Analysis: How Will Regulators Handle the Growing ICO Market?

Initial Coin Offerings or ICOs are the most controversial fundraising technique today with barely any established financial institution around the world in support of it. However, based on market figures, there seems to be no stop in raising money with ICOs anytime soon.

An ebb after the flow

Despite the first successful ICO event by Ethereum in 2014, the boom in the sector happened only mid-2017. The year saw some of the biggest ICOs, with names such as Hdac and Filecoin raising more than $250 million with their token sales. However, the trend, which peaked in June of 2017, seemed to slow down as the year approached its end with an increasing number of failed ICOs.

Join our Telegram channel and get all the latest cryptocurrency news directly to your phone!

As reported by Finance Magnates last year, only 69 out of 169 projects seeking to raise money via token sales successfully reached their goals. As the trend was wearing off, it attracted the attention of prominent figures of the blockchain sector, including Vitalik Buterin, who even compared it to a bubble.

Trend reversal

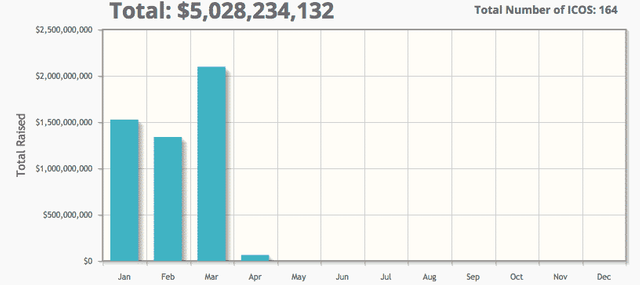

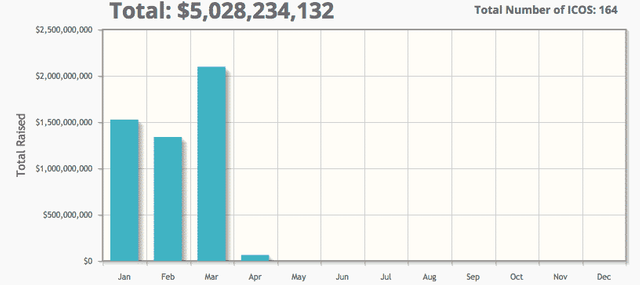

However, the downward facing ICO trend reversed with force by the end of 2017 and attained an entirely new level in the first quarter of 2018. According to Coinschedule, December alone registered combined token sales worth more than $1 billion. As we welcomed 2018, waves of new ICOs flooded the market and in a mere three months, blockchain firms raised over $5 billion by selling tokens – 31 percent more than in all of last year.

This huge figure was attained as big names entered the nascent market with their future prospects by leveraging blockchain. The encrypted messaging platform Telegram broke all records as it raised $1.2 billion with two consecutive rounds of pre-sales. The already massive user base on the platform lured the investors towards the ICO. The amount of Telegram’s ICO was followed by the ICO of Dragon and Huobi, which raised $320 million and $300 million, respectively.

The number of ICOs also skyrocketed as every month of this year registered at least 50 ICOs, whereas, in 2017, none of the months saw more than 26 ICOs, except December.

<figure id="attachment_224827" style="width: 816px" class="wp-caption alignnone">

<figcaption class="wp-caption-text">ICOs in 2018, Coinschedule</figcaption></figure>

Scams and frauds

The fraudsters and people with shady business models saw a massive opportunity in the lucrative unregulated market of ICOs. Huge projects like Bitconnect were shut down after reaching a $2.5 billion market cap.

The market even saw complete scams like Benebit, which duped early investors for an amount between $2.7 million to $4 million. The fake project was so well-orchestrated that the team spent more than $500,000 for nothing but marketing. Had the project not been busted, it would have siphoned off a much bigger sum.

Moreover, the concentrated funds on digital platforms become easy prey for hackers. In 2017 alone, 450 ICO projects were attacked at some level, according to a report published by the cybersecurity firm Group-IB.

In another study, Ernst & Young concluded that more than 10 percent of the $3.8 billion raised through ICOs in 2017 were either lost or stolen by hackers.

Regulators’ headache

The gaining popularity of ICOs has become a major concern for regulatory authorities around the world for mainly two reasons – the vulnerability of the investors and the flow of money to an unregulated sector. However, the complicated decentralized architecture of the blockchain has made it very difficult to impose any rules on the wild market.

Authorities in China and South Korea were first to act against the booming sector by imposing a blanket ban on ICOs in September last year. The implications of that clearly reflected on the market, but not for long.

Recently, the United States, the largest ICO market, became the hub of the regulatory debate on ICO and cryptocurrencies. Without any concrete plan, various US agencies, including the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) are trying to define the rules according to their own, limited understanding.

The SEC is trying to bust as many ICOs as possible by labeling them as unregistered securities. In certain states, the state authorities also presented a similar argument to ban various token sales to its residents.

Is there any solution?

As the numbers suggest, the ICO market is far from coming to a halt. However, this also means that more and more projects will try to dupe investors, as only a whitepaper and a website with lots of buzz words are often sufficient to convince investors to part with their money.

However, the SEC in its current approach often bans legit ICOs in the attempt to regulate the market. With everything in hand, it is clear that it will be very tough to put a noose on the ICO market.

Source

Warning! This user is on my black list, likely as a known plagiarist, spammer or ID thief. Please be cautious with this post!

To get off this list, please chat with us in the #steemitabuse-appeals channel in steemit.chat.