In the wake of Dropping to $5120, Bitcoin Price Surges Above $5,650

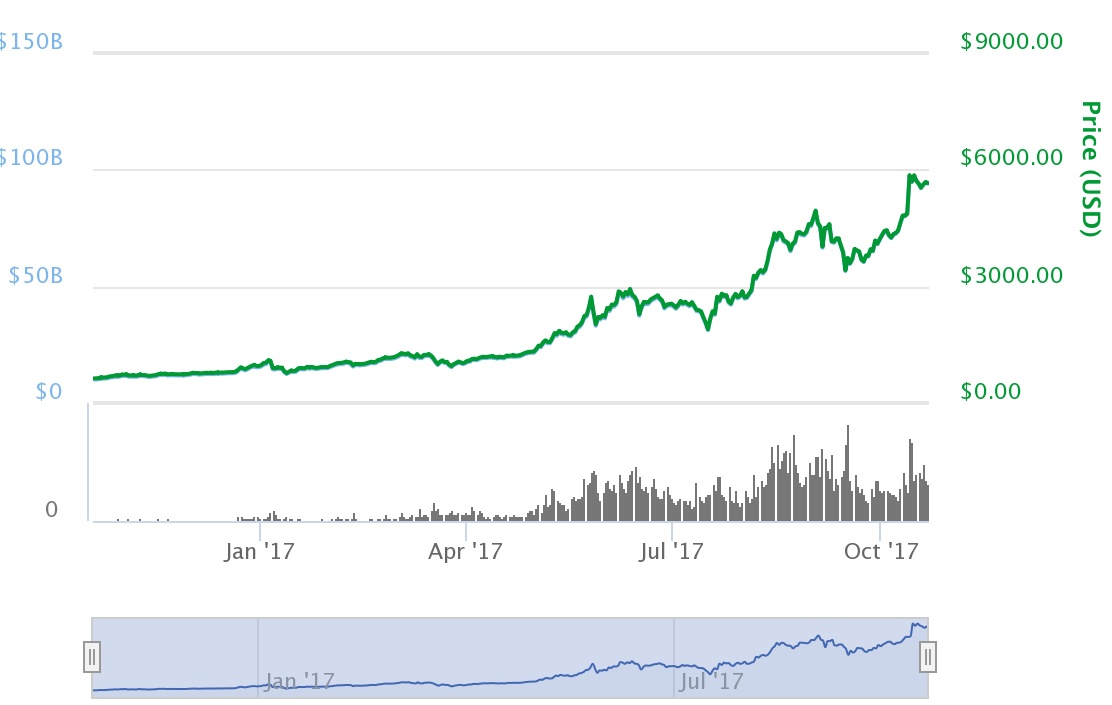

Prior today, on October 20, the Bitcoin cost marginally declined from $5,720 to $5,650. Yet, inside the previous 48 hours, the Bitcoin cost has surged altogether, as the market picked up certainty over Bitcoin's mid-term rally.

On October 18, the Bitcoin cost dove from above $5,500 to $5,120, as the whole Cryptocurrency market persevered through a noteworthy adjustment. Cryptocoinsnews already detailed that driving digital forms of money including Ethereum and Ripple have fallen by around 10 percent inside 24-hour time span.

Traders are Buying the Dip

Noticeable Bitcoin Traders and Imvester including Tuur Demeester uncovered that they have purchased "the plunge" as the Bitcoin cost dove beneath $5,120 in a solitary day, from over $5,500. It is exceptionally likely that numerous brokers were expecting the cost of Bitcoin to adjust itself following a solid two-week long rally, which has prompted a surge in the Bitcoin cost from $4,500 to $5,920.

Regularly, preceding hard forks, the Bitcoin value has a tendency to be very unpredictable, as the group and the market choose to help one blockchain over the other. While contentions that SegWit2x supporters and speculators are putting resources into Bitcoin to acquire SegWit2x coin or B2X in November and in this manner pushing the bitcoin cost up are substantial, it is more probable that the help over Bitcoin's mid-term development is enabling the market to manage an upward force and pattern.

More to that, if the market had been worried concerning Bitcoin's execution ensuing to the SegWit2x hard fork in November, by far most of dealers would have put resources into elective digital currencies (altcoins) as opposed to Bitcoin. In any case, that clearly has not been case as the Bitcoin predominance record has expanded to 55.9 percent, the most elevated point since early May.

In what manner Will the SegWit2x Hard Fork Impact Bitcoin Price?

The SegWit2x hard fork, in the event that it will be sought after as arranged, is required to be initiated in mid October. Which implies, in under three weeks, another fork of Bitcoin will develop, aside from Bitcoin Cash.

A few Bitcoin organizations and wallet stages, for example, Xapo and Blockchain have adopted a somewhat disputable strategy in tending to the fork, informing the Bitcoin people group that the Bitcoin blockchain will be recorded as the minority chain or (BC1) on the off chance that it has bring down hashrate than Bitcoin. However, as Alistair Milne clarified in an expository blog entry, diggers have a tendency to take after the cash and the more productive blockchain.

As observed in Bitcoin Cash, Bitcoin mineworkers had already moved to the Bitcoin Cash blockcahin organize preceding its trouble change, which permitted Bitcoin Cash to have huge hash control. Very quickly after Bitcoin Cash turned out to be less productive to mine than Bitcoin, most mineworkers changed back to Bitcoin, including Bitmain and Antpool.

Subsequently, if organizations like Xapo and Blockchain choose to list Bitcoin as a minority chain in light of hash rate, which as Milne said isn't a handy and precise method for legitimizing the dominant part chain, it could affect the mid-term execution of the Bitcoin cost adversely.

In any case, in light of the current rally of Bitcoin, it is apparent that the group and the market are certain that Bitcoin will stay as the larger part chain after the fork, which is a positive marker at the Bitcoin cost.

@cmtzco has voted on behalf of @minnowpond. If you would like to recieve upvotes from minnowponds team on all your posts, simply FOLLOW @minnowpond.

To receive an upvote send 0.25 SBD to @minnowpond with your posts url as the memo

To receive an reSteem send 0.75 SBD to @minnowpond with your posts url as the memo

To receive an upvote and a reSteem send 1.00SBD to @minnowpond with your posts url as the memo