Mt. Gox is a big reason for the Bitcoin price crash from all time high

Reading the crypto subreddits today I stumbled on a post showing new evidence of some of the Mt. Gox bitcoins having been sent off to exchanges and dumped there during the all time high of Bitcoin and all the way down to $6,000.

Now of course this may not be the only reason, many different things could have together resulted in the huge drop of price, such as Bitconnect, Futures, regulations and Chinese New Year which I've posted about before.

An article on trustnodes.com explains how the Mt. Gox trustee sold half a billion worth of both Bitcoin and Bitcoin Cash between December and February. The analysis of the blockchain data correlates well with price falls of bitcoin. The addresses of the bitcoins of Mt. Gox has been well known by detectives/analysts following the transactions from their root addresses.

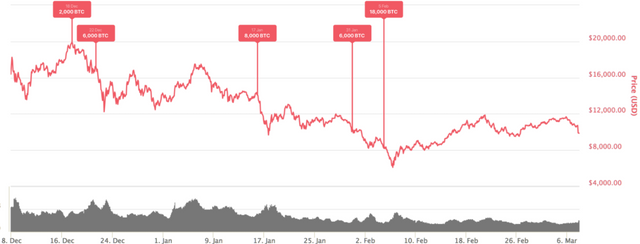

The first sell of 2,000 BTC started on December 18th as the price was at $19,000 and that very same day dropped to $18,000 and continued to fall. 4 days later another 6,000 BTC were moved and dumped on the market bringing the price down another $2,000.

He continued selling of Bitcoin from January 17th to February 5th when the majority was sold bringing the price down to its latest low at $6,000.

A user by the name of riverflop on Reddit mapped the exact time when Bitcoin were transferred to exchanges. A total of 40,000 BTC was sold.

Here's source to all the transactions:

2017-12-18 2,000 BTC

2017-12-22 6,000 BTC

2018-01-17 8,000 BTC

2018-01-31 6,000 BTC

2018-02-05 6,000 BTC

2018-02-05 6,000 BTC

2018-02-05 6,000 BTC

As trustnodes.com stated, this is now the 4th time Mt. Gox causes the Bitcoin price to crash. First time in 2011 when the exchange was hacked out of half a million Bitcoin, second time in March 2013 when it was DDOSed, February 2014 when it went bankrupt and now late 2017-early2018 by selling 40,000 BTC.

People noticed that the equivalent amount in $ that was sold equaled the amount that Mt. Gox owed creditors at a price of $400 per Bitcoin. In another trustnodes.com article they included a PDF of the report (in Japanese) of the trustee acknowledging the amount of Bitcoin and Bitcoin cash to be 35,841 BTC and 34,008 BCH which means he probably did not sell all of the 40,000 seen transferred onto exchanges above and either left 4,169 btc on the exchange (which they believe to have been Kraken) or transferred them onto a new address.

If these Bitcoin are going to be returned to the customers that lost during Mt. Gox it is good news in general, we may not know how much more is going to be sold or what they will do with it at this time. The amount of Bitcoin left in the trustee is considered to be another 165,000 BTC currently worth ~$1.5 billion + an equal amount of BCH worth another $150 million.

The question remains why they didn't sell the coins off exchange such as auctioning them. It is clear as to why they did not announce the sale to not cause the market to panic and sell as high as possible. Rumors on Reddit are emerging though that the trustee or other people aware of these sells could've profited while selling by shorting Bitcoin on other exchanges such as Bitfinex, BitMex, etc.

Knowing a major reason to the huge correction from $20,000 feels somehow good for the future price of Bitcoin and other cryptocurrencies, we have to bear in mind though that the rest of their holdings are probably going to be sold at some point as well. It is unclear if that will happen, when it will happen and what effect it will have on the price at the time.

well the article that i read this morning suggested that there was another 170k BTC held by the trustee.

So that begs a few questions:

if you're a creditor, wouldn't you prefer the BTC rather than the fiat equivalent of the price at the time?

If they're giving fiat equivalent of the price at the time, then who keeps the profits?

was the dumping of the coins a deliberate action to bring down the market? what was the motivation for this? government? opportunistic chance to buy cheaper bitcoins?

Yeah on one hand it's nice to read the actual reason - but personally I was never really concerned about the viability as a result of the "crash" (which I prefer to call a correction). Whether it's this, or that, or whatever, it'll still bounce back to a new ATH soon enough.

exactly, I was thinking this too.

we both know that answer :/

My gut tells me they were shorting it at the same time, but who knows... in a way it's good for newcomers and believers to be able to buy cheaper but at the same time so many must've lost a fortune panic selling, etc...

the joys of an unregulated economy. Opens the door to more blatant manipulation.

