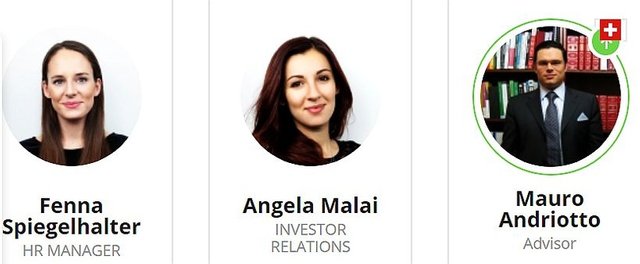

Team of the Bitbond ICO

Partnerships

FOR MORE INFORMATION PLEASE VISIT THE LINKS I HAVE PROVIDED BELOW;

- Website: https://www.bitbondsto.com

- Lightpaper: https://www.bitbondsto.com/files/bitbond-sto-lightpaper.pdf

- Prospectus: https://www.bitbondsto.com/files/bitbond-sto-prospectus.pdf

- ANN thread: https://bitcointalk.org/index.php?topic=5130337.0

- Telegram: https://t.me/BitbondSTOen

- Facebook: https://www.facebook.com/Bitbond/

- Twitter: https://twitter.com/bitbond

- Medium: https://medium.com/bitbond

- Reddit: https://www.reddit.com/r/BitbondSTO/

- Instagram: https://www.instagram.com/bitbondofficial/

- YouTube: https://www.youtube.com/user/Bitbond

- Author: Saliya Prasad

- BitcoinTalk profile link: https://bitcointalk.org/index.php?action=profile;u=2150359

- My Affiliate link: https://www.bitbondsto.com/?a=LKRFMI