That's the price we pay i guess..

Same thing will happen when all these exit scam lending platforms sell off their stolen btc smh

...and it's easier to dump something that is stolen and not earned with hard work.

That is def true

And thus cause billions in loss for others. I am concerned about the people who came to crypto in excitement of that bull run and have never recovered there money. I am sure many burnt their money by selling their coins at loss. Such a mishap.

You are a kind person. Thank you for voting on my reply to Acidyo.

I seriously doubt that these sell orders are the reason for BTC's pullback over the last couple months. If you look at the first sell date, 12/18/17, the 24 hour volume on that date was something like $13 billion. The 2000 BTC sold would account for only about $38 million of that, putting it at about 0.3% of the volume for that day. That's nothing to sneeze at for a single seller, and it would probably put downward pressure for the instant it was happening, but it's hardly the market-moving behemoth that it seems when you hear those big numbers in the millions as compared to the billions in volume. Also if you look at the price action, it had peaked on the day before and was already on the decline when they pulled the trigger.

Even the biggest sell on 1/17/18 of 8000 BTC would only amount to $69 million, accounting for only 0.4% of the $19 billion volume for that date. With this one the sell order happened near a bottom and the market continued to climb out of that bottom as it happened. It didn't pull the market down at all in that instance. Let's just face it, it was a bubble, it burst because the noobs who drove it up panic sold, and now recently crypto price action has resumed a more sane pace for a change. Don't worry though, we'll probably see some insanity in the near future.

I agree for the most part, but I am not so sure that it was the noobs who panic sold that drove the market down. The small guys are playing with 100s of thousands of dollars at most, most of them much smaller amounts, as you stated there was billions of dollars of volume every day.

I think Chinese NY, FUD around regulations, Scams like Bitconnect, FUD around futures and the Issues with Tether all culminated at a point where BTC was at an ATH and an attractive sell point for many early hodlers and whales. Once it started it snowballed as FUD after FUD in the news kept coming out and spooking the market lower and lower. Smart money drove the market lower and I feel many a noob got burned on the way down.

Good point, but thinking on it a little more, does big money necessarily mean seasoned veteran in crypto? Just because investment bankers started to play doesn't mean they're professionals in this investment category. I mean, I've been trading stocks for over ten years, but I've only been here for a couple. Then again I didn't spook, so maybe you're right after all.

Haha, that is also a good point, one idea I have tried to express to people for a long time since pondering trends and why things happen at all, in any sector, in anything at all is; there are always unfathomable amounts of ideas, outcomes, reasons, for anything to happen at all.

In regards to trading, I have found many people get caught in the trap of thinking a market moves in any direction as a type of hive mind almost instantaneously. Traders, Investors, Speculators and everyone in between buy and sell for all sorts of different reasons and they buy and sell at different price points. The markets are a living, breathing beast.

I think you are right, a whale might play with a few million dollars but he might not care if he loses some because it's only 2% of his wealth. People who buy at different prices will have different levels at which they are spooked, some easily, some not so. some people are willing to sell at a loss, others will never sell unless their portfolio meets their requirements for retirement, FOMOers are perhaps happy to get out at break even. The variables are incalculable. To me at least.

Very good stats, thanks.

We think it was a coordinated gov't + big bank attack, which began with listing of the futures (the anticipation of which helped prices in the Fall 2017 going into the "sell the news" moment of the futures listing). Large govts have too much vested interest in money printing to let crypto achieve trillion dollar asset values, at a trillion (even before a trillion) crypto is a REAL problem.

You got that right. Martin Armstrong has even been talking about this and he's been very dismissive of crypto up to this point. We'll see if he's right that they'll succeed in shutting it down. I don't think they can. It would be too expensive at this point.

Think they can, and Napster/Kazaa shutdowns (PirateBay) are the blueprint. You TECHNICALLY can't shut crypto down, but you can make it illegal activity like the US outlawed gold ownership from 1933-1972. This puts 95-99% of people "in line".

The rest are (dark side of the force) outlaws, and run the risk of jailtime. So yes, a dark crypto will eventually become the backbone of black markets, but how many people can afford to run the imprisonment risk?

We agree, you can't shut crypto down, but you can deter the masses from using it rather easily, and they already are starting (with the SEC crackdown on "semi-legal" exchanges). But they certainly clever in how the subterfuge it, ey?

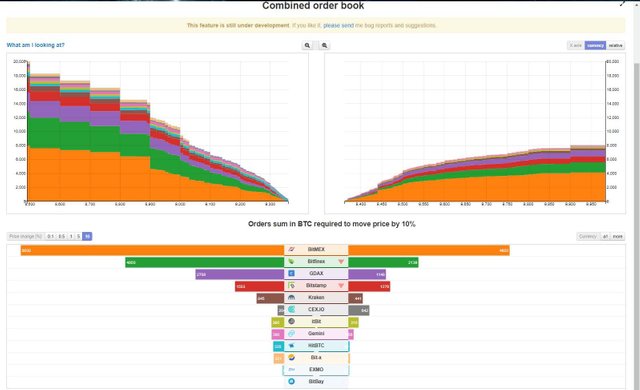

It'd only take 8k btc on Bitmex to immediately drop the market by 10%...that's 6k Gox Trustee and only 2k panic sellers.

IMHO, I don't see large buyers at current prices knowing there's a Gox fire sale in the near future.

https://data.bitcoinity.org/markets/books/USD

Right, but that's not going to last an entire 24 hours, and total market volume was about double that of present at the peak sale of 2000 BTC, and almost triple the volume for the 8000 BTC sale. That increased volume accounts for a reduced effect. As we saw during the 8000 BTC sale, the price actually went up simultaneously. This is not to mention the fact that arbitrage will quickly absorb the differences between exchanges. Even today, you'd need 20K BTC to move the entire market that same 10%. Given the fact that we saw a drop of almost 70%, the effect of that 40k BTC on higher volumes would have been relatively small. It would move the market only 20% even at today's prices and volumes, only momentarily, and only if it was dumped all at once.

I came to BTC in 2011. All I can say is "just calm down".

And HODL

Imagine what will happen if Satoshi’s hoard ever hits the market!

That's at least a million bitcoins sitting on the sidelines. Imagine that!

If that happened it would be over for bitcoin. The market assumes those coins are dead. There was some talk about a bitcoin trust holding these coins until at least 2020 when Craig Wright claimed to be Satoshi but make of that what you will:

https://www.economist.com/news/briefings/21698061-craig-steven-wright-claims-be-satoshi-nakamoto-bitcoin

Imagine he loses that $10bn lawsuit against him.

Good for us.BTC would be then worth 1 cent.You could buy all you want. :))

What if Satoshi is waiting for the last btc to be mined, maybe slowly releasing them out to the public?

The last btc will never be mined. Total number tends towards 21m but never reaches it as rewards just get lower and lower.

He will be dead before that happens.

We will all be dead. We are 122 years away from the last bitcoin to be mined. 2140 is not soon.

That last paragraph is exactly what was bothering me as I read this. Let me get this straight: they have how much and sold how much of that? It seems they have an awful lot more left than what they sold, which is a troubling thought if they have the power to do even worse damage than it appears they did in the last few months.

But yes, if it was the result of this one factor, that is encouraging for the strength of the overall market among the general public. That's of course assuming they put a few years between each of these little selling sprees.

sold about 35k btc and bch and have around 165k of both left

This is why you don't fork to create a new coin, especially of one that has had so many disasters and scandals in the past... :P

Are you talking about Bitcoin Private? x)

Any Bitcoin fork, really.

Hopefully the market is a lot bigger when the next batch is sold off.

I hope this is the reason for the sell-off. It has been painful the last couple of months. Perhaps today is the blow-off bottom on this bear market and we will start to see some upwards direction.

It is amazing that something bankrupt for a number of years could still affect the market. What this shows is how small the crypto space truly is and how it can be easily manipulated. We just need to weather the storm and do what we can to make sure the space grows overall.

Yeah I hope so too, kinda lame that only 35k BTC did all this.. my guess is some may have noticed the coins moving in time before these news hit the public and acted accordingly.

The trustee even took a break from selling for a longer period at some point but the last ~25k btc brought it down all the way to $6k.

It's not lame at all in my opinion. At an average of $15,000 per Bitcoin, 35k Bitcoin mean $525 million of sell. In a market where most of the Bitcoins are held for long-term and only a handful of them are traded on exchanges, 35k Bitcoins sold in big chunks can create a huge effect on the market. So it did.

Otherwise too, the marketcap at any given time is not the actual USD amount invested in all the coins. It's probably less by a factor of 50 in actual value because the maretcaps are determined based on total circulating supply. The amounts shown in circulating supply is not actually circulating because most coins are stored in wallets or masternodes.

We can see Steem as an example. The 251 million Steem shown as circulating are mostly frozen in Steem Power on Steemit and many are stored as liquid Steem. The amounts available for trading represents only a portion of the circulating supply.

I hope you know this all better than me but I loved writing this comment as it solidified my learning. I can be wrong, of course, and I request correction in case so is the case.

Lame was maybe the wrong word, I was hoping there would've been more buy pressure. Considering all other negative things that happened during that time though it might have been a combined effort to cause such a steep decline.

If mt. gox dumping to pay back the users that lost all that money in 2014 is one of the causes for the massive scam Bitconnect to go down, I'm not too disappointed by what happened to the price.

The attacks did seem to be coordinated and even right now, after having creating so much fud already, the attacks are still on.

What happened with BitConnect is good for the the crypto market any day. I agree with your sentiments.

I want to thank you for posting this. Earlier I read the headlines and thought "another bunch trying to figure out why markets moved in a given day". Yet you explained that this is a trend over a couple months. That makes it a lot clearer.

As I was reading I was thinking that this explains Bitcoin but it also shows how the alt-coins still are at the mercy of the grand daddy of them all. I know many proclaim Bitcoin dead (on a weekly basis it seems) but the market tells a different story. It is still the ringleader of this circus.

Any break from BTC is only temporary...everything else follows it over time.

There has to be a breakout at some point of one of the other coins. They cannot be simply tied by the apron strings to BTC for ever. Its like most of the worlds currenices tied to USD. Its not healthy for the future of crypto.

Well this explains a lot. I hope the Mt. Gox trustees will space their selloffs so as not to cripple the crypto market but there are so many variables in crypto that sometimes one can't say what will cause a fall in price.

I totally agree with @taskmaster4450 concerning the dependence of alt-coins on bitcoin in determining price. It is rather infuriating to see the price of steem go down because bitcoin's price did also. I also concur with @nathen007; alt-coins should break away from bitcoin. This is the only way for a truly decentralized world economy to emerge

I don't think it was only 35k worth of BTC that caused the crash in price, as acidyo stated, Chinese NY, FUD around regulations, Scams like Bitconnect, FUD around futures and the Issues with Tether all culminated at a point where BTC was at an ATH and an attractive sell point for many hodlers.

In my opinion it is great that BTC held 6k and held well above where it started at jan 2017 with all the selling that happened, all that selling is out of the market now, all the FUD is priced in and BTC held 6k and bounced to 12k doubling, it's only natural that many who bought the tops and bottoms over this wild price action will take their profits and losses or break evens as everyone has their own game and view points here.

The whales are pro's at selling off under pshycological pressure.

People lose track of how the market cap of crypto is just a blip compared to other markets. Was listening to an alt-media podcast recently. An otherwise smart guy (might have been John Rubino?) was talking about how cryto’s “current bubble” bursting could cascade into other markets.

Sheer nonsense. The crypto market is tiny compared to the silver market which is tiny compared to the gold market which is tiny compared to the equities market which is tiny compared to the bond market.

...which are tiny compared to the derivatives market.

I agree completely...we are not even close to cryptocurrency affecting the traditional markets.

The market cap of crypto is a rounding error in the equities market.

I made a prediction based upon a 2 thousand year old technique by Vettius Valens and wrote software that calculates the mathematics of this 20 years ago. This work is what I'm most known for. I also wrote about why I don't believe in astrology (but still use it). Nature is mathematical and set theoretical and a process of differentiation and exclusion generates pressure toward negentropy that is predictable.

If the pattern continues, we're in for about a year of relative weak market circumstances and then there will be a dramatic jump upward in price. Another (possible manic) peak should happen summer of 2020 to early 2021.

The Nasdaq is a tic below it's all-time high, owning any FANG stock yields a 2% gain every single day, which is larger than what you'd make in risk-free US Gov't Tbills of 1-year duration. Even bitcoin almost doubled off it's early Feb bottom. Remind us again how 2018 is weak?

do the planets and math distinguish between stocks and cryptocurrency?

The technique gives assessments relative to the larger picture, so 'weak' is relative to what is to come, not what has been. In my opinion no such differentiaion exists except from the differentiation pressure that comes from different starting points which generates negentropy. I've been writing "why I don't believe in astrology (but still use it). Life isn't random, but is mathematical and set theoretical.

We'd love to see a plot of gravitational force exerted on earth from all sources less than the moon. Think that would occupy some time, but perhaps be very fruitful. Gravity has such a huge effect on people's lives, yet we tend to ignore the small contributors such as Venus and Jupiter to name two.

Wouldn't it be interesting if those two combined for a pattern of peaks and valley we could chart into the past and see if it means anything?

Wow another year of weakness? That will be tough to live with.

Certainly it is possible...just disappointing.

Thank you for the links, I will follow them and see what you posted there.

I agree that there are mathematical equations that can predict most of what takes place...especially when it comes to markets which are based upon nothing more than human behavior as it pertains to data.

So you are looking for another run up to begin in early 2019?

That's the pattern. However, when I say "weakness" that is very relative to the overall picture. The problem with this technique is that dollar values are impossible to pinpoint. It could be that bitcoin is considered weak in this period because it only goes up to $100K. When you stretch it out on a graph, that $100K will look small compared to what comes after (perhaps it's only $20K - $40K in 2018 and then it jumps to $700K). I also view that chart as being applicable to all crypto in general.

Ah so your chart does not tell higher or lower, only weakness.

So how does this help from the standpoint of where things are going?

I understand the 15 year trend means bullishness yet how can one tell ups and downs? Is that possible or is it only just weakness?

The theory is based upon something that is very anthropomorphic applied to a process that is really much more sterile. If this was the chart of a person, an astrologer would say that the reputation during this time is "idle" because the ruler of the times is in detriment and under the beams of the Sun (made invisible). The Sun is often associated with authority and in Capricorn, represents possible restrictions and regulations coming. But while the symbolism says this according to the rules, bitcoin is not a person and so it doesn't have the same sense of "katarche" (important beginning in Greek).

The key to interpretation is to see it in hindsight. What the chart seems to say is that relative to what happens to crypto in the early 2020's that this period is running idle by comparison. The question is how much. It could be that bitcoin only makes it to $40K by the end of this year and that is considered "idle" because it looks flat on a graph when you compare it to prices in the early 2020's.

Ah okay I understand.

And you feel that the chart for crypto overall mirrors that of Bitcoin....that we are going to see the real upward action in the early 2020s...and there could still be upward moves between now and then, but not as much in comparison?

Am I following correctly?

Yes.

Is this in relation to the % that it jumps from where it starts and ends? 1k to 20k is larger than 20k to 60k? the first jump was much stronger?

This actually does make sense along with many other factors ofc.

This demonstrates how closely "plugged-in" crypto-enthusiasts are to the social-media/news cycle, and how much the crypto markets are influenced by short-term news events & psychological reactions to them. I believe this is largely what makes cryptos so volatile.

Knowing that this is "the way it goes" in the crypto markets, it does provide great opportunities for buying dips based on short-term FUD. I also think that the somewhat slower & measured recovery of the BTC price is a good thing - more sideways movement that tests both support and resistance levels. Hopefully, this is helping to make BTC slightly more stable in the long-term.

Resteemed.

Very good reasoning.

Bitcoin is free market and this is actually great. Free markets obey supply and demand rules more transparently. And selling big stack of Bitcoins just trigger predictable consequences. So people who know enough of markets and trading had profited and dummies pay the price. As it goes:

So folks it's education time! Educate yourselves about trading and crypto markets and volatility will be no problem any more. I'm just fine with it. Holes in my accounts teach me to manage my risk and use head instead of balls in trading.

I realize that reasonable profits over longer period are the right thing. the sooner people will learn that lesson, the better crypto world will bee. I think that is definitively possible to manage wealth in crypto assets and they are great because wealth is private and only yours and you have full control over your property in crypto.

Absolutely, coupled with Crypto being so easy to move and sell as opposed to other assets, must cause huge volatility as investors and speculators see the news, it is easy to sell almost instantly and just as easy to buy up on the dips.

It's great that all of that FUD has been priced in and it bounced of the 6k region, getting no where near jan 2017 territory. some stability now in price will send some good signals to investors also as regulations come into place, creating a safer environment for big funds and whales, there is even talk of central banks considering adding small positions as well.

In 2018 begining i made THIS POST at 800 Billion $ market cap to sell everything, when all the famous Crypto Channels on youtube were telling to buy them. I also posted HERE the PROOF of me selling cryptos, and then BUYING at 295 Billion $ market cap, and so on..

People start giving reasons and making judgements after things happen, rather then before things happen, like the majority.. Thats why i only listen, most of the times i do opposite